My AMEX Business Platinum Card Paid for Itself in a Single Trip, Saving Me Over $650 (I’ll Show You How!)

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

I recently took a trip to San Francisco to spend the weekend with one of my best friends. She was in town for work, and we decided it would be the perfect opportunity to plan a girls weekend getaway. I also figured it would be a great time to use the AMEX Fine Hotels & Resorts perk I have with The Business Platinum® Card from American Express.

Boy did it pay off in a BIG way! In fact, the AMEX Business Platinum card paid for itself during this one, single trip. Adding up the value of the in-flight Wi-Fi passes I used along with the AMEX Fine Hotels & Resorts perks I took advantage of, I saved $670!

Here’s a breakdown of all the ways I saved using my AMEX Business Platinum card.

The AMEX Business Platinum Card Really IS Worth the Annual Fee

I’ve held my AMEX Business Platinum card for nearly 3 years now, and I continue to find tons of value in the card’s perks, despite its high annual fee.

I’m always able to use up the $200 airline fee credit. And I’ve had good luck finding deals using the 35% points rebate you get for any flight booked with your selected airline through the AMEX travel portal using Pay With Points. But I hadn’t ever booked a hotel through the AMEX Fine Hotels & Resorts program.

When you book a room with AMEX Fine Hotels & Resorts, you get the following perks:

- Room upgrade upon arrival (when available)

- Daily breakfast for 2 people

- Guaranteed 4:00 pm late check-out

- Noon check-in (when available)

- Complimentary Wi-Fi

- Unique property amenity, like a food & beverage or spa credit

Given this was a girls weekend, I wanted to splurge a little. I hopped on the AMEX Fine Hotels & Resorts’ website and eventually decided on the Loews Regency San Francisco.

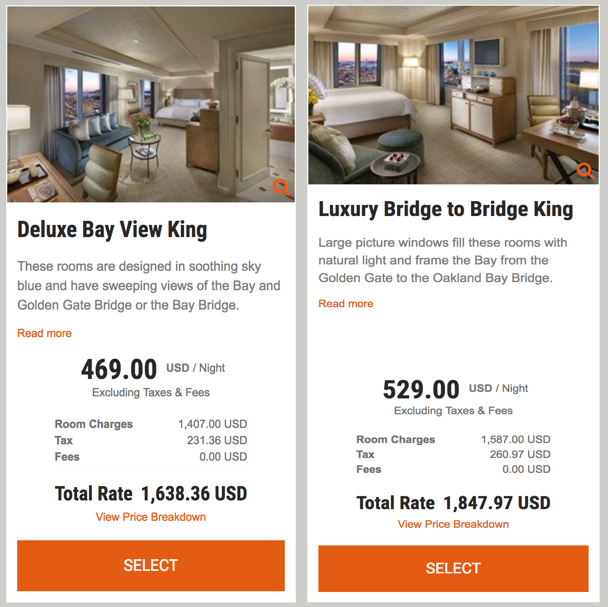

Before booking, I did a quick search on Loews’s website to compare prices and the rates were identical. I booked a Deluxe Bay View King, and we were upgraded to a Luxury Bridge to Bridge King. I can’t rave enough about our room! But more on that in a future post. 😉

Getting this complimentary upgrade saved us $240 total ($60 per night). And wow…the views from the Bridge to Bridge room were INCREDIBLE!

Along with the free upgrade, we made sure to maximize the other AMEX Fine Hotels & Resorts perks too.

We ordered room service (almost) every morning and had breakfast in bed overlooking the San Francisco Bay. If that sounds incredibly indulgent – let me tell you – it was! And I loved it. Which is saying a lot, because I’m usually a very frugal and low-key traveler.

With a bit of quick math I saw that with our $40 per person per day breakfast credit, we could each order the American breakfast and have enough credit to cover the extra charges for room service.

We saved $240 total ($80 per morning) using the breakfast credit.

The booking also came with a complimentary $100 food and beverage credit that could be used for room service, at the hotel’s popular rooftop bar dubbed “Spirits in the Sky,” or for anything off the menu at the hotel’s restaurant, The Bear and Monarch.

The only catch was the credit had to be used all at once. It couldn’t be split across various tabs during our stay.

We figured spending it at the rooftop bar would be pretty silly because we could actually see the rooftop bar from our amazing room. And after perusing the menu at The Bear and Monarch, we decided we’d rather eat out, given San Francisco is known for so many great restaurants.

So, we ordered a bottle of sparkling pink rosé and a piece of cheesecake (it doesn’t get any girlier than that!). Which totaled just under $100 after the room service fees.

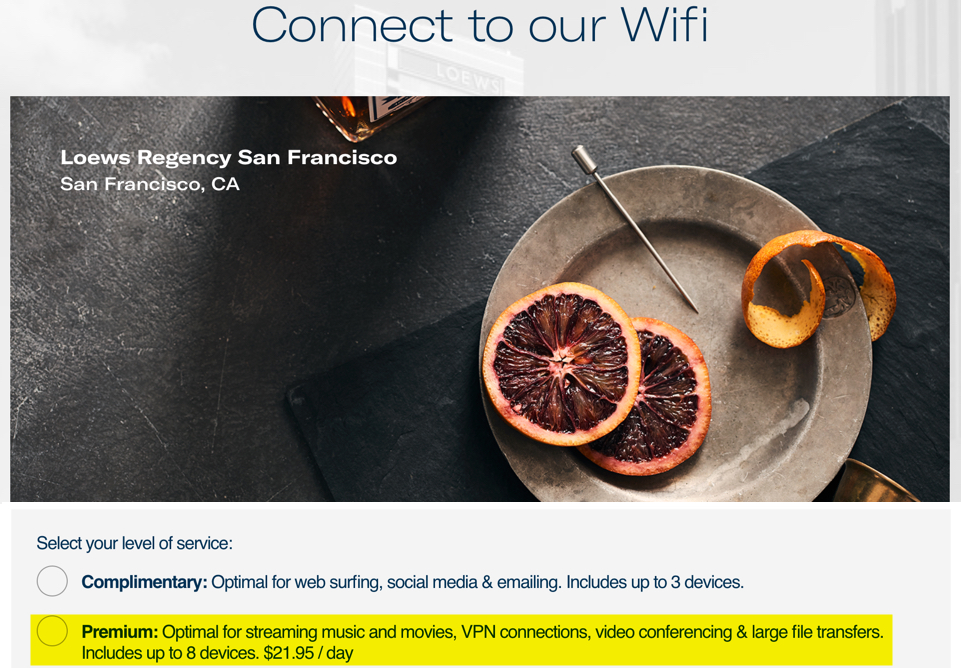

Lastly, I can’t forget to mention the complimentary Premium Wi-Fi! This likely isn’t a huge deal for most, but given we’d both planned to work a few days over the long weekend, it was great to have. And had we paid for it, it would have been an additional ~$66.

All in all, the benefits of booking through AMEX Fine Hotels & Resorts saved us ~$646 during our stay at the Loews Regency San Francisco!

That’s pretty incredible. And as you could imagine, your savings would quickly add up if you regularly booked a few hotel stays throughout the year.

Plus, I even managed to squeeze out another ~$24 in savings on my flight to San Francisco by using the Gogo in-flight Wi-Fi passes you get for being an AMEX Business Platinum cardholder.

It’s a Great Time to Apply for the AMEX Business Platinum Card

Apply Here: The Business Platinum® Card from American Express

Our Review of the AMEX Business Platinum

Both the personal and business AMEX Platinum cards come with the AMEX Fine Hotels & Resorts perk. But the AMEX Business Platinum card is offering a welcome bonus of up to 75,000 AMEX Membership Rewards points; 50,000 bonus points after you spend $10,000 in the first three months. Plus, an extra 25,000 bonus points after you spend an additional $10,000 in the same time frame.

That’s a huge welcome offer that could be worth thousands of dollars, depending on how you use it. You can read our in-depth review of the AMEX Business Platinum card here.

The card’s $450 annual fee is NOT waived the first year. But as you can see, it’s incredibly easy to offset that fee if you take advantage of the card’s numerous perks.

Bottom Line

I saved over $650 on a recent girls weekend getaway to San Francisco by simply using the perks that come with my AMEX Business Platinum card.

In my opinion, the card’s benefits more than outweigh its big $450 annual fee. I was able to offset the annual fee after just a single trip!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!