American Express points review: You’ll want to collect these if you’re serious about award travel

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Smart travelers know earning transferable points, like American Express points, is the easiest and most flexible way to travel for nearly free. Instead of being locked into a specific airline or hotel program, you can use Amex points to travel just about anywhere.

It’s also incredibly easy to earn Amex points with American Express cards like the American Express® Gold Card, The Platinum Card® from American Express, and The Blue Business® Plus Credit Card from American Express. And you’ve got plenty of options for redeeming points, including transferring to airline and hotel partners, booking paid travel with points through the Amex portal, or cashing them in for gift cards.

I’ll share everything you need to know in this American Express points review. And include a quick reminder about how Amex is responding to the coronavirus pandemic with added card benefits and extended minimum spending time periods.

American Express points review

Just about everyone on the Million Mile Secrets team has a stash of Amex Membership Rewards points, and we all use them in different ways to fit our personal travel styles. Meghan’s a big fan of The Business Platinum Card® from American Express and likes to redeem her points for flights through the Amex travel portal, because with the card she gets a 35% points rebate on coach flights with her selected airline and all business and first-class flights (up to 500,000 points per calendar year). Others like to instantly transfer Amex points to Delta to take advantage of Delta’s award sales and save miles. And Jasmin has moved points from her Amex Blue Business Plus Card to Air Canada and Delta to visit family across the continent (or bring them to visit her).

Whether you’re looking for luxury international first-class flights or prefer to stretch your points for shorter coach flights close to home, Amex Membership Rewards points give you the flexibility to travel however you like.

How to earn American Express points

Amex has an important rule you should know. You can only earn the welcome offer on a specific Amex card once, per person, per lifetime. So, for example, if you’ve had the Amex Platinum in the past, you won’t be eligible to earn it again. But you would still be eligible to earn an intro offer with the Amex Business Platinum since they are considered different products.

Your points will not expire as long as you have at least one Amex Membership Rewards earning card open. You can read the full details of each card in our review of all the ways to earn Amex points.

Once you have an Amex Membership Rewards travel credit card, there are other ways to earn points beyond the welcome offer and spending, including:

- Amex Offers

- Referring friends to apply for a card (not all cards are eligible)

- Book hotel stays with Rocketmiles

- Enroll in extended pay (targeted)

How much are Amex points worth?

The value of Amex Membership Rewards points depends on how you redeem them. You’ll generally get the biggest bang for your points by transferring them to airline and hotel partners, like Delta, Air Canada Aeroplan, ANA and Flying Blue.

Here’s what you’ll typically get for various redemption options:

- Transfer to airline and hotel partners – ~0.4 to ~7+ cents each

- Airfare through the Amex travel portal – 1 cent per point (~1.54 cents per point if you have The Business Platinum Card® from American Express)

- Other travel through the Amex Travel Portal – 0.7 cents per point

- Cash back as a statement credit – 0.6 cents per point

- Gift cards – ~0.7 to ~1 cent per point (usually)

- Shop with points for purchases, like Amazon or Walmart – 0.7 cents per point (but you can get better value when there are promotions to use at least 1 point to earn a big discount)

- Shop with points through the Amex Membership Rewards mall – 0.5 cents per point (please don’t do this – you’re better off buying an item directly and redeeming points for a statement credit)

Even if you don’t have travel plans, you can rest easy knowing you’ve got other options to cash out your points. But again, you’ll almost always get the most value when you redeem points for travel.

How to use American Express points

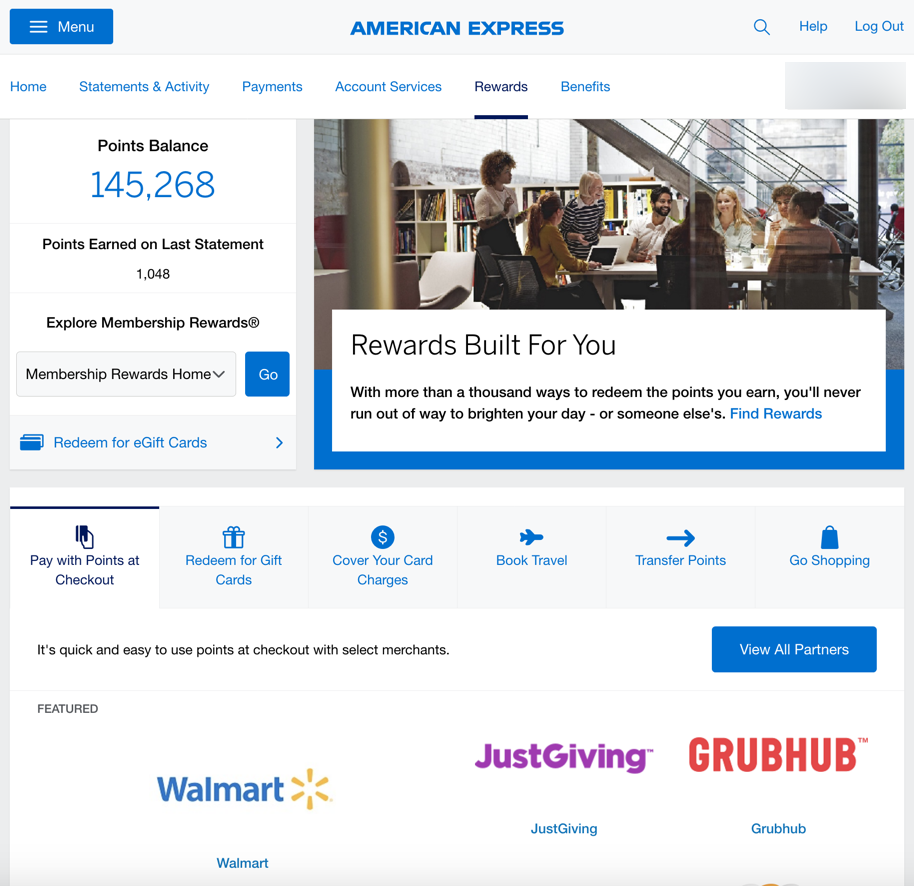

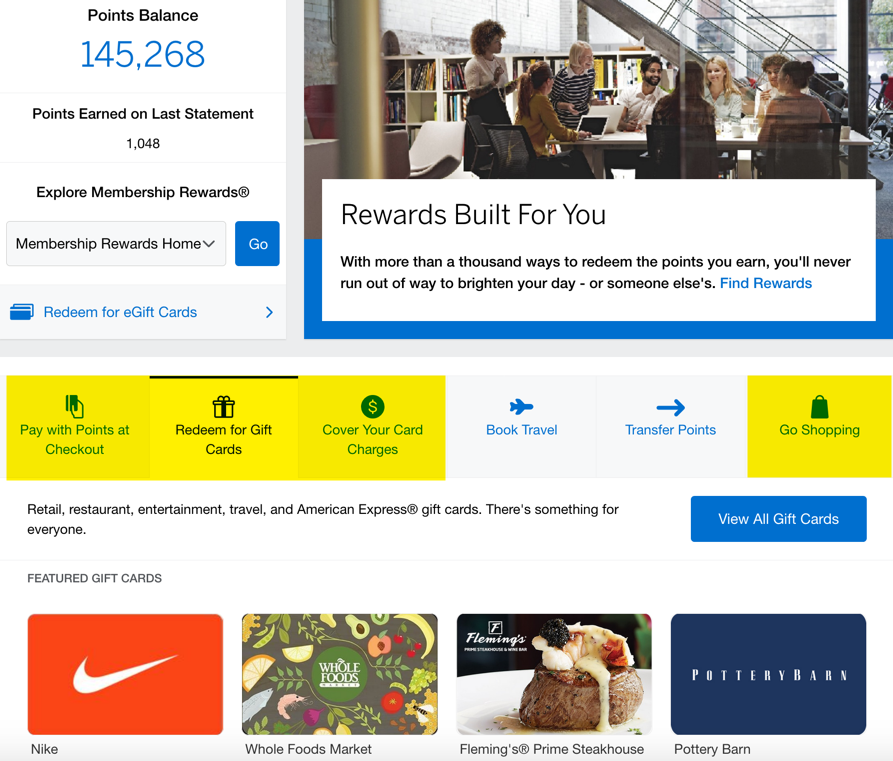

The quickest way to start using your Amex Membership Rewards points is to log into your Amex account at either americanexpress.com or membershiprewards.com. From here you’ll find a dashboard with all your redemption options.

If you’re shopping with points through retailers like Amazon, you can skip this step and go directly to the merchant’s site. If your card is linked to your Amazon account for example, you should have the option to pay with points at checkout. Be very careful with this if you’re only looking to spend one point to get in on a promotion.

Transfer Amex Membership Rewards points to airline and hotel partners

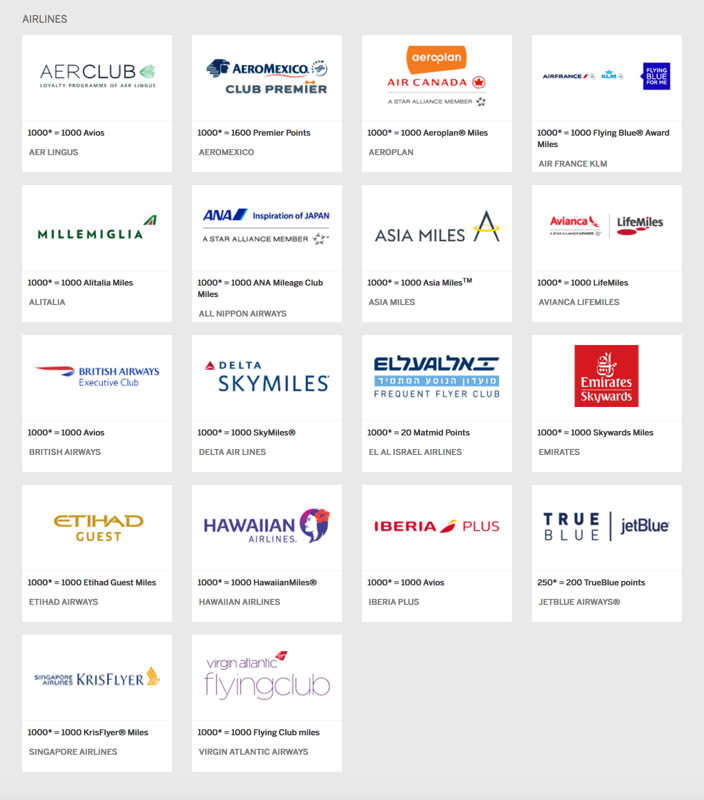

Transferring Amex Membership Rewards points to airline and hotel partners gives you lots of options for travel. Currently there are 18 direct airline partners and three hotel partners. But because of alliances and partnerships, you can also book flights on other airlines even if they’re not a direct transfer partner.

For example, you can move points to Air Canada Aeroplan (part of the Star Alliance) to book award flights on United Airlines. Or transfer points to British Airways for award flights on American Airlines (a oneworld partner).

Keep an eye out for occasional Amex transfer bonuses (where you’ll get more airline miles or hotel points than the usual ratio).

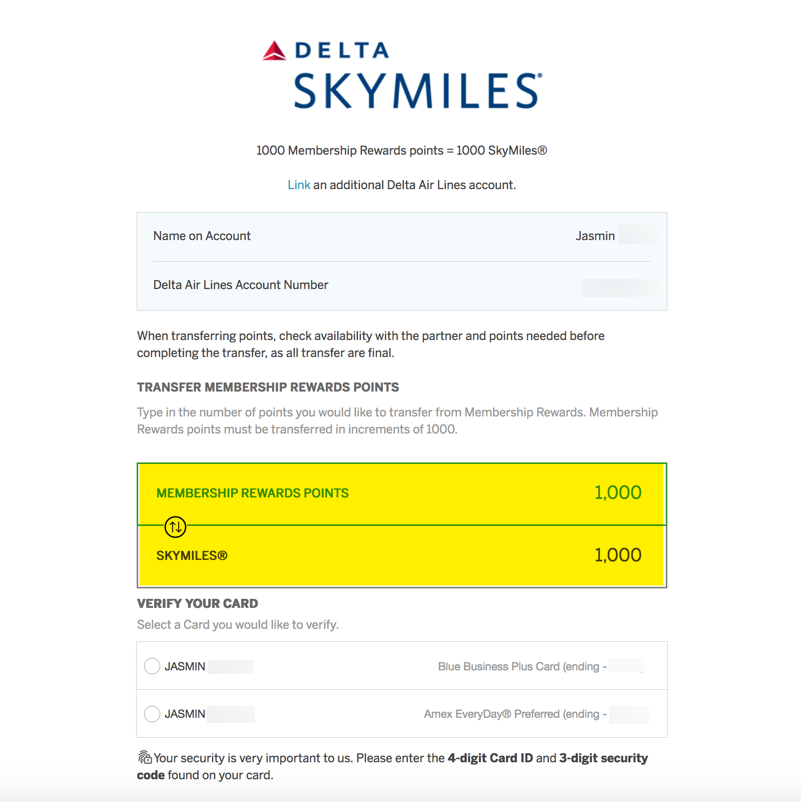

To get started transferring Amex Membership Rewards points to a partner, you’ll have to link your airline or hotel account first. You’ll need to verify your Amex account by entering your credit card information (if you have multiple Amex cards, you can just choose one and enter the required details). And you can also link loyalty accounts in your name or in the name of an authorized cardholder.

At this step, you’ll also enter your airline or hotel loyalty number. This will let Amex know where to transfer the points. Once you’ve linked your account, it’s a straightforward process to move the desired number of Amex points to your airline or hotel account.

Keep in mind, you’ll pay a small excise fee of 0.06 cents per point (up to a maximum of $99) when you transfer points to U.S. airlines. And – big caveat – once you’ve moved your points to a partner, you can not get them back.

For step-by-step points transfer instructions, check out our detailed guide to transferring Amex Membership Rewards points to partners.

Book travel through the Amex travel portal

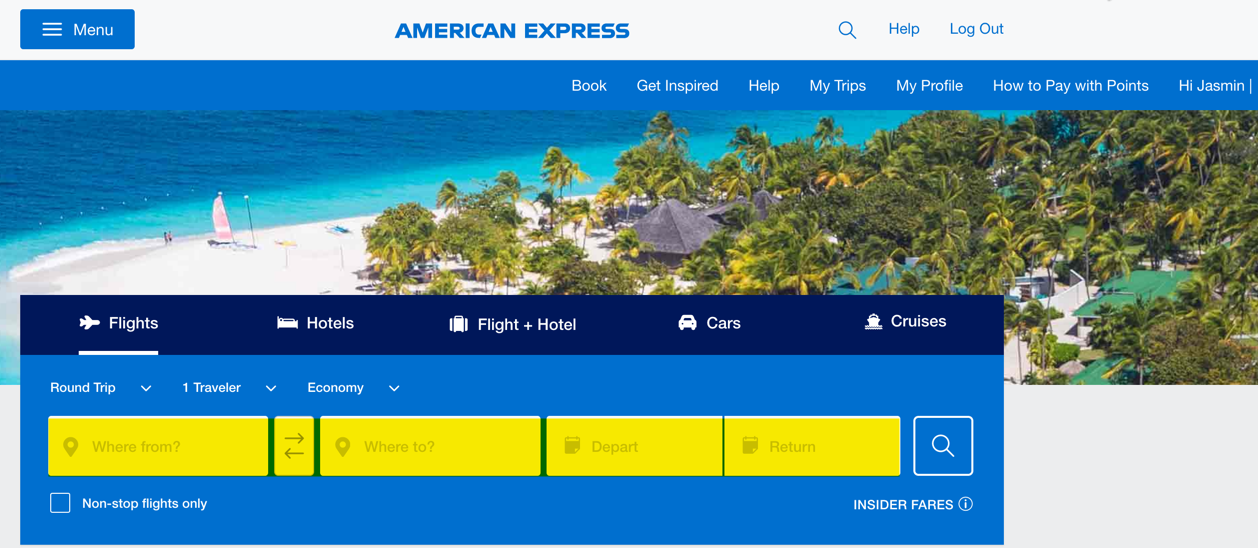

If you’d rather not fuss with award charts or availability, booking airfare and hotels through the Amex travel portal can make your travel planning easier. You won’t necessarily get as much value from your points by booking this way. But if you prefer ease of booking over squeezing the most value from your points, or only have specific times you can travel, booking through the Amex Travel Portal can make sense. You won’t have to deal with blackout dates during popular travel times.

The Amex travel portal works similarly to other 3rd-party booking sites, like Orbitz or Expedia. To search, enter your travel dates and destinations as you normally would.

For flights, your Amex Membership Rewards points are worth one cent apiece. Folks with the Amex Business Platinum can actually do very well booking through the portal, because they’ll get a 35% points rebate when they book coach flights on their selected airline (or any business or first-class flight).

You won’t do as well with hotels, which only offer 0.7 cents per point. If you find a cheap rate this can make sense, but run the numbers to see if you’ll get a better deal booking an award room or redeeming points from other flexible points programs, like Chase Ultimate Rewards, where your points can be worth more.

Redeem Amex Membership Rewards points for statement credits, gift cards, and shop with points

Cashing in your Amex Membership Rewards points for statement credits, gift cards, or shopping with points won’t get you the most for your points. It’s good to know the option is there if you don’t plan to take a trip or aren’t able to travel.

Again, this is your weakest pick for redemption. I don’t recommend it unless there’s no way you’ll redeem your points for travel.

Should you collect Amex Membership Rewards points?

If you love to travel for free or really cheap, absolutely. Earning transferable points like Amex Membership Rewards will add lots of flexibility and versatility to your miles and points toolbox. You’ll do best with Amex Membership Rewards points if you:

- Use rewards credit cards that have bonus categories and perks that align with your spending and travel habits

- Know how to make the most of airline and hotel award charts

- Prefer booking flights and hotels with no blackout dates through the Amex travel portal

- Have travel plans that fit with Amex’s airline and hotel transfer partners

For folks who prefer to redeem rewards for statement credits, gift cards, or merchandise, Amex Membership Rewards can help, but they aren’t your best choice. Instead, look to the best cash back credit cards, where you could get a much better return for your spending.

Bottom line

Amex Membership Rewards points are important if you’re serious about unlocking the freedom to travel. They’re transferable to airline and hotel partners like Delta and Marriott and flexible in other ways to redeem them. You don’t have to be after international first-class flights or luxury resorts either – I’ve almost always redeemed mine for coach flights to visit family and friends in North America.

They’re also easy to earn from Amex Membership Rewards cards like the American Express® Gold Card, The Platinum Card® from American Express, and The Blue Business® Plus Credit Card from American Express. Just remember Amex’s strict application rules, which only allow you to earn a welcome offer once, per card, per person, per lifetime.

| For more travel and credit card news, deals and analysis sign-up for our newsletter here. |

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!