11 Amex Platinum benefits that will save you $1,150 per year (AFTER paying the annual fee)

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

The Platinum Card® from American Express comes with 75,000 Amex points after you spend $5,000 on purchases within the first six months of account opening. That’s worth so much in travel, and one of the biggest no-brainer travel credit card bonuses of the year.

But Amex has added to that the ability to earn 10 Amex points per dollar at U.S. supermarkets and U.S. gas stations for up to $15,000 in combined eligible spending in the first six months you have the card (then 1 point per dollar).

Do you know what that means??

If you find some way to spend $15,000 in the first six months (it’s not actually as difficult as you think), you could end up with up to 225,000 Amex points. That’s enough for two round-trip first class flights to Japan, which will save you a good $30,000 (read our post on the best ways to use Amex points).

But here’s perhaps the best news. If you travel even a few times per year, the Amex Platinum can save you up to $1,200 per year in benefits and statement credits alone — even after paying the $550 annual fee (see rates & fees).

Here are 11 benefits that make this card worth keeping year after year.

[ Subscribe to our newsletter for more on how to maximize your credit card benefits ]

Amex Platinum benefits and perks

$200 in United Airlines airfare

Conservative annual value: $200

When you open a card like the Amex Platinum, you get the opportunity to choose the airline you like to fly the most. You’ll then get up to $200 in annual credits for incidental fees on that airline.

So what’s that mean? You can get a up to $200 for expenses such as:

- Checked baggage fees (including overweight/oversize)

- Itinerary change fees

- Pet flight fees

- Seat assignment fees

- Food and alcohol during your flight

- Airport lounge day passes and annual memberships

- United TravelBank funding

That United TravelBank one is definitely the most enticing of all. You can use your Amex Platinum to fund your United TravelBank (basically credit that you can use to buy United Airlines tickets) to essentially get $200 in United money.

And get this — you’ll receive the $200 airline credit each calendar year. That means if you open the card in 2020, you’ll get a $200 credit. And once January 2021 rolls around, you’ll get another credit. That’s $400 in credits for the first year you have the card!

$200 in food

Conservative annual value: $200

The Amex Platinum comes with up to $200 per calendar year in Uber credits (for use in the U.S.), but they’re doled out a little funkily:

- $15 credit each month from January to November

- $35 credit in December

Don’t think you’ll use the Uber credits on rides? You can use it for Uber Eats, instead. That’s up to $200 in Uber Eats food each year.

Additionally, the Amex Platinum will now receive a complimentary Uber Eats Pass membership. Uber Eats Pass is Uber’s food delivery subscription service that offers benefits like waived delivery fees at eligible restaurants and 5% off Uber Eats orders of $15 or more (taxes and fees may apply and do no count toward order minimum). An annual membership normally costs $119, but cardholders will receive this complimentary benefit for 12 months upon enrolling. You’ll have to enroll your card by Dec. 31, 2021.

Expedited airport security

Conservative annual value: $25

The Amex Platinum comes with a statement credit every four years that will completely offset your application fee for Global Entry or TSA PreCheck. This is perfect because membership to both of these programs lasts five years. You’d otherwise pay:

- up to $100 for Global Entry

- up to $85 for TSA PreCheck

TSA PreCheck lets you keep your shoes, belt, and light jacket on when going through domestic security checkpoints. You can even keep your toiletries and laptop in your bag! It’s a huge timesaver.

Global Entry allows you to enter back into the U.S. without having to stand in the immigration line. Just find a Global Entry kiosk, put your hand on the fingerprint scanner, look into the security camera and you’ll be on your way. Oh, and Global Entry comes with a complimentary TSA PreCheck membership.

As you can see, Global Entry is the far superior membership.

You can earn a credit for the application fee for either Global Entry (up to $100 once every four years) or TSA PreCheck ($85 once every four-and-a-half years). Because you get the credit every four years, this gives you a $25 value per year. But time is money, so you’ll be saving a lot more than that.

The best airport lounge access

Conservative annual value: $300

Airport lounges are more than just tranquil oases from the noisy bustling terminal. They almost always have free alcohol (pour it yourself!), snacks, even hot food. Some have showers, some have beds and they all have loads of comfy seats with nearby electrical outlets.

The Amex Platinum gives you access to the best lounges of any card on the market. Some lounges will give you full sit-down meals, premium spirits, even wine tastings and whiskey flights.

You’ll get unlimited airport lounge access to 1,300+ lounges worldwide with networks such as:

- Priority Pass (you’ll find them almost everywhere)

- Centurion Lounges (widely considered the best domestic lounges available)

- Delta Sky Club (when flying Delta)

- Escape Lounges

- Airspace Lounges

With most of these programs, you can also bring in two guests. Day passes with many of these lounges sell for around $60 each. That means if you and your partner want to access a lounge, you’ll pay $120 per visit. Assuming you visit three lounges per year, you’ll get plenty of value from this perk

VIP treatment at luxury hotels

Conservative annual value: $250

If you want your hotels to think you’re as big of a deal as you think you are, you’ve gotta book through Amex Fine Hotels & Resorts. When you reserve your stay through this site, you’ll get extra benefits such as:

- Early check-in

- Guaranteed 4 p.m. late checkout

- room upgrades when available

- free breakfast

- free parking

- $100 food and beverage credits

- $100 spa credits

- Third night free

You can read about Meghan’s incredible stay at the Loews Regency San Francisco and how booking through Amex Fine Hotels & Resorts saved her $650. Even though these bookings are processed through a third party, as long as you don’t prepay for your stay, you should be able to earn hotel points and elite benefits for Amex Fine Hotels & Resorts’ stays.

You’ll also get to access The Hotel Collection, which offers room upgrades and up to $100 in hotel credits. You must stay two or more nights and can book your stay through the American Express Travel portal at amextravel.com or by phone at 800-297-2977.

Coupons on steroids

Conservative annual value: $300

Amex Offers are basically super coupons that you can add to your Amex Platinum (or any Amex card, to be fair). You’ll find yourself saving $20 or $30 a pop, in many cases. You’ll save on everyday purchases like Amazon, groceries, dining, clothing, travel, etc. They are targeted, so different cardholders will have different offers.

They’re actually better than coupons for a couple of reasons:

- They are given to you as statement credits after your purchase. In other words, you’ll earn points for the full price, and get the credits afterwards. An offer will trigger automatically once you’ve satisfied its terms

- Amex handles the statement credits, which means you can add other coupon codes or promo codes at checkout and stack them both. You can even go through online shopping portals

- You’ll still earn points from Amex on the purchase as well.

My wife and I have saved $634 this year with Amex Offers. And we would have saved hundreds more were it not for coronavirus, as there was some extremely generous travel offers that we couldn’t use. Amex

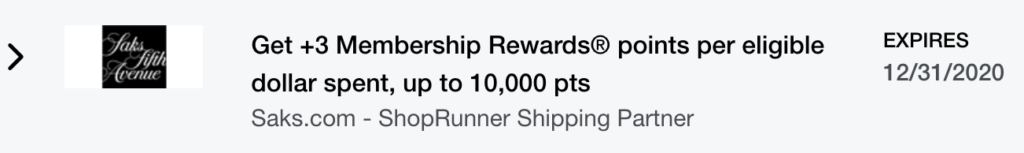

$100 in Saks Fifth Avenue credits

Conservative annual value: $100

I hate this credit profoundly and wrestled with the decision to even include it. The Amex Platinum gives you up to $50 in Saks Fifth Avenue credit from January to June, and another $50 credit from July to December.

If you’re part of the 1% that shops at Saks Fifth Avenue, enjoy this credit. For the rest of us, this is a toughie to utilize. Saks gift cards reportedly won’t trigger the credit. If you buy something and return it, Amex has been known to snatch back their credit.

Your best bet may be to purchase something and return it for store credit. At least then you can allow your balance to accrue, and make a lavish purchase at a later date. At worst, you can use the credit to buy a gift or stocking stuffer for a friend or loved one.

You can also shop through a shopping portal and earn some extra points on the purchase, plus stack it with Amex offers that constantly seem to appear.

Gold elite status with Hilton and Marriott

Conservative annual value: $50

Gold elite status is worth much more than $50, but the fact that you can earn it so easily with other hotel credit cards made me adjust this perk’s value for the Amex Platinum.

The card gives you Gold elite status with Hilton and Marriott, which offers (depending on where you stay) benefits like:

- Free breakfast (Hilton hotels only)

- Upgrades to bigger rooms where available

- Late checkout

- Better rooms (views, higher floors, etc.)

- More points for paid stays

The benefits really will vary greatly by property. When my wife and I visited the Maldives, I had just earned Platinum status hours before checking in. Upon arrival, they greeted me and informed us that as Gold elite members, we would be upgraded to a suite that costs $500+ more per night.

Rental-car elite status

Conservative annual value: $50

As an Amex Platinum cardholder, you’re eligible for the following elite status:

In my experience, you’ll receive some sort of incremental upgrade four out of five times you rent a car. With National, where you can choose your own car once you arrive, you’ll have access to a higher-tiered pool of cars, called the Executive Aisle.

You’ll also earn points faster, which can quickly translate into a free rental day. Read our post on how to save on car rentals for more.

Travel insurance, purchase protection and Platinum Concierge

Conservative annual value: $200

You’ll get a whole suite of protections with your Amex card membership:

- Car rental loss and damage insurance

- Extended warranty

- Purchase protection

- Return protection

- Baggage insurance plan

- Premium Global Assist hotline (includes medical evacuation insurance)

- Trip cancellation/interruption insurance

- Trip delay coverage

You may never need these benefits, but they can be lifesavers if you do. I’ve saved over $1,000 from trip delay insurance alone in the past few times my flights have been delayed or canceled. Amex will pay for your food, your hotel, even clothing and toiletries if you need them! While you may not get a value of $200 per year from these benefits, you won’t have to spend money insuring your trip at the airline’s checkout screen.

Another convenient (and time-saving) perk is access to the Amex Platinum Concierge, which can help you book hard-to-get restaurant reservations or concert tickets, or assist with requests like finding the right venue for a meeting. Here’s more about all the tasks you can outsource to the Amex Platinum Concierge.

Complimentary two-day shipping and returns

Conservative annual value: $25

ShopRunner is a membership that basically gives you that Amazon Prime two-day delivery for 100+ retail stores. You’ll even get free returns! Participating stores include:

- Peet’s Coffee

- Bloomingdale’s

- Under Armour

- American Eagle

- NFL Shop

- bareMinerals

- Saks Fifth Avenue

- Lenovo

ShopRunner comes complimentary with the Amex Platinum. And while an annual membership normally costs $79, I would not personally pay $79 per year for the thing — hence our lower estimated value. If you order rushed delivery three or four times per year from participating stores, this benefit will save you money.

Annual value: $1,700

After adding up the (conservative) value of all the perks, you should be able to get $1,700 in value from the Amex Platinum’s benefits.

That’s not to mention the 75,000 point welcome bonus and 10x points on gas and grocery for the first six months. You could easily end up with nearly 200,000 points after your first year. That’s worth $3,400 according to our points valuations.

The American Express Travel portal lets you redeem your points for airfare at a rate of one cent per point. So the welcome bonus is worth at bare minimum $750 and potentially much more if you transfer it to one of the Amex transfer partners.

You’ll also earn Amex points at the following rates (terms apply):

- 5x Amex Membership Rewards points on airfare (booked either directly with the airline or booked with American Express Travel). Starting Jan. 1, 2021, earn 5x points on up to $500,000 spent on these purchases per calendar year.

- 5x Amex Membership Rewards points on prepaid hotels booked with American Express Travel.

- 1x Amex Membership Rewards point on everything else

There’s a $550 annual fee (see rates and fees). If you can make the most of these incredible perks, you’ll offset the annual fee and likely come out ahead. Here’s our full review of the American Express Platinum.

Bottom line

The Amex Platinum card comes with a generous welcome bonus of 75,000 Amex Membership Rewards points after spending $5,000 on purchases within the first six months of opening your account. You’ll also get 10x points when spending at U.S. supermarkets and U.S. gas stations for the first six months of card membership for up to $15,000 in combined eligible spending. The intro bonus alone is enough to justify paying the $550 annual fee. You can always downgrade or cancel the card after a year if you don’t find the benefits useful.

But remember, the excellent benefits and perks are why many people keep this card in their wallet. You’ll get up to $1,700 in value from the benefits each year (conservatively), which offsets the $550 annual fee. and leaves you with $1,150 in value.

In brief, you’ll get (Terms Apply):

- Free food and drinks and a comfortable place to relax at airport lounges

- Room upgrades and food credits through Amex Fine Hotels & Resorts

- Discounts with Amex Offers

- Elite status with hotels and rental car agencies

- Up to $200 annual airline fee credit

- Up to $200 annual Uber credit

- Complimentary travel protections and purchase protections

- And more

Enrollment required for select benefits.

You can apply for the Amex Platinum here.

Conservative annual value is based on MMS valuation and not provided by the issuer.

Let us know what you think of the card! And subscribe to our newsletter for detailed card breakdowns like this delivered to your inbox once per day.

For rates and fees of the Amex Platinum Card, click here.

Click here for Uber Eats terms and conditions.

Featured photo by Sopotnicki/Shutterstock

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!