5 ways to avoid overpaying for your rental car

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

I usually use my hard earned miles & points for flights and hotels. So when it comes to other expenses, like rental cars, I want to get the best deal possible (when it doesn’t make sense to use points). There are lots of small things you can do to ensure you’re not paying excessive fees or for extras you don’t need.

And you can save a bunch by doing a little shopping around or letting AutoSlash work its magic…seriously if you’ve never used AutoSlash you need to change that.

How to save on car rentals

When you’re renting a car, you’ll want to make sure you’re paying attention to the extra fees and “services” you might be charged for. I’ve found that these fees can easily exceed the price of the rental if you’re not careful. Plus, the fees vary depending on the company and even the state you’re renting in. But if you do a little research, have the right insurance coverage in place and know the rules, you’ll be in a better position to find the best deals.

Be flexible with your time, date or destination

To get the best car rental deals you’ll want to be aware of what can cause your rental car prices to fluctuate. And there isn’t an exact way to know exactly what factors will swing the price of a car rental one way or the other.

Usually, one-way rentals are more expensive than round-trip bookings. But we’ve had MMS staffers book two separate one-way rentals for less than the price of a round-trip. So you just never know. If you can pick-up your rental in an off-airport location, you might save on taxes. Reader Mark saved $100+ in taxes by picking up a cheap car rental in Boston at an off airport site and returning it to the airport because the taxes were only charged for the origin not the destination.

If you play around with your pick-up or return time you might be able to find a better deal. For example, I researched car rental deals for a 5-day trip from Baltimore to Pennsylvania. I started off looking for round-trip deals. But I also considered doing two one-way, one-day rentals, because I only needed the car for the trips to and from the airport.

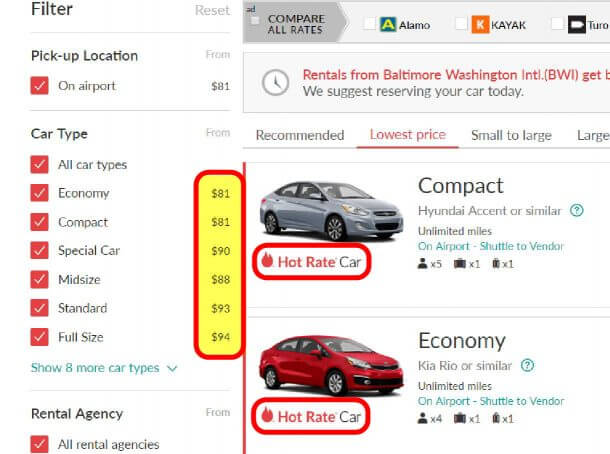

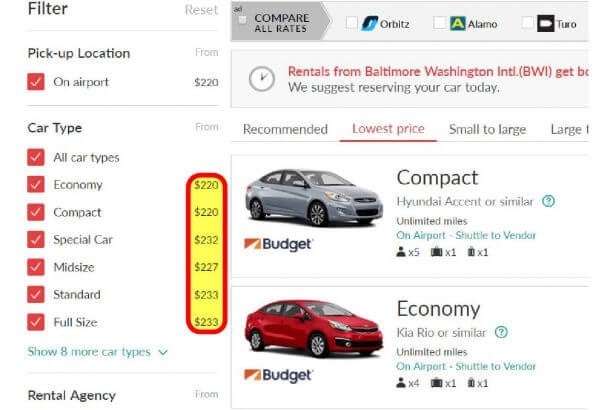

I usually check Hotwire or Priceline for cheap prices, but I know lots of people who like to search Costco Travel as well. The cheapest round-trip rental I found was ~$220 for 5 days (~$44 a day) including taxes & fees. When I looked into one-way prices, it was only ~$20 less to book 2 one-way rentals as opposed to a single 5-day rental. As a last ditch effort, I figured I could return the car earlier on the day of my flight and just work from the airport lounge.

I thought doing that would save me one day of charges (~$44) because even though I was only returning the rental four hours earlier, those four hours were the fifth day of the rental, but instead the price dropped drastically.

I was shocked to see the daily rate drop from ~$44 to ~$20 (both rates include taxes & fees). That’s a ~55% savings, which made a 4-day round-trip rental actually cheaper than even a single one-way trip. What’s the catch? I had to book a Hot Rate deal to get the price and Hotwire Hot Rate bookings can’t be canceled or changed. I thought it was a great deal and my plans were set, so I wasn’t worried about needing to change it.

If your travel plans are flexible, it can pay to search different dates, times, and locations. Reader Anthony gets cheaper car rentals by booking at non-airport locations and then taking an Uber there. While, reader Marc stumbled on a way to rent a car for cheap in Portugal when the Avis agent pointed out that he could get better rates by booking through the Avis Portugal site. So before you book an international rental, check the local country’s website to see if you can save.

Save time and money with AutoSlash

AutoSlash is an amazing service tracks the price of your rental car reservation and emails you if it finds a cheaper price. This is where booking a non-refundable rate can hurt you, because you won’t be able to use AutoSlash. In my case, I thought it was a good enough deal to book even though it was non-refundable. But in most cases, using AutoSlash is going to be the quickest way to save money because you can set it and forget it.

The last two times I used AutoSlash the cheapest car rental prices it sent me were $90+ less than what I originally booked. That said, AutoSlash won’t search for better rates on different dates, times, pick-up or drop-off locations, so it would have missed the deal I found. If your travel plans are flexible, it’s worth spending a few extra minutes to check the prices on different days and times.

Don’t make this mistake with extra rental car “services”

Benjamin Franklin is credited with saying “in this world nothing can be said to be certain, except death and taxes.” I would like to add hidden fees to that list. Rental car fees can be tricky, so it’s important to always pay attention to the details because the rules will vary not just between companies, but also depending on what state you’re in. For example, in California, you won’t have to pay extra to add additional drivers to your rental. In most other states, whether or not you pay a fee for additional drivers varies by company.

I like to think of myself as a savvy traveler and I pride myself on avoiding ridiculous fees. But in the past, the rental company got the best of me because I didn’t read the fine print. I wanted to save on tolls by using National Car Rental’s TollPass (similar to EZ-Pass). At the time, the service cost ~$4 a day (to up ~$20 for the rental period). I assumed this service would allow me to take advantage of the lower toll prices offered to EZ-Pass users compared to paying cash. I did the math for a 2-day trip and thought I could save ~$15+ in tolls (even after paying the extra ~$4 per day).

I found out after taking the trip that I was wrong. It turns out the TollPass service (and most other similar “services” offered by rental companies) charges you for tolls at the cash rate, not the discounted rate for paying with an electronic transponder. The extra fee wasn’t horrendous and it did save me time at the tollbooths. But in the future, I will be getting my own EZ-Pass (if I’m going through a state that accepts it) because you can use it for “any vehicle of the same class,” including rental cars.

Don’t overpay for rental car insurance

The collision damage waivers that rental car companies offer can cost up to $20 per day. That can be as much as the rental car, so I almost always book with a card that provides primary rental car insurance, like the Chase Sapphire Preferred® Card. Just remember, this primary rental car insurance for collision only covers the rental for damage or theft, not the liability for damage to other vehicles, property or for injuries. For most people this isn’t an issue because your personal auto insurance is likely to cover your rental car for liability, but you’ll want to double check to make sure.

Because I live in a city with great public transportation, I don’t own a car. I could purchase supplemental liability insurance through the rental company, but that can cost $10-$40 a day. Instead, I’ll take out a non-owner auto insurance policy (costs me ~$33 a month) whenever I need coverage. It provides liability coverage for almost any car I drive, including rentals or even if I’m just borrowing someone else’s car.

If you’re looking for coverage, MMS readers R. Johnson and GR8FUL both recommend Allianz as a good company for getting a cheap ($8 to $12 per day) collision damage waiver. And reader Marc says that USAA members can get non-owner auto insurance for only ~$25 a year, which is an exceptional deal.

Pay for rental with points

Whenever I can I avoid paying cash for my travel expenses, usually this means booking hotels and airfare with points, but it’s not limited to that. There are a handful of ways to pay for rental cars or other travel expenses with points. The simplest is just to earn cash-back rewards you can apply toward any purchase. You can also use fixed-value points that can be redeemed for a set value for an eligible travel purchase. Each specific type of point works differently and has a different value.

For example, the Capital One rewards you earn with cards like the Capital One Venture Rewards Credit Card or Capital One Spark Miles for Business can be used to “erase” eligible travel purchases made with the card at a rate of one cent per point (you can also transfer them to travel partners). But, with the U.S. Bank Altitude™ Reserve Visa Infinite® Card each point you earn is worth 1.5 cents toward eligible travel purchases (one cent per point toward other purchases). However, U.S. Bank points are redeemed differently, you can use them to book travel through the U.S. Bank travel site or you can use U.S. Bank’s Real-Time Rewards to redeem points (minimum of $250 to use Real-Time Rewards for rental cars).

You can also use Chase Ultimate Rewards points to pay for rental cars (and other travel) through the Chase Travel Portal. The value of your points depends on which Chase Ultimate Rewards credit card you have:

| Chase Ultimate Rewards Card | How Much Are Points Worth Toward Travel? |

|---|---|

| Chase Sapphire Reserve® | 1.5 cents |

| Chase Sapphire Preferred® Card | 1.25 cents |

| Ink Business Preferred® Credit Card | 1.25 cents |

| Ink Business Cash Credit Card | 1 cent |

| Ink Business Unlimited Credit Card | 1 cent |

| Chase Freedom® | 1 cent |

| Chase Freedom Unlimited® | 1 cent |

You can also use the miles and points you earn from many of the best travel credit cards and top rewards credit cards to pay for your rental car. But it’s not always the best because in most cases you’ll be getting one cent per point in value or much less. Also, if you have to book through a specific bank or rewards portal in order to be able to pay with points you might not always be getting the best price on your rental.

The information for the U.S. Bank Altitude™ Reserve Visa Infinite® Card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

Bottom line

Flights and hotels aren’t the only big expense when it comes to travel. Rental car rates and hidden fees can quickly add up, but with very little extra effort you should be able to save a lot of cash using these tips:

- Be flexible with your travel dates, times and rental locations

- Use AutoSlash

- Avoid tricky fees

- Don’t overpay for rental car insurance

- Pay with your credit card rewards

I was able to save ~55% on a car rental by adjusting my return time by only four hours and I’ve saved $100s on car rentals over the years thanks to AutoSlash. And the rules for renting a car vary widely by company and by the state you’re renting in. So it’s always important to read the fine print so you don’t end up getting stuck paying more than you should.

| For more travel and credit card news, deals and analysis sign-up for our newsletter here. |

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!