Full review of Capital One Rewards

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Capital One miles are the EASIEST rewards to use — but their marketing could use a little work. That’s why I’m here.

Capital One calls their rewards “miles,” but they actually function like points. You can convert them to airline miles, or you can redeem them for a statement credit toward travel purchases. And regardless of your level of interest in learning the ins and outs of miles & points, you can practically redeem Capital One miles in your sleep.

I’ll give you step-by-step instructions to redeeming them, and highlight the best ways to use Capital One miles. If you want to learn more about how to make the most of your credit card rewards, subscribe to our newsletter.

Capital One miles review

Million Mile Secrets readers love Capital One miles because they’re so easy to use. The rewards program is very straightforward: You can either redeem your miles for 1 cent each toward travel purchases, or you can transfer your miles to 13 airline partners where they’re potentially worth much more.

We’ll cover both ways to use Capital One miles in this post. You can read here about how to set up a Capital One miles account.

How to use Capital One miles with “Purchase Eraser”

Purchase Eraser is perfect for folks who don’t want to worry about blackout dates, available hotel award nights, and airline award zones.

With Capital One’s Purchase Eraser, you can use Capital One miles to erase almost any travel purchase, including airfare, hotels, Uber, car rentals, room service, and lots more. Just buy travel like you normally would with your card. Then, you’ll have 90 days to sign into your online account, find the travel purchase, and “erase” it with your miles.

Here’s a quick step-by-step tutorial for redeeming Capital One miles.

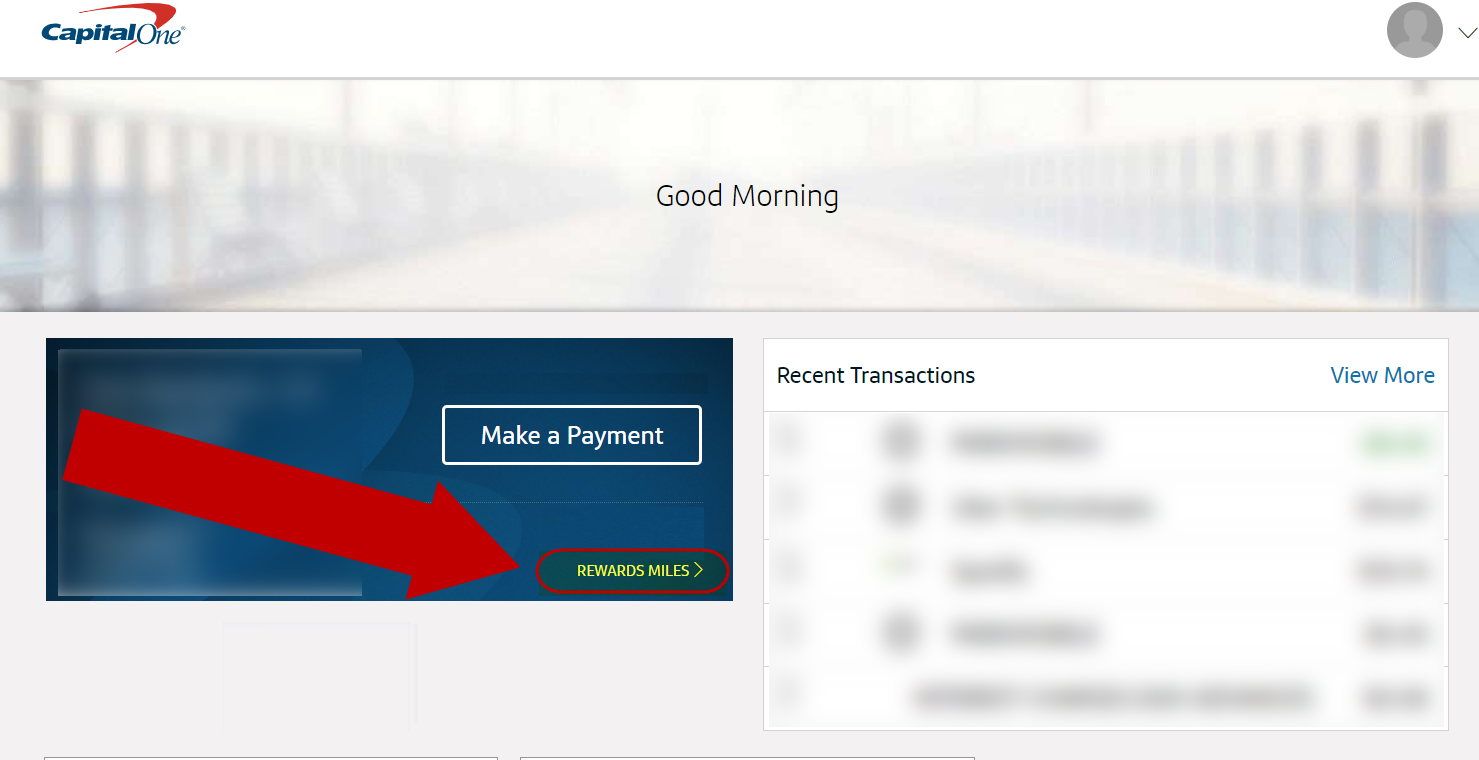

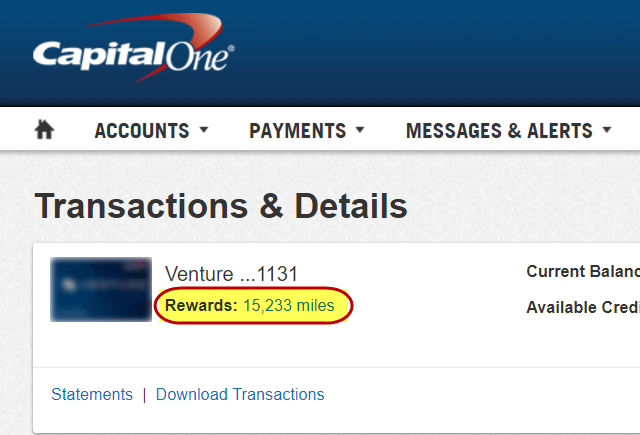

Step 1. Log into your Capital One account and click your rewards

You’ll see the number of miles you have next to your card. Click that number to begin redeeming your miles.

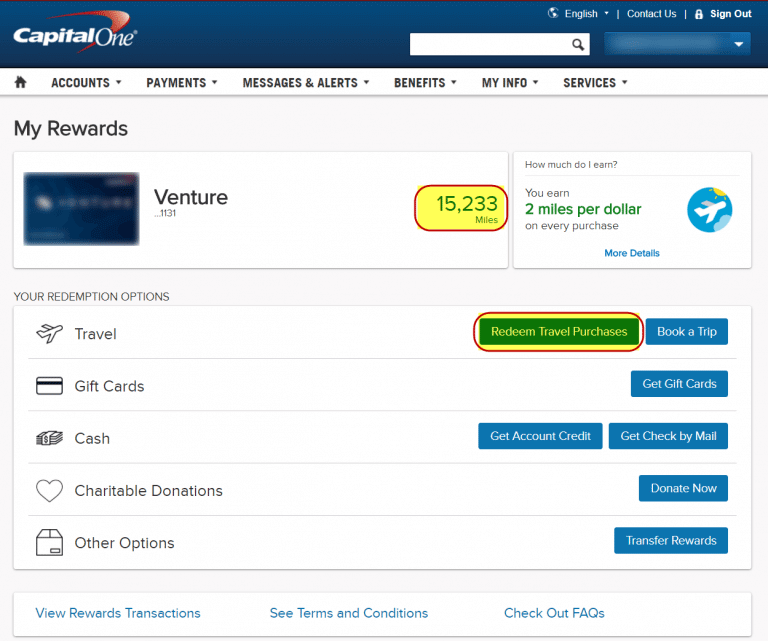

Step 2. Click “Redeem Travel Purchases”

There are a few different ways you can redeem Capital One miles, but you’ll get the best value by using them for travel. For example, you can redeem for gift cards or a statement credit at 0.5 cents per point (a terrible value). But Capital One miles value is 1 cent each towards travel.

Just make travel purchases using your card, and then erase those purchases later. To do this, click “Redeem Travel Purchases.”

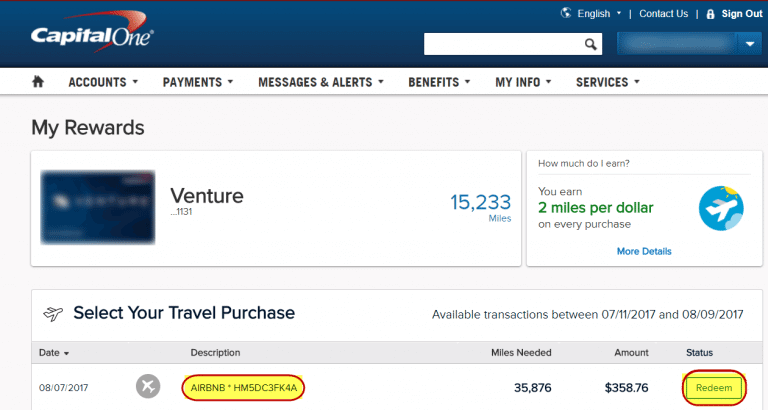

Step 3. Choose the purchases you want to erase

As long as a transaction codes as a travel purchase, you can erase it with Capital One miles. For example, you can redeem Capital One miles toward purchases with travel companies like airlines, hotels, rental cars, and even tolls. But you can’t erase purchases you make at the grocery store, for example.

Sometimes it can be difficult to know for sure if something will code as a travel purchase. I used Capital One miles for afternoon tea at a restaurant in the Burj Al Arab hotel in Dubai. The transaction coded as a hotel purchase because the restaurant was inside a hotel, so I was able to erase the purchase with Capital One miles.

I tried the same thing at a restaurant in The Drake Hotel in Chicago, and the transaction coded as a regular restaurant purchase. So I couldn’t erase it with miles. Just note that your results may vary.

Capital One will give you a list of the travel purchases that can be erased. Click “Redeem” to begin the process.

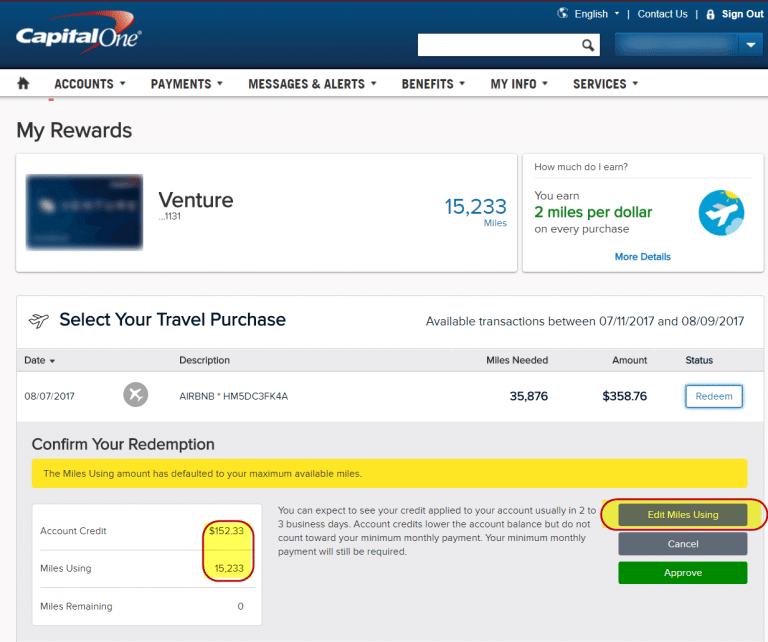

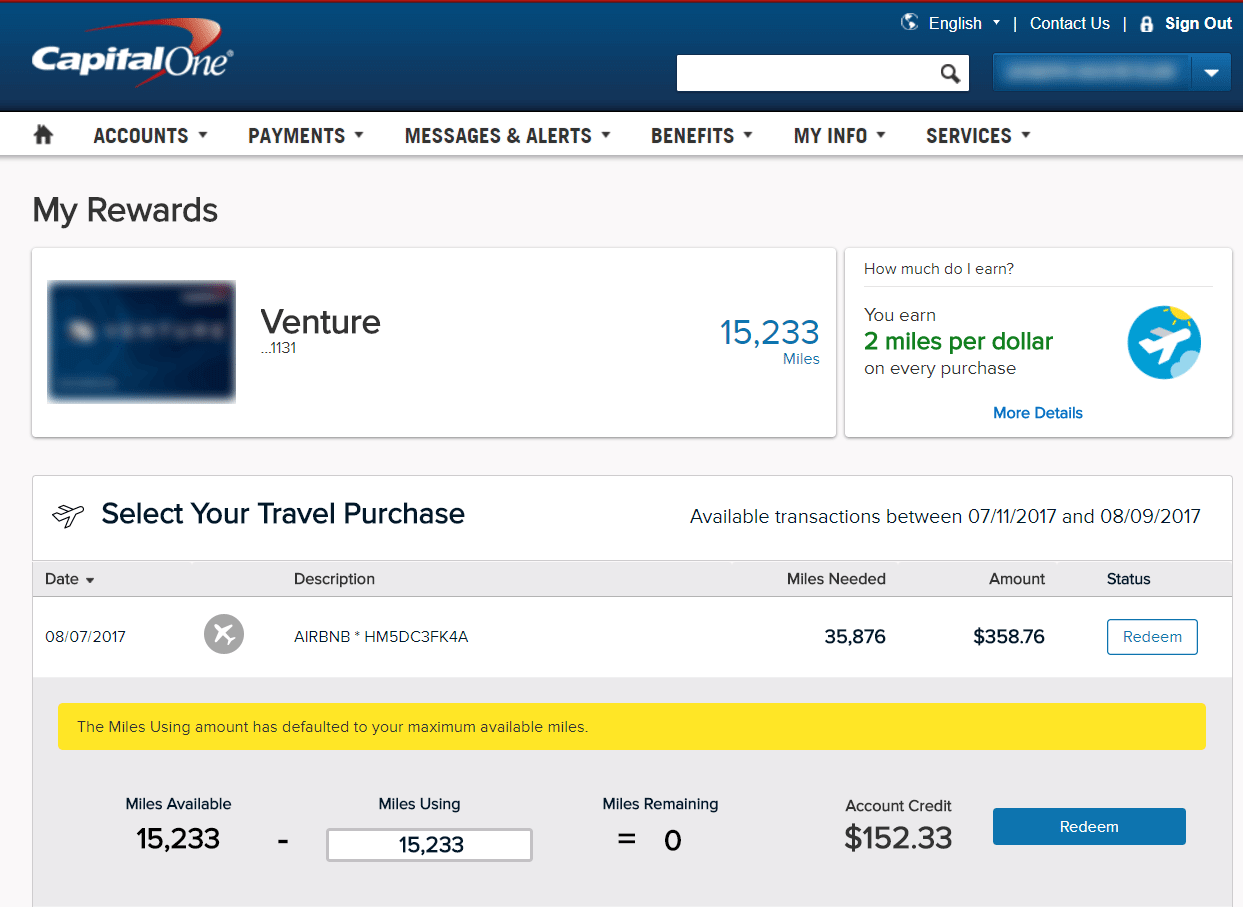

Step 4. Choose how many points to redeem

You can choose whether you want to use miles to completely erase a purchase, or if you want to use a combination of cash and miles. Select “Edit Miles Using” before you confirm your redemption.

There isn’t a minimum redemption amount when you redeem miles, unless you’re using miles to partially pay for a travel purchase. In that case, the minimum is 2,500 miles ($25).

Step 5. Redeem your points

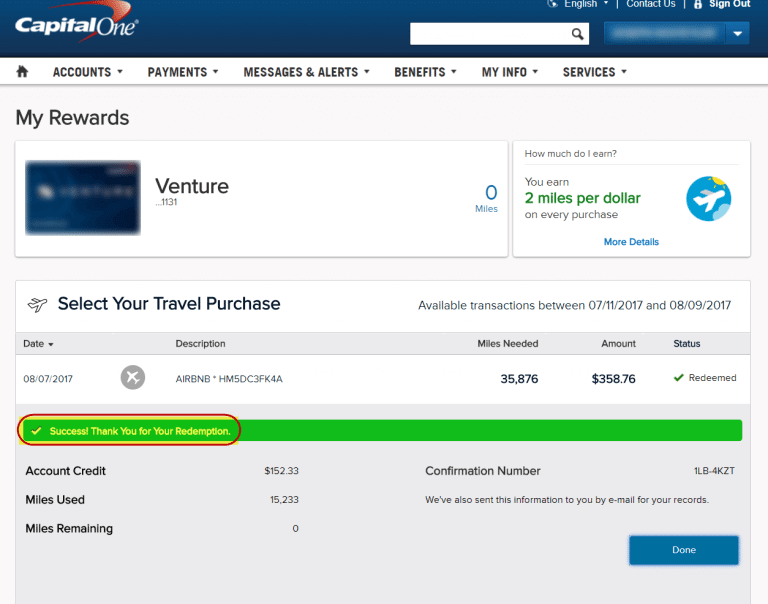

After you’ve decided how many miles you want to use, click “Redeem.”

That’s it! You’ll see a confirmation number and a message below the transaction telling you that you’ve successfully redeemed miles. You’ll also get an email confirmation.

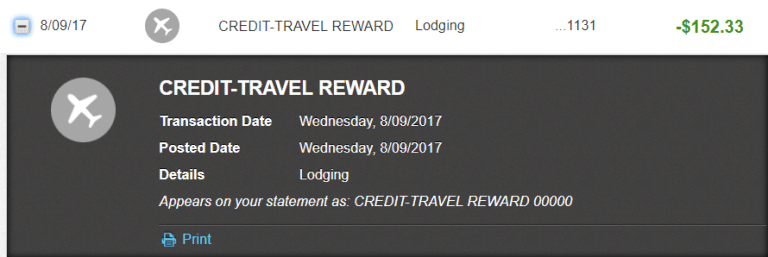

You should receive the statement credit by the next day. And the redeemed miles will show up on your transaction history as “CREDIT-TRAVEL REWARD.”

Transfer your miles to airline partners

If you’d like to try and squeeze a value greater than 1 cent from each mile, Capital One has an option for you — redeem with Capital One transfer partners! The process could not be easier, and it can be the best way to use Capital One miles if you know what you’re doing. Here’s how it works.

Step 1. Click “Rewards Miles” in your online account

Log into your Capital One account. On the home page, you’ll see your recent transactions, balance, available credit, and payment button. In the middle of all this is a link that says “Rewards Miles.“ Click it.

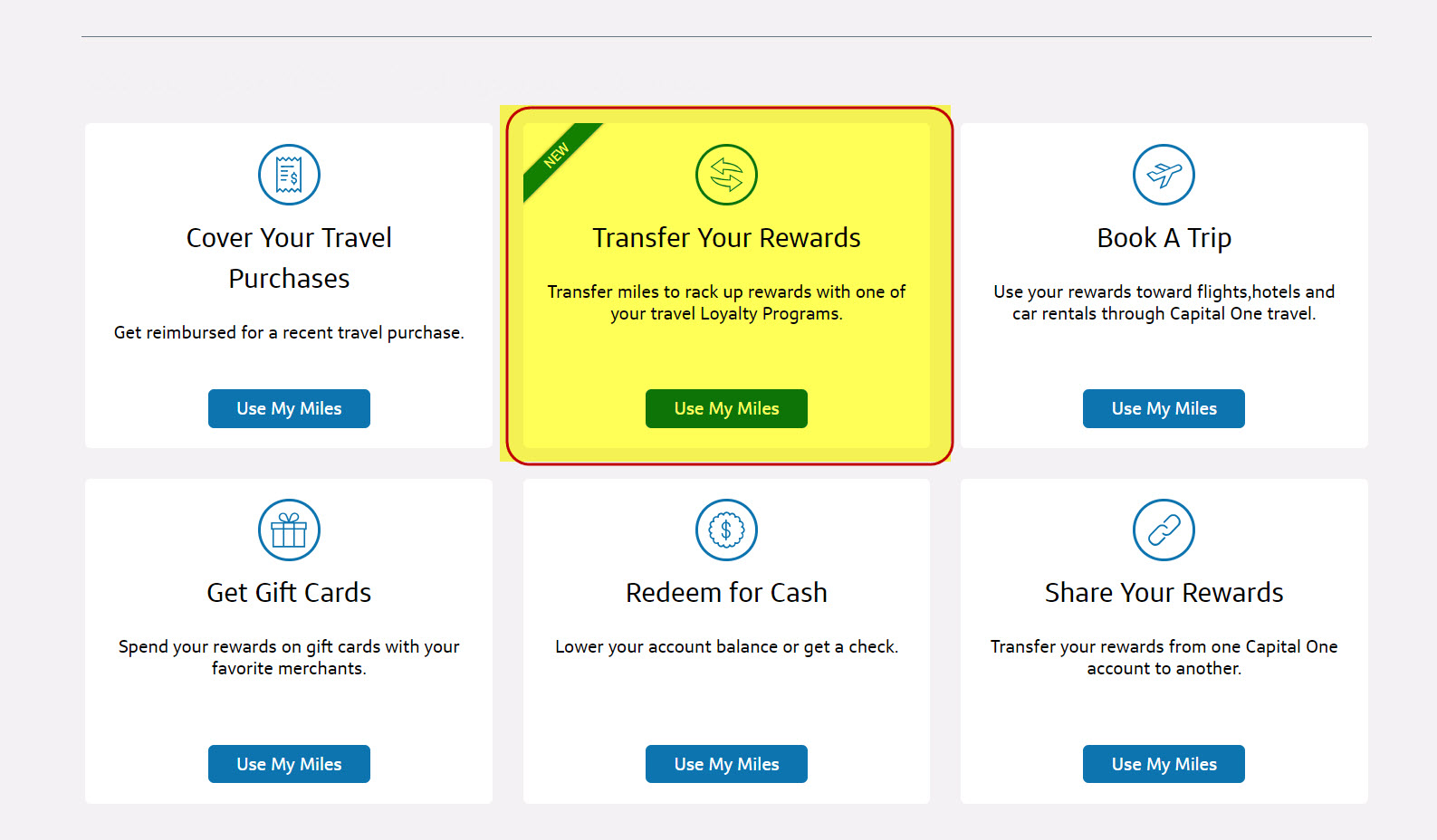

Step 2. Click the “Transfer Your Rewards” box

Scroll down the page to see your options for redeeming Capital One miles. Click the “Use My Miles” button in the “Transfer Your Rewards” box.

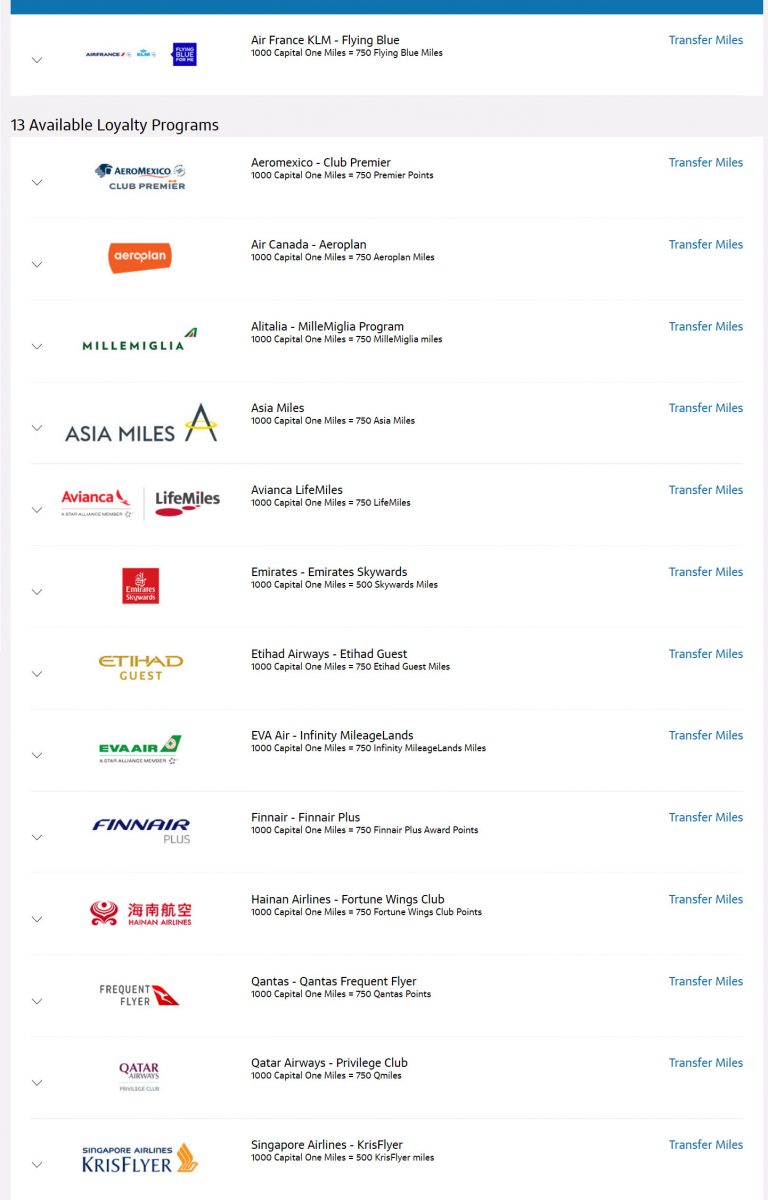

Step 3. Choose the airline you want to use

You’ll see 13 airlines to choose from, some with different transfer ratios. The best deal isn’t necessarily the airline with the most favorable transfer ratio. You’ll need to dig into each airline’s award chart to know the option for your upcoming travel. We’ll cover a bit of that later.

An important note is that while Capital One miles transfer instantly to most of these airlines, there are a couple that don’t. Singapore Airlines is reported to post the miles within 36 hours, and Qantas posts within 24 hours.

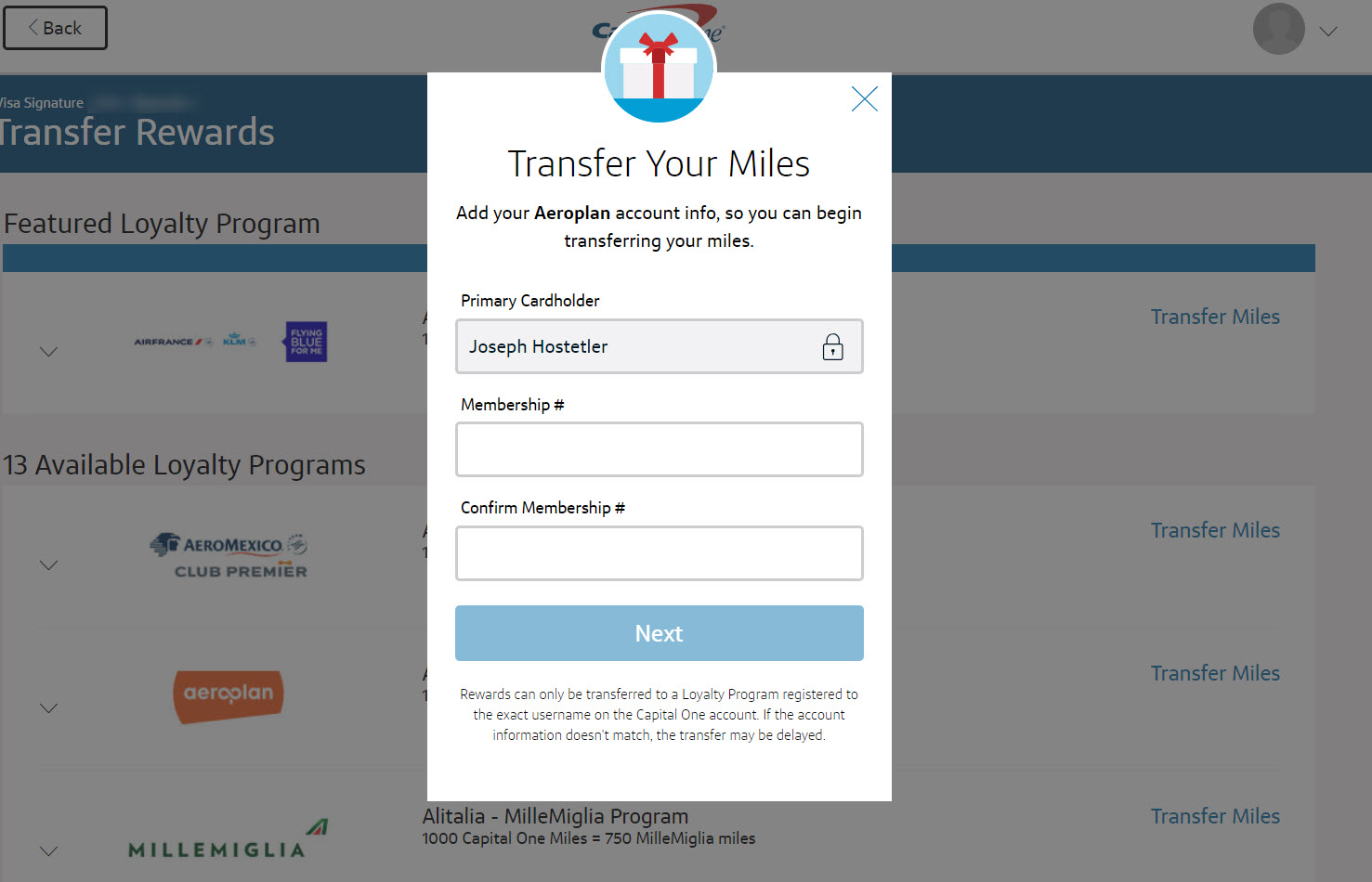

Step 4. Enter your airline frequent flyer number

When you click on the airline you want to use, you’ll need to enter your airline frequent flyer number if it’s your first time transferring the miles.

You can only transfer Capital One miles to your own frequent flyer account – the names must match.

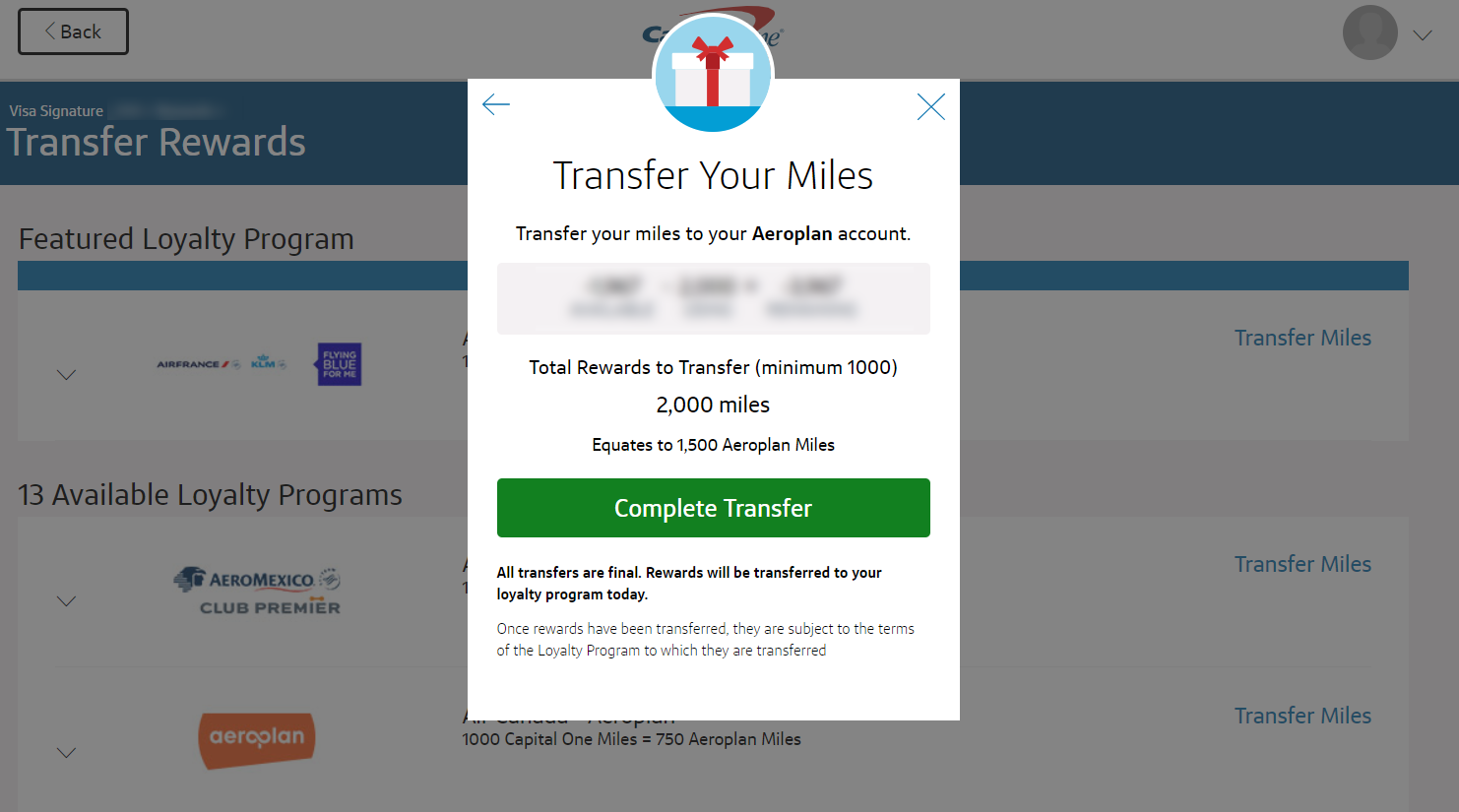

Step 5. Confirm your transaction

You will then have the option to select the number of miles you want to transfer. You must transfer at least 1,000 miles at a time. After that, you can transfer in increments of 100 miles. Most other flexible points programs force you to transfer in increments of 1,000, so this is a great feature.

It’s worth stating that you can’t transfer your miles back to Capital One after you transfer them to an airline. It’s a one-way street, so be absolutely sure you want to transfer them before you click the “Complete Transfer” button.

Just remember, when you transfer your miles to an airline, you’ll be subject to blackout dates and limited by available award seats. If you use your miles to erase purchased travel, you won’t have to worry about blackout dates.

Smart ways to use Capital One miles

Purchase Eraser

To use the Capital One purchase eraser, your transaction must code as travel.

According to Capital One, travel purchases include:

Airlines, hotels, rail lines, car rental agencies, limousine services, bus lines, cruise lines, taxi cabs, travel agents, and timeshares.

However,

Availability for redemption is based on the merchant category code assigned to them by the merchant. Capital One is not responsible for how merchants assign these codes.

There are plenty of things not listed by Capital One that readers have found they can erase with Capital One miles, such as:

- Online travel agencies and 3rd-party booking sites (like Orbitz)

- Rail lines

- Hotel meals (when charged to your hotel room, including Disney hotels)

- Airbnb

- Lyft and Uber

- Disney World tickets or other park tickets purchased through Undercover Tourist

- U-Haul storage units, according to a phone call with a Capital One representative

If you’re planning a Disney or Universal Studios trip, Undercover Tourist sells discounted tickets. And folks report these purchases qualify for a Capital One miles redemption.

You can’t erase these types of purchases

Keep in mind, some purchases you’d think would code as travel aren’t actually eligible. These include:

- Global Entry fees

- Aquariums

- Airport parking

- Gas stations

- Homeaway.com

- Some hotel point purchases

- Some airline mile purchases

- Car2Go

- www.b-europe.com

As always, the best way to use miles and points is for travel that’s important to you.

Airline transfers

Air Canada – 1:1 transfer ratio

Aeroplan, (Air Canada’s loyalty program) is a great destination for your Capital One miles. The program has some great sweet spots, such as:

- 150,000 Air Canada Aeroplan miles for round-trip Business Class flights to Africa

- 110,000 Air Canada Aeroplan miles for round-trip Business Class flights to Western Europe

- 25,000 Air Canada Aeroplan miles for round-trip coach award flights within the mainland US and Canada

Air Canada adds fuel surcharges to certain partner award flights. Check the full cost before you transfer any miles out of your account. And be sure to read our ultimate guide to using Air Canada miles!

Air France & KLM (Flying Blue) – 1:1 transfer ratio

Flying Blue doesn’t have an official award chart. But they do run monthly Promo Rewards on popular routes. For example, in the past we’ve seen Business Class flights to Europe for 35,000 Flying Blue miles one-way, and coach awards to Europe for just 14,000 Flying Blue miles one-way. That’s astounding.

This can often be a better use of your miles than using the purchase eraser. Just note that taxes and fees can be high for these award flights. You’ll need to decide if the thousands and thousands of points you’ll save is worth the tradeoff.

Singapore Airlines – 1:1 transfer ratio

Did you know it’s possible to book flights on United Airlines at cheaper rates with Singapore Airlines? This is even true for super desirable routes to Hawaii.

You can fly round-trip in coach from the U.S. to Hawaii for 35,000 Singapore Airlines miles. Depending on cash ticket prices, you could receive a value greater than 1 cent per mile by using your rewards this way.

How to earn Capital One miles

The easiest way to quickly earn Capital One miles is by opening these cards and earning the welcome bonus:

- Capital One Venture Rewards Credit Card

- Capital One VentureOne Rewards Credit Card

- Capital One Spark Miles for Business

- Capital One Spark Miles Select for Business

A couple of these cards are among the best credit cards for travel, simply because of the cinch-to-redeem rewards they collect. If you’re not in the market for a new credit card, here are a few other ways to earn Capital One miles.

Combine your miles with others

You can transfer your miles to anyone as long as they have one of the above cards. If you and a travel companion want to reserve an amazing hotel, you can combine your miles to achieve your goal.

You can also ask your kind and loving family to open one of these cards and transfer the miles to you, if they’re not invested in travel rewards.

Targeted referral offers

Capital One occasionally has targeted refer-a-friend offers with the Capital One Venture cards, though they often come in the form of very generous statement credits. If you have one of the above cards, keep an eye on your email to see if Capital One gives you a rewards incentive to refer others to the card.

Swipe your cards

The final (and most obvious) way to earn more Capital One miles is to use your card for your everyday purchases. You’ll get 2 miles per dollar, so estimate your monthly spending and multiply it by 2, and that’s how many miles you can expect.

We have a helpful guide showing folks how to easily meet minimum spending requirements (you can read it here). Lots of the information in that post is an all-around effective strategy to show you how to generate miles on your card without spending a dime more than you already plan to spend. There are some things most folks didn’t think about using their credit card for.

Bottom line

Capital One miles are valuable because they’re super flexible.

You can use them to erase travel purchases like airfare and hotels, and you don’t even have to worry about blackout dates. You can transfer your miles to airline partners like Air Canada and Flying Blue to receive outsized value per mile. The welcome bonus on the Capital One Venture card is worth $600 in travel (60,000 bonus miles when you spend $3,000 on purchases in the first three months from account opening).

And miles are extremely easy to redeem. Just book your travel with the card, then use your miles to erase the whole charge or a partial amount within 90 days of your purchase.

It often makes more sense to redeem Capital One miles for travel purchases that can’t be offset by other miles and points, like boutique hotels, inexpensive Uber or taxi rides, or train tickets. You can even use Capital One miles to pay for Disney and Universal Studios tickets purchased through Undercover Tourist!

Let me know your favorite use of Capital One miles.

And for more tips, tricks, and deals, subscribe to our newsletter.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!