“The 5 Cards I’m Using the Most Right Now” – Jasmin

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.If you’re passionate about free travel, you’ll want to earn the most miles, points, or cash back for every $1 you spend. And for many of us that means using the right credit card for different types of purchases.

That doesn’t mean you need to keep dozens of cards in your wallet (though a few team members have 20+ cards!). But having a strategy for spending will help you make the most of your day-to-day purchases. Depending on your lifestyle and spending habits, the best cards for you could be vastly different from others!

So I’ve asked Million Mile Secrets team members to share the 5 cards they use the most. Here’s team member Jasmin!

Jasmin: Thanks, Daraius!Like others on the team, I have more cards than actually fit in my wallet (that’s what sock drawers are for!). 😉 But only a few cards stay there constantly for my everyday spending.

Some are no-brainers for certain categories because they earn bonus points. And others I’ll use in specific circumstances for the benefits or protection they provide.

“The 5 Cards I’m Using the Most Right Now” Series Index

Don’t Miss Out on Miles and Points!

You might have heard others in our hobby say that not using a rewards-earning card is like leaving money on the table. But the same concept is true for using the right card for your purchase. Even if it’s a cup of coffee or pack of gum!

It doesn’t have to be super complicated. Just shifting purchases to a card that earns a bonus in a category you spend in frequently can make a huge difference in your miles and points balances over the long term.

Suppose you drive a lot for work and spend $400 a month on gas. You could use a card that earns 1 point per $1 at gas stations to earn 400 points per month or 4,800 points per year (12 months X 400 points). Which is better than paying cash and not earning anything at all.

But if you moved that spending to a card that earns 2X or 3X points on gas, your year-end points total from just that spending alone could be 9,600 or 14,400 points per year! And get you much closer to an award flight or hotel stay.

That said, the best cards for you depend on your spending habits and travel goals. To get started, we recommend these 3 cards:

- Chase Sapphire Preferred (our favorite card for beginners)

- Chase Ink Business Preferred (our favorite small business card)

- Capital One Venture Rewards Credit Card (our favorite card for easy to use rewards)

Here’s more about the 5 cards I keep in heavy rotation!

1. Chase Sapphire Preferred

Link: Chase Sapphire Preferred

Link: My Review of the Chase Sapphire Preferred

The Chase Sapphire Preferred was the first card I got when I was new to miles and points. I fondly remember the thrill of getting a fancy new card and earning the big sign-up bonus. And how happy the kids were when I used Chase Ultimate Rewards points to book a dream trip to Walt Disney World.

But my sentimental attachment isn’t the reason why I keep the card year after year, even with the $95 annual fee. Chase Ultimate Rewards points are my favorite because they’re so flexible. And we continue to enjoy Big Family Travel by transferring points to partners like Hyatt, Southwest, and United Airlines.

Because the Chase Sapphire Preferred earns 2x Chase Ultimate Rewards points per $1 on travel and dining (worldwide), this is my go-to card at restaurants, most hotels, and for travel abroad.

And I always use it for car rentals, because it includes primary rental insurance. Knock on wood, I’ve never had to file a claim, but you can read about how the card saved team member Joseph ~$2,300 after an incident with his rental car in Ireland! What a lifesaver!

2. Chase Freedom

Link: Chase Freedom

Link: My Review of the Chase Freedom

I’ll be keeping the Chase Freedom forever because it has no annual fee. It’s also one of my oldest cards, so hanging onto it helps my credit score by increasing the age of my credit history.

The Chase Freedom earns 1 Chase Ultimate Rewards point (1% cash back) per $1 on all purchases. So I won’t use it if I can earn a bonus with another card.

But where the Chase Freedom really shines is its rotating category bonuses. Each quarter, you can earn 5X Chase Ultimate Rewards points (5% cash back) on up to $1,500 in combined spending in categories folks often spend a LOT in. You’ll have to remember to activate the bonus, but once that’s done, the extra points add up quick!

For example, last quarter the categories were Walmart and department stores, so I earned a ton of bonus points from holiday shopping and shifting spending to Walmart. And this quarter, through March 31, 2018, you’ll earn the bonus on gas station, internet, cable, phone, and mobile wallet purchases (Android Pay, Apple Pay, Chase Pay, and Samsung Pay).

And because I also have the Chase Sapphire Preferred, I can combine the points from my Chase Freedom card and transfer them to travel partners. Or book paid flights, hotels, rental cars, and activities through the Chase travel portal at an improved rate of 1.25 cents per point.

3. AMEX Blue Business Plus

Link: The Blue Business®️ Plus Credit Card from American Express

Link: My Review of the AMEX Blue Business Plus

I picked up the AMEX Blue Business Plus last year when it was first introduced and came with a welcome bonus after meeting minimum spending requirements. It no longer comes with a welcome bonus, but I would still consider it anyway!

That’s because it earns 2x AMEX Membership Rewards points per $1 on your first $50,000 in purchases per year (then 1X). No categories to remember!

This makes it the perfect card for spending in categories that wouldn’t normally earn a bonus, like repairs to your home office, utilities, or services like legal and accounting fees.

There’s no annual fee, so it’s free to keep forever. (See Rates & Fees) And it’s one of the few AMEX Membership Rewards earning cards with NO annual fee that allow you to transfer points to travel partners like Delta, Air Canada Aeroplan, and Hilton.

I qualify for small business cards through a couple of side hustles I have, like reselling. And even if you think you aren’t eligible, there are lots of for-profit activities and side jobs that could qualify you. Plus, AMEX typically doesn’t have strict income requirements for their small business cards.

AMEX (and most other) small business cards do NOT show up on your personal credit report. So they’re not counted towards your “5/24” status, and won’t impact your ability to get approved for valuable Chase cards later!4. Chase Ink Plus (No Longer Available)

I’ve had the Chase Ink Plus (no longer offered) for a couple of years now. And while I’m currently coveting the Chase Ink Business Preferred, the Ink Plus is still one of my top cards for recurring expenses!

With the Chase Ink Plus, I earn 5X Chase Ultimate Rewards points per $1 on purchases at office supply stores and on cellular phone, landline, internet, and cable TV services (up to $50,000 in combined purchases per account anniversary year). Plus 2X Chase Ultimate Rewards points per $1 on the first $50,000 spent per year combined at gas stations and on direct hotel bookings.

It’s a quick way to boost my Chase Ultimate Rewards point balance each month, especially because I have my cellular phone, cable, and internet bills set to auto-pay with the card. Easy peasy.

That said, I’ll likely downgrade this card to the no annual fee Chase Ink Business Cash Credit Card when the $95 annual fee comes due. I’ll still earn 5% cash back (5X Chase Ultimate Rewards points) at office supply stores and on cellular phone, internet, and cable TV services, but only up to $25,000 in combined purchases per account anniversary year. That’s plenty for me, and I’ll save my pennies instead for the Chase Ink Business Preferred when I get under “5/24“.

5. AMEX EveryDay® Preferred Card

Link: AMEX EveryDay® Preferred Credit Card

Link: My Review of the AMEX EveryDay Preferred

With 3 rapidly growing kids, I have a substantial grocery bill. That’s one of the main reasons I applied for the AMEX EveryDay Preferred card and use it often (not just at supermarkets!).

With the AMEX EveryDay Preferred, you can earn 3 AMEX Membership Rewards points per $1 on up to $6,000 per year on purchases at US supermarkets. And 2 AMEX Membership Rewards points per $1 at US gas stations. Otherwise, it earns 1 AMEX Membership Rewards point per $1.

But the card is even better if you make a lot of transactions each month. Any time you use the card 30 or more times in a billing cycle, you’ll earn 50% bonus points for those purchases. As long as you hit the transaction threshold, you’ll earn:

- 4.5 AMEX Membership Rewards points per $1 (on up to $6,000 per year) at US supermarkets (3X points X 1.5)

- 3 AMEX Membership Rewards points per $1 (2X points X 1.5) at US gas stations

- 1.5 AMEX Membership Rewards points per $1 (1X points X 1.5) on everything else

The supermarket category is huge for my family. I typically spend ~$500 per month on groceries, which fits nicely into the $6,000 yearly spending cap to earn bonus points at supermarkets. That’s an extra 27,000 AMEX Membership Rewards points each year ($6,000 in grocery spending X 4.5 points per $1).

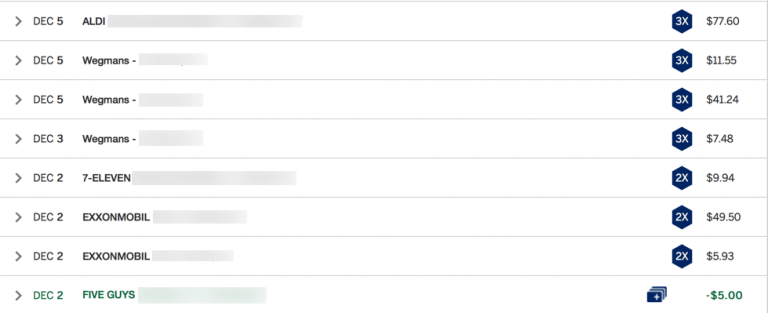

I often use the card for gas, as well (except when the Chase Freedom has gas stations as their 5X rotating bonus category. Because my local gas station is also a 7-Eleven, it’s easy to reach 30 transactions in a month (any time I fill up, the kids inevitably want me to go in for a snack or a Slurpee).

And I’ve saved a ton (and earned lots of bonus points) with AMEX Offers on this card. Between that and a $50 retention offer I got towards this year’s $95 annual fee, it was an easy decision to renew for another year.

Bottom Line

Million Mile Secrets team member Jasmin uses these 5 cards most often:

- Chase Sapphire Preferred

- Chase Freedom

- The Blue Business®️ Plus Credit Card from American Express

- Chase Ink Plus (no longer available)

- AMEX EveryDay® Preferred Credit Card

Like many parents, some of her biggest expenses are groceries & meals out, utilities, and chauffeuring her kids around gas. So using the card that earns the most miles and points in these categories helps her take the sting out of spending she’ll make anyway.

Your situation might be totally different! To find the best cards for your spending habits and travel goals, check out our brand new TravelCardFinder tool!

For rates and fees of the Blue Business Plus card, please click here.Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!