“I Saved $300 at the Car Rental Agency and $2,300 at the Scene of the Wreck With This $95 Annual Fee Card”

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.I don’t claim to be an authority in auto body repair. But it seems like rental car damage estimates are usually a little steep.

When I bumped my rental car into a pole during a trip to Ireland, I expected to be charged for a few plastic wheel trim clips and a tube of Turtle Wax scratch remover. Instead, I was charged ~$2,300.

Because I have the Citi Prestige, I have elite status with Avis, National, and Sixt. More often than not, I receive SOME kind of rental car upgrade that’s above my social status. So it’s important I have rental car insurance!

Purchasing insurance through the rental car agency can be costly. One great benefit of cards like the Chase Sapphire Preferred Card, Chase Sapphire Reserve, and Chase United MileagePlus Explorer Card is that they offer primary rental insurance coverage when you decline the rental company’s collision damage waiver (CDW) and pay in full with your card.

It’s not comprehensive coverage, because you’re only covered for theft or collision damage, NOT liability. But it’s still an excellent benefit that can save you tons of money. Using a rental car agency’s CDW can easily cost $15+ per day!

The Chase Sapphire Preferred saved me THOUSANDS of dollars when I damaged my rental car a few years ago. And filing the claim was easy. I’ll show you how it’s done!

The Magic of Primary Rental Car Insurance

Back in 2014, I was relatively new to miles & points. As green as I was, I had learned at least one thing: Don’t leave home without the Chase Sapphire Preferred!

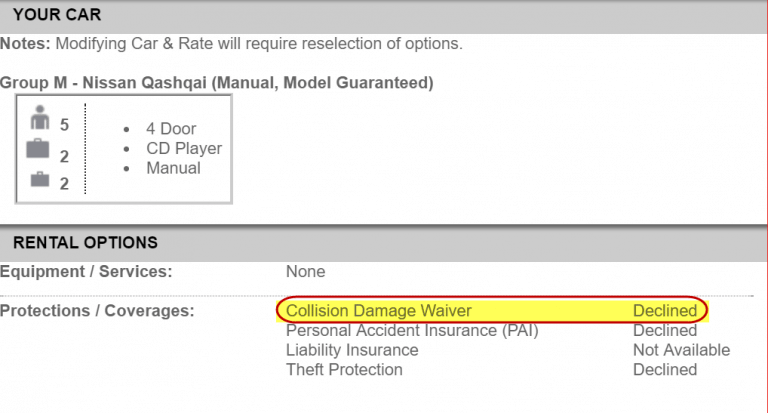

I had read about the card’s primary auto coverage, and used it to rent my 29-day car rental through Avis. The auto insurance alone would have cost ~$300, so waiving their insurance would save a LOT of money.

The Avis agent did NOT like that I waived the insurance, claiming that it was mandatory. I said I already had primary insurance from my credit card, but he informed me that “Things work differently here in Ireland.”

After literally 3 minutes of squabbling in front of a queue of spectators, he agreed to let me decline the insurance.

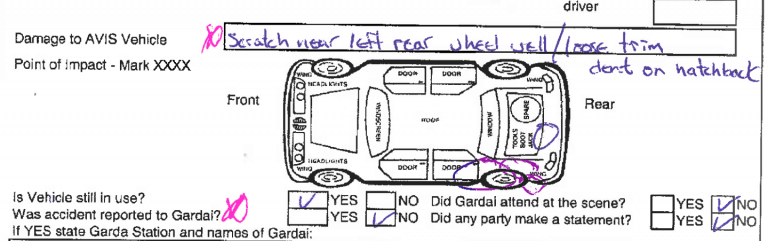

The majority of that trip to Ireland was living hell, but I now look back on the memories fondly. The most stressful ordeal occurred in an underground parking lot, where I scraped my rental car against a cement pillar.

I filed a claim with Chase, and the process of getting reimbursed for the damages was much easier and faster than I had anticipated!

Timeline of Events

I’ll give you a quick rundown of what happened.

- October 15 – I scraped my car, damaging the paint and wheel well trim.

- October 20 – I called Chase to see if there’s anything I should know before returning the car to Avis. The agent said Chase will need information from the rental company, so report the damage and keep all the documents.

- October 22 – I returned the car to Avis and reported the damage.

- October 24 – Avis charged $2,300 to my Chase Sapphire Preferred. I immediately filed a claim, because I thought Avis would have reached out to me to account for the charge. I promptly submitted my claim to Chase.

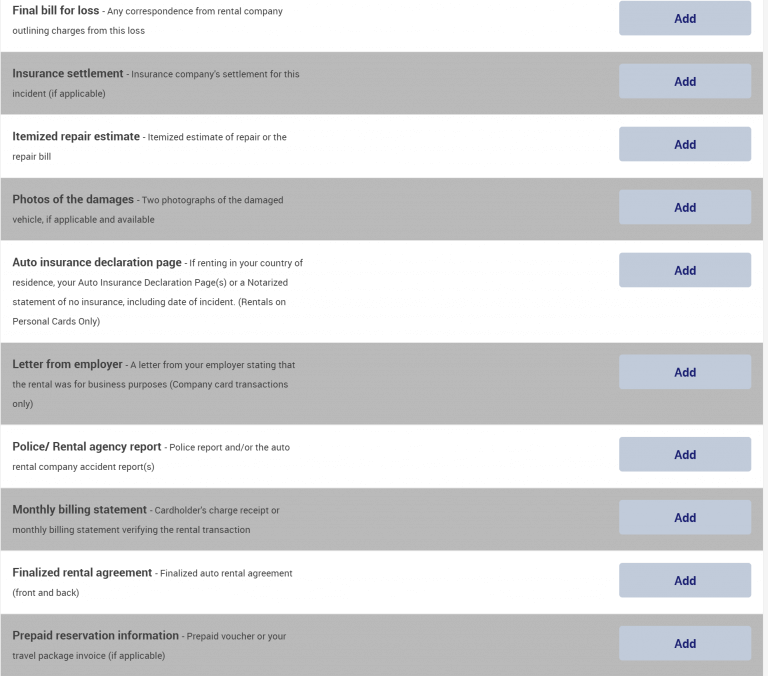

- October 29 – I received an email from the claims department, saying they would need:

- A copy of the Incident Report taken at the time of the incident

- A letter from the rental agency itemizing the amount of the claim

- A copy of the itemized estimate of repair or appraisal detailing the repairs made to the rental

vehicle

- A copy of the monthly billing statement verifying the charge for damages to the rental

vehicle

- A copy of the charge receipt and monthly billing statement verifying the rental transaction was applied to the covered card

- Photographs of the damage to the rental vehicle, if available

- November 13 – Avis emailed all the documents I needed. I uploaded the documents to my open claim.

- November 24 – I received an email that I had forgotten to attach 1 document (GAH!). I uploaded the document.

- December 1 – I had a check in my hand for the full amount of damages, ~$2,300.

Once the claims office had all the documentation they needed, it took just a week for me to receive my check through snail mail! That was a pleasant surprise. If I had submitted all my documents the first time, I reckon I would have had the check much earlier.

How to File a Claim With Chase

Filing a claim is very easy and straightforward. Here’s a quick guide!

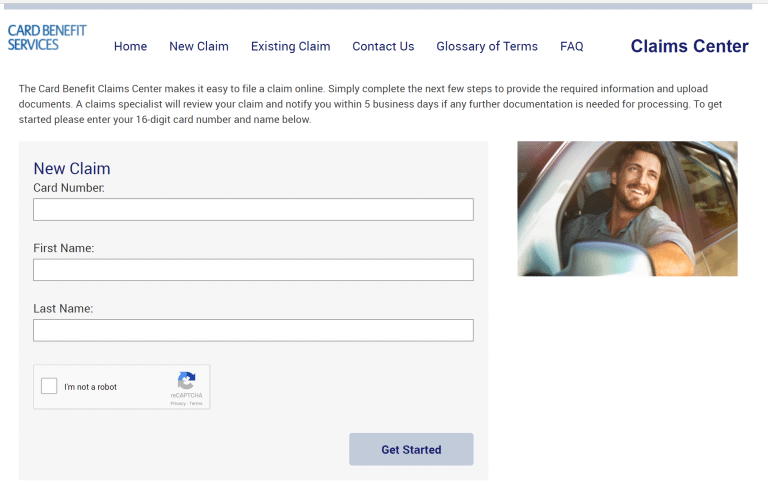

Step 1. Enter Your Credit Card Information Into the Card Benefit Services Website

Go to the Eclaims Line website and press the “New Claim” button. You’ll need to enter the number of the credit card you used to rent your car.

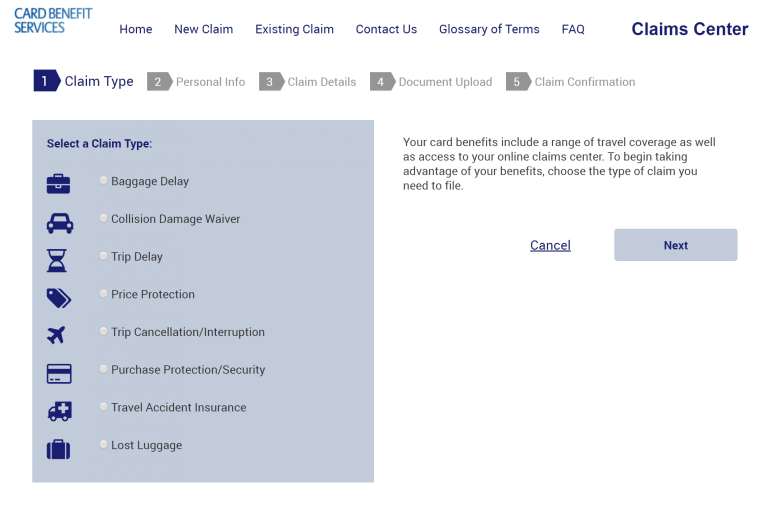

Step 2. Choose the Claim Type

This is the same website you use to open claims for delayed baggage, trip delay, trip cancellation, and more. So select the type of claim you want to open. In this case, it is Collision Damage Waiver.

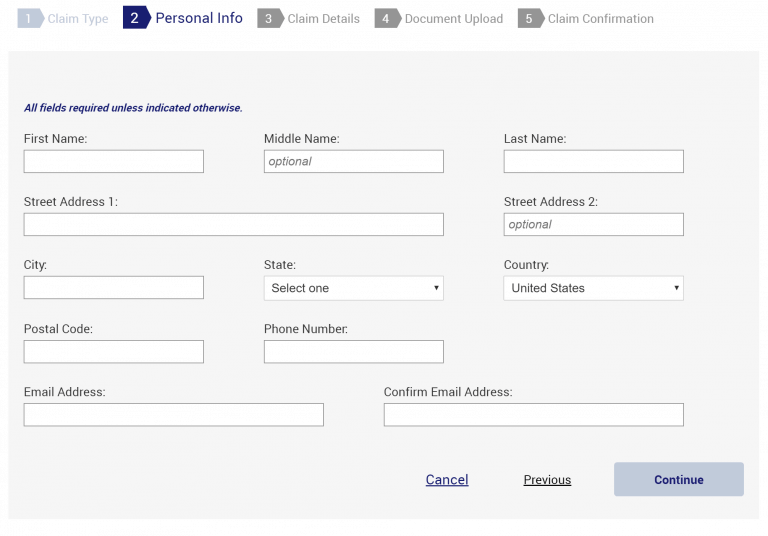

Step 3. Enter Personal Information

Enter information to help the claims office contact you. In my experience, there was both email and snail mail involved.

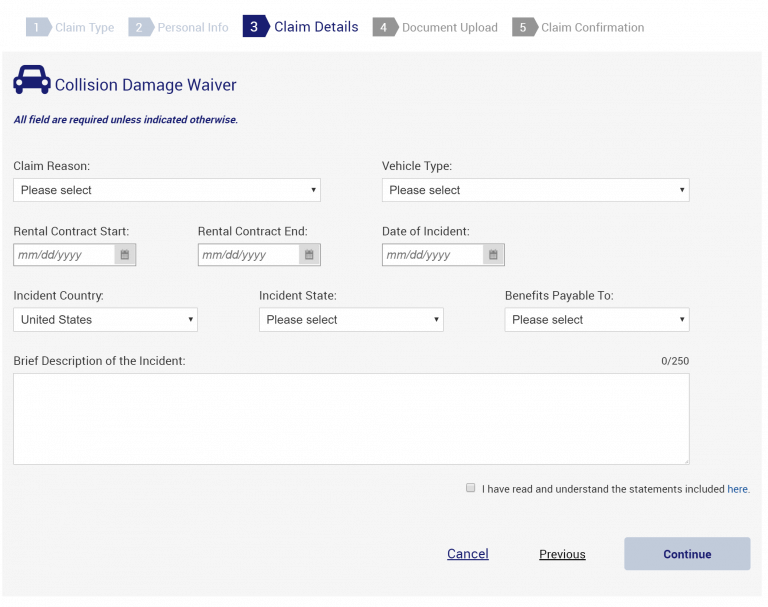

Step 4. Enter Claim Details

Now’s your chance to explain yourself! You’ll need to enter details of the incident, like what kind of vehicle you were driving, when it happened, and in what country.

You can write a small paragraph of any important (and vindicating) details you think the claims office should know.

Step 5. Upload Relevant Documents

There’s a long list of documents you can upload. But not all of them are relevant to your situation, and the claims office will email you a list of documents they need for your claim.

That’s it! Submit your claim and wait for a response.

A very important thing to note is that personal liability insurance is NOT covered by credit cards. Primary rental car coverage with a credit card only pays for damages to your rental car. It does NOT pay for damage to other cars, damaged personal items, or medical care, which is covered by liability insurance.

Bottom Line

I was reimbursed ~$2,300 when I damaged my rental car during a month-long trip to Ireland. I used my Chase Sapphire Preferred‘s primary rental insurance benefit, and received coverage without buying insurance through the rental agency for what would have been ~$300.

We always recommend the Chase Sapphire Preferred to folks new to miles & points. This is a prime example of the solid benefits of the card!

Do you have any experience filing a travel insurance claim with Chase?

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!