How I Saved 123,980 AMEX Membership Rewards Points in 2018 With the AMEX Business Platinum Rebate (Enough for at Least 4 More Round-Trip Tickets!)

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

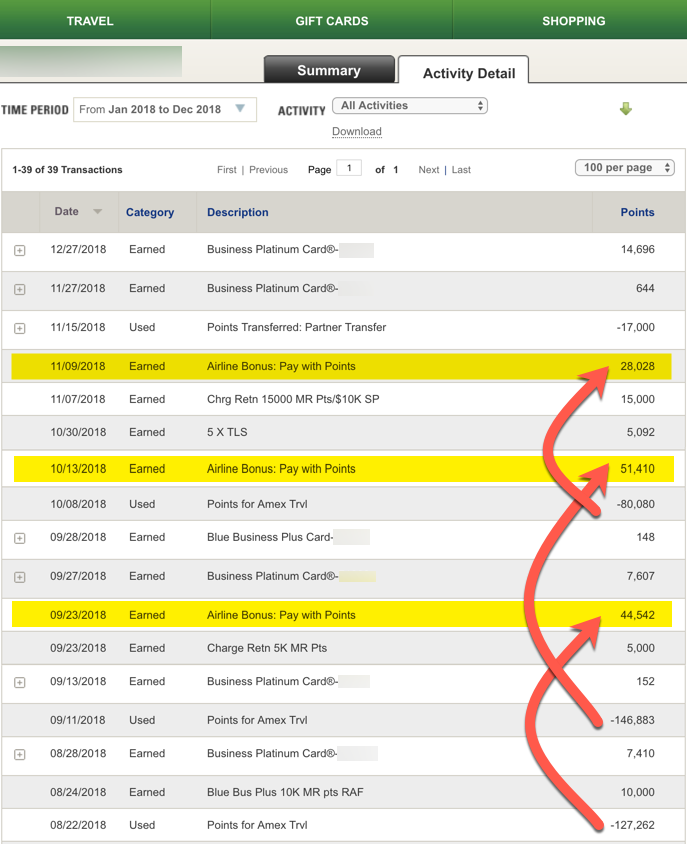

This past year, I used AMEX Membership Rewards points for flights to destinations including Denver, Santa Barbara, Chicago, and London. And with the 35% rebate I get for being a Business Platinum® Card from American Express cardholder and booking with my selected airline (United Airlines), I saved 123,980 AMEX Membership Rewards points on my award tickets!

Considering a round-trip coach ticket within the US costs 25,000 miles on an AMEX airline transfer partner like Delta, the points I saved are enough for at least 4 MORE free tickets. Or I could use AMEX Pay With Points and save ~$1,240 on my next trip!

I’ll explain how the 35% rebate and Pay With Points works, along with the other perks of The Business Platinum® Card from American Express, and help you decide whether it makes sense for you.

Utilizing One of My Favorite Perks of the AMEX Business Platinum Card

This past year alone I saved over a hundred thousand AMEX Membership Rewards points by utilizing the 35% points rebate I get for having the AMEX Business Platinum card. As a cardholder you get:

- 35% of your points back for ALL First Class or Business Class flights booked through the AMEX travel portal

- 35% of your points back for all flights, including coach tickets, booked with your selected airline through the AMEX travel portal

I chose United Airlines as my selected airline because they offer the most flight options out of my smaller home airport of Missoula, Montana. Check out my AMEX Membership Rewards points summary below:

As you can see, each time I used AMEX Membership Rewards points to buy tickets, about a month later I was credited for the 35% points rebate.

This benefit, along with the other AMEX Business Platinum card perks like the $200 in statement credits per calendar year for airline incidentals with your selected airline (luggage fees, in-flight food & drink, etc.) and airport lounge access, make the card’s heftier annual fee worth it for me (See Rates and Fees).

Right now, the AMEX Business Platinum card is offering up to a 75,000 AMEX Membership Rewards point welcome bonus after meeting tiered minimum spending requirements. You’ll earn:

- 50,000 AMEX Membership Rewards points after you spend $10,000 on purchases in the first 3 months of account opening.

- 25,000 AMEX Membership Rewards points after you spend an additional $10,000 on qualifying purchases within the same timeframe

That’s easily worth $1,000+ in free travel, depending on how you use them. You can check out our full review of the card here.

Does the 35% points rebate make the AMEX Business Platinum card more enticing to you? I’d love to hear your thoughts in the comments below!

For the rates and fees of The Business Platinum Card From American Express, please click here.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!