How to get the Amex Platinum 100,000 (or targeted 125,000) points offer

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

It’s no secret that The Platinum Card® from American Express is one of the best rewards cards on the market. And right now, it’s offering a whopper of a bonus.

With the public offer on the Amex Platinum, you can earn 100,000 Membership Rewards® Points after you spend $6,000 on purchases on the Card in your first 6 months of Card Membership.

According to our Amex point valuations, 100,000 Membership Rewards are worth $1,800 when redeemed for travel with Amex’s transfer partners. Plus, if you can max out the 10x bonus categories, you’d end up with a total of up to 350,000 points — which have an average value of $6,300.

But wait! What if I told you there was a way to earn an even bigger bonus? Well, there is. And it’s by using the CardMatch tool to see if you’re targeted for an even more lucrative welcome offer — of 125,000 Amex points after meeting minimum spend requirements. This offer is subject to change at anytime.

Here’s what you need to know.

How to use the Cardmatch tool

Using the CardMatch tool is very straightforward. The process takes no more than five minutes and with just a few clicks, you’ll be able to see if you’ve been targeted for any increased offers.

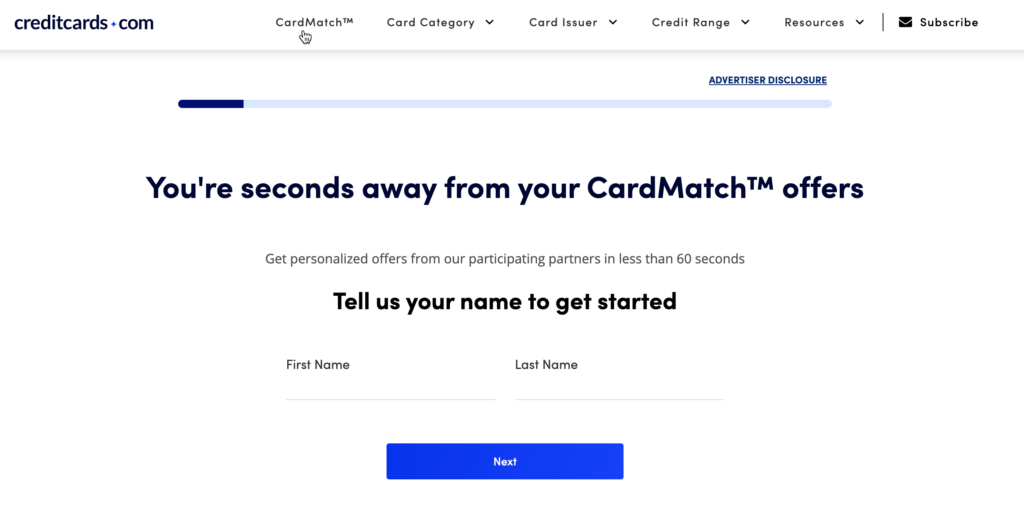

Step 1. Navigate to the CardMatch tool

You can get to the CardMatch tool using this link.

Step 2. Enter your personal information

You’ll be asked to provide personal information, like your name, current address, annual income, and last four digits of your social security number. You’ll also be asked to provide your email address.

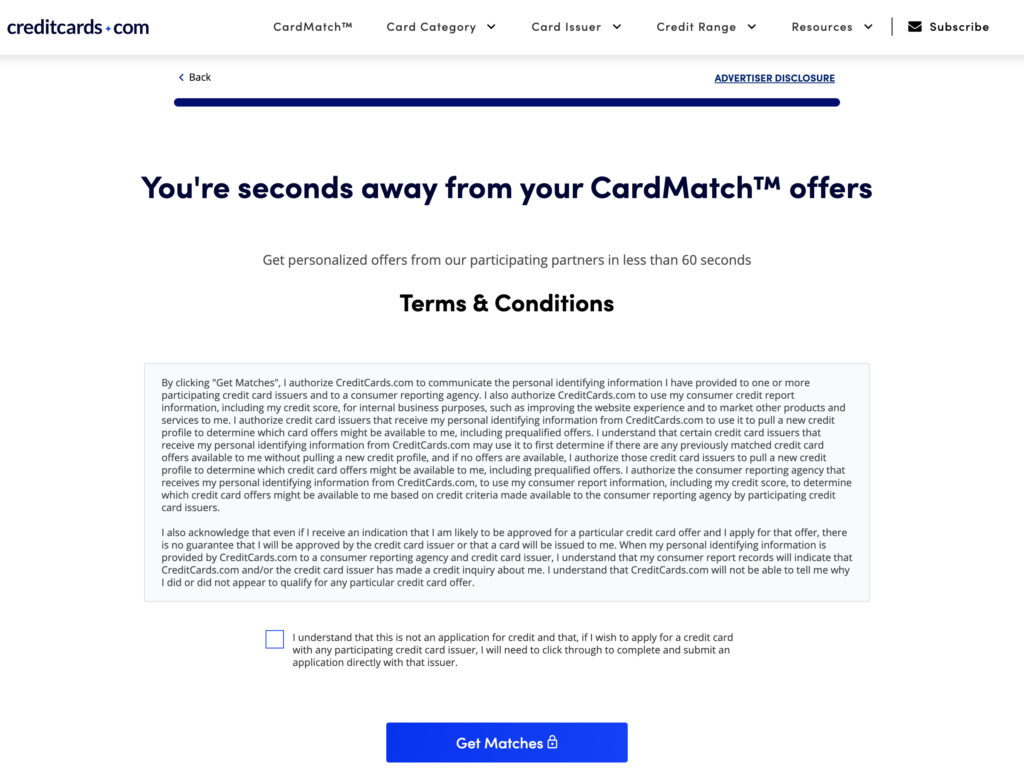

Step 3. Agree to the Terms & Conditions

Check the box to agree, and you’ll be on your way to your personalized offers.

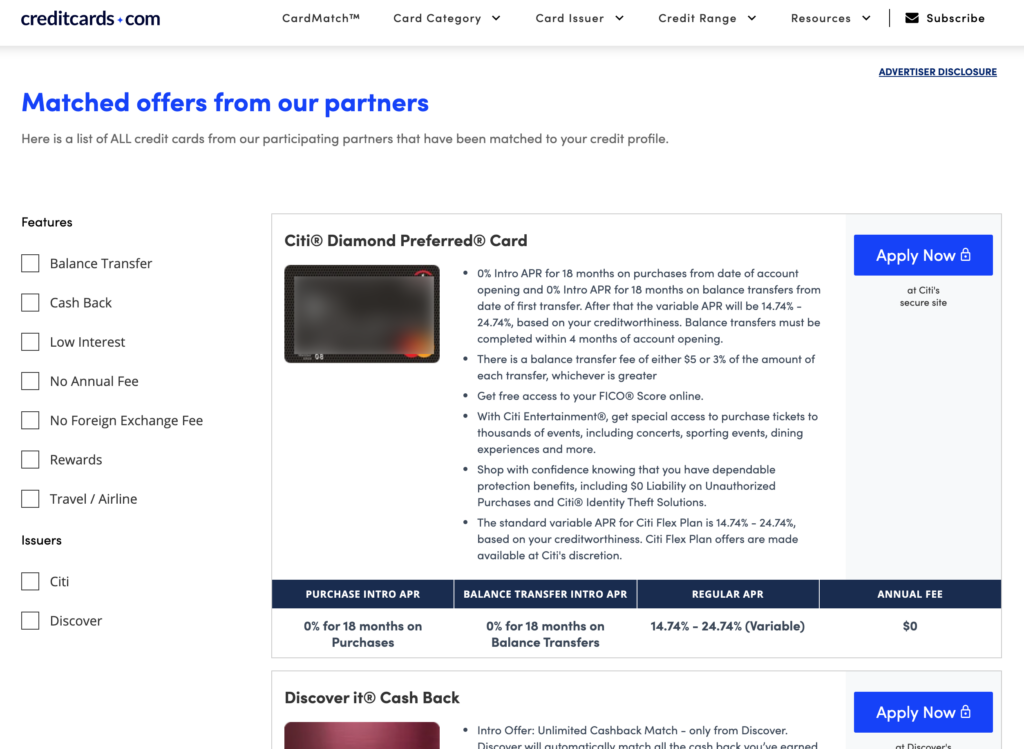

Step 4. Locate your offers

From here you’ll be able to scroll through the list of offers.

Step 5. Apply for the card you want

Here’s our step-by-step guide to finding increased offers with the CardMatch tool.

Reasons you might not get targeted

If you aren’t targeted for any special offers, don’t fret. The banks use a variety of factors to determine who gets targeted for what offers. Those with low credit scores, for example, are less likely to be targeted for better offers.

The CardMach tool will NOT result in a hard pull to your credit report. So there’s no harm in frequently checking to see if you’re targeted for any increased offers.

Amex targeted mail offers

Who gets targeted for these offers?

Amex won’t divulge its formula for determining who gets targeted offers and who doesn’t. But there are a few steps you can take to increase your odds of receiving a targeted mailer.

Be sure to sign up to receive offers via email. To do so, follow these steps:

Step 1. Login to your Amex account

Select “Account Services” and then “Alerts & Communications Preferences.”

Step 2. Navigate to the “General Marking Email Preferences” tab

Within the “Alerts & Communications Preferences” tab, select “Marketing Email Preferences.”

Step 3. Turn on “Offers”

Be sure the box marked “Offers” is checked.

Amex Platinum public offer and benefits

The public offer for the Amex Platinum card is currently 100,000 Membership Rewards® Points after you spend $6,000 on purchases on the Card in your first 6 months of Card Membership.

In addition to the initial bonus, cardholders will also get a number of valuable benefits including:

- Up to $200 annual credit for incidental fees on your selected airline*

- Up to $200 in U.S. Uber credits per calendar year ($15 per month and $35 in December)*

- Up to $100 credit for Saks Fifth Avenue (up to $50 from January to June, and up to $50 from July to December)*

- Lounge access to a select network of lounges*

- Complimentary Gold elite status with Hilton and Marriott*

- Statement credit every four to four-and-a-half years for Global Entry ($100) or TSA PreCheck ($85)

- Terms apply

*Enrollment required for select benefits.

Plus, you’ll get a suite of protections with your Amex card membership:

- Car rental loss and damage insurance

- Extended warranty

- Purchase protection

- Return protection

- Baggage insurance plan

- Premium Global Assist hotline (includes medical evacuation insurance)

- Trip cancellation/interruption insurance

- Trip delay coverage

Enrollment required for select benefits.

So even if you aren’t targeted for a special offer through CardMatch or through the mail, the public offer is still well worth it.

FAQs

How much are Amex points worth?

According to our points valuations, Amex points are worth 1.8 cents a piece, on average. So, earning a 100,000-point bonus with the Amex Platinum card would net you a value of about $1,800 — an amazing deal!

Can I get an Amex targeted offer if I have other Amex cards?

Yes, it’s certainly possible to be targeted for an Amex offer even if you have other Amex cards. But there’s no guarantee. And there’s anecdotal evidence that suggests Amex may use these targeted offers to entice new customers. So if you’re already an Amex cardholder, your chances of being targeted may be diminished.

Is the Amex Platinum worth it?

The answer to this question is a resounding “yes!” Between the lucrative welcome bonus and the card’s numerous perks, if you can make use of the card’s benefits, you’ll come out well ahead of the cost of the annual fee.

Here’s an in-depth look at all the reasons the Amex Platinum is worth it.

Bottom line

If you happen to be targeted the 125,000-point Amex Platinum offer, go for it. Even with the card’s $695 annual fee (see rates & fees), you’ll come out ahead when considering the value of the Amex points you’ll earn. And that’s not even taking into account the card’s other valuable benefits and perks.

For rates and fees of the Amex Platinum Card, please click here.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!