American Express Platinum: Is it worth it?

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

When it comes to The Platinum Card® from American Express, the question isn’t, “Is it worth it?” (because it definitely is the first year), but rather, “Is the American Express Platinum worth it long term?”

Is the Amex Platinum worth the yearly fee?

The Amex Platinum comes with tons of benefits, a nice welcome bonus of 75,000 Amex Membership Rewards points after you spend $5,000 on purchases within the first 6 months of account opening – and an eye-popping annual fee.

But it’s definitely worth keeping if you use the ongoing perks, including:

- Access to Centurion Lounges, Priority Pass lounges, Delta Sky Clubs, and others

- Up to $200 in annual Uber credits (for use in the U.S.)

- Up to $200 in annual airline incidental credits

- Complimentary Hilton Gold elite status (free breakfast, upgrades when available, late checkout) and Marriott Gold elite status

- 5x points per dollar on airfare when booked directly with airlines or through American Express Travel. (Earn 5x points on up to $500,000 on these purchases per calendar year.

- 10x points on eligible purchases on your new card at U.S. Gas Stations and U.S. Supermarkets, on up to $15,000 in combined purchases, during your first 6 months of Card Membership.

- Terms apply

Enrollment required

That’s because the value you can get from these benefits can far exceed the cost of the annual fee. Many MMS team members have (or have had) this rewards credit card, myself included. It’s one of the best Amex credit cards. If you know a period of heavy travel is coming up, or you’re a road warrior, you definitely want to review the list of perks.

American Express Platinum benefits that make it worth it

Huge welcome offer

With The Platinum Card® from American Express, you’ll earn 75,000 Membership Rewards Points after you spend $5,000 on purchases within the first 6 months of account opening. Plus, you’ll earn 10x points on eligible purchases at U.S. Gas Stations and U.S. Supermarkets, on up to $15,000 in combined purchases, during your first 6 months of card membership. If you max out those bonus categories, you could end up with 225,000 Membership Rewards points.

We value Amex points at 1.8 cents each, meaning 225,000 points is worth a whopping $4,050 in travel.

Additionally, some of you will be targeted for an amazing 100,000-point bonus (in addition to the 10x points at U.S. supermarkets and U.S. gas stations). You can check out our CardMatch tool to see if you qualify (offer subject to change at any time).

75,000 points alone is enough for an award flight in business class to nearly anywhere in the world, including any destination in the continental U.S., Hawaii, the Caribbean & Mexico and Europe. It can be worth hundreds, if not thousands, depending on how you use your American Express points. You can convert your points into airline miles or hotel points by utilizing Amex transfer partners. Check out our in-depth review of the Amex Platinum card for more information and ideas.

And the welcome bonus easily offsets the $550 annual fee (see rates & fees) the first year all on its own. It’s subsequent years you have to consider because that’s a lot of money for a travel credit card. Luckily, the benefits easily exceed the fee. Here are the best ones.

Up to $500 in annual credits, plus another credit for Global Entry/TSA PreCheck

The Platinum Card® from American Express comes with a boatload of statement credits:

- Up to $200 in annual airline incidental fee credits for an airline of your choice

- Up to $200 in Uber credits per year (for U.S. services)

- Up to $100 in credits for Saks Fifth Avenue

- Statement credit every 4-4.5 years for Global Entry ($100) or TSA PreCheck ($85)

- Terms apply

Let’s break this down. Every year you’ll pay $550 to keep the Amex Platinum, but if you can take full advantage of the credits you effectively bring your out of pocket cost down to $50. The up to $200 airline fee credit is tied to the calendar year, so you have from January to December to use it. The Uber credits are dolled out on a monthly basis, you’ll get up to $15 in Uber cash each month and up to $35 in December. And the Saks Fifth Ave. credit is available in $50 increments, you can earn $50 from January to June and another $50 from July to December. Enrollment required.

These credits are an easy way to recoup nearly the entire cost of the card’s annual fee. Of course, that’s only if you use them – but note that you can use your $200 in Uber credits toward Uber Eats. That’s $200 in food each year with the Amex Platinum. And on top of all that you can get your application fee reimbursed for either Global Entry (once every four years) or TSA PreCheck (once every 4.5 years).

Up to $30 monthly PayPal credit (up to $180)

Due to the pandemic and restricted travel, American Express has added temporary credits to many of its cards. In January, it added a $30 monthly credit on the Platinum card. towards purchases made with PayPal. The credit lasts from Jan. 2021 through June 2021, meaning you could receive up to $180 of statement credits for purchases made at PayPal.

The best thing about this credit is that it’s nearly like cash, as PayPal is accepted at thousands of online retailers and even in some stores.

Lounge access in nearly every major airport

Now here’s a perk that can really make or break your experience with The Platinum Card® from American Express. You can access:

- The Centurion Lounge network

- International American Express Lounges

- Delta Sky Clubs (when you’re flying Delta that day)

- Priority Pass Select lounges (not valid at Priority Pass restaurants)(enrollment required)

- Airspace Lounges

- Escape Lounges

- Plaza Premium Lounges

This is far and away the most comprehensive credit card you can possess for accessing airport lounges. No other credit card comes close to offering access to the same number of lounge clubs. This is the definitive airport lounge credit card.

I’m a fan of Centurion Lounges in particular. By showing your card and boarding pass for a departing flight, you can enter (within three hours of departure) and bring two guests along. These lounges have full buffet-style meals, a bar with specialty cocktails and local beers, business centers, free Wi-Fi and more. I easily value each visit at $25 — more if you bring guests.

If you visit once per month, that’s worth $300, assuming you agree with my valuation ($25 X 12). That’s over half the cost of the card’s annual fee. And of course, if you visit more often or value your visits for more, it can be worth paying The Platinum Card® from American Express’s annual fee for this perk alone.

Gold Elite status with Hilton and Marriott

The cool thing about this benefit is you get Hilton status and Marriott Bonvoy elite status with no stay requirements. You simply enroll and can take advantage of the perks, including elite upgrades, free breakfast (with Hilton Gold status) and late check-out, without any history with either chain. When I stayed at the Hilton Tokyo, my friend and I got a huge buffet breakfast for free each morning of our 4-night stay and I’ve enjoyed opulent upgrades at Hilton hotels around the world.

Plus, I used a 4:00 pm late checkout for my family when we stayed in Hawaii. Our flights didn’t leave until 10:00 pm, so it was like getting an entire extra day to lounge on the beach. It’s hard to put a value on this perk, but even just four free breakfasts can be a savings of over $100. Suffice it to say if you stay regularly at Hilton or Marriott hotels, it’s nice to enjoy these perks right out of the gate.

Amex Fine Hotels & Resorts

The Platinum Card® from American Express offers a perk that’s simply not given enough credit. You’ll receive access to Amex Fine Hotels & Resorts, which is a program that sharply elevates your experience at luxury hotels around the world. When you book your stay through Fine Hotels & Resorts, you’ll receive perks like guaranteed 4:00 pm late checkout, big room upgrades, your third night free, free breakfast and more. Some hotels even have a unique benefit, like a $100 spa credit.

It’s worth pointing out that this is only useful if you’re paying for your stay – you can’t use this benefit if you’re booking an award stay. Just think of Amex Fine Hotels & Resorts as an online travel agency (like Orbitz) that guarantees you valuable benefits and upgrades. Team member Brendan just used this card perk to save hundreds in breakfast during his stay at the JW Marriott in Venice. He also received a $100 food credit and a room upgrade.

Again, if you make use of this perk it can easily save you $100s on a paid hotel stay. Yet another way you can offset the cost of the card’s annual fee.

Additional Amex Platinum perks

Making good use of any of the benefits above makes The Platinum Card® from American Express worth getting and keeping long term. But other ancillary perks have their own ability to make this card even better. You’ll also get (terms apply):

- 5x Amex Membership Rewards points on airfare (booked either directly with the airline or through Amex Travel)

- 5x Amex Membership Rewards points on prepaid hotels booked with American Express Travel

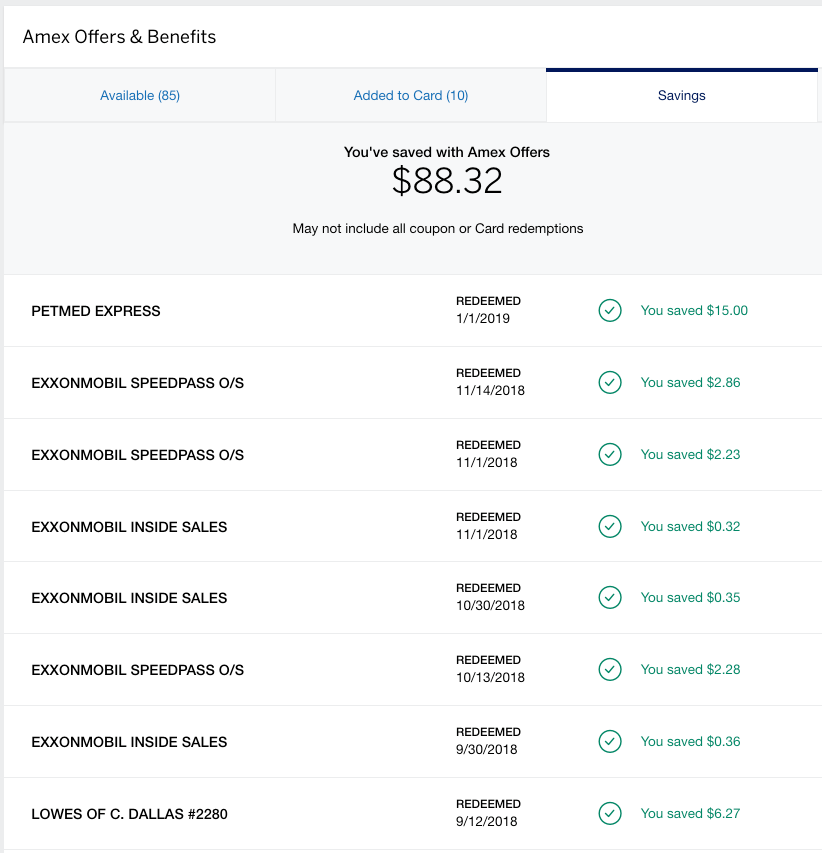

- Access to Amex Offers

- Car rental loss and damage insurance

- Extended warranty

- Purchase protection

- Return protection

- Baggage insurance plan

- Global Assist hotline

- Free ShopRunner subscription (enrollment required)

- Trip delay insurance

- Trip cancellation/interruption coverage

It’s hard to place a value on this list of extras. That said, using any one of them can easily recover the cost of the annual fee. For example, if you file a claim for purchase protection or extended warranty, you can save a lot of cash by using those perks just once.

Or if you book lots of flights directly with airlines, earning five Amex Membership Rewards points per dollar will keep your collection well-stocked for when it’s time for an award trip. And the card’s trip delay benefit kicks in after an eligible delay of six hours or more and will reimburse you up to $500 per covered trip for eligible expenses, like lodging, meals and toiletries.

And if you use Amex Offers frequently, that can add up fast, too. I’ve used offers to save on gas, things around the house, and pet supplies. All of them were purchases I had to make anyway, so the rebates were money back in my pocket.

Temporary Amex Offers

Amex released a slew of lucrative Amex offers in January along with the monthly PayPal credit. Recent offers include:

- Best Buy – Spend $50 or more, get $50 back, up to 2X (total of $100). Online only.

- Home Depot – Spend $50 or more, get $50 back. Up to 3 times (total of $150).

- Home Chef – Spend $50 or more, get $50 back, up to 2X (total of $100). Online only.

- Scribd (5 free months) – Spend $9.99 or more, get $9.99 back. Up to 5 times (total of $49.95)

- Instacart (50 off $250) Spend $250 or more, get $50 back. Up to 2 times (total of $100).

- Samsung ($200 off $1000) Spend $1,000 or more, get $200 back

- Avis – Spend $250 or more, get $75 back. Up to 2 times (total of $150).

- Container store – Spend $150 or more, get $50 back. Up to 2 times (total of $100).

Even if you just take the Best Buy offer into consideration, that’s a free $100 to spend at the store. And if you don’t have any electronics to purchase, Best Buy also sells third-party gift cards to many merchants, so you could use your credits to cover a gift card to Starbucks, Uber, Hotels.com and more.

In order to keep Platinum card members engaged during the pandemic, it’s likely Amex will continue to roll out more lucrative Amex Offers while travel is still on hold.

The total value of the Amex Platinum benefits

If you’re able to maximize many of the Amex Platinum card’s benefits, you’ll be looking at substantial savings over the course of the year.

The simplest way to decide if it’s right for you is to see if the up to $500 in annual statement credits ($200 for airline incidentals + $200 for Uber + $100 for Saks Fifth Avenue) are useful for you. If so, that brings the net annual fee down to $50 – and then it’s a no-brainer.

The up to $500 in annual credits alone is almost enough to cover the card’s annual fee. Add that to the approximate $300 value you’ll get from lounge access and another (at least) $200 even infrequent travelers can get from perks like Hilton Gold status and you’re already saving $1,000 – just taking into consideration a few of the card’s perks.

If you sign-up for the card today, you’ll be able to take advantage of the temporary PayPal credits which could save you up to $150 from February through June.

Finally, the card has a large value proposition in the first year due to the massive welcome bonus that could net you up to 225,000 Amex points.

Bottom line

The Platinum Card® from American Express is an alluring and enigmatic card, especially for frequent travelers. It’s also the ultimate case of “you get what you pay for.” That’s because if you can make use of the numerous perks, the annual fee will pay you back in spades, but if you don’t, well, many of the best credit cards for travel will suit you better.

Here’s our full Amex Platinum card review to help you decide. If you have the Amex Platinum Card already, which perks make the card worth the annual fee?

For more travel and credit card news, deals and analysis sign-up for our newsletter here.

For the rates and fees of The Platinum Card from American Express, please click here.

Featured photo courtesy of Delta.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!