Capital One miles review: Start traveling now with the simplest rewards program around

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

If you’re tired of worrying about blackout dates, available hotel award nights, airline award zones, and other complicated aspects of the miles & points hobby, you might want to collect Capital One miles!

You can use Capital One miles for nearly any travel purchase, like airfare, Lyft, car rentals, room service, and much more. They are extremely easy to redeem and great for beginners.

I’ll give you step-by-step instructions for how to redeem Capital One miles.

How to use Capital One miles to erase travel purchases

At their core, Capital One miles aren’t “miles” at all. They are miles worth a flat 1 cent each that you can redeem towards any travel purchase, like airfare, hotels, tolls, and Uber. They’re handy because you don’t have to think about searching for available airline award seats or hotel award nights.

To redeem your miles for travel, just buy travel like you normally would with your card. Then, you have 90 days to sign into your online account, find the travel purchase, and “erase” it with your miles. I’ll show you how to use Capital One miles with the “Purchase Eraser.”

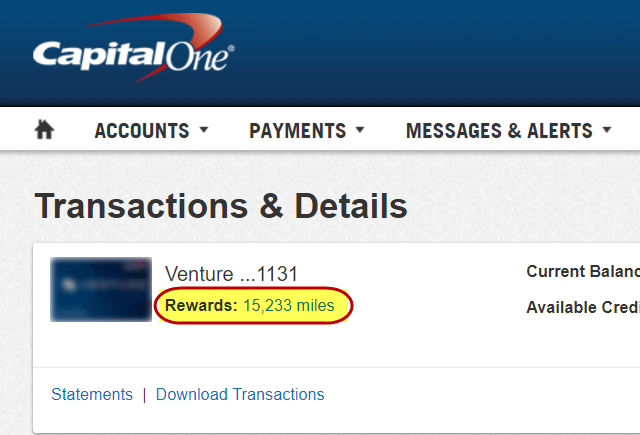

Log-in to your Capital One account and click “Rewards”

You’ll see the number of miles you have next to your card. Click that number to begin redeeming your miles.

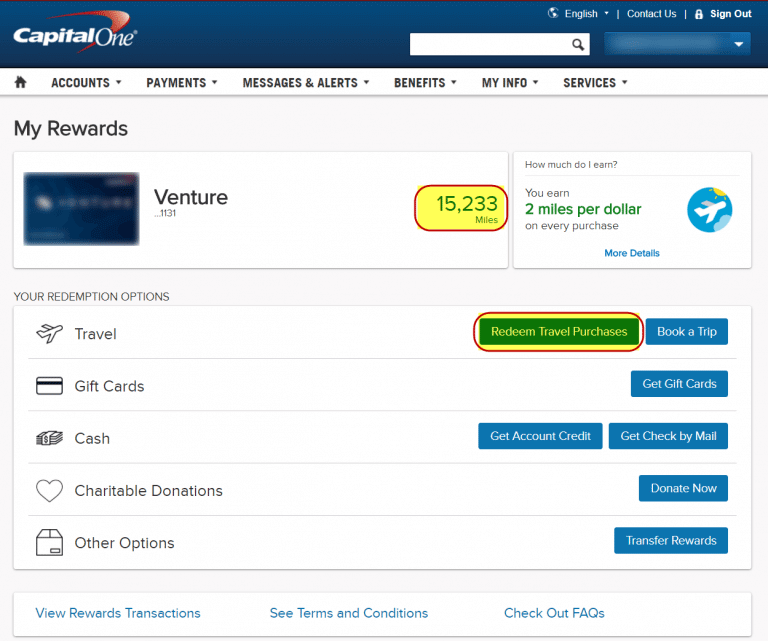

Click “Redeem Travel Purchases”

There are a few different ways you can redeem Capital One miles, but you’ll get the best value by using them for travel. For example, you can redeem for gift cards or a statement credit at 0.5 cents per point (a terrible value!). But you’ll get a value of 1 cent per point towards travel.

Also, through September 30, 2020, you can redeem Capital One miles for food delivery, takeout, and even streaming services at a rate of one cent per mile — just as you would for travel.

All you need to do is make travel purchases (or takeout, deliver, or streaming purchases) using your card, and then erase those purchases later. To do this, click “Redeem Travel Purchases.“

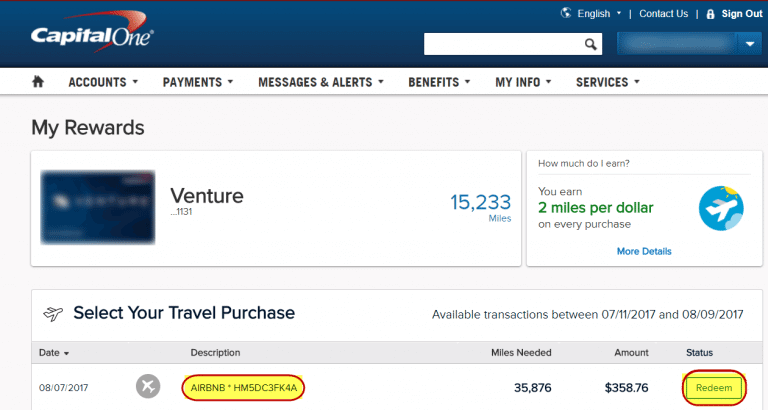

Choose the purchases you want to erase

As long as a transaction codes as a travel purchase, you can erase it with Capital One miles. For example, you can redeem Capital One miles towards purchases with travel companies like airlines, hotels, rental cars, and even tolls. But you can’t erase purchases you make at the grocery store, for example.

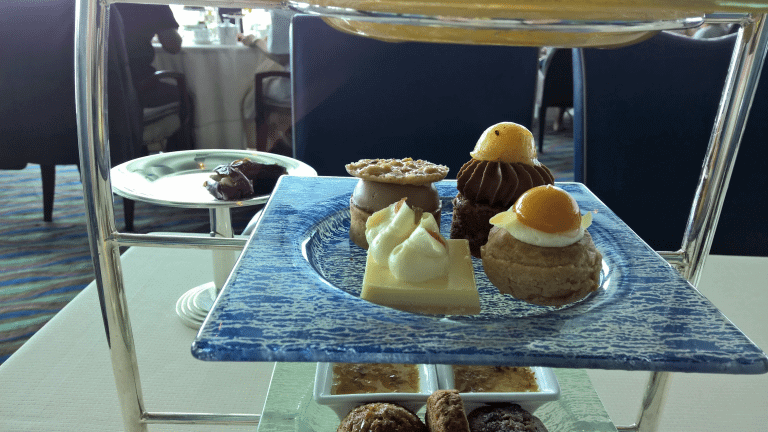

Sometimes it can be difficult to know for sure if something will code as a travel purchase. I used Capital One miles for Afternoon tea at a restaurant in the Burj Al Arab hotel. The transaction coded as a hotel purchase because the restaurant was inside a hotel, so I was able to erase the purchase with Capital One miles.

But I tried the same thing at a restaurant in the Drake Hotel in Chicago, and the transaction coded as a regular restaurant purchase. I couldn’t erase that one with miles.

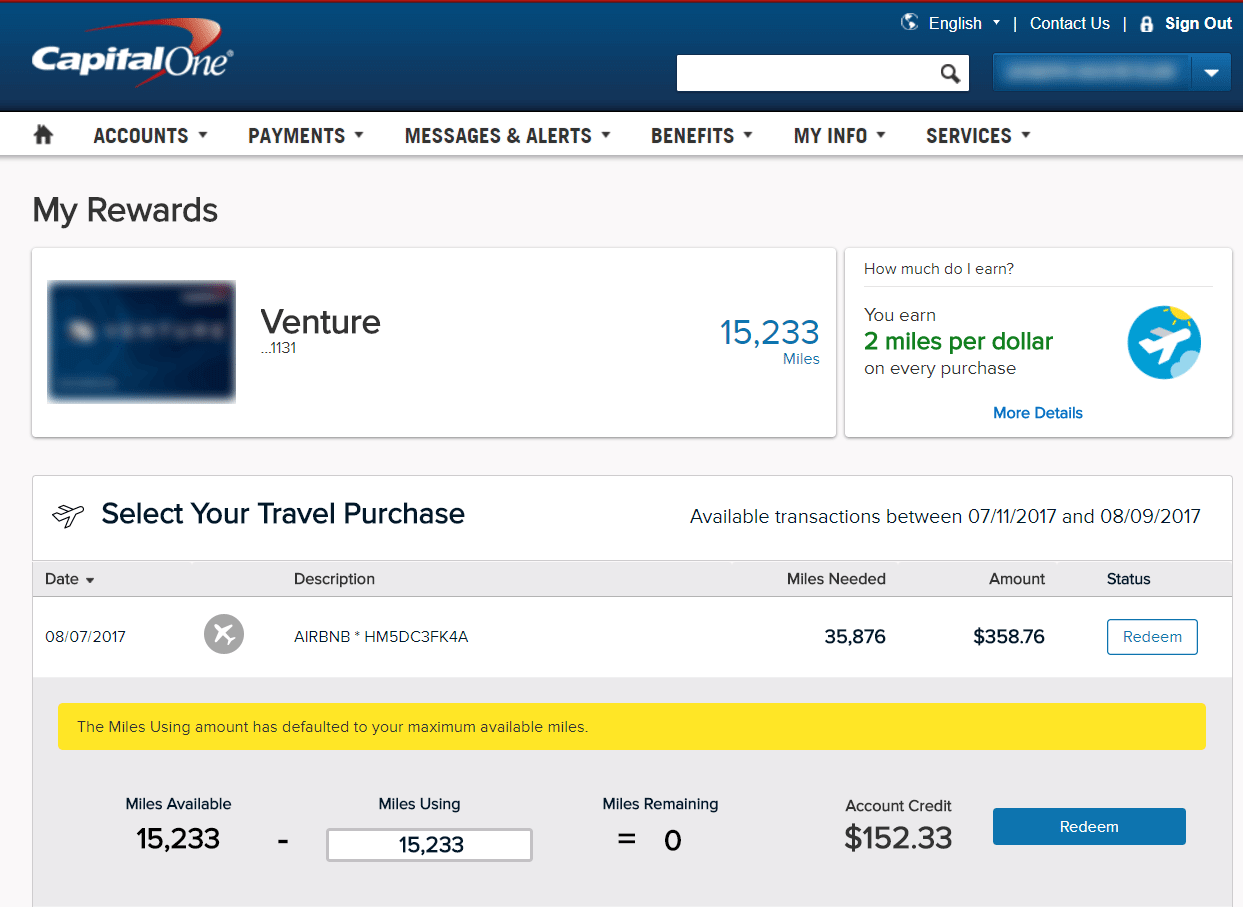

Capital One will give you a list of the travel purchases you can redeem Capital One miles for. Just click “Redeem” to begin the process.

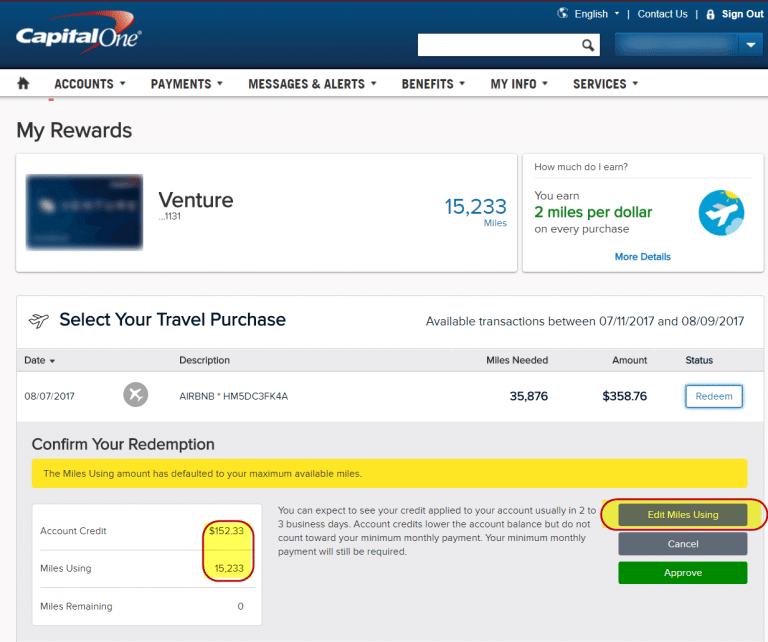

Choose how many miles to redeem

You can choose whether you want to use miles to completely erase a purchase, or if you want to use a combination of cash and miles. Select “Edit Miles Using” before you confirm your redemption.

There is no minimum redemption amount when redeeming miles, unless you’re using miles to partially pay for a travel purchase. In that case, the minimum is 2,500 miles ($25).

Redeem your miles

After you’ve decided how many miles you want to use, click “Redeem.“

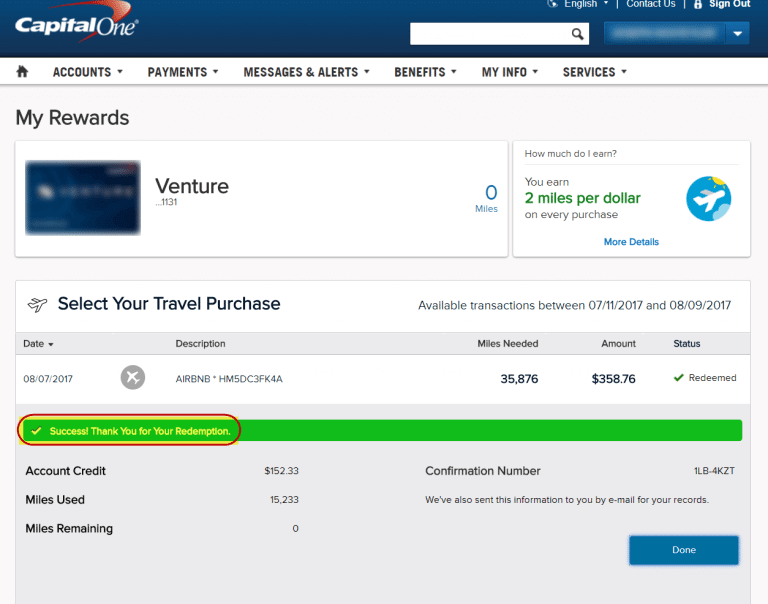

That’s it! You should then see a confirmation number and a message below the transaction telling you that you’ve successfully redeemed miles. You’ll also get an email confirmation.

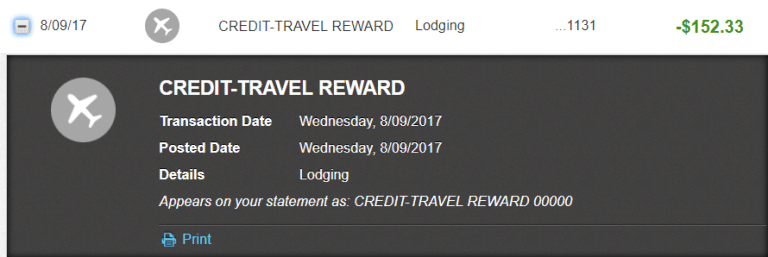

You’ll usually receive the statement credit by the next day. And the redeemed miles will show up on your transaction history as “CREDIT-TRAVEL REWARD.“

Transfer to travel partners

If you so choose, you can transfer your miles to Capital One transfer partners and potentially squeeze more than the standard Capital One miles value of 1 cent per mile from your rewards. If you know what you’re doing, this could be the best way to use Capital One miles. Here are all of Capital One’s transfer partners:

- Aeromexico

- Air Canada (Aeroplan)

- Air France & KLM (Flying Blue)

- Avianca

- Cathay Pacific

- Emirates

- Etihad

- EVA Air

- Finnair

- Qantas

- Singapore Airlines

- Accor Hotels

- Wyndham

For example, you can transfer Capital One miles to Qantas at a ratio of 1.5:1. By transferring 22,000 Capital One miles to Qantas, you can book a round-trip short-haul flight on American Airlines (16,000 Qantas miles).

Earn More Capital One miles

If you want to earn Capital One miles quickly, sign-up for Capital One credit cards.

The Capital One Spark Miles for Business comes with a welcome bonus of 50,000 bonus miles (worth up to $500 to spend on travel) after spending $4,500 on purchases within the first three months from account opening. The Capital One Venture Rewards Credit Card comes with an offer 60,000 bonus miles after you spend $3,000 on purchases within the first three months of account opening.

Both cards earn 2 Capital One miles per dollar on all purchases, and come with a $95 annual fee. To be approved for either of these cards, Capital One says you’ll need excellent credit. They describe excellent credit to be anyone who has:

- Never declared bankruptcy or defaulted on a loan

- Has not been more than 60 days late on a loan in the past year

- Has had a loan or credit card for three or more years with a credit limit of $5,000+

The information for the Capital One Spark Miles has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

Should you apply?

If you’re a miles & points beginner, and plan to apply for lots of cards later, these aren’t good cards for you. There are other credit cards with much better sign-up bonuses that earn more valuable points and have better travel benefits. Capital One miles are usually not worth as much as airline miles or hotel points.

Opening these Capital One cards could decrease your chances of being approved for great Chase cards later on. That’s because if you’ve opened five or more cards in the past 24 months (not counting Chase business cards and other business cards), Chase won’t approve you for many of their cards. This is called the Chase 5/24 rule.

However, if you already have all the Chase cards you want or you’re happy with Capital One’s straightforward program, these cards are definitely worth a look.

Bottom line

You can use Capital One miles for a wide range of travel purchases, like Airbnb stays, hotels, flights, and more. And they’re super easy to redeem.

Capital One miles are usually not worth as much as airline miles or hotel points, but they’re also generally easier to use. If you don’t want to deal with available hotel award nights, airline blackout dates, and award charts, you might be interested in collecting Capital One miles.

Are Capital One miles worth the convenience — Or would you rather collect other miles & points to get a better value?

You can subscribe to our newsletter for more in-depth posts for how to use your miles and points for free travel.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!