American Express Travel portal: A full review

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

The American Express Travel site is a third-party travel booking portal open to anyone, regardless of whether you have an American Express card. Depending on which Amex travel credit cards you have, using Amex Travel can be advantageous. Unfortunately, there are also quite a few downsides to using third-party sites like this and others one of which is because you might not be able to take advantage of elite status perks or earn points on your travel.

So let’s take a look at when you should and shouldn’t use the Amex travel site to book your next trip.

What is American Express Travel?

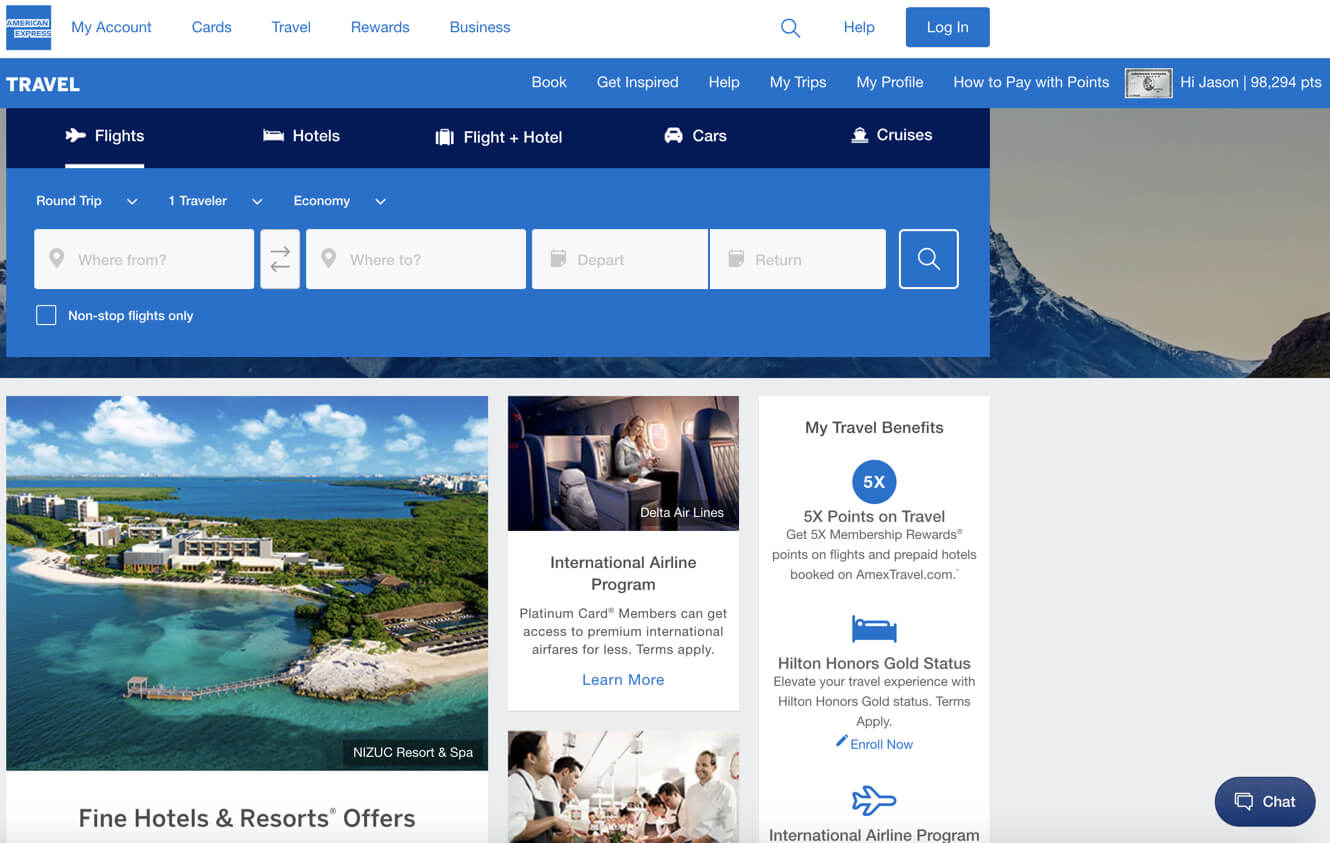

American Express Travel is a third-party booking site, just like Orbitz or Expedia. Overall, it is a well-functioning website that is user-friendly. Sometimes, third-party travel websites can be clunky, but the Amex Travel site is easy to use.

If you log in to your Amex account, you’ll be able to see how many Amex Membership Rewards points you have and use them to pay for travel, although that’s not always a good deal. (We’ll cover more on that later.)

The site also shows you the perks you have with your American Express cards, including earning 5x points on flights and prepaid hotels booked through American Express Travel with The Platinum Card® from American Express. It’s one of the best cards for earning American Express Membership Rewards points.

Pros and cons of using a third-party website to book travel

If you are looking to earn points and elite status with hotels, steer clear of third-party websites, including American Express. When you are booking through a third party, the hotel (Hilton, IHG, etc.) will almost never recognize your status and you won’t earn points. The same also applies to rental cars.

For example, if you book a Hilton hotel through Hotels.com, you won’t receive any benefit from having Diamond Hilton status thanks to your Hilton Honors Aspire Card from American Express. Plus, you won’t earn 14x Hilton points when you use your card to book a Hilton stay because you did not book directly.

The information for the Hilton Aspire card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

With airlines it’s a bit different, because you will still earn miles and elite status credit when booking flights with a third-party provider. That means you could pay for you flight with Amex points when you book through Amex Travel and still earn frequent flyer miles on your free flight. However, the miles and status credits you earn will still depend on which fare class you book, so watch out for those Basic Economy tickets.

If you are in the business of simply saving money or do not care about hotel elite status, there are certain cases where a third-party site could provide value. Just be sure to always shop around for the best price and always use an online shopping portal to earn extra rewards when you can.

When does it make sense to book through Amex Travel?

There certainly are cases where booking with Amex makes complete sense. If you’re booking a stay with a hotel that isn’t part of a loyalty program, earning 5x American Express Membership Rewards points on prepaid bookings made with an Amex Platinum or The Business Platinum Card® from American Express is a great option. You’ll just want to be sure you’re still getting the best price.

Another advantage to having the Amex Business Platinum card is that you’ll get a 35% points rebate (up to 500,000 points per calendar year) when you use the Amex Pay With Points option for airfare. This rebate only applies to first- or business-class fares, or any fare booked with the airline you selected for your airline incidental fee credit. Paying with points isn’t a good option for most business- or first-class flights; for those you’ll want to transfer your Amex points to airline partners instead.

Occasionally you can book cheap economy fares with your selected airline for fewer points when you use the Pay With Points feature. Your Amex points are worth one cent each toward airfare (less for booking other travel). So a cheap $200 flight would cost 20,000 Amex points and you could get a 7,000-point rebate in addition to earning miles on your flight. This also gives you the option to use Amex points for flights with airlines that aren’t direct Amex transfer partners, like Alaska Airlines.

Customer Service

While I’ve minimal interaction with American Express Travel directly, the few times I have called needing assistance have gone smoothly. However, booking a hotel with cash is always a bit more difficult than booking with points. Typically, if you are able to book with points, you can cancel your room and your points will be refunded immediately.

One piece that I have no experience with is its Lowest Rate Guarantee. If you are able to find a a publicly-available lower price available online elsewhere, American Express will refund the difference. The terms and conditions say:

If you book a qualifying prepaid hotel rate on amextravel.com and then find the same room, in the same hotel, for the same dates, the same number of children and adults, at a lower price online, before taxes and fees, we’ll refund you the difference. Your claim must be submitted prior to your stay, before the date of check-in.

If you have any experience with this, I’d love to hear how it went in the comments.

Best American Express cards to use with American Express Travel

The best Amex cards for earning points when booking with American Express Travel are the Amex Platinum and the Amex Business Platinum. Both of those cards earn 5x Amex points on airfare and prepaid hotels booked through the site. But these cards have bigger annual fees — $695 for the personal Amex Platinum (see rates and fees) and $595 for the Business Platinum ($695 if application is received on or after 01/13/2022) (see rates and fees).

You could also earn bonus points on travel and pay a smaller annual fee with the American Express® Green Card ($150, see rates and fees) or the American Express® Gold Card ($250, see rates and fees). The Amex Green card earns 3x Amex points on travel purchases (not just purchases made through Amex Travel) and the Amex Gold earns 3x points on flights booked directly with airline or through Amex Travel. The information for the Amex Green Card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

If you want to use your Amex points to pay for travel, two Amex business cards are your best options – the Amex Business Platinum and the American Express® Business Gold Card. As we mentioned before, the Amex Business Platinum has a 35% points rebate and the Amex Business Gold has a 25% rebate with you use Pay With Points (up to 250,000 points rebated per calendar year).

Bottom line

Booking travel in the most efficient way can take some time and effort. But American Express Travel can potentially make the process a bit easier, especially if you have an Amex Business Platinum Card and can take advantage of the card’s 35% points rebate. However, in most cases, booking with American Express Travel provides no advantage over using another third-party booking service.

If you have any American Express Travel tricks or tips, be sure to leave them in the comments below.

| For more travel and credit card news, deals and analysis sign up for our newsletter here. |

Featured photo by First Class Photography.

For rates and fees of the Amex Green card, click here.

For rates and fees of the Amex Platinum Card, please click here.

For rates and fees of the Amex Business Platinum Card, please click here.

For rates and fees of the Amex Gold card, click here.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!