Don’t Fight With the US Bank Travel Portal Anymore! Introducing Real-Time Rewards!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Lots of folks like earning Big Travel with Small Money with cards that earn cash back, or miles & points that you can redeem for cash back. With these types of rewards, you don’t have to worry about blackout dates. And you can earn frequent flyer miles from your free flights!

But in order to get the highest redemption rates per point, you’ll usually have to book through the bank’s travel center or have a specific credit card to get the best deals. 🙁

Not anymore! US Bank has introduced a new, potentially more valuable way to redeem certain US Bank points!

US Bank has several credit cards which earn points you can redeem for 1.5 cents each toward eligible travel expenses. In the past, to get this increased redemption rate, you’d have to book your travel through the US Bank travel portal.

But now US Bank has introduced Real-Time Rewards, which allows you to skip the US Bank travel portal and stack discounts on top of your points redemptions!

Being able to redeem your US Bank points without having to navigate the US Bank travel portal has some great benefits. But not all US Bank cards are eligible for this service.

So let’s take a look at how you can increase your savings with US Bank Real-Time Rewards. And I’ll let you know which cards are eligible and show you how to activate the service, step-by-step.

How to Use Real-Time Rewards to Your Advantage

Link: US Bank Real-Time Rewards

Once you’ve activated your Real-Time Rewards, you won’t have to book your travel through the US Bank travel portal ever again!

Instead, every time you make a qualifying travel purchase you’ll get a text message asking if you want to redeem points for it. Simply text back “Redeem” and the points will automatically be credited at 1.5 cents each toward the purchase!

So you don’t need to waste time trying to find the flight or hotel you wanted on the US Bank travel portal. And you don’t have to worry about whether or not you’re getting the best price. Because you can find the best deal from any site and just pay with your eligible US Bank card to use the service.

Because you can book directly with the travel provider, you’ll earn miles & points on top of your award travel! And you should earn credit card points on these purchases as well.

One of the biggest advantages to redeeming rewards this way is you can still make your purchases through shopping portals!

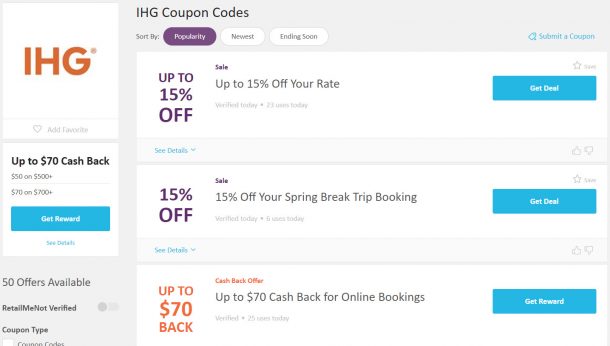

For example, you could click through the RetailMeNot cash back portal to save $50 off a $500 IHG booking. Because you’re still booking directly with the hotel, you’ll be able to earn IHG points, take advantage of any current hotel promotions, and have your elite status recognized.

And if you make the purchase with a U.S. Bank Altitude™ Reserve Visa Infinite® Card, you would earn 3 Altitude Reserve points per $1. Because you’re paying for the travel first and then redeeming your points to erase the charge!

Then you’d be able to use the extra 1,500 US Bank Altitude Reserve points ($500 x 3 US Bank Altitude Reserve points per $1) to save ~$23 on another travel purchase (1,500 US Bank Altitude Reserve points X 1.5 cents each)!

Which US Bank Cards Are Eligible for Real-Time Rewards?

Not every US Bank credit card is eligible for Real-Time Rewards. You’ll be able to register if you have one of these US Bank cards:

| Card | Card Details | |

|---|---|---|

| U.S. Bank Altitude™ Reserve Visa Infinite® Card |  | 50,000 US Bank Altitude Reserve points after spending $4,500 on purchases in the first 90 days of account opening - 3X Altitude Reserve points per $1 on all eligible mobile wallet and travel purchases - 1 Altitude Reserve point per $1 on all other eligible purchases |

| U.S. Bank FlexPerks® Business Travel Rewards |  | 25,000 FlexPoints after spending $2,000 on purchases in the first 4 months of account opening - 2X Flexpoints for eligible charitable donations - 2X Flexpoints on the category you spend the most on (gas, office supplies or airlines) and most cell phone expenses during each billing cycle |

| U.S. Bank FlexPerks® Travel Rewards Visa Signature® Card |  | 25,000 FlexPoints after spending $2,000 on purchases in the first 4 months of account opening - 2X Flexpoints for eligible charitable donations - 2X Flexpoints on the category you spend the most on (gas, grocery stores or airline) and most cell phone expenses during each billing cycle |

Real-Time Rewards is currently not available for the U.S. Bank FlexPerks® Select+ American Express® Card or the U.S. Bank FlexPerks® Gold American Express® Card.

How to Activate US Bank Real-Time Mobile Rewards

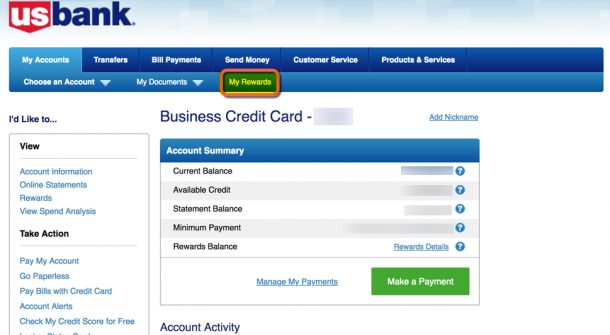

First you’ll need to log into your US Bank account.

Step 1. Click “My Rewards”

Select the “My Rewards” tab to continue.

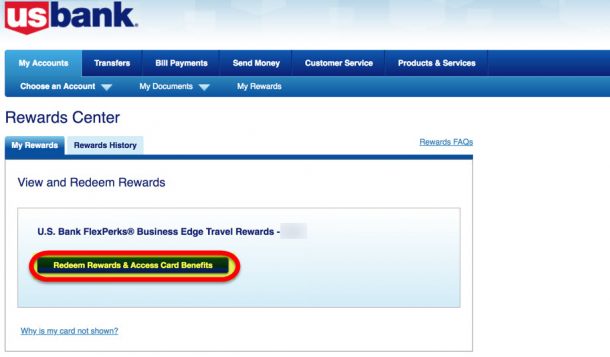

Step 2. Select “Redeem Rewards & Access Card Benefits”

Next, click the “Redeem Rewards & Access Card Benefits” button.

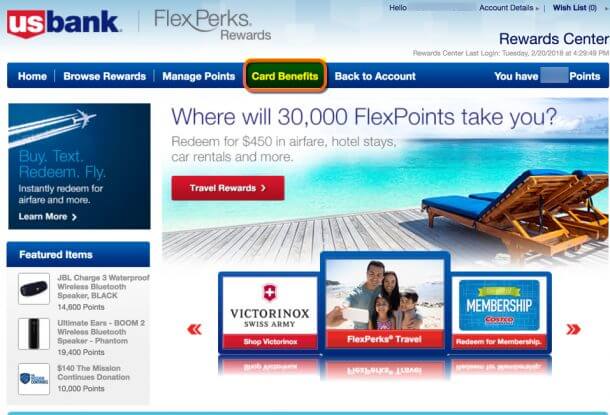

Step 3. Click “Card Benefits”

Now you can select the “Card Benefits” tab.

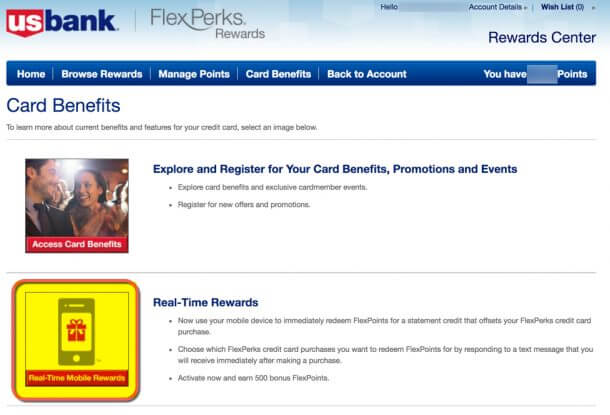

Step 4. Choose “Real-Time Rewards”

To continue, select “Real-Time Rewards“.

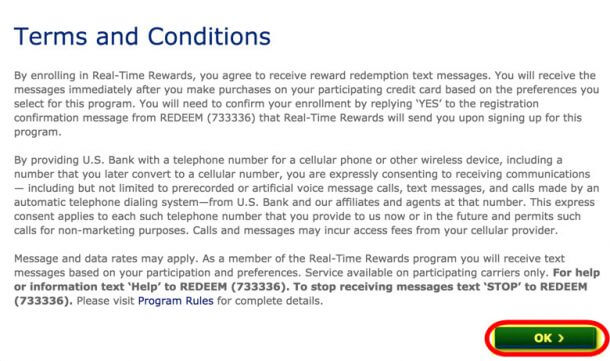

Step 5. Accept the Terms & Conditions

To accept the terms and conditions, click the “OK” button in the bottom right corner.

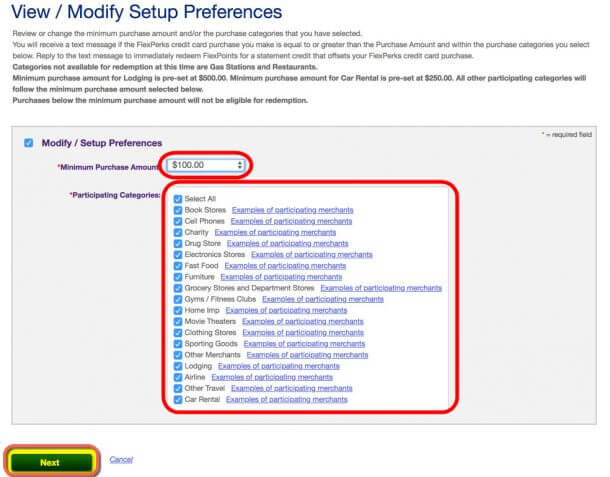

Step 6. Set Your Reward Options

You are able to choose the minimum purchase amount for redeeming your US Bank points. You’ll also need to choose which categories of purchases you want to redeem your points for. Or you can simply click the “Select All” button at the top to choose every category.

When you are ready, click the “Next” button to finish your registration!

No matter what you set your minimum purchase amount to, the minimum redemption amount for hotel purchases will be no less than $500. And the minimum purchase amount for rental car redemptions will not be less than $250.

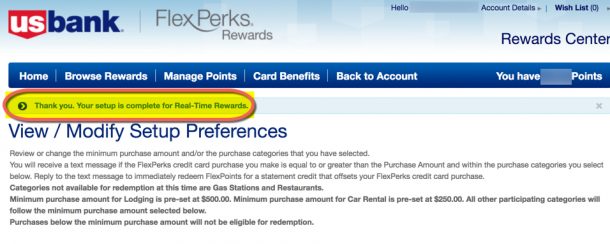

Step 7. You’re Good to Go!

Now you should see this confirmation page letting you know your setup was successful!

By now, you should have received a text from US Bank asking you to confirm your enrollment. Reply to the text with “YES” to finish your activation.

Bottom Line

If you like the simplicity of redeeming miles & points for cash back, you might like US Bank’s new Real-Time Rewards.

Once you’re registered, you can redeem your US Bank points for 1.5 cents as a statement credit toward travel purchases. And you do NOT need to go through the hassle of booking through the US Bank travel portal! Not all US Bank cards qualify.

When you make a qualifying purchase on an eligible US Bank card, you’ll receive a text message asking if you want to redeem your US Bank points for the purchase. To redeem your points simply response by texting “Redeem” and you’re done!

You should still earn credit card rewards for your purchases. And because you’re not booking through the US Bank travel portal, you’ll be able to take advantage of shopping portal deals!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!