Chase Ultimate Rewards: Everything you need to know

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Whether you’re brand new to earning miles and points for free travel, or you’re a seasoned veteran who’s always planning their next international adventure, Chase Ultimate Rewards points are the most useful points to have in your arsenal. That’s because it’s easy to earn and redeem Chase points with plenty of options to book flights, hotels, car rentals and more.

That’s also why Chase Ultimate Rewards is the first program we recommend for beginners. If you’re just getting started, the Chase Sapphire Preferred® Card is one of the best rewards credit cards to have – all of us on the MMS team have had it in our wallets for years. And, right now there is an all-time high bonus offer for the Ink Business Preferred® Credit Card, you can earn 100,000 points after spending $15,000 on purchases in the first three months from opening the account.

Here’s our full Chase Ultimate Rewards review.

Chase Ultimate Rewards review

It’s no secret we love Chase Ultimate Rewards points – here’s why: Earning Chase Ultimate Rewards points is easy. Many of the best credit cards for travel, such as the Chase Sapphire Preferred Card, Ink Business Preferred Credit Card and Chase Sapphire Reserve®, offer big intro offers and generous bonus categories. A Chase point’s value is sky-high because of its versatility. You can use them to book flights, hotels, rental cars, cruises and activities without blackout dates through the Chase travel portal or use Chase transfer partners like United Airlines and Hyatt (when you have an annual-fee Ultimate Rewards card) to get hugely oversized value. Chase points are simple to use – even if you don’t want to travel, you can redeem points for straightforward cash back, gift cards and more.

Here’s everything you need to know about Chase Ultimate Rewards points.

How to earn Chase Ultimate Rewards points

There are three main options to earn Chase Ultimate Rewards points:

- Credit card sign-up bonuses and spending

- Bonus points by shopping through the Chase Ultimate Rewards shopping portal

- Refer-a-friend bonuses

Setting up a Chase Ultimate Rewards account is a simple process once you’ve opened a Chase Ultimate Rewards earning card.

Earn Chase points from credit cards

Currently, there are four personal Chase credit cards and three business credit cards that earn Chase Ultimate Rewards points:

| Card | Bonus and spending requirements | Our review |

|---|---|---|

| Ink Business Preferred Credit Card | 100,000 Chase Ultimate Rewards points after spending $15,000 on purchases within the first three months of opening your account | Read why this is the top card for small business owners |

| Chase Sapphire Preferred® Card | 100,000 bonus points after you spend $4,000 on purchases in the first three months from account opening. | The #1 card for beginners |

| Chase Sapphire Reserve< | 60,000 bonus points after you spend $4,000 in the first three months from account opening. | Lots of folks love this premium credit card because of the ongoing perks! |

| Ink Business Unlimited Credit Card | $750 bonus cash back after you spend $7,500 on purchases in the first 3 months from account opening. | Read our review of the Ink Business Unlimited |

| Ink Business Cash Credit Card | $750 bonus cash back after you spend $7,500 on purchases in the first 3 months from account opening. | Read our review of the Ink Business Cash |

| Chase Freedom Unlimited | $200 bonus (20,000 Chase Ultimate Rewards points) after spending $500 on purchases within the first three months of opening your account | Here's our review for the Chase Freedom Unlimited |

| Chase Freedom | $200 bonus (20,000 Chase Ultimate Rewards points) after spending $500 on purchases within the first three months of opening your account | Here's our review of this great no-annual-fee card! |

All of these cards are subject to the Chase 5/24 rule, which means if you’ve opened five or more cards (from any bank, except Chase business cards and certain other business cards) in the past 24 months, you won’t be approved.

Beyond the welcome bonuses, you can also earn a ton of Chase Ultimate Rewards points from ongoing spending on these cards. Some earn bonus points for spending in common categories, like travel and dining. For example:

- Chase Sapphire Reserve: Earn three Chase Ultimate Rewards points per dollar on travel and dining worldwide (after earning your $300 travel credit)

- Chase Ink Business Preferred: Earn three Chase Ultimate Rewards points per dollar on travel up to $150,000 maximum per account anniversary year (combined with other 3x earning categories)

- Chase Sapphire Preferred: Earn two Chase Ultimate Rewards points per dollar on travel and dining worldwide with no limits on how much you can earn

And if you prefer not to fuss with bonus categories, the Chase Ink Business Unlimited card and Chase Freedom Unlimited® both earn 1.5% cash back (1.5 Chase Ultimate Rewards points per dollar) on purchases with no limits.

Check out our post on all the ways to earn Chase Ultimate Rewards points for the full rundown of all the Chase Ultimate Rewards cards and their spending categories.

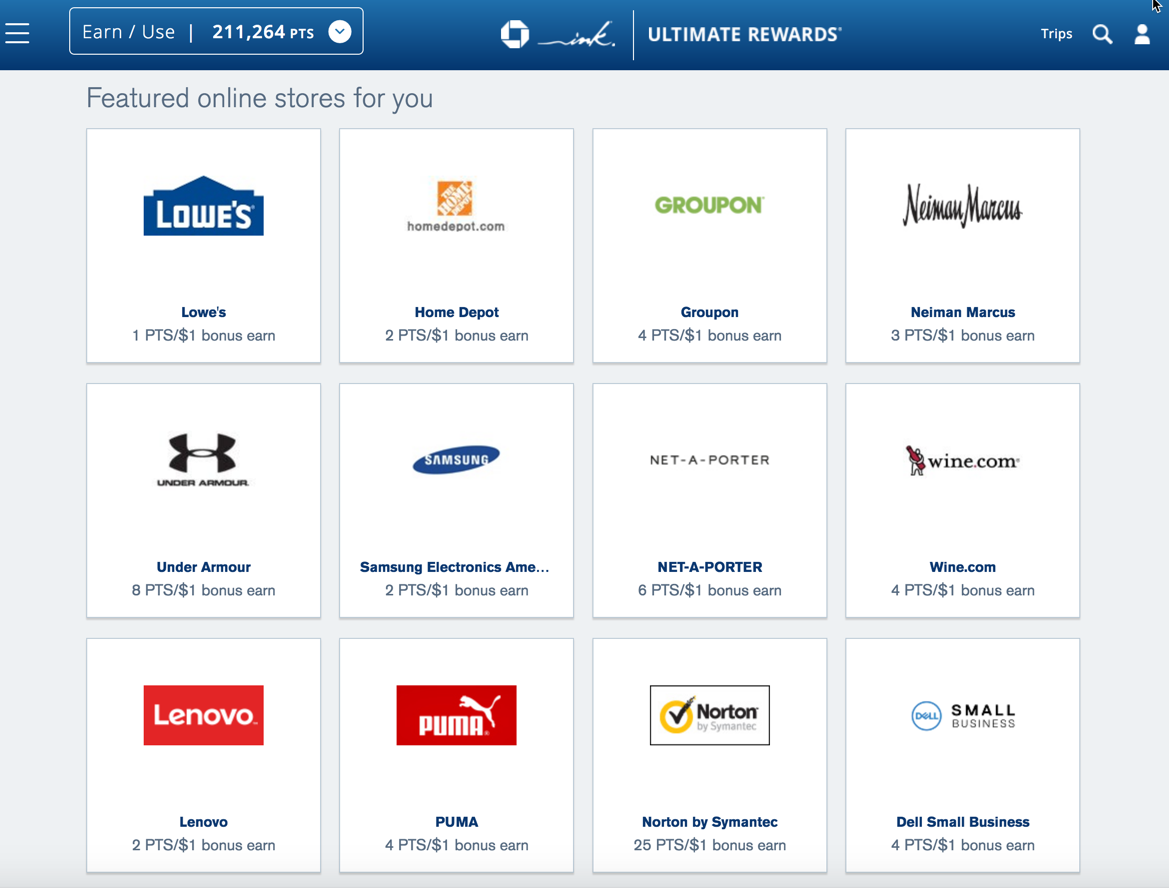

Earn Chase Ultimate Rewards points through the Chase shopping portal

In addition to sign-up bonuses and everyday spending on your Chase credit cards, making purchases online through the Chase Ultimate Rewards shopping portal can also help you top up your balance.

When you start your shopping through the Chase Ultimate Rewards shopping portal, you’ll earn bonus points at a wide range of online merchants, including department stores, home improvement stores and more. It’s a good way to earn a little extra on purchases you’d make anyway.

For a refresher on how to earn points by shopping through the Chase Ultimate Rewards shopping portal (or any other portal), view our comprehensive guide on everything you need to know about earning bonus miles shopping online. And remember, sometimes you’ll earn or save more by using a different portal.

Earn Chase Ultimate Rewards points when you refer a friend

Referring your friends and family to Chase credit cards is a quick way to give your points balance a boost long after you’ve earned the welcome bonus on a card.

When someone you’ve referred is approved for a card through the Chase Refer-a-Friend program, you’ll earn bonus points (they’ll earn a welcome bonus, too). The number of referral points you’ll earn depends on the card and it’s capped at a maximum number of bonus points per year.

Chase has started sending out 1099 tax forms for referral bonuses, so be aware there may be implications come tax time. Consult your tax professional for advice.

How much are Chase points worth?

The value of your Chase Ultimate Rewards points depends on the cards you have and how you redeem your points.

Typically, you’ll get the most value when you transfer points to airline and hotel partners like United Airlines, Singapore Airlines and Hyatt. To do this, you’ll need either the Chase Sapphire Preferred Card, Ink Business Preferred Credit Card or Chase Sapphire Reserve.

Your next best bet is redeeming points through the Chase Ultimate Rewards travel portal for flights, hotels, rental cars, cruises or activities. Here’s what your points are worth when linked to a specific card:

| Chase Ultimate Rewards Card | How Much Are Points Worth Toward Travel? |

|---|---|

| Chase Sapphire Reserve® | 1.5 cents |

| Chase Sapphire Preferred® Card | 1.25 cents |

| Ink Business Preferred® Credit Card | 1.25 cents |

| Ink Business Cash Credit Card | 1 cent |

| Ink Business Unlimited Credit Card | 1 cent |

| Chase Freedom® | 1 cent |

| Chase Freedom Unlimited® | 1 cent |

The great thing about Chase Ultimate Rewards points is you can combine them between your accounts. Let’s look at an example.

If you only have the Chase Ink Business Cash, you can’t move points to travel partners and they’re only worth one cent each when you book through the Chase Ultimate Rewards travel portal. But, if you also have the Chase Sapphire Reserve, you can combine your points to that account, then transfer them to airline and hotel partners or book travel at a rate of 1.5 cents per point.

How to use Chase Ultimate Rewards points

You’ve got loads of options for using your Chase Ultimate Rewards points, including:

- Redeem points through Chase transfer partners if you have the Chase Sapphire Preferred Card, Ink Business Preferred Credit Card or Chase Sapphire Reserve

- Redeem points through the Chase travel portal for airfare, hotels, rental cars, cruises and activities

- Cash back, gift cards, Amazon purchases and Apple purchases

Remember, the best value for your points is whatever makes you happy and meets your needs. The choice is yours.

Transfer Chase Ultimate Rewards points to travel partners

When you have the Chase Sapphire Preferred Card, Ink Business Preferred Credit Card or Chase Sapphire Reserve, you’ll unlock the ability to transfer your Chase Ultimate Rewards points to 10 airline and three hotel programs:

- Aer Lingus

- British Airways

- Emirates

- Flying Blue (loyalty program of Air France & KLM)

- Iberia

- JetBlue

- Singapore Airlines

- Southwest

- United Airlines

- Virgin Atlantic

- Hyatt

- IHG

- Marriott

You can get tremendous value from your points this way, especially if you book international first and business-class flights or 5-star luxury hotels. Or even if you stick close to home and redeem your points for award flights and hotel stays in pricey cities or during the busy travel season.

Transfers are usually instant. Here’s a summary of transfer times to various partners:

| Travel Partner | Estimated Transfer Time |

|---|---|

| Aer Lingus | Instant |

| British Airways | Instant |

| Emirates | Instant |

| Flying Blue | Instant |

| Hyatt | Instant |

| Iberia | Instant |

| IHG | 1-2 days |

| JetBlue | Instant |

| Marriott | 1-2 days |

| Singapore Airlines | 1-2 days |

| Southwest | Instant |

| United Airlines | Instant |

| Virgin Atlantic | Instant |

Redeem Chase Ultimate Rewards points for travel through the Chase Travel Portal

For convenience and ease of use, nothing beats redeeming your points through the Chase Travel portal. My family and I have done this on several occasions when we’re particular about wanting to fly at a specific time or stay at a certain hotel, and we don’t have the patience or flexibility to deal with transferring our points to various travel partners. As mentioned, the specific value of your Chase Ultimate Rewards points can change depending on which card you’re redeeming them from (see the table above).

The best thing about redeeming your points for various travel options through the Chase Ultimate Rewards portal is simplicity. If you want to book a flight on a specific date (without blackout dates), a hotel at a unique location, or a rental car (my favorite booking), booking through the Chase portal is a solid bet. And if you’d rather not do the investigation or research yourself, you can call Chase travel at 866-951-6592.

You’ll also earn points on the flights you take. But note that you won’t earn hotel points or stay credits because it’s considered a third-party booking.

My Favorite Usage: I love booking unique or hard-to-find hotels through the Chase portal using my Chase Sapphire Reserve for 1.5 cents per point. For example, I used ~28,000 Chase Ultimate Rewards points per night to book a stay at the White Pearl Villas in Santorini on an anniversary trip two years ago. The hotel was unique, gorgeous and way more money that I would’ve wanted to pay in cash. This was a huge win for me and another reason I pay the annual fee on the Chase Sapphire Reserve year after year.

Redeem Chase Ultimate Rewards points for cash

Your Chase Ultimate Rewards points are always worth one cent per point when you redeem them for cash back. So, for example, redeeming 50,000 Chase Ultimate Rewards points would be worth $500.

This is a good option if you won’t travel or just prefer straight cash back. Keep in mind, you’ll get a much better bang for your point when you have the Chase Sapphire Preferred, Chase Ink Business Preferred or Chase Sapphire Reserve and redeem them for travel by transferring to partners or booking through the Chase travel site.

For this reason, I recommend you don’t redeem for cash back if you like to travel. Check out our post on the best way to use Chase points to learn how you can receive outstanding value for your points – far, far more than you’ll get by cashing them out.

Redeem Chase Ultimate Rewards points for gift cards

Redeeming Chase Ultimate Rewards points for gift cards (one cent per point), Amazon.com (0.8 cents per point) or Apple products (normally 0.8 cents, but sometimes up to one cent during special promos) isn’t a great deal, unless there’s a gift card sale.

Amazon and Apple are particularly poor option, because you’d be better off paying for your Amazon purchase with your card then redeeming points for cash at one cent per point to offset the charge. At least this way you’d earn points for the purchase.

Do Chase Ultimate Rewards points expire?

Unlike many airline and hotel programs, your Chase Ultimate Rewards points do not expire if your card is open and in good standing. However, you will lose your points if you close a card without first transferring your points to another Chase Ultimate Rewards card account or travel partner.

Bottom line

Chase Ultimate Rewards points are a valuable tool for every miles and points collector – from beginners in our hobby to the most experienced frequent flyer. They’re super easy to earn and even more simple to redeem, whether you prefer hunting down the most valuable award redemptions after transferring to partners or like the ease of booking directly with no blackout dates through the Chase Ultimate Rewards travel portal.

And if you have no travel plans, you can always trade in your points for cold, hard cash back. You won’t necessarily get the most value that way, but it’s a solid option if you prefer the flexibility of cash.

Let us know your favorite way to use Chase Ultimate Rewards points. And subscribe to our newsletter for more tips to take more trips.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!