Step-by-step guide to finding increased credit card offers with CardMatch

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

CardMatch offers are subject to change at anytime.

The best way to quickly unlock free travel is by earning valuable credit card welcome bonuses. And luckily, there are plenty of travel cards with huge bonuses right now that will help you achieve your travel goals.

That said, did you know that you may be eligible to earn an even higher bonus than what’s advertised?

An easy way to see if you’re targeted for a higher offer is with the CardMatch tool. It’s extremely easy to use, and takes just a few seconds. Some customers are even finding themselves with an opportunity to earn 100,000+ Amex Membership Rewards points with The Platinum Card® from American Express. That’s 40,000 points more than the highest publicly available offer!

I’ll show you how to find targeted credit card offers with the CardMatch tool.

What is Cardmatch?

If you’re looking to see whether you’re eligible for a particular credit card, consider using the CardMatch tool. CardMatch matches you with current credit card offers for which you might be eligible. But the exciting thing about using the CardMatch tool is that your matched offers are sometimes much higher than the standard offers available publically.

For example, the current public offer on the The Platinum Card® from American Express is 100,000 Membership Rewards® Points after you spend $6,000 on purchases on the Card in your first 6 months of Card Membership. While some people have been able to get 100,000 or 125,000-point offers through CardMatch.

What is a targeted credit card offer?

A targeted offer on a credit card is one that isn’t available publicly but instead, is targeted to a select group of people. Targeted offers are usually better than standard offers.

If you see a great offer through CardMatch or receive an email or flyer from a card issuer, check the offer against the public offer. If it’s a card you’re interested in and the targeted offer you’ve received is significantly higher than the standard offer, it’s a great opportunity to score a bigger than normal welcome bonus.

How to use the CardMatch tool

As credit card issuers continue to tighten their restrictions on earning welcome bonuses, it’s more important than ever to make sure you’re getting the highest possible offer. Some banks (especially American Express) like to target certain people for increased offers.

CardMatch is a tool that helps you identify these special bonuses the banks may be extending to you. It’s quick and easy, and the tool will NOT hard pull your credit!

Step 1. Head to CardMatch

You can navigate directly to the CardMatch tool with this link.

Step 2. Enter your personal information

The tool will ask you to enter personal information, like your name, current address, and last four digits of your social security number. You’ll have to keep clicking through the various screens to enter all of the information.

For example, after entering your name you’ll be asked to enter your zip code.

Next, the tool will ask for your address.

And then, you’ll be required to give your employment status, and so on and so forth.

Again, using this tool won’t result in a hard pull to your credit. It’s just a soft pull, and completely harmless.

Step 3. Agree to the Terms & Conditions

Before you submit your information, you’ll need to check a box agreeing to the terms. The notification at the bottom lets you know you are in no way applying for credit cards.

Step 4. Locate your offers

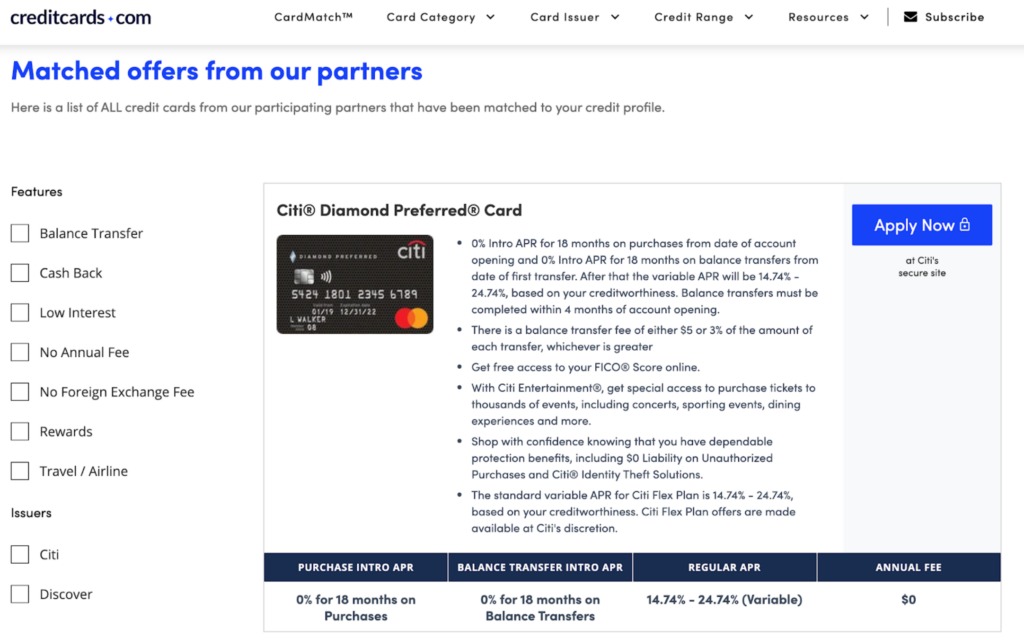

In seconds, the tool will give you the results of the credit card offers for you. To the left of the page, you’ll be able to filter your results by issuer card features.

Offers last pulled on Jan. 2, 2021

You’ll find the increased welcome bonuses under the “CardMatch Special Offers” filter. If you don’t see this option, CardMatch simply didn’t find any targeted offers for you. I’m not currently targeted for anything. You can also sift through your pre-qualified offers, to see if there’s anything you’re interested in. These are cards that banks determine are a good fit for you based on a soft credit pull. It does not mean you’re guaranteed to be approved, though.

Top Cardmatch offers

Here’s a look at some of the top offers we’ve seen on CardMatch at the time of writing:

The Platinum Card® from American Express

For some, the CardMatch tool has been showing 100,000 – 125,000 point offers on the Amex Platinum card. That’s 25,000 – 50,000 points higher than the standard offer.

We value Amex Membership Rewards points at around 1.8 cents apiece. So an additional 25,000 to 50,000 points could be worth $450 to $900. That’s significant! Be sure to read our piece on how to check to see if you’re targeted for this amazing Amex Platinum offer.

American Express® Gold Card

With this CardMatch offer on the Amex Gold card, you can earn a 75,000 Membership Rewards point bonus after spending $4,000 on the card in the first six months of account opening.

This is 15,000 more points than the standard offer (60,000 bonus points after meeting the same minimum spend requirements). With Amex Membership Rewards valued at 1.8 cents a point, that’s worth at least $270. And that makes it an exceptional deal for those wanting the apply for the Amex Gold.

Not targeted for any offers?

It’s okay if you don’t qualify for any improved bonuses right now. The banks use lots of factors to determine who they’re going to target — and we don’t know exactly what they are. Fortunately, the CardMatch tool is free, and using it doesn’t affect your credit score. You can check it often to see if there’s anything special down the road.

There are other ways to receive targeted offers that you won’t find on the CardMatch tool. For example, you can try visiting your bank’s local branch to see if they have any special offers for you.

You can also try registering a new domain name with your information. I’ve received targeted credit card offers for a small business I used to have, addressed to his domain name.

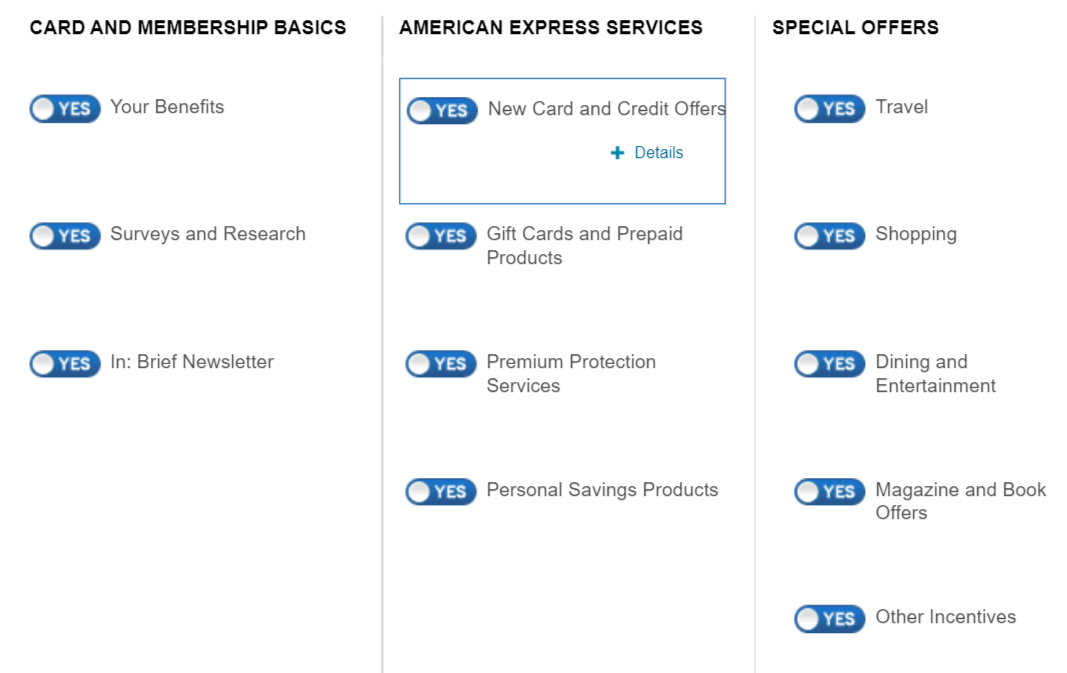

Also, some banks like Amex and Barclays give you the opportunity to opt-in for receiving new credit card offers in your account’s preferences.

You can also opt-in at OptOutPrescreen. This will allow the three credit bureaus to provide your information to credit card and insurance companies. These methods may result in lots of junk mail, so decide for yourself if the possibility of an increased bonus is worth it.

Many times we’ve seen targeted 100,000-point Amex Platinum offer through CardMatch. And through the Amex website, customers are being targeted for up to 125,000 points after spending $5,000 within the first three months of account opening (see rates and fees)! That’s more than double the current public offer.

With 100,000 Amex Membership Rewards points, you could transfer those points to book round-trip flights to Hawaii from anywhere on the mainland U.S. on United Airlines using only 35,000 Singapore Airlines miles each (a 1:1 Amex transfer partner).

If you want to go someplace more exotic, you can transfer 50,000 Amex points to ANA for a round-trip coach ticket between the U.S. and Japan during the regular season and only 40,000 points during the low season.

Note: You’ll pay an excise fee of 0.06 cents per point, to a maximum of $99, when you transfer American Express Membership Rewards points to U.S. airlines, like Delta or JetBlue.

FAQ about CardMatch

Why should you use CardMatch?

Using CardMatch doesn’t affect your credit score, so there’s really no reason not to use it. With the potential to get bigger, better offers through CardMatch, anyone looking to apply for a rewards card should check CardMatch first.

Does Cardmatch impact my credit score?

No, CardMatch does not impact your credit score. When using CardMatch, you’ll be asked for minimal personal information. And checking for targeted offers with the tool won’t affect your credit score.

Is it safe?

Yes, CardMatch is completely safe. You’ll only be asked to provide your name, address and the last four digits of your social security number to check for matched offers. The information you share is not used in any other way but to check for your eligible offers.

Bottom line

Credit card issuers are tightening their credit card application rules all the time. It’s very important to make sure you’re getting the biggest bonus available to you. That’s particularly true with American Express cards because you can only receive the welcome bonus once per lifetime on each card.

An easy way to do this is with the CardMatch tool. Just enter a few pieces of personal information, and the tool will perform a soft pull on your credit to see if any banks are offering you special bonuses. Using the tool will in no way affect your credit score, so you can check often for new targeted offers. There are other ways you can increase your chances of earning an increased welcome bonus, too.

What’s the best offer you’ve received through the CardMatch tool? Let us know in the comments.

For rates and fees of the Amex Platinum, click here

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!