Stop paying extra – Here’s when you actually need to pay for car rental insurance

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Has this been you? You’ve booked your rental car with one of the best credit cards for car rentals, confident that you won’t have to pay any extra insurance for your vehicle. While checking out, the agent runs you through your pricey insurance options with the car rental company, and when you decline, a high-pressure sales pitch ensues.

They try to scare you with worst-case scenarios: What if you injure someone and get sued for millions of dollars? What if you crash the car onto someone else’s property? Do you know that a minor mishap could be financially devastating? Are you sure you don’t need extra coverage?

I’ve been through this many times, and admittedly, when I wasn’t as seasoned a traveler, I second-guessed declining the rental company’s insurance on multiple occasions. It’s no fun pulling out of the rental garage with anxiety over whether or not you made the right choice. That’s why being prepared and knowing exactly what you are (and aren’t) covered for can help you decide if you need to pay for car rental insurance.

Do you need to pay for car rental insurance?

Before you give in to a pushy rental agent and pay for car rental insurance, it’s important to know what you’re already covered for. There’s no sense in duplicating coverage if your own insurance or credit card benefits are adequate.

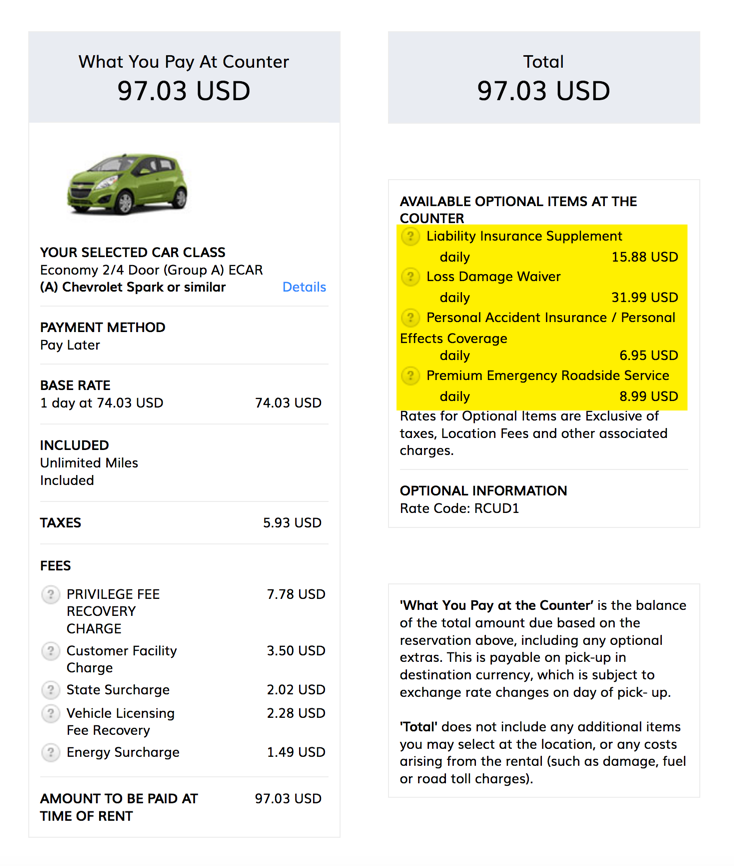

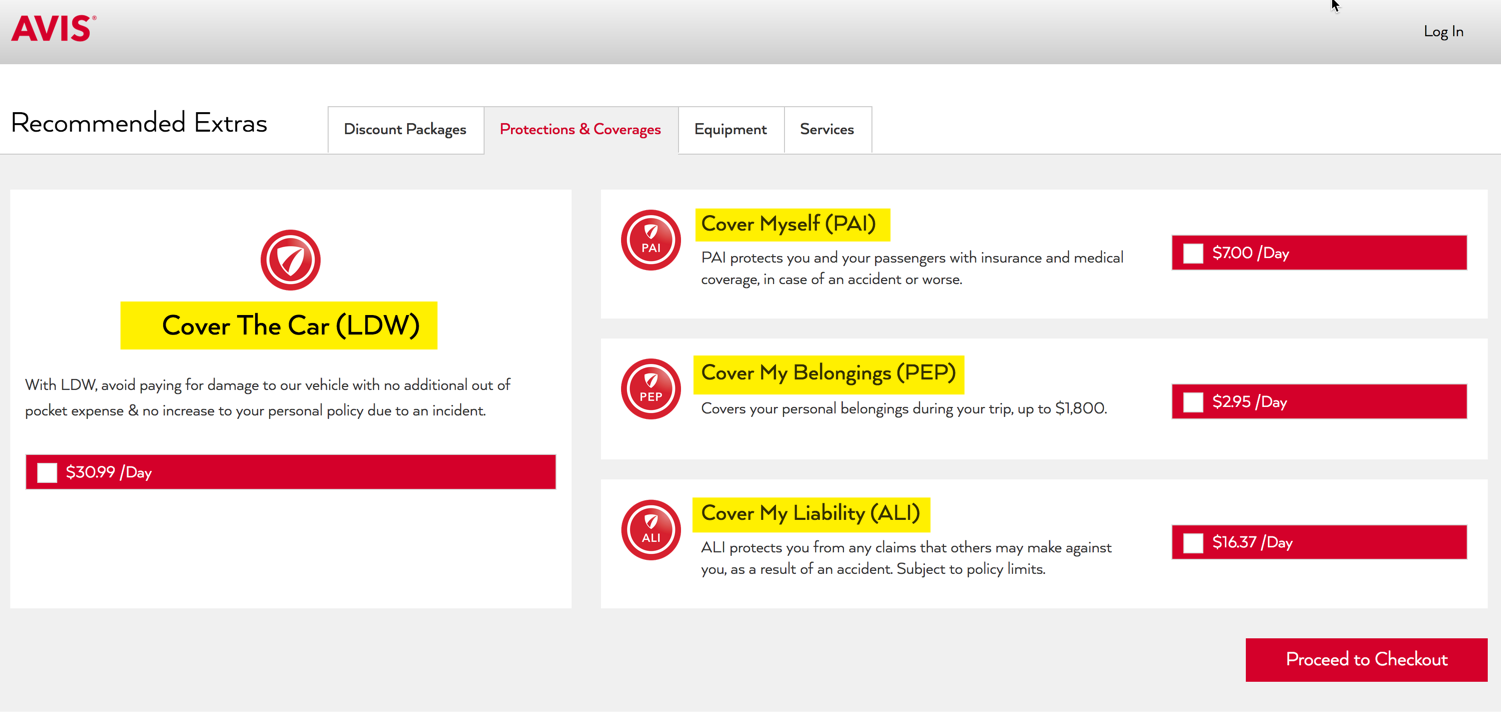

Typically, car rental agencies offer four types of car rental insurance:

- Collision Damage Waiver or Loss Damage Waiver (CDW or LDW): This covers the car for damages due to collision or theft. So if you dent the side of your vehicle or get into a bigger accident, you won’t have to pay for repairs (and sometimes towing or loss-of-use charges).

- Liability insurance: This covers claims from other people due to injury or damages to their vehicle or property. Overseas, this may already be included in the cost of the rental car.

- Personal accident insurance: This covers medical costs and death benefits to you and your passengers in the event of an accident.

- Personal effects coverage: This covers theft of your personal belongings from the rental car.

These protections aren’t cheap. You can expect to pay anywhere from a few dollars to $30 or more per day for additional insurance, depending on the coverage you choose. Often, rental companies will bundle several types of coverage together at a discount, but even then the costs involved can sometimes exceed the daily rental car rate.

Here’s an example of coverage options on a one-day rental with Hertz:

And this is an example of insurance on an Avis rental with the same destination and travel dates:

Rental agents will try to persuade you into signing up for the maximum amount of coverage they provide — they’re in this to make money, after all. They may even argue with you when you say you’ve got your own coverage through your personal policy and travel credit card benefits. I had a car rental agent once in Washington, D.C., who pestered me for a good 10 minutes with frightening accident possibilities and statistics that bordered on bullying – it was tempting to just give up and pay the additional cost to make him stop.

Being prepared ahead of time is key. You’ll want to do some research into exactly what you’re covered for (and what you’re not) before you sign on the dotted line.

Know what your personal insurance policies cover

If you have a personal car insurance policy, you may already have sufficient coverage for a lot of scenarios. Give your insurance agent a call and ask these questions:

- Does your policy include rental cars and if so, how much are you covered for in event of damage to the vehicle?

- Are there restrictions? For example, you may not be covered for rentals overseas, certain types of vehicles, longer rentals or if your rental is for business purposes.

- Are loss-of-use and towing charges included?

- Does your policy include liability, and if so, is it adequate in case you get sued for damages or injuries?

- What else is covered in the event of a mishap with a rental car?

You’ll also want to check in with your insurance agent if you carry homeowners or renters insurance. You may already have coverage if personal items are stolen from your rental vehicle. You might also consider printing out the relevant portions of your policies or having electronic copies handy while you’re on a trip.

And if you and your passengers have medical insurance or purchased travel medical insurance, it may not be necessary to carry additional personal accident insurance through the rental company. However, it’s especially important to find out if your medical insurance covers accidents or injuries when you’re abroad.

If you find you have gaps in your coverage – for example, if your liability insurance is minimal – you may want to consider purchasing additional insurance through the rental agency.

Know what rental car insurance your credit card covers

Aside from earning a big travel rewards bonus, one of the best reasons to have a rewards credit card for the primary rental car insurance some of them offer. If your card comes with primary coverage you don’t have to file a claim with any other insurance (like your personal policy). Some cards provide secondary rental car insurance, where they’ll only pay out for amounts left over after you’ve filed a claim with other insurance policies you have.

In most cases, this type of insurance only covers damage to the rental car (due to collision or theft) and for it to kick in you must pay for the entire rental with the card and decline the car rental company’s collision damage waiver or loss damage waiver (CDW or LDW). Depending on the credit card, there are always restrictions, including:

- The maximum they’ll pay out for damages (for example, the Chase Sapphire Reserve® offers primary rental insurance for damage due to collision or theft on most rental vehicles up to $75,000).

- Types of vehicles covered (for example, the primary insurance offered with the Chase Sapphire Preferred® Card won’t cover expensive, exotic, and antique automobiles; certain vans; vehicles that have an open cargo bed; trucks; motorcycles, mopeds, and motorbikes; limousines; and recreational vehicles).

- Geographic restrictions (for example, rentals in Australia, Italy, New Zealand and Office of Foreign Assets Control (“OFAC”) sanctioned countries aren’t eligible for the secondary insurance provided by The Platinum Card® from American Express)

- Length of rental restrictions (for example, Chase credit cards don’t cover rentals that exceed 31 consecutive days)

- Type of rental covered (for example, the Ink Business Preferred Credit Card offers primary insurance when renting primarily for business purposes in your country of residence, otherwise it’s secondary. However, if you don’t have your own personal insurance or you’re renting outside of your country of residence, coverage is primary regardless of whether it’s for personal or business reasons).

Team member Joseph scraped his rental car against a cement pillar with damages to the tune of $2,300, but he was covered by his Chase Sapphire Preferred.

If you’re unsure, call the benefits administrator for your card and ask exactly what you’re covered for on a specific rental. Keep in mind the insurance provided by credit cards is for damage to the car due to collision or theft only, in most cases. Liability, medical and personal effects coverage is not included.

You can also read our post on things you must know before relying on credit card rental car insurance for additional guidance.

A note about American Express cards. When you enroll your card in the Amex Premium Car Rental Protection program, then use the card to pay for your rental, you’ll get primary rental insurance. They’ll charge a flat fee of $12.25-$24.95 per rental (not per day) for rentals up to 42 consecutive days. The fee depends on where you live and the coverage level you choose. Be aware that there are restrictions; for example, rentals in Australia, Ireland, Israel, Italy, Jamaica and New Zealand are not eligible.

Here’s another thing to keep in mind: If you’re relying on secondary insurance to top-up the coverage provided by your personal auto insurance policy, remember you’ll need to file a claim with your personal policy first, which could result in a big increase in your premiums down the road. That’s why it’s always better to use a card with primary insurance – my go-to card is the Chase Sapphire Reserve, which has the best coverage of any Chase credit card.

You also might have rental insurance depending on the payment network and card designation you have. For example, the best Visa credit cards have the Visa Infinite designation, which include primary rental coverage for 15 days (varies by card). On the other hand, the top Mastercard credit cards, with the World Elite Mastercard designation, don’t come with rental coverage as a standard perk.

Err on the side of caution

If there’s any doubt in your mind about your coverage (perhaps you didn’t check in with your insurance agent before the trip or you’re unsure if it’s enough), it’s always better to pay for additional insurance through the rental agency. Yes, you’ll get stung with additional charges, but the peace of mind that comes with knowing you’re protected is worth it.

Besides which, you may have already saved a ton on your car rental by using sites like Autoslash to monitor for lower rates.

Bottom Line

Before you cave in to a heavy-handed insurance sales pitch at the car rental counter, it’s important to know if you’re already covered by your personal policies or credit card with rental insurance for damages or costs in the event of an accident:

- Collision Damage Waiver or Loss Damage Waiver (CDW or LDW): Damages due to collision or theft

- Liability Insurance: Claims from other people due to injury or damages to their vehicle or property

- Personal Accident Insurance: Medical costs and death benefits to you and your passengers in the event of an accident

- Personal Effects Coverage: Theft of your personal belongings from the rental car

You may already have decent coverage through your personal auto insurance policy and credit card, but rental company agents might try to convince you otherwise. Your best bet is to call your insurance agent and credit card benefits administrator to find out exactly what you’re covered for on a specific rental. This may vary depending on the type of vehicle, country, reason for rental and more.

That way, when you’re paying for your car, you can confidently decline the insurance you don’t need from the rental agency and save big bucks in the process.

| For more travel and credit card news, deals and analysis sign up for our newsletter here. |

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!