How to check how many credit cards you have open (along with your Chase 5/24 status)

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Monitoring your credit is arguably the most important aspect of the miles and points hobby. Without a healthy credit score, you won’t be eligible to earn valuable welcome bonuses from the top credit cards for travel. Along with knowing your credit score, knowing how many credit cards you have open is critical due to banks’ application restrictions.

Most notable is Chase’s “5/24” rule — and it’s essential to understand how this rule could impact your quest for free travel. That’s because Chase has some of the best miles and points credit cards around, like our top choice for beginners, the Chase Sapphire Preferred® Card, and one of the best small business credit cards, the Ink Business Preferred Credit Card.

So, let’s take a look at an easy way to track the number of cards you have open in order to determine your Chase 5/24 status.

For example, with Chase’s tough application rules, it’s unlikely you’ll be approved for most of their cards if you’ve opened 5+ cards from any bank (not counting Chase business cards and these other business cards in the past 24 months).

Canceling a card will not help get you below the “5/24” limit because any credit card you’ve opened in the past two years usually counts, regardless of whether it is currently open. This includes credit card accounts on which you are an authorized user. But sometimes folks have had success calling and getting Chase to not count those accounts.

Some Chase cards are not impacted by the bank’s stricter application rules.

How to check the number of cards you have open

To see how many credit cards you’ve opened, I recommend using myBankrate — it’s free and easy. First, you’ll need a Credit Karma account. It’s free to create and only takes about two minutes. During sign-up, they’ll ask you a few questions to confirm your identity.

Credit Karma uses information from your TransUnion and Equifax credit reports — but it doesn’t matter which credit bureau they use because new personal credit cards will show up on reports from all three credit bureaus (Equifax, Experian, and TransUnion).

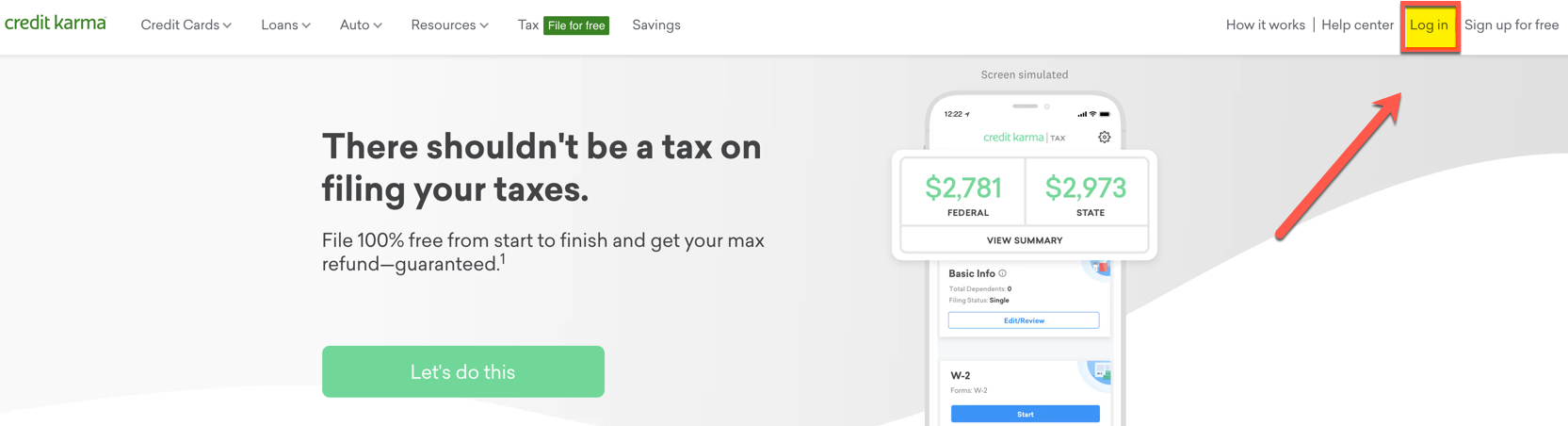

Step 1. Log in to Credit Karma

After creating an account, you’ll need to log in — click the “Log in” button.

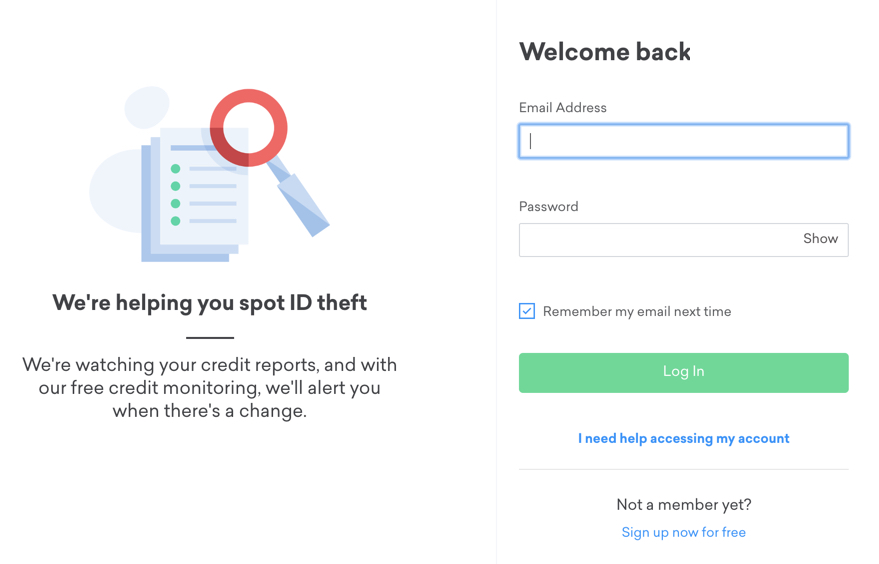

From there you’ll be able to enter your email address and password and click the next “Log in” button.

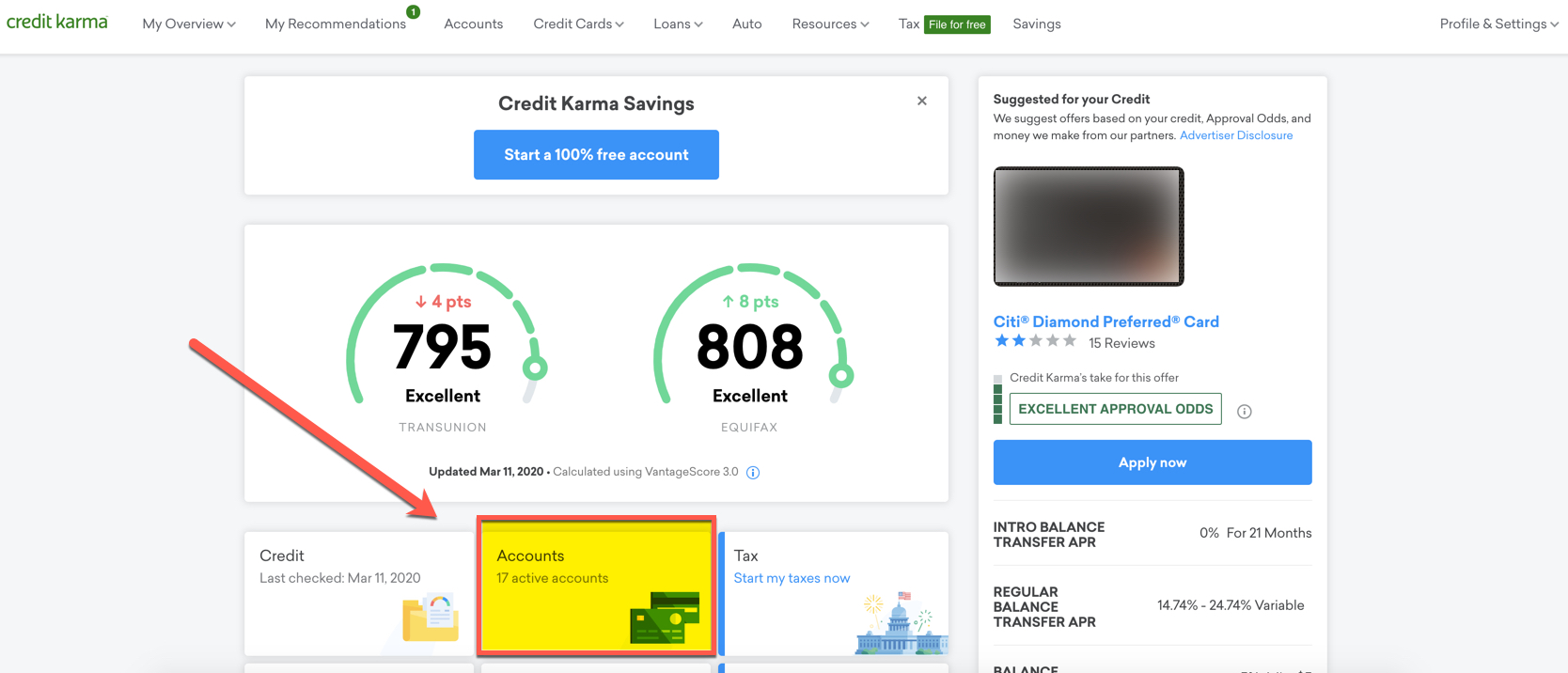

Step 2. View your credit report

After you’re logged in, you’ll see your credit scores from both Transunion and Equifax. To dig deeper into your credit report, start by clicking the “Accounts” section.

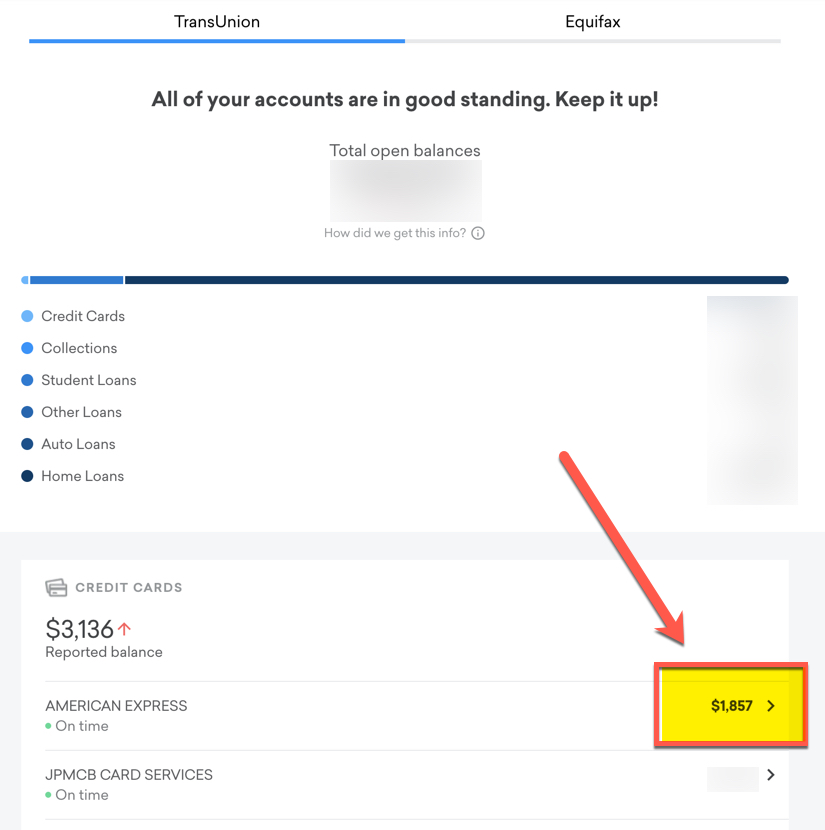

Step 3. Count the number of open card accounts

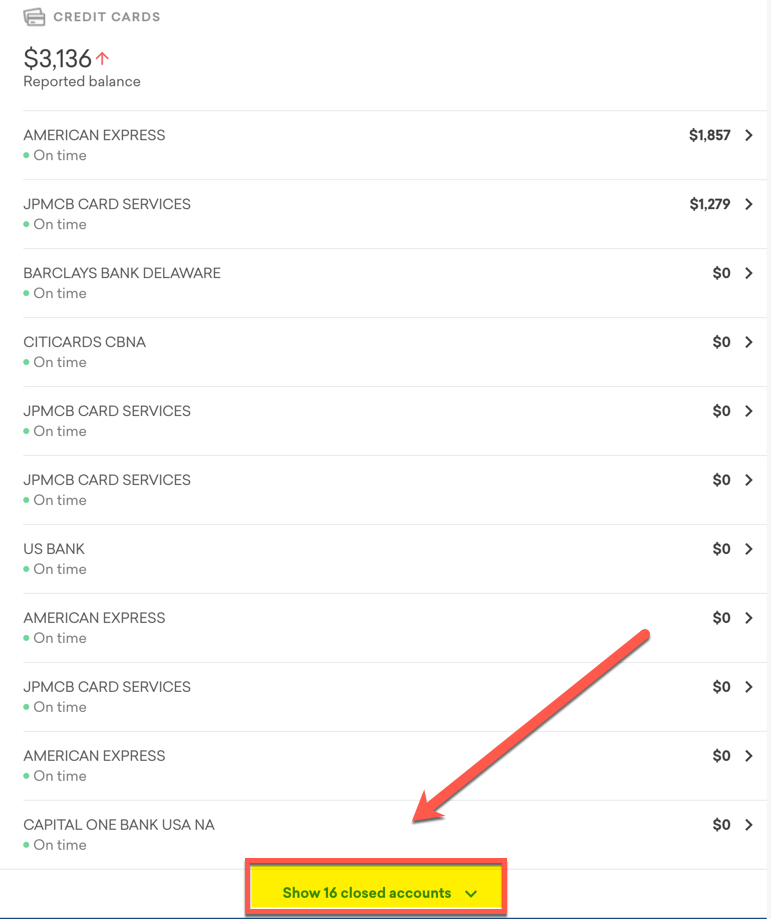

You’ll then see a list of all your credit card accounts. As you scroll down, you’ll be able to see each account.

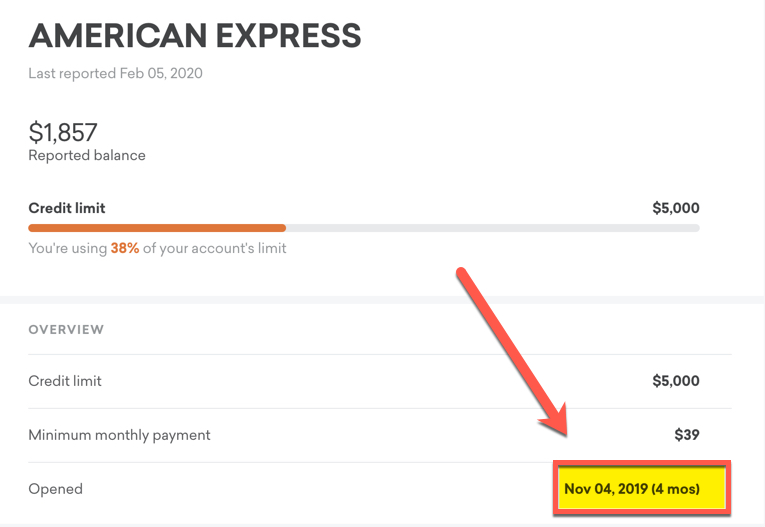

You’ll need to click the drop-down function on each account to see the account’s open date — that’s the date you’ll need to check to calculate your “5/24” count.

Keep in mind, if you’ve opened a card in the last ~30 days, it may not show up on your credit report, so you will need to add that to the count yourself. If you have not canceled any cards in the past 24 months, you’re all done at this point. But if you have, you’ll want to follow the next step to make sure you’re counting all of the cards necessary.

Step 4. Be sure to see if any closed accounts impact your “5/24” limit

Remember, even if you canceled a card that had been opened within the past 24 months, it still counts toward the Chase “5/24” limit. To check when you opened your canceled cards, scroll down to the “closed accounts” section.

The details will show you when the closed card was opened. If it’s been less than two years, you’ll have to include this in your card count to determine whether you’re likely to be approved for a new Chase card or not.

Chase’s application rules mean you should get their cards first

Because it’s tougher to get Chase cards, I recommend applying for their cards first. Specifically, I recommend applying for cards that earn valuable Chase Ultimate Rewards points.

Here are some of the top Chase cards we recommend:

- Chase Sapphire Preferred® Card (Chase Sapphire Preferred review)

- Chase Sapphire Reserve® (Chase Sapphire Reserve review)

- Chase Freedom Unlimited® (Chase Freedom Unlimited review)

- Chase Freedom® (Chase Freedom review)

- Ink Business Preferred Credit Card (Ink Business Preferred review)

Note: Chase restricts people to only having one Sapphire card at a time. For example, if you have the Chase Sapphire Reserve, you won’t be able to open a Chase Sapphire Preferred card (or vice versa).

Bottom line

If you’re looking to check how many credit cards you’ve recently opened, I recommend using Credit Karma — it’s free and easy to use.

It’s important to know how many cards you’ve opened if you plan to apply for Chase credit cards, because Chase will not approve you for most of their cards if you’ve opened five or more cards from any bank (not counting certain business credit cards) in the past 24 months.

This is why my recommended card strategy for beginners is to apply for Chase cards first. With cards like the Chase Sapphire Preferred and Chase Ink Business Preferred, you can earn big sign-up bonuses and save lots of money on travel.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!