How to combine Chase Ultimate Rewards points

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

One of the best perks of the Chase Ultimate Rewards credit cards with no annual fee is the ability to pool your points. This makes the points you earn with Chase credit cards like the Ink Business Cash Credit Card, Chase Freedom® or Chase Freedom Unlimited® more valuable because you can transfer them to travel partners through an annual-fee Chase Ultimate Rewards card like the Chase Sapphire Preferred® Card.

This can be especially lucrative if you combine your points onto your Chase Sapphire Reserve® account because they will be worth more when you redeem them through the Chase Ultimate Rewards travel portal (1.5 cents per point) compared to the other Ultimate Rewards credit cards.

How to increase the value of your Chase Ultimate Rewards points

If you redeem Chase Ultimate Rewards points for travel through the Chase portal, be sure to move points to the right card. That’s because each Chase Ultimate Rewards card has a set rate of how much your Chase Ultimate Rewards points are worth when booking through the Chase site:

| Chase Ultimate Rewards Card | How Much Are Points Worth Toward Travel? | Do Points Transfer to Travel Partners? |

|---|---|---|

| Chase Freedom | 1 cent | No |

| Chase Freedom Unlimited | 1 cent | No |

| Chase Sapphire (no longer available) | 1 cent | No |

| Chase Sapphire Preferred Card | 1.25 cents | Yes |

| Chase Sapphire Reserve | 1.5 cents | Yes |

| Chase Ink Business Cash Credit Card | 1 cent | No |

| Ink Business Unlimited Credit Card | 1 cent | No |

| Chase Ink Bold (no longer available) | 1.25 cents | Yes |

| Chase Ink Plus (no longer available to new applicants) | 1.25 cents | Yes |

| Ink Business Preferred Credit Card | 1.25 cents | Yes |

So Sapphire Reserve cardholders get the best deal because you’ll get a 50% bonus (1.5 cents per point) when you redeem points for travel through the Chase portal. If you don’t have the Chase Sapphire Reserve card, but someone in your household does, it’s possible to transfer your points to their account. For personal rewards credit cards that earn Chase Ultimate Rewards points, Chase says:

You can move your points, but only to another Chase card with Ultimate Rewards belonging to you, or one member of your household.

For business credit cards the rules are similar, except you can also share points with a business co-owner.

The above rules apply when you are sharing Chase points between accounts, but the guidelines are slightly different if you want to transfer points directly into someone else’s airline or hotel loyalty account. In this situation, you can only transfer points directly into the loyalty account of a spouse/partner who is living at the same address and is an authorized user on your Chase travel credit card. Or if it’s a business card, you can make Chase points transfers directly into the airline or hotel account of a co-owner who is also an authorized user on the same business card.

How to pool your points

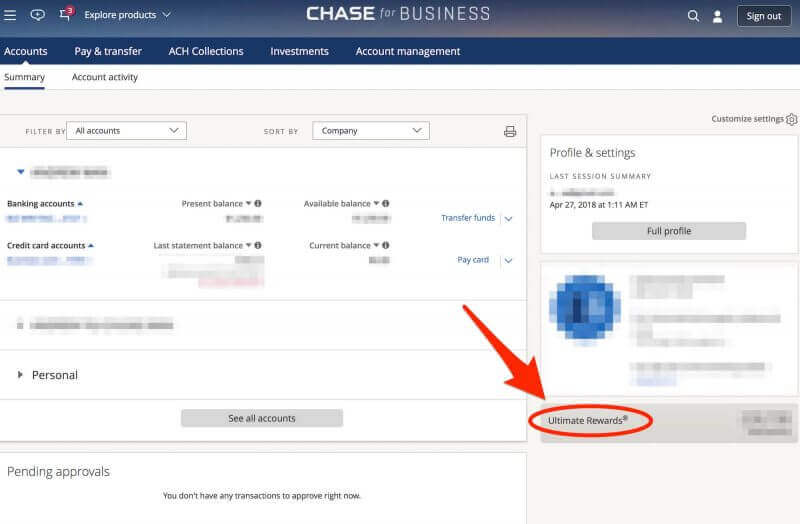

Sign into your Ultimate Rewards account

First, login to your Chase Ultimate Rewards account. You can do this by signing into your account from the Chase homepage and then clicking on the “Ultimate Rewards” banner.

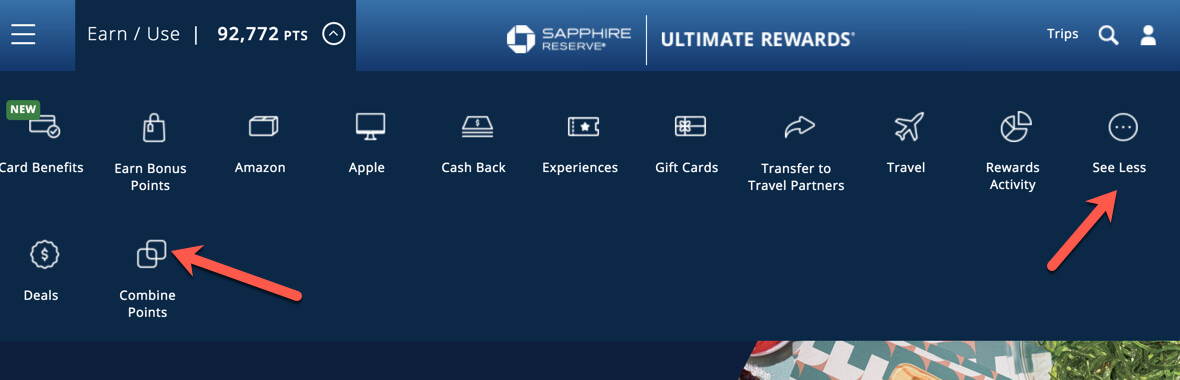

Click on “Combine Points”

Once you’re into the Chase Ultimate Rewards page, go to the banner at the top of the screen and click on “Combine Points.” You may have to click on the “See More” ellipsis to get the option to combine points to appear.

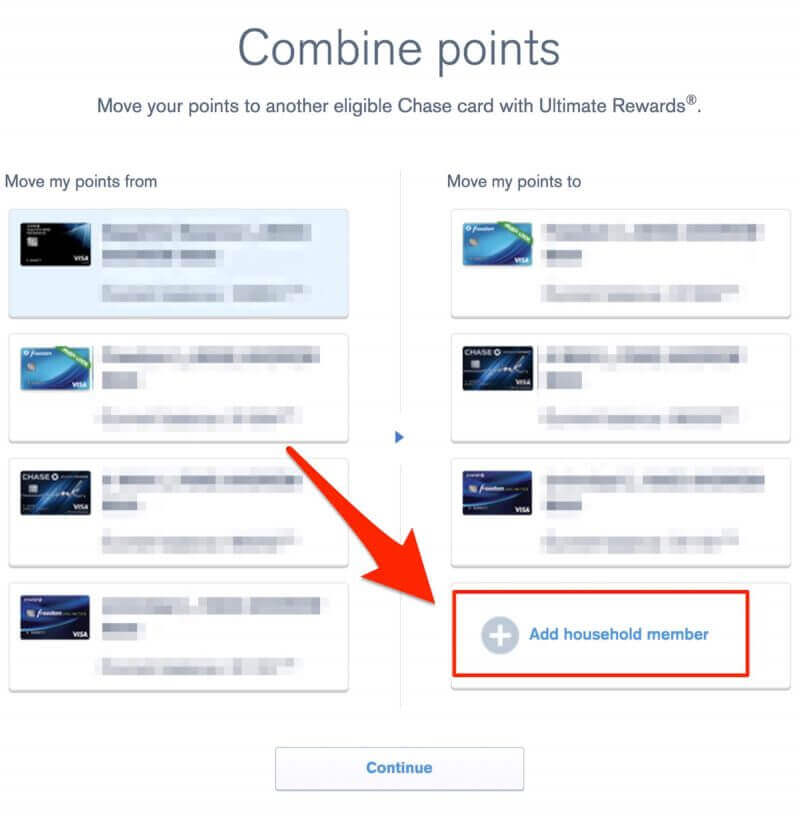

Add a household member

This will take you to the next screen, giving you the option of adding a household member so that you can transfer points to them.

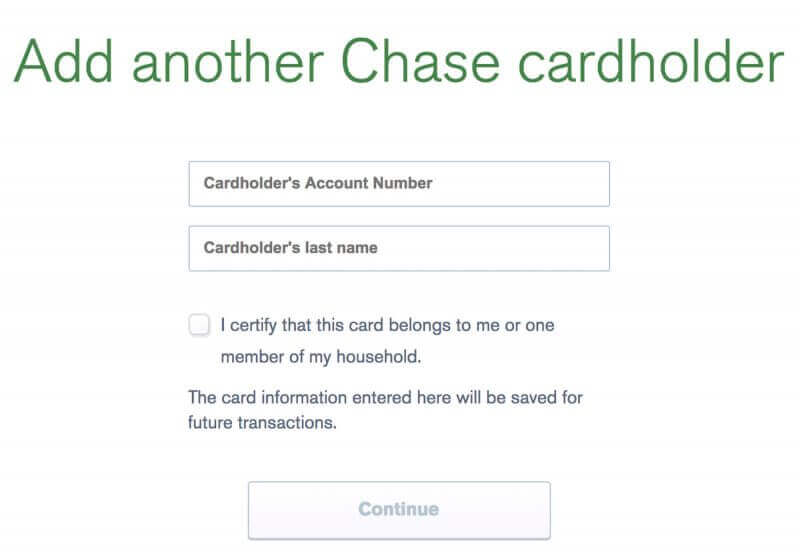

Enter the other cardmember’s information

The last step is to enter the account number and last name, and then click “Continue.” Remember, they must be a household member if you want to transfer points to them. If it is a business card, they do not need to be a household member as long as they are a co-owner of the company.

Once you’ve transferred the points to the other person’s account, they’ll also be able to move the points among their own cards. So for instance, if you transferred the points to their Chase Freedom card, they could then combine the points with their Chase Sapphire Preferred card or any other Chase card that also earns Ultimate Rewards points.

When you transfer points to the other person, you can still freely move points back and forth. So if the other person decides they no longer need the points, they can login to their Chase Ultimate Rewards account and simply transfer the points back to you.

Bottom line

For personal accounts, Chase allows you to transfer points to one other person as long as they also live in the same household. If you would like to transfer points from a business credit card to someone, they can be either a household member or a co-owner of that company.

Transferring the points and having them in a single account can make it much easier to book a flight for multiple people. This also comes in handy if a member of your household needs a few extra miles to book an award flight. Chase scrutinizes these types of points transfers and can close out your accounts if you violate the terms, so just make sure you are following these rules.

| For more travel and credit card news, deals and analysis sign up for our newsletter here. |

Featured photo by Daryl L/Shutterstock.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!