How to use your Amex airline fee credit — even for flights!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

One of the best American Express credit card perks is the annual credit for airline incidental fees. This is a valuable benefit that comes with cards like The Platinum Card® from American Express and Hilton Honors American Express Aspire Card.

With it, you can get from up to $200 to up to $250 toward incidentals on your airline of choice — and the credits renew each calendar year. You can choose which airline the credit will apply to when you open the card, but it must be used by the end of the year.

Normally you can only use the credit towards incidental purchases. But there’s another way to essentially use your airline credit towards United flights (more on that below).

Here’s how to select your airline — and a look at what types of fees do and don’t qualify for these credits.

The information for the Hilton Aspire card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

How to select your airline

You can change your selected airline by logging into your Amex account or calling the number on the back of your card. You can choose one of these airlines for your credit:

- Alaska Airlines

- American Airlines

- Delta

- Frontier Airlines

- Hawaiian Airlines

- JetBlue

- Southwest

- Spirit

- United Airlines

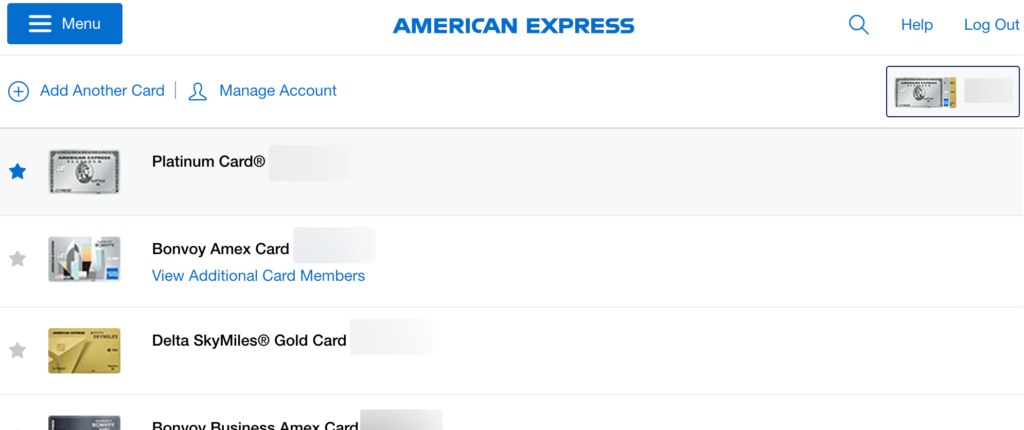

Step 1. Choose your qualifying card

To begin, log into your Amex account. If you’ve got multiple Amex cards (like most of us), you’ll have to select the card that comes with the airline incidentals credit. Click on the card you want to access from the top right of the screen. In my case, it’s the Amex Platinum.

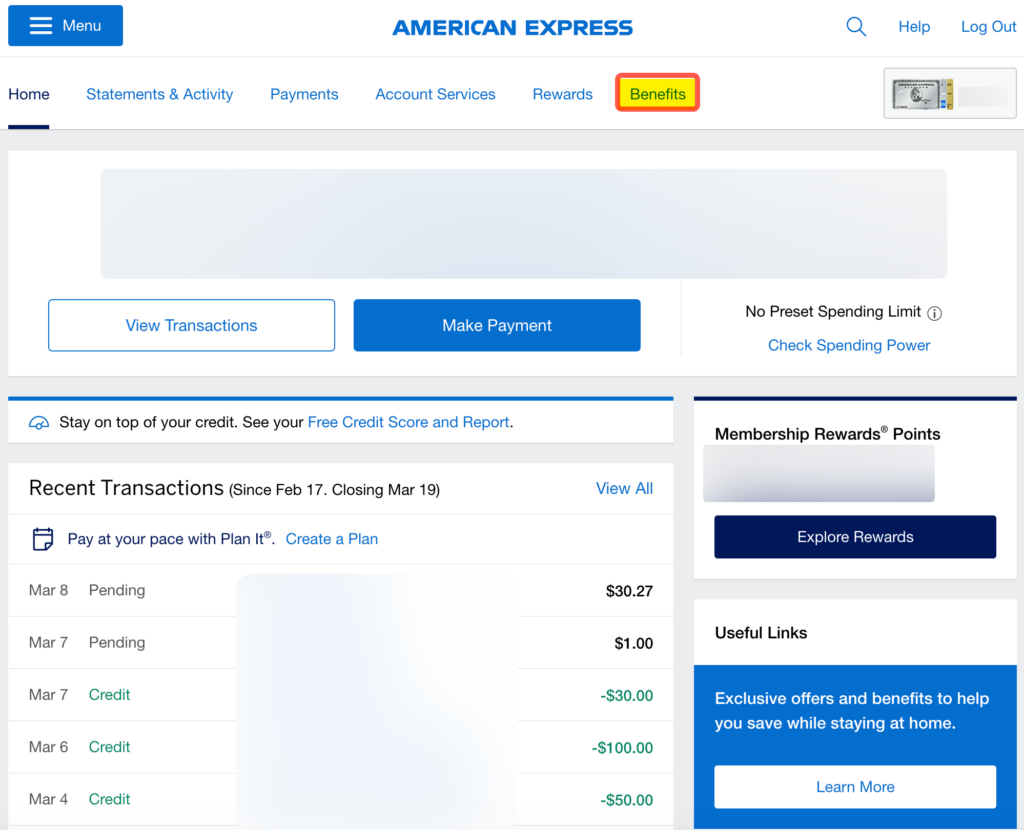

Step 2. Select “Benefits”

You’re now on the correct landing page for the card that offers the airline fee reimbursement. Next, you’ll click “Benefits” at the top navigation bar. It’ll take you to an outline of all the significant benefits that come with this specific card.

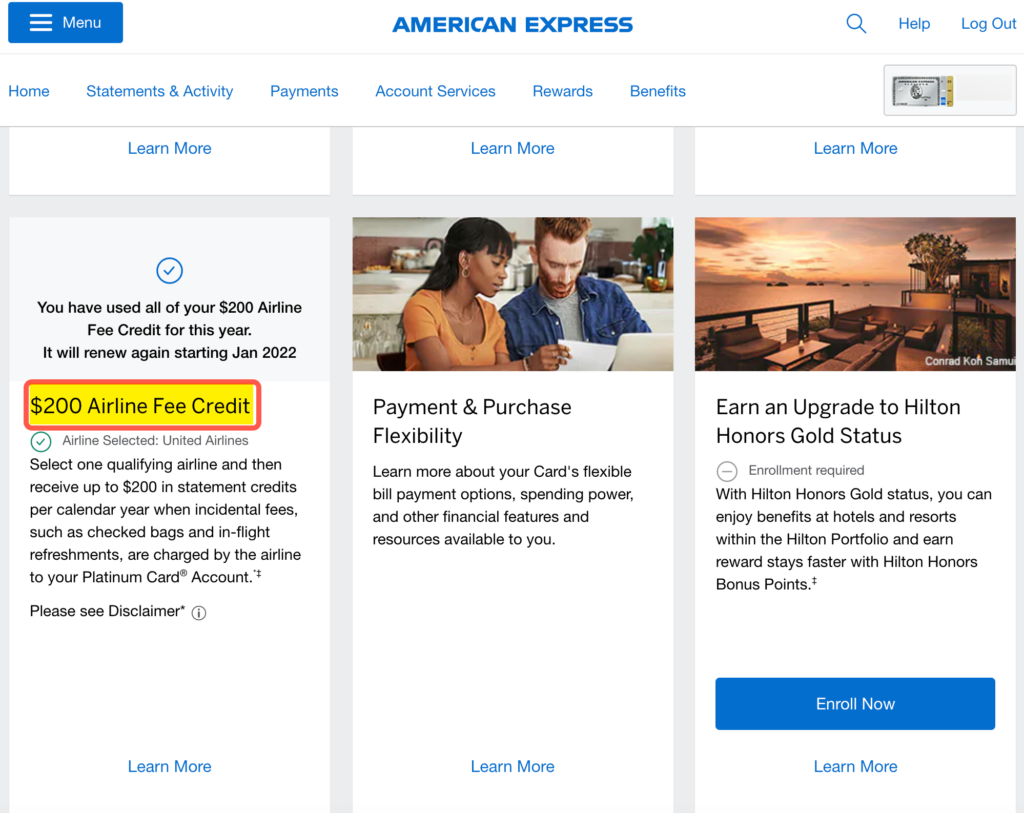

Step 3. Click “Enroll Now”

Scroll down the page until you see “Airline Fee Credit.” Simply click “Enroll Now” to get the process started. I’ve already enrolled my account, which is why the big “Enroll Now” button isn’t showing. (enrollment required).

Step 4. Pick your airline and confirm

Afterward, you’ll see a screen with a drop-down menu with all your airline options.

Once you set your airline, the terms state that you can’t change it until the following January, so be certain you select the one you want most. If you’re really in a bind, however, cardholders have been able to change it at other times by chatting with an Amex representative — as long as you’ve not used your credit yet.

Once you’ve made your choice, click “Submit Selection.”

Step 5. Remember your selection

You can start spending on your selected airline right away. Should you forget which airline you chose, you can always log back into your online Amex account to find out.

Amex says qualifying fees will be reimbursed within two to four weeks, but in my experience, it’s much faster – usually two to five business days. If you made a qualifying charge and haven’t received a statement credit after a few weeks, call Amex at the number on the back of your card to see if they’ll manually apply the credit for you.

Amex cards that offer an airline-fee credit

These Amex cards come with airline-fee credits that reset each calendar year (terms apply):

- The Platinum Card® from American Express (read our review) — Up to $200 airline incidental credit on your selected airline

- The Business Platinum Card® from American Express (read our review) – Up to $200 airline incidental credit on your selected airline

- Hilton Honors American Express Aspire Card – Up to $250 airline incidental credit on your selected airline

If you have The Business Platinum Card® from American Express, choosing the right airline is even more important because you’ll get an extra benefit: Using the Amex Pay With Points feature to purchase airfare through the Amex Travel portal, cardholders get a 35% points rebate on all business and first-class tickets (up to 500,000 points back per calendar year). And you’ll get the same 35% points rebate on all coach flights booked with your selected airline through the Amex travel portal using the Pay With Points feature.

You can use the airline credit for fees including:

- Checked baggage fees (including overweight/oversize)

- Itinerary change fees

- Phone reservation fees

- Pet flight fees

- Seat assignment fees

- Inflight amenity fees (beverages, food, pillows/blankets, headphones)

- Inflight entertainment fees (excluding wireless internet because it’s not charged by the airline)

- Airport lounge day passes and annual memberships

- United TravelBank funding

You cannot use fee credits for fees including:

- Airline tickets

- Upgrades

- Mileage-points purchases

- Mileage-points transfer fees

- Gift cards

- Duty-free purchases

- Award tickets

Unofficial ways to use the Amex Airline credit

While airline tickets are officially not recognized, there are reports which indicate Southwest, Delta and JetBlue flights under $99 will be reimbursed. However, this is not guaranteed as the purchase codes as airfare. You can scour the internet for data points to see what’s working at the moment.

Purchasing a Southwest or Delta flight partially with a Southwest or Delta gift card, respectively, and the rest with an Amex card will sometimes trigger the reimbursement credit. Spirit’s $9 Fare Club membership and Frontier’s Discount Den membership have also been known to work — though I’ve got no experience with those myself.

Using the Amex airline credit to load your United TravelBank

In the past, it was possible to get these fee credits to work for things like gift cards, but that is no longer true.

However, the option to load your United TravelBank with funds to trigger the airline fee credit is working again. Loaded funds won’t expire for five years and can be extended beyond for another five years that by having any TravelBank activity (funding or usage). You can use United TravelBank funds for United flights purchased on United.com. What this means is that you’re essentially able to use your airline credit towards United flights. Enrollment required for select benefits.

It’s very important to note that it’s not guaranteed for these methods to work. Reaching out to Amex won’t help either since these things are not on the official list of reimbursable items. I just tried this recently with two $100 loads and it did not work, but I tried again with four $50 loads and it worked like a charm. In other words, I purchased $200 in United credit that I didn’t intend to. I’ll use the credit, so I’m not miffed, but it’s very important you understand this isn’t a given.

Before making a purchase, you’ll want to look around the internet for data-points to make sure this method is still working.

Bottom line

Amex cards with airline incidental credits include (Terms Apply):

- Up to $200 with The Platinum Card® from American Express and The Business Platinum Card® from American Express

- Up to $250 with the Hilton Honors Aspire Card from American Express

These fee credits reset each calendar year and can be used for incidentals like checked bag fees, seat assignment fees, airport lounge day passes and more. However, you may be able to indirectly purchase airline tickets with them.

If you have experience with reimbursement for airline-fee credits, please share! And subscribe to our newsletter for more travel tips and credit card tricks like this delivered to your inbox once per day.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!