Capital One transfer partners – Earn rewards that you can use with 10+ loyalty programs

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Redeeming Capital One miles used to be a straightforward activity, but now, thanks to certain Capital One cards like the Capital One Venture Rewards Credit Card, you can transfer your miles to 10+ airline and hotel partners. Transferable miles give you flexibility when you travel and each program has its own sweet spots. With so much uncertainly in the travel industry right now, earning transferable miles can give you a bit more peace of mind because your rewards aren’t tied to a single airline or hotel loyalty program.

But not all the partners are worth your time. We’ll show you which partners you can get the most value with and which partners to avoid. Remember, you can always redeem Capital One miles for one cent each towards an eligible travel purchase (made within the last 90 days). So if you’re going to transfer your miles you want to get more than one cent per mile in value in return.

Capital One transfer partners

You can transfer Capital One miles to 16 airline programs (transfer ratios included):

- Aeromexico (2:1.5)

- Air Canada Aeroplan (2:1.5)

- Air France & KLM (Flying Blue) (2:1.5)

- Alitalia (2:1.5)

- Avianca (1:1)

- Cathay Pacific (1:1)

- Emirates (2:1)

- Etihad (1:1)

- EVA Air (2:1.5)

- Finnair (1:1)

- JetBlue (2:1.5)

- Qantas (1:1)

- Singapore Airlines (2:1)

- British Airways (2:1.5)

- Turkish Airlines (2:1.5)

- TAP Portugal (1:1)

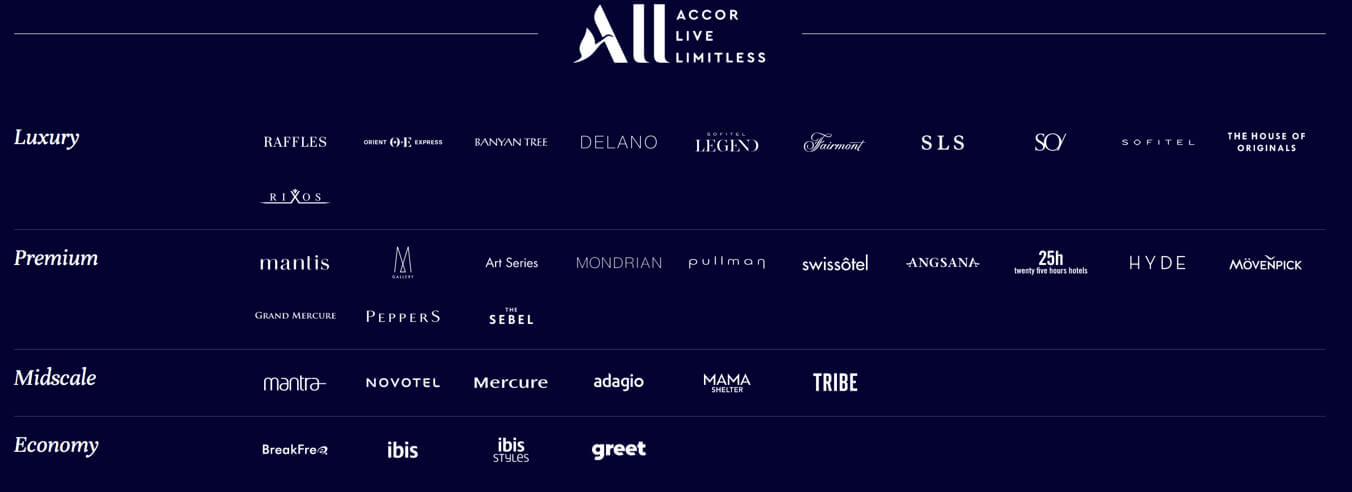

And you can transfer Capital One miles to these three hotel programs:

- Wyndham Rewards (1:1)

- Accor Live Limitless (2:1)

- Choice Hotels (1:1)

The transfer ratio will be 2:1.5 for most partners, so you’ll get 1.5 miles/points for every two Capital One miles you transfer. The exceptions are Emirates, Accor and Singapore Airlines, which have a 2:1 transfer ratio.

That’s not a 1:1 transfer ratio like other transferable points programs including Chase Ultimate Rewards, Amex Membership Rewards and Citi ThankYou points. It breaks down to .75 miles/point for each Capital One mile (.5 miles/point for Emirates, Accor and Singapore Airlines).

Any time you transfer miles from Capital One to an airline, you can’t transfer them back again. So it’s important to know what you want to use them for before you initiate the transfer. The minimum transfer amount is 1,000 miles and from there you can transfer in increments of 100.

With that in mind, here are ways to get value from your Capital One miles – and which programs to avoid. You can always use Capital One miles to erase travel charges at a rate of one cent per point. So we’ve broken down the transfer partners into good, OK and bad classifications based on how easy it is to get more than one cent per point in value. One thing to know is that if you erase the travel charge with your miles you’ll still be able to earn airline miles or hotel points (when you book directly), which is something that won’t happen if you transfer miles to the program to book awards.

Accor – OK

There are nearly 5,000 Accor hotels under 34 different brands worldwide, but most of those are in Europe. Accor also has a simple rewards program, there is no award chart and instead, you can redeem points for a set amount. Every 2,000 points is worth $40 Euros, so depending on the exchange rate that’s a value of around 2.2 cents per point (at the exchange rate at the time of writing of .9 Euros to one dollar).

That means at a 2:1 transfer ratio you’re getting just a bit over one cent per mile in value by transferring to Accor. But if you just paid for the Accor stay and erased the charge with miles you’d also earn 2.5 Accor points per Euro (at the vast majority of brands) and you’d earn elite status credit. Depending on the exchange rate that can bump the value between transferring or just erasing the stay with Capital One miles to about even. Also, if you transfer to Accor the points expire after 12 months of inactivity and, per the terms, the expiration can only be reset by staying at an Accor property.

One potentially niche use of Accor points is that they transfer to airlines, while most airline partners have a 2:1 transfer ratio you can actually convert Accor points to Finnair, Qantas, Iberia or Virgin Australia at a 1:1 ratio. That means these airlines are indirect 2:1 transfer partners with Capital One, although it’s better to just transfer miles to Qantas directly at a 2:1.5 ratio.

Aeromexico – Bad

This program is a bit disorganized and the quoted number of points on the award chart suddenly changes when you run a search. And there aren’t many great deals, anyway, so usually, you’re better using your travel credit card rewards somewhere else.

For example, flights within Mexico are 28,000 Aeromexico points for a round-trip coach award ticket. To get that many points, you’d need to transfer ~38,000 Capital One miles (28,000 / .75). On their own, those miles are worth $380 toward flights. We ran a few searches, and domestic flights within Mexico are hardly over $200 round-trip. In the vast majority of cases, you’d be better off redeeming Capital One miles for paid flights.

Flights to the U.S. are 56,000 Aeromexico points round-trip. You’d need to transfer a staggering ~75,000 Capital One miles for a round-trip coach award seat. Between the high award prices and typically cheap paid tickets (even in business class), we wouldn’t recommend that you transfer miles to Aeromexico unless there was a transfer bonus or particularly good award sale going on.

Air Canada – Good

Aeroplan, the loyalty program for Air Canada, has a few stellar uses, including:

- 150,000 Air Canada Aeroplan miles for round-trip business class flights to Africa (200,000 Capital One miles)

- 110,000 Air Canada Aeroplan miles for round-trip business class flights to Western Europe (~147,000 Capital One miles)

- 25,000 Air Canada Aeroplan miles for round-trip coach award flights within the mainland U.S. and Canada (~34,000 Capital One miles)

Long-haul business class flights, in particular, can easily cost $1,000s if you pay cash, so this can be an excellent use of your Capital One miles, depending on where you want to go.

Keep in mind, Air Canada adds fuel surcharges to certain partner award flights. So check the full cost before you transfer any miles out of your account and be sure to read our ultimate guide to using Air Canada miles.

Air France & KLM (Flying Blue) – Good

While there’s no longer an official award chart, Flying Blue runs monthly Promo Awards where you can save big on award flights. For example, during a past sale, you could fly in business class to Europe for 35,000 Flying Blue miles (~47,000 Capital One miles). That’s an incredible deal to visit Europe in style. And at other times there have been coach awards starting at just 14,000 Flying Blue miles one-way (~19,000 Capital One miles).

It’s worth running a search to see what comes up. For example, I found coach awards to Mexico on Aeromexico (a SkyTeam alliance partner) for 14,500 Flying Blue miles (~20,000 Capital One miles) each way. Depending on where you’re flying from and how much paid tickets cost, this can be a good use of your miles – especially if your airport has a big SkyTeam presence (Air France, Delta, KLM, Korean Air, etc.).

Another great feature of Flying Blue is that it is a transfer partner with many other rewards credit card programs, like Chase Ultimate Rewards, Amex Membership Rewards and Citi ThankYou. So you can combine your points from different programs to book awards.

Alitalia – Bad

I took a quick look at Alitalia’s award chart and got out of there fast. In looking at prices for one-way award flights in coach and business class, you can fly all of these routes cheaper with other mileage programs.

Avianca – Good

Avianca has its fans. There are no fuel surcharges on flight awards, you can book most partner awards online and there are some great sweet spots, like:

- Within U.S. Zone 1 for 7,500 Avianca miles (10,000 Capital One miles) each way in United Airlines coach

- From U.S. Zone 1 to U.S. Zone 2 for 10,000 Avianca miles (14,000 Capital One miles) each way in United Airlines coach

- Business class to Europe for 63,000 Avianca miles (84,000 Capital One miles) on partner airlines

Keep in mind there’s a $25 booking fee for all award tickets.

If I wanted to fly on a Star Alliance airline, I’d run the search through Air Canada and Avianca and see which is better as far as miles required, surcharges and any other fees or conditions. Between these two partners, you can get to a lot of the world on Star Alliance airlines.

Cathay Pacific – OK

Cathay Pacific has a distance-based award chart, so the longer the flight, the more miles you’ll need and it’s usually not worth it and each airline partner has its own separate award chart, which gets confusing really fast.

They have an award calculator where you can check award prices. But you have to check each route and airline individually. The best uses of Cathay Pacific miles are generally for shorter flights on Cathay Pacific.

Emirates – Good

The good deals in this program are for more of a niche market, but they are really, really good. Especially since Emirates recently eliminated their crippling fuel surcharges for award flights. To fly from New York (JFK) to Dubai in coach, you’ll pay 62,500 Emirates miles (125,000 Capital One miles). And for a one-way first class ticket, it costs 136,250 Emirates miles (~273,000 Capital One miles) and ~$842.

However, you can also fly round-trip from New York to Athens in first class for just 130,000 Emirates miles (260,000 Capital One miles). That is an astonishing deal, especially considering this ticket costs $7,000+ if paying with cash.

This is a partner you really need to run the numbers with. That’s because first class tickets in one of the world’s most luxurious cabins can cost $19,000+. It depends on what your goals are, as well as your preferred travel style – because this could be the trip of a lifetime.

I’m marking this one as “good” option because while there’s huge value to unlock, it’s certainly not for everyone.

Etihad – OK

This one’s a hard sell because, in my experience, transfers can take several days to over a week. If your award disappears while you wait for the transfer to complete, you likely don’t want Etihad miles hanging around unused.

There are niche uses for Etihad miles, like short flights within Europe on Brussels Airlines for only 5,000 Etihad miles (~7,000 Capital One miles) each way in coach. That catch is you have to fly to or from Brussels. I loved Belgium, but this is admittedly a limited use.

Another excellent use is booking award flights on American Airlines flights for much cheaper than American Airlines charges. But this is where each airlines’ limitations work against each other. Transfers into Etihad are slow and award seats on American Airlines are scarce and often go quickly. At best, you’d be speculatively transferring miles to Etihad.

You can still fly from the U.S. to Japan or South Korea for only 50,000 Etihad miles (~67,000 Capital One miles) each way in business class. That’s a heck of a deal, if you can find it.

EVA Air – Bad

Eva Air’s award program is called “Infinity MileageLands,” which has always confounded me. Anyway, booking a partner award flight is confusing and costs way too many miles on nearly every route.

The only exception is on EVA Air flights within Asia, which are 35,000 EVA Air miles (~47,000 Capital One miles) round-trip in coach to fly the span of the continent. Even then, you might be able to get cheaper awards with other mileage programs. Always run the numbers — but this one is generally not a good deal.

Finnair – Bad

There is absolutely nothing “redeeming” about Finnair’s mileage program. The only exception, maybe, is that one-way coach awards within Northern Europe (Scandinavia, Poland, and Russia) are 10,000 Finnair miles (~14,000 Capital One miles) each way.

You’ll pay similar prices booking through Qantas, so there aren’t any standout gems here.

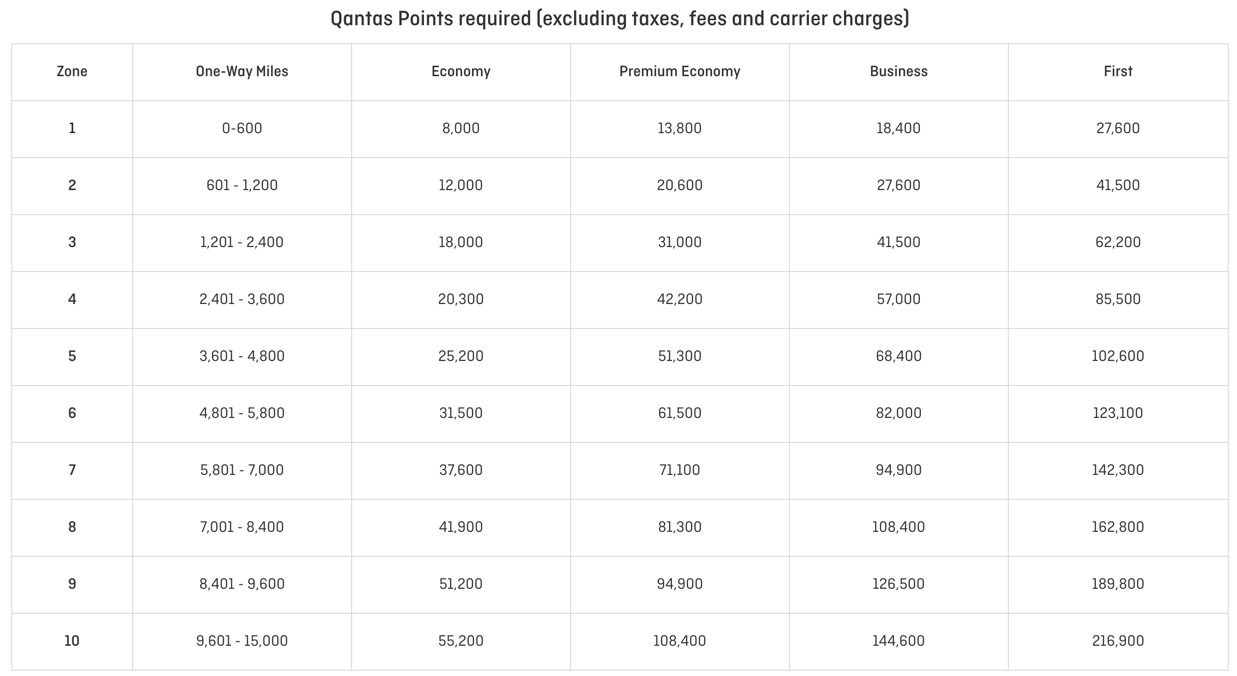

Qantas – Good

You can use 16,000 Qantas miles (~22,000 Capital One Miles) to book round-trip short-haul flights 600 miles or less on American Airlines. These are sometimes the most expensive paid flights. In fact, this award chart applies for many award flights, including on Qantas, Emirates, and Fiji Airways.

If you want to fly around Australia, you can also score great deals with Qantas miles. Even longer flights between 601 and 1,200 miles on Qantas, American Airlines, and other partners are only 12,000 Qantas miles (16,000 Capital One miles) each way in coach.

These are excellent deals you shouldn’t overlook just because the loyalty program isn’t domestic.

Singapore Airlines – Good

While I’m disappointed with the decreased 2:1 ratio with Capital One transfers to Singapore Airlines, you can do well with this partner. We’ve written a lot about how to get flights on United Airlines (especially to Hawaii) at cheaper rates than United Airlines charges for its own flights. You can fly round-trip in coach from the U.S. to Hawaii for 35,000 Singapore Airlines miles (70,000 Capital One miles). Depending on how much flights cost, that can be a bargain.

And of course, you can book flights on Singapore Airlines, which is consistently ranked one of the world’s best airlines. It’s also easy to collect Singapore Airlines miles. With this addition, they’re officially a transfer partner of every transferable points program, so when you’re ready to travel, you’ll have plenty of ways to get where you’re going.

JetBlue – OK

With the improvement in the JetBlue transfer ratio, this can be a viable option in some cases. JetBlue doesn’t have an award chart, instead, the points price is tied to the cash price and JetBlue points are usually worth ~1.4 cents each (except when booking Mint class, then it’s closer to one cent per point). Because the transfer ratio to JetBlue is 2:1.5 that means you’re getting a bit over one cent per point toward JetBlue flights if you transfer. Which is almost the same as if you purchased JetBlue flights with your card and then used your Capital One miles to erase the charge at a rate of one cent each.

But, if you purchase the flight and then erase the charge you’ll also earn JetBlue points and elite credit for the free flight and you won’t be paying the taxes out of pocket. So in most cases transferring to JetBlue isn’t the best option, but on some JetBlue award flights you can get slightly more than 1.4 cents per point, so you’ll want to do the math.

Wyndham – OK

When Wyndham acquired La Quinta it became one of the largest hotel chains in the world with over 9,000 locations. The Wyndham award chart is simple and is broken down into three categories:

- Category 1 is 7,500 points (10,000 Capital One miles) per night or 1,500 points + cash

- Category 2 is 15,000 points (20,000 Capital One miles) per night or 3,000 points + cash

- Category 3 is 30,000 points (40,000 Capital One miles) per night or 6,000 points + cash

The amount of cash you’ll pay for points and cash stays varies by hotel, but calculating whether or not it’s worth it to transfer to Wyndham is fairly straight forward. You’ll want to get more than one cent in value per point, so transferring can be a good deal when a category one hotel costs more than $100 a night, a category 2 costs more than $200 a night and a category 3 costs more than $400 a night. But the cost per night should be a bit higher than those numbers because by transferring points you’re giving up the option to earn Wyndham points and elite credit.

How to earn Capital One miles

There are numerous cards that earn Capital One miles, including:

- Capital One Venture Rewards Credit Card: 100,000 bonus miles when you spend $20,000 on purchases in the first 12 months from account opening, or still earn 50,000 miles if you spend $3,000 on purchases in the first 3 months.

- Capital One VentureOne Rewards Credit Card: 20,000 miles after spending $500 on purchases within three months of account opening

- Capital One Spark Miles Select for Business: 20,000 miles after spending $3,000 on purchases within three months of account opening

- Capital One Spark Miles for Business: 50,000-mile offer after spending $4,500 on purchases within three months of account opening

The information for the Capital One Spark Miles and Capital One Spark Miles Select has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

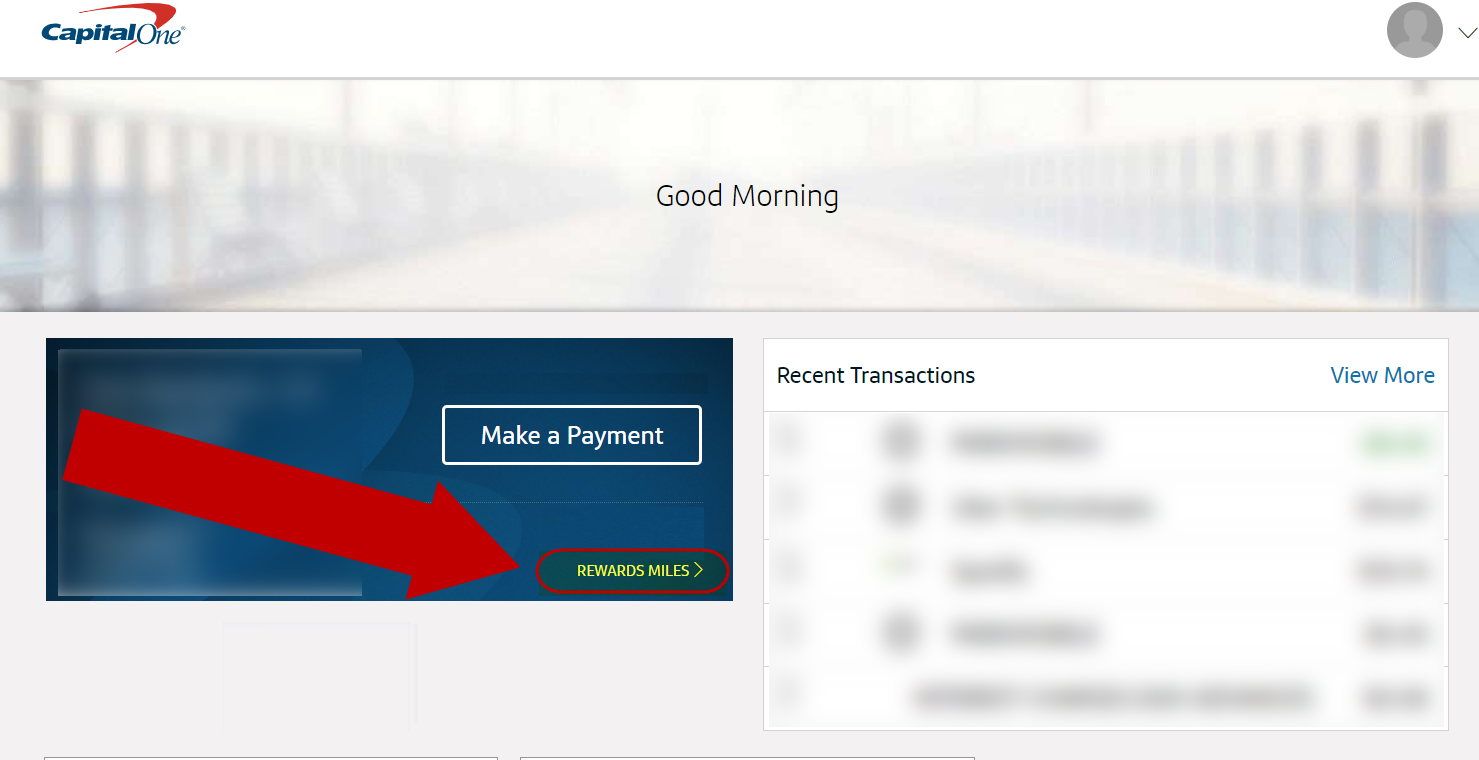

How to transfer Capital One Miles to airline partners

If you transfer Capital One miles they are still super easy to use and the process of transferring Capital One miles to airlines could not be easier.

So here’s how to transfer those miles.

Click “Rewards Miles” in your online account

Log into your Capital One account. On the home page, you’ll see your recent transactions, your balance, available credit, and payment button. In the middle of all this is a link that says “Rewards Miles.” Click that one.

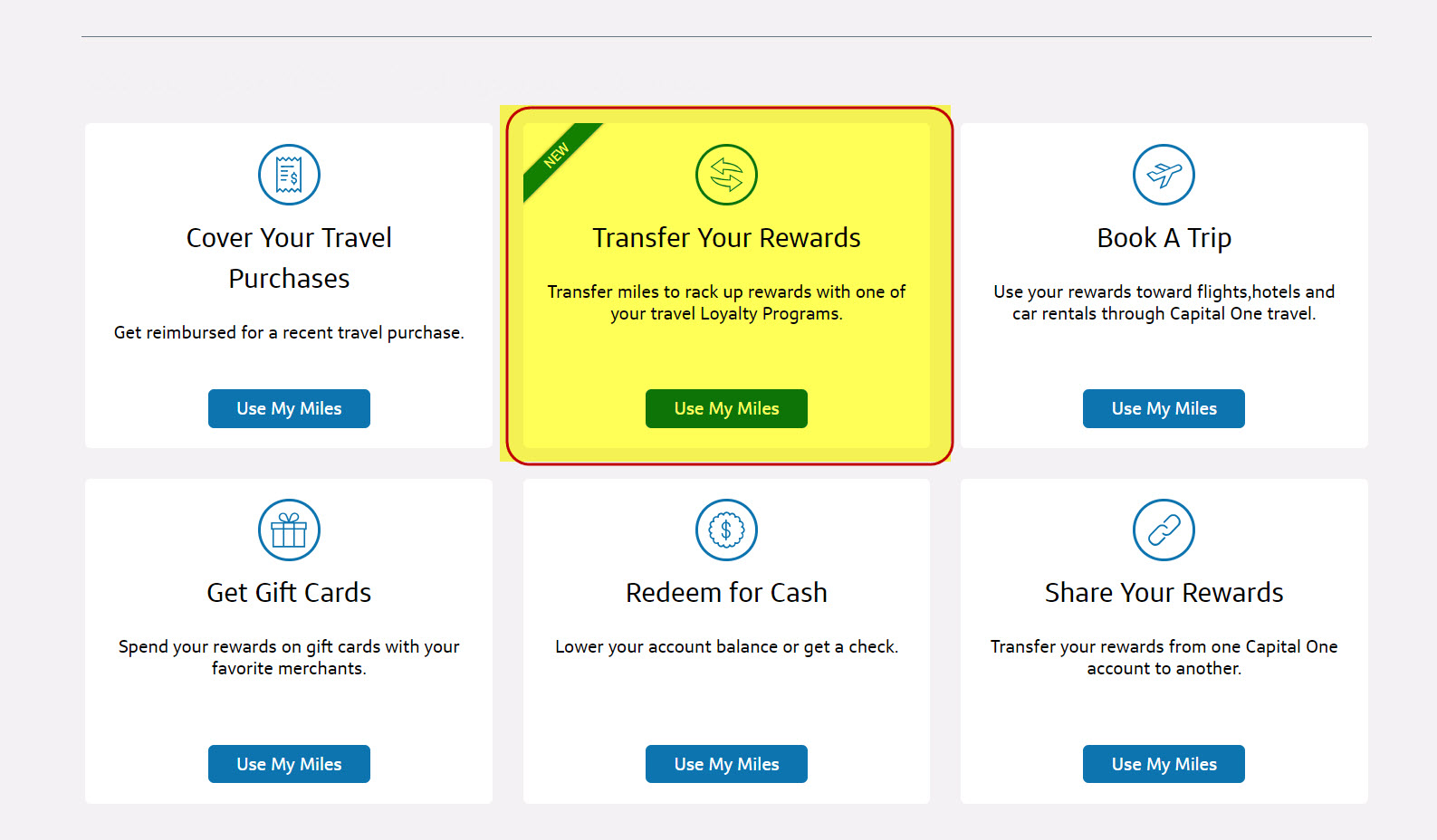

Click the “Transfer Your Rewards” box

Scroll down the page to see your options for redeeming Capital One miles. Click the “Use My Miles” button in the “Transfer Your Rewards” box.

Choose the airline you want to use

You’ll now see the partners you can choose from. Some of them have different transfer ratios. For example, you’ll receive 750 Flying Blue miles for every 1,000 Capital One miles you transfer, but just 500 Emirates miles for every 1,000 Capital One miles you transfer.

To get the best value for your Capital One miles you’ll want to use a partner with a favorable transfer ratio and a useful loyalty program, as we’ve discussed.

While Capital One miles transfer instantly to most of these partners, there are some that have a lag. Transfers to Cathay Pacific, Qantas, Singapore Airlines, Etihad and others typically take 24+ hours to show up in your account, so plan accordingly.

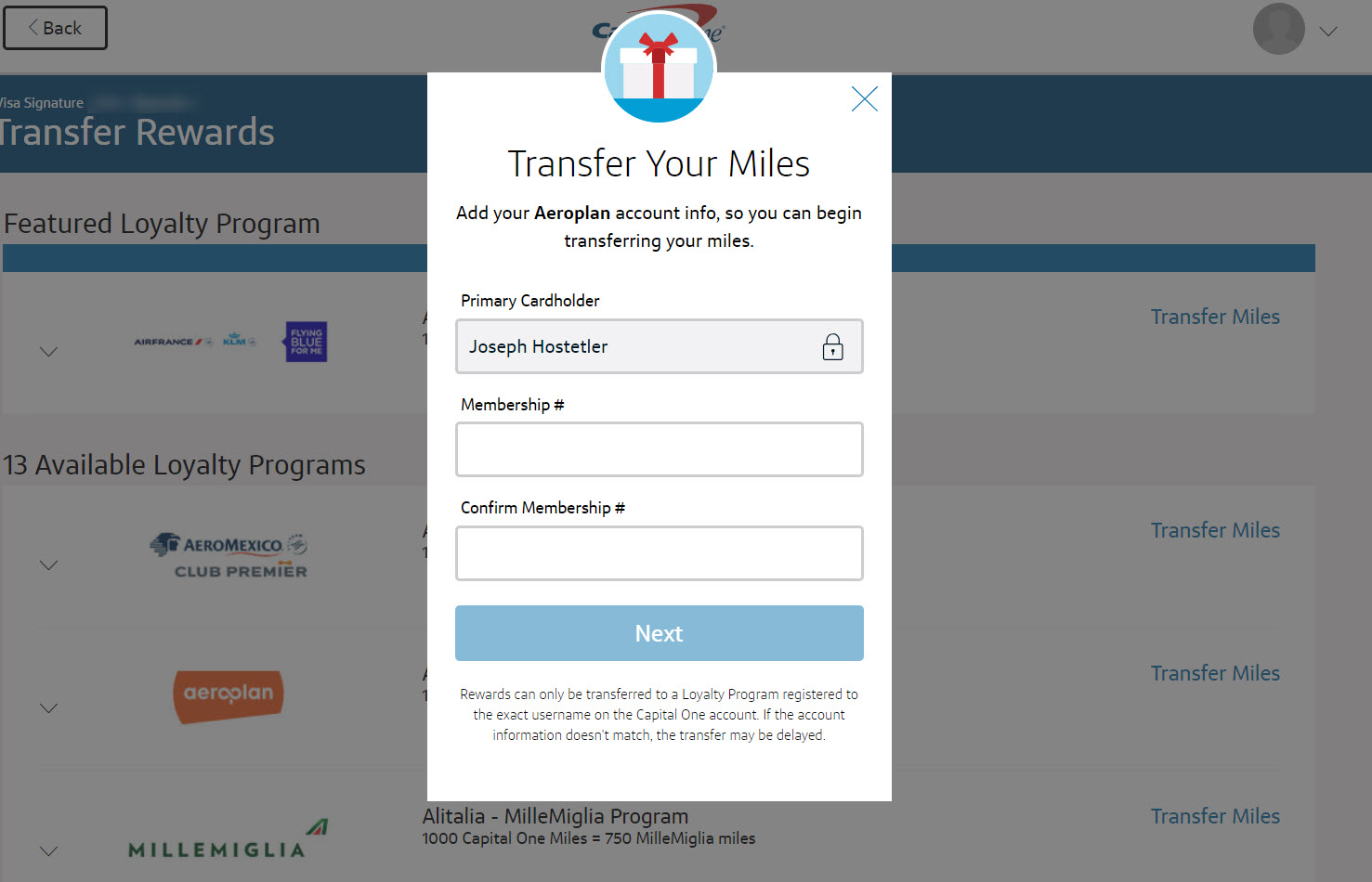

Enter your airline frequent flyer number

When you click on the partner you want to use, you’ll need to enter your airline frequent flyer number if it’s your first time transferring miles to that partner.

You can only transfer Capital One miles to your own loyalty account – the names must match.

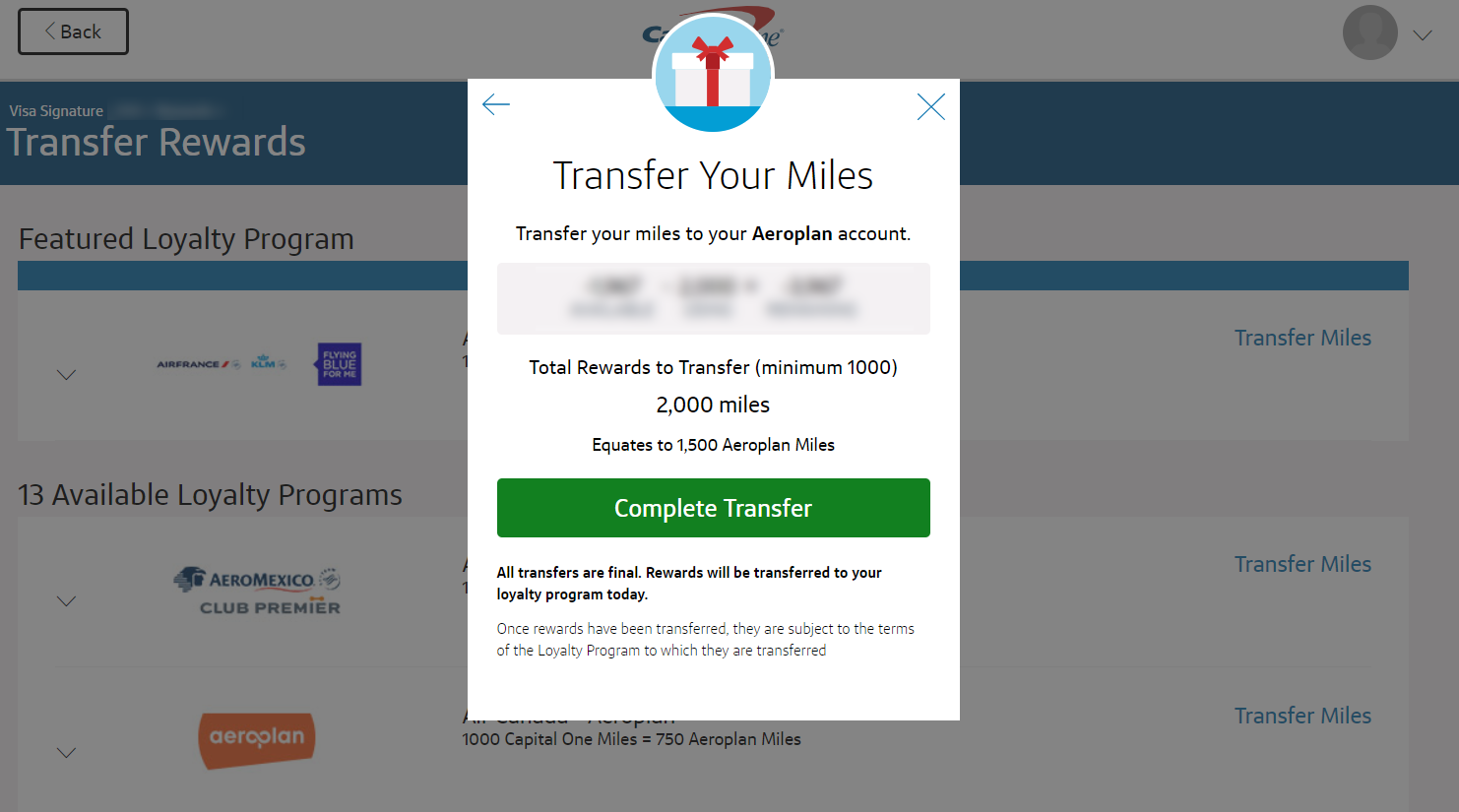

Confirm your transaction

You will then have the option to select the number of miles you want to transfer. You must transfer at least 1,000 miles at a time. Above that, you can transfer in increments of 100 miles. That’s pretty neat, because most other flexible points programs force you to transfer in increments of 1,000.

You can’t transfer your miles back to Capital One after you transfer them to a partner. It’s a one-way street, so be absolutely sure you want to transfer them before you click that “Complete Transfer” button. And remember, when you transfer your miles to a partner, you’ll be subject to blackout dates and limited by award space – which would not be an issue if you just used your miles to erase purchased travel.

Bottom line

Capital One miles can be earned on cards like the Capital One Venture transfer to 13 airline loyalty programs and two hotel programs.

Here’s hoping Capital One will continue to add new partners because as it stands, none of the good ones are domestic airlines. And it’s hard to mine the good deals and sweet spots buried within the current list. That said, if you have a use for your miles in mind, they can be worth much more than if you redeem them for one cent each toward travel, especially for the programs marked as good.

What’s your favorite Capital One airline partner? Which airlines are you hoping they’ll add? And do you agree with our rankings?

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!