“The 5 Cards I’m Using the Most Right Now” – Joseph

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

The information for the Chase Freedom® and Chase Freedom Unlimited® has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

Don’t make the mistake of putting all of your spending on just 1 credit card! You can earn a lot more points by strategically using multiple cards for certain purchases.

Many of us in the miles & points hobby have unique strategies for collecting miles & points. That’s because we all have different goals and stages in our miles & points career! My top credit card recommendations are:

- Chase Sapphire Preferred – My top pick for beginners

- Ink Business Preferred – My top pick for small business owners

- Capital One Venture Rewards Credit Card – My top pick for folks who like simplicity in redeeming their points

I’ve asked Million Mile Secrets team member Joseph to share the 5 cards he’s using the most right now, and why. Because you can often learn a lot by hearing the personal reasons others like certain cards!

Joseph: No problem, Daraius! My miles & points earning strategy has been pretty vanilla lately. I value Chase Ultimate Rewards points above all else (as many of you probably do), so many of the cards I use most often accrue Chase Ultimate Rewards points. Other cards I use solely for the benefits that come with them, and earning points is just a bonus!

“The 5 Cards I’m Using the Most Right Now” Series Index

What I’m Swiping Most Often

1. Chase Sapphire Preferred

Link: Chase Sapphire Preferred

Link: My Review of the Chase Sapphire Preferred

The first miles & points card I ever opened, and a card I’ve never taken out of my wallet, is the Chase Sapphire Preferred. It’s the number 1 card we recommend for folks new to miles & points.

That’s because it earns flexible Chase Ultimate Rewards points, which you can transfer to lots of useful airline and hotel partners, like Hyatt, Southwest, and United Airlines. And if all else fails, you can redeem your points for paid flights, hotels, rental cars, and activities through the Chase Ultimate Rewards Travel Portal at a value of 1.25 cents each.

It’s a good card for folks who have yet to solidify their travel goals, because the points you earn are so versatile!

I am eternally grateful for my Chase Sapphire Preferred and its excellent travel benefits. It’s saved me thousands over the years. For example, when United Airlines lost my checked bag for 40 days, I received $500 from the Chase Sapphire Preferred’s lost luggage benefit. And when I damaged my rental car, the Chase Sapphire Preferred primary rental car insurance covered the entire $2,300 in damages!

I always use my Chase Sapphire Preferred for rental cars. And because it earns 2X Chase Ultimate Rewards points on dining purchases, I always use it at restaurants.

2. Chase Freedom

Link: Chase Freedom

Link: My Review of the Chase Freedom

The Chase Freedom is a pretty standard no annual fee credit card that earns 1% cash back (1X Chase Ultimate Rewards point per $1) on purchases. But its superpower is its ability to earn lots of bonus points on select purchases.

Every 3 months, Chase introduces new bonus categories, where Chase Freedom cardholders can earn 5% cash back (5X Chase Ultimate Rewards points per $1) on up to $1,500 in combined spending. Sometimes the bonus categories aren’t very useful to me, like movie theaters and cable bills. But the current rotating categories are the MOST exciting I’ve ever seen!

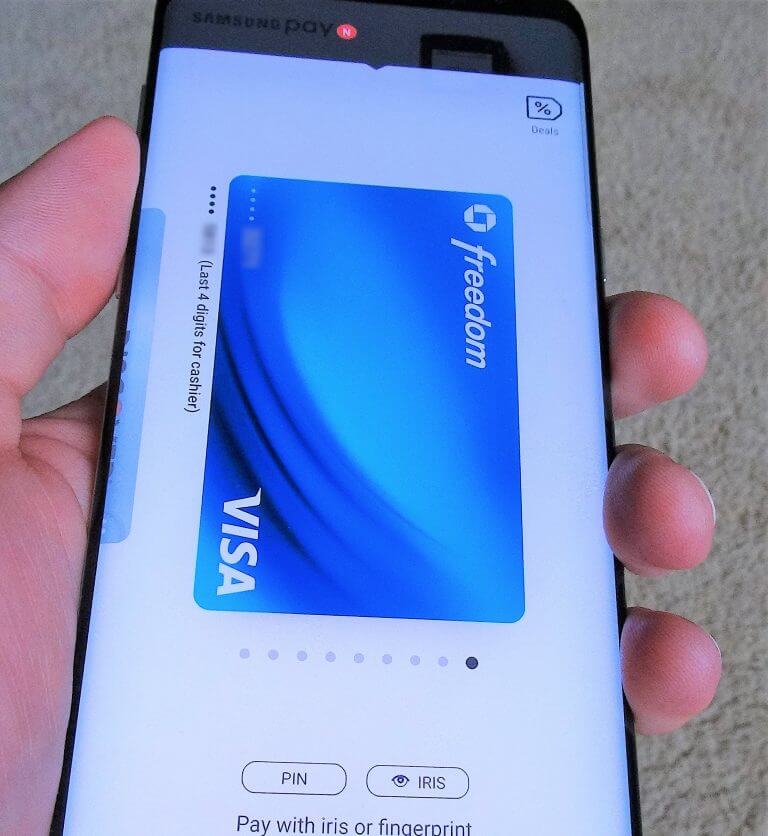

Until March 31, 2018, you can earn 5% back (5X Chase Ultimate Rewards points per $1) when you use the Chase Freedom through Android Pay, Apple Pay, Chase Pay, and Samsung Pay. I use Samsung Pay, so at any store that accepts Samsung Pay (nearly every single place ever), I’ll earn 5% back on up to $1,500 in combined bonus category spending!

And if you have cards like the Chase Sapphire Preferred, Chase Sapphire Reserve, or Ink Business Preferred, the points you earn with the Chase Freedom become much more valuable! That’s because you can transfer your points to one of these cards, and then move them to airline and hotel partners. Or book paid travel through the Chase Ultimate Rewards Travel Portal at 1.25 cents each (1.5 cents per point if you have the Chase Sapphire Reserve).

3. Chase Freedom Unlimited

Link: Chase Freedom Unlimited

Link: My Review of the Chase Freedom Unlimited

Similar to the Chase Freedom, the no annual fee Chase Freedom Unlimited earns Chase Ultimate Rewards points which you can redeem for cash back. Or you can transfer them to travel partners if you have cards like the Chase Sapphire Preferred, Chase Sapphire Reserve, or Ink Business Preferred.

The big difference is that this card does NOT have rotating bonus categories. It instead earns a flat 1.5X Chase Ultimate Rewards points per $1 (1.5% cash back) on all purchases.

I often use this card for spending that my other cards won’t give me a bonus for.

4. Citi Prestige

Link: Citi Prestige

Link: My Review of the Citi Prestige

The Citi Prestige earns Citi ThankYou points, which I don’t focus on collecting as much as other flexible points. That’s because they don’t have a great selection of transfer partners (though I can usually get a decent value for my Citi ThankYou points by transferring them to Flying Blue for flights on Delta).

You can also redeem them for paid airfare through the Citi ThankYou online portal for 1.25 cents each.

The lackluster points the card earns does NOT bother me at all. I use the Citi Prestige for its benefits, not to earn points. In my opinion, it has by far the most generous travel benefits of any card.

The Citi Prestige has a $450 annual fee. But it comes with:

- An annual $250 airline credit for flight-related purchases (like airfare and baggage fees)

- Unlimited 4th night free for paid hotel stays

- Priority Pass Select membership for access to airport lounges (2 free guests or immediate family allowed)

I use those perks regularly, which EASILY makes up for the annual fee. The Priority Pass membership alone costs $399 (with NO guest privileges). And I use the 4th night free perk once or twice per year.

The card also has ridiculously good travel insurance benefits. For example, the delayed baggage benefit kicks in after a delay of just 3+ hours. And if your flight is delayed for 3+ hours, you could be reimbursed up to $500 per ticket for reasonable expenses, like meals, lodging, toiletries, etc. That’s half the time it takes to trigger the Chase Sapphire Reserve benefits!

I use this card for all my international flights and any hotel stays of 3+ nights.

5. Barclaycard AAdvantage Aviator

Link: Barclaycard AAdvantage® Aviator™ Red World Elite Mastercard®

Link: My Review of the Barclaycard AAdvantage Aviator Red

That’s right, American Airlines.

For a long time now, it’s been difficult to find saver level American Airlines award seats to just about everywhere. American Airlines has been nightmarishly stingy.

However, the past several times I’ve looked for American Airlines award flights, I’ve been able to find exactly what I’m looking for. So I’m a little hopeful that American Airlines is loosening their white-knuckle grip on available award flights. And I’m again open to collecting American Airlines miles if an easy opportunity arises.

I wouldn’t normally bring the Barclaycard AAdvantage Aviator anywhere near a merchant. Its only bonus category is with American Airlines. Everywhere else, it earns 1 mile per $1.

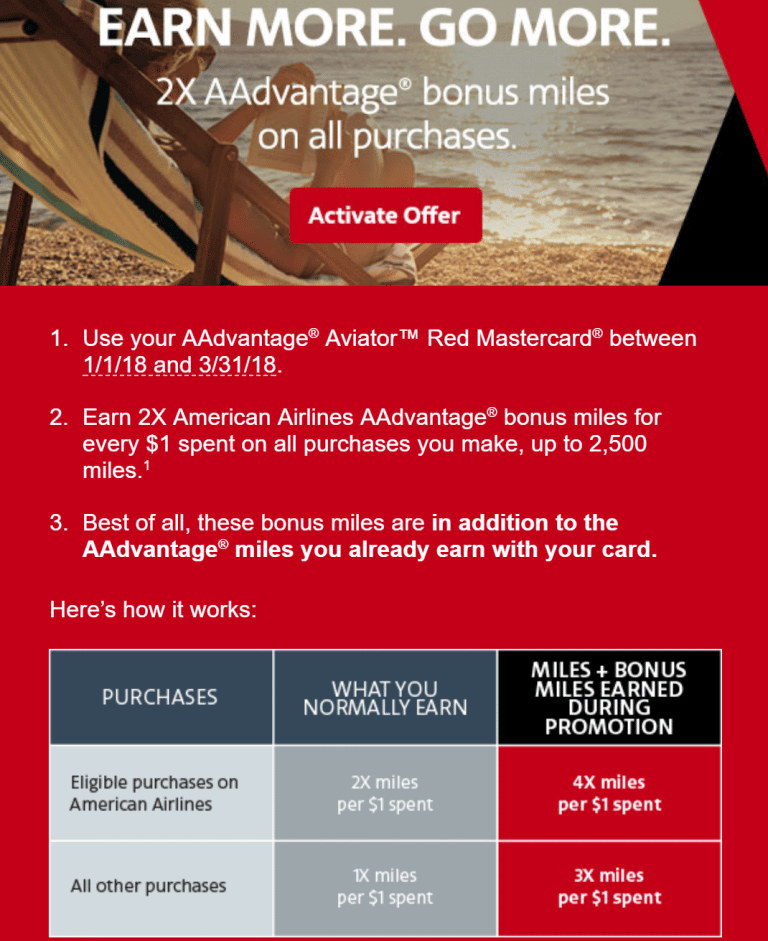

But American Airlines sent me an email last week encouraging me to put more spending on my card by offering 3 American Airlines miles per $1 (up to 2,500 bonus miles).

I’ll be using this card for my non-bonus spending to earn the maximum number of bonus miles, and then I’ll revert back to my trusty Chase Freedom Unlimited.

Bottom Line

Understanding why other folks in the miles & points hobby choose to use certain cards over others can help you formulate your own credit card strategy.

The 5 cards team member Joseph is using right now are:

- Chase Sapphire Preferred

- Chase Freedom

- Chase Freedom Unlimited

- Citi Prestige

- Barclaycard AAdvantage Aviator

His main focus is collecting Chase Ultimate Rewards points. And he balances his travel experience with a card that gives him amazing travel benefits. He also watches for promotions that might give him a reason to use one of his sock drawer cards.

To find the best card for your particular situation, check out our Credit Card Reviews page!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!