Keeping 22 Cards, Downgrading 1, Canceling 7: Harlan’s Plan

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers. This page includes information about the Discover it® Cash Back that is not currently available on Million Mile Secrets and may be out of date.I asked Million Mile Secrets team members to share which credit cards are in their wallet. And to let us know if they plan to make any changes. We don’t reimburse writers for their credit card fees, so folks don’t have an incentive to pay unnecessary credit card fees.

Here’s team member Harlan!

Harlan: I currently have 30 credit cards! The majority of them have annual fees. And I plan on keeping most of them!

I’ll share my credit card strategy. And let you know which cards I’m keeping, converting, and canceling!

Team Credit Card Inventory Index

- Hello to 3 New Cards, Goodbye to 7, Keeping 8: Joseph’s Plan

- Keeping 12 Cards, Downgrading 1, Canceling 3: Keith’s Plan

- Keeping 7 Cards, Downgrading 1, Canceling 2: Meghan’s Plan

- Keeping 22 Cards, Downgrading 1, Canceling 7: Harlan’s Plan

2017 Credit Cards Worth Paying the Annual Fee

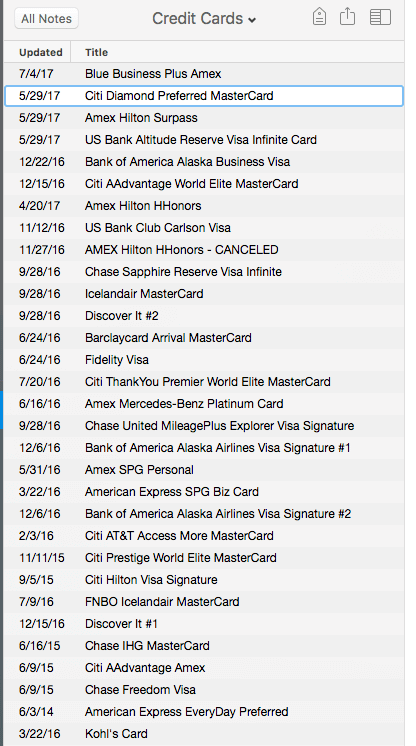

Here are the 30 credit cards I currently have and their annual fees.

The annual fees for my cards total $2,399. But a few have statement credits. For example, I get back:

- $200 for airline incidentals from The Platinum Card® from American Express Exclusively for Mercedes-Benz

- $300 toward travel from the Chase Sapphire Reserve

- $250 for airline travel and incidentals from the Citi Prestige® Card

- $325 toward travel from the U.S. Bank Altitude Reserve Visa Infinite Card

That brings my net annual fee cost down to $1,324. But I also make the most of other card perks like:

- Annual free night at ANY IHG hotel from the IHG® Rewards Club Select Credit Card

- Annual free night at a Hyatt Category 1 through 4 hotel from The Hyatt Credit Card

- Up to 10,000 American Airlines miles refunded on 100,000 miles redeemed from one of the American Airlines credit cards

- 10,000 bonus Citi ThankYou points when I spend $10,000 on the Citi AT&T Access More card

- A free companion fare (for the cost of taxes and fees) from the Bank of America Alaska Airlines Visa Signature® Card

- Sheraton lounge access from the Starwood Preferred Guest® Business Credit Card from American Express

- Centurion Lounge access from The Platinum Card® from American Express Exclusively for Mercedes-Benz

- Fourth night free when I pay with my Citi Prestige® Card

The 4th night free perk alone saved me over $3,000 last year! So I definitely hone in on how to get the most back from all my card perks.

If you can’t tell, I do NOT qualify for most Chase cards because I open more than 5 new cards every 2 years. I do, however qualify for small business credit cards because I host on Airbnb. And many small business cards do NOT count toward Chase’s card limit!

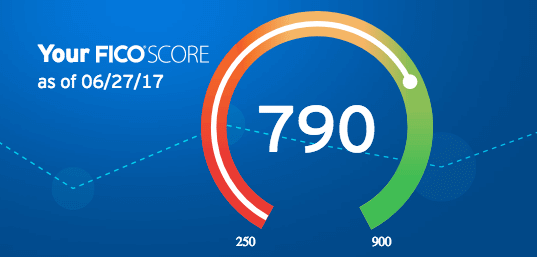

Despite having so many credit cards, I maintain a great credit score. I pay my balances in full each month. And make sure to keep my oldest cards open to boost the average age of all my accounts.

Here are the cards I’m keeping, converting, and canceling.

Cards I’m Keeping

1. AMEX Blue Business Plus

Link: The Blue Business®️ Plus Credit Card from American Express

This card is still fairly new. It had a sign-up bonus when it came out in May 2017. Currently, there’s NO sign-up bonus.

But this card is still worth it because you earn 2X AMEX Membership Rewards points on your first $50,000 in purchases each year. And there’s no annual fee, so it’s a free way to keep your points active.

Opening this card will NOT impact your chances of getting Chase cards in the future. That’s because AMEX small business cards do NOT show up on your personal credit report. And because I have other AMEX credit cards, I didn’t get a hard pull when I opened this card.

I plan on keeping this one forever and using it for non-bonused spend, like dentist visits, pet care, repair services, and anything else that pops up without a category bonus!

2. AMEX Hilton

Link: Hilton Honors Card from American Express

This one’s free to keep, too. Hilton is my preferred hotel chain. I find the points easy to earn and redeem. And they’re everywhere I want to be.

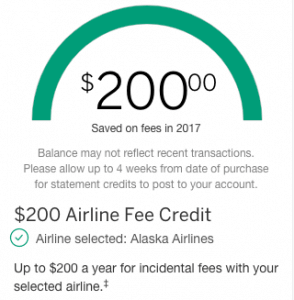

3. AMEX Mercedes-Benz Platinum Card

Link: The Platinum Card® from American Express Exclusively for Mercedes-Benz

I always keep an AMEX Platinum Card in my travel bag to get into Centurion Lounges. I’m based in Dallas, which has the best Centurion Lounge. 😉

I make a point to enjoy a meal and high-end cocktails before or after a flight at Dallas – Fort Worth.

Plus, I get $200 in Uber credits each year. And $200 per calendar year toward travel incidentals with an airline of my choice (I picked Alaska Airlines). Between all these benefits, I feel like I get more than my money’s worth!

You also get:

- Access to airport lounges (Delta, Priority Pass, Airspace, and American Express Centurion Lounges)

- Earn flexible AMEX Membership Rewards points

- Flexible spending limit

- Free Hilton Gold elite status (free breakfast and upgrades when available)

- Free Starwood elite status (which you can match to Marriott)

- No foreign transaction fees

- Statement credit for Global Entry or TSA PreCheck

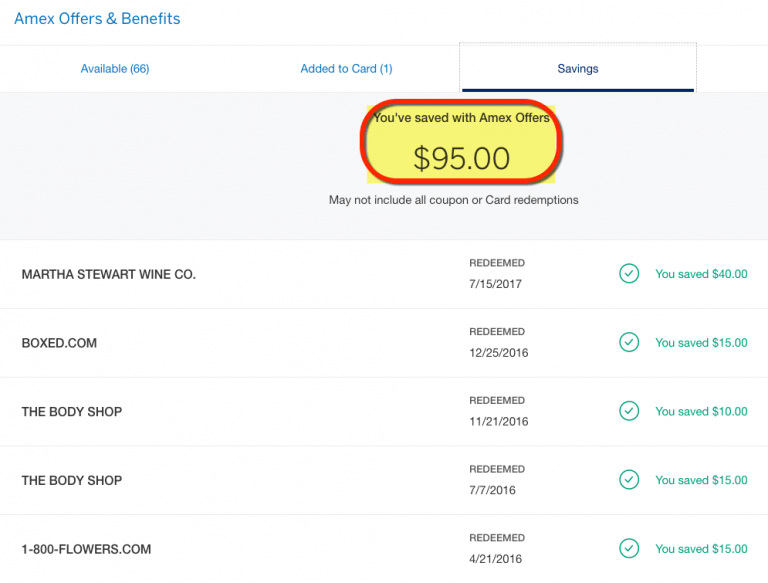

4. AMEX Starwood

Link: Starwood Preferred Guest® Credit Card from American Express

I keep this one for access to AMEX Offers – I save more than the $95 annual fee on this card. Plus, I get elite-qualifying stay credits each year just for having the card.

5. AMEX Starwood Business

Link: Starwood Preferred Guest® Business Credit Card from American Express

I charge my Marriott and Starwood stays on my AMEX Starwood small business card. I also like:

- 2 stay credits or 5 night credits toward Starwood elite Status

- Access to AMEX Offers

- Free in-room premium internet at participating Starwood hotels

But I mostly keep it for access to Sheraton Club Room lounges.

This perk is ONLY on the small business version of the card. And on its own, it’s saved me some serious cash. I snacked and drank for 3 days at the Sheraton Prague Charles Square. Plus, I used points earned from the card’s sign-up bonus to stay there – so it was all completely free!

6. Barclaycard Arrival Mastercard

I downgraded to this card from the Barclaycard Arrival Plus World Elite Mastercard because it doesn’t have an annual fee (for the first year). And it kept my credit line and history intact. I place a small charge on it every once in a while to keep it active. But I don’t use this card for everyday spending.

7. Chase Freedom

Link: Chase Freedom®

I opened a Chase student credit card in 2002 (my first year of college). Through the years, it’s changed into the Chase Freedom – so I’ve had the account open 15 years! This is not only my oldest card, but one I use often. I make the most of the rotating quarterly 5X categories – right now it’s restaurants (August 2017), which is awesome.

Then, I combine points with my other eligible Chase cards and transfer them directly to airline and hotel travel partners like British Airways and Hyatt.

And this is another card with no annual fee. So I’ll keep it forever to help age my other credit accounts!

8. Chase Hyatt

Link: The Hyatt Credit Card

With a free night at a Category 1 to 4 Hyatt every card anniversary, I can easily offset the Chase Hyatt card’s $75 annual fee expense.

I used it to book an award night at Hyatt at the Bellevue in Philadelphia. Nights there can easily cost $300+. As long as the free night benefit stays, I’ll keep this card!

9. Chase IHG

Link: IHG® Rewards Club Select Credit Card

Here’s another card I’ll keep forever because of a valuable free night perk. I used my free night this year to stay in New York, which can be a pricey place! The annual fee on this card is only $49, so it’s a no-brainer.

10. Chase Ink Plus

I pay my monthly cell phone and internet bills to earn 5X Chase Ultimate Rewards points per $1 spent on the Chase Ink Plus (no longer available). I also shop at office supply stores quite a bit, and earn 5X there, too.

Because I earn so many valuable Chase Ultimate Rewards points with this card, I’ll keep it for as long as I can. It’s been key to getting free travel in Cancun, around Europe, and all over the US!

11. Chase Sapphire Reserve

Link: Chase Sapphire Reserve

This card is always in my wallet, so I’m definitely keeping it! Because I often spend on travel & dining and earn 3X Chase Ultimate Rewards points for these purchases. I use it to pay for parking, tolls, and dining throughout the year – those points add up!

This card also comes with a $300 annual credit for travel purchases, like airfare and hotels. So it effectively makes the annual fee $150 ($450 annual fee – $300 travel credit).

And when you pay for travel with the card, you get amazing trip protection benefits.

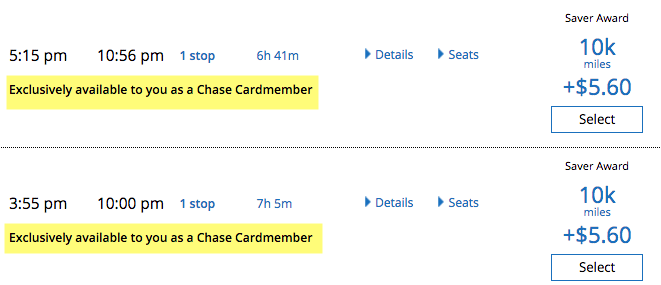

12. Chase United

Link: United MileagePlus® Explorer Card

I don’t put much spending on this card. But I’m keeping it anyway because it gets me:

- 25% more miles when I shop through the MileagePlus X app

- More award seats on United Airlines flights!

It’s hard to quantify those benefits. How much is an extra award seat worth? To me, it’s worth a lot.

This card has a $95 annual fee. But if it’s the difference between taking a trip or not, I’ll keep it. Plus the bonus miles I earn through the MileagePlus X app add up over the course of a year!

13. Citi American Airlines Platinum Select AMEX

This card is no longer available. But I sync a lot of AMEX Offers to it via Twitter. And get back 10% of redeemed American Airlines miles each year, up to 10,000 miles. So between these 2 perks, the card is easily worth keeping.

14. Citi AT&T Access More

This one’s also no longer available. But it earns 3X Citi ThankYou points for online purchases. And when you spend $10,000 on the card in a year, you get 10,000 bonus points.

- Business Class flights to Europe on Brussels Airlines via Etihad

- Family vacations to Hawaii with FlyingBlue and Singapore miles

- Lots of flights booked through the Citi travel portal

To say I use this card constantly would be an understatement. I probably put the most spend on this card out of all the ones I have!

15. Citi Diamond Preferred

I opened this no annual fee card to take advantage of its stunningly long introductory period. I made a big payment toward my student loan and won’t have to worry about accruing interest until 2019. In the meantime, I’ll save thousands of dollars in student loan interest!

This card also has access to Citi Easy Deals, which is handy for buying gift cards at a discount. That’s not a bad setup for a card with no annual fee. And I’m happy about saving so much money toward paying back my student loan!

16. Citi Hilton Visa

Citi recently discontinued this card. There’s no annual fee, and you earn 10,000 bonus Hilton points when you spend $1,000 each year on Hilton stays. So if you stay a few times, it’s worth paying with this card for some extra points!Plus, it’s free to keep long-term, so there’s no reason not to hang onto it.

17. Citi Prestige

Link: Citi Prestige

I get the most savings with the Citi Prestige. That’s because several times per year I take advantage of the 4th night free perk when booking paid hotel stays.

In 2016, I saved over $3,000 with this perk. And in 2017, I’ve already saved more than $500. So continuing to pay the card’s $450 annual fee is a no-brainer.

The card also comes with $250 in annual statement credits for airline purchases such as airfare and baggage fees. This is a terrific perk to offset the annual fee expense further. Plus, its trip delay and cancellation benefits are the best of any credit card! So I always charge my airfare to it.

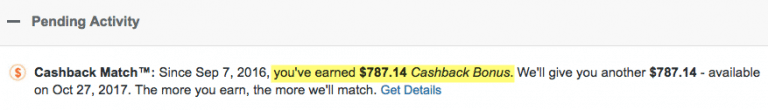

18. Discover it® Cash Back

Link: Discover it® Cash Back

This card has rotating quarterly categories to earn 5% cash back. But even better, Discover will match all your cash back earned during the first 12 billing cycles and post it to the 13th billing statement. So you effectively earn 10% cash back in 5X categories the first year!

There’s no annual fee on this card. And most folks don’t have Discover cards, so you can likely open one easily. If you shop a lot in the 5X categories, which in the past included restaurants, Amazon, and groceries, you can do well with with card – especially the first year.

I have 2 of these cards. So I’ll keep one and cancel the other.

19. US Bank Club Carlson

I downgraded to this from the Club Carlson Premier Rewards Visa Signature® Card to preserve the credit line and history. I no longer care about Club Carlson hotels since US Bank changed the perks on my original card, so I just keep it because it’s free.

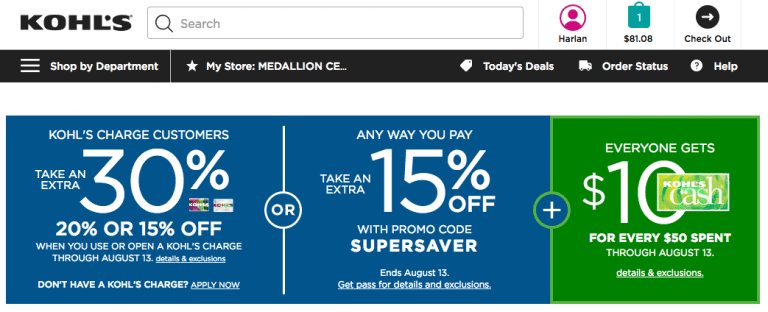

20, 21, 22. Fidelity Visa, Icelandair MasterCard, Kohl’s Card

The Fidelity Rewards Visa earns 2% cash back on every purchase when you deposit to a Fidelity account. But now that I have the The Blue Business®️ Plus Credit Card from American Express, I don’t use it much any more. That said, there’s no annual fee, so I’ll keep it.

I’ve had the Icelandair MasterCard since 2005, so it helps to age my accounts. I rarely use it.

And I shop at Kohl’s a lot for my Airbnbs. Having a Kohl’s card gets me frequent 30% discounts and free shipping, which I use regularly. It’s not for everyone, but it’s free to have. And if you shop at Kohl’s a lot it could be worth it to save on shipping and have access to more sales throughout the year.

Cards I’m Downgrading

1. Barclaycard American Airlines Aviator Red

Link: Barclaycard AAdvantage® Aviator™ Red World Elite Mastercard®

Not gonna lie, I got this card for the sign-up bonus. 😉 I’ll keep it for a bit because Barclaycard gives targeted category bonuses throughout the year. So I’ll see how worthwhile it is to keep long-term to earn more American Airlines miles. If they don’t make it worth paying the $95 annual fee, I’ll downgrade it to the no annual fee version.

Cards I’m Canceling

1. AMEX Hilton Surpass

Link: Hilton Honors™ Surpass® Card from American Express

As mentioned, I have 3 Hilton cards and don’t need them all. Although this card earns the most Hilton points per $1 spent, I’m not a fan of the $75 annual fee because the other ongoing benefits aren’t worth it for me. So I’ll likely cancel it next year.

This card comes with Hilton Gold elite status, which gets you free breakfast and upgrades when they’re available. That can make the annual fee more than worth it for many folks! But because I already get that perk with The Platinum Card® from American Express Exclusively for Mercedes-Benz, it doesn’t help to have the same benefit on 2 cards.

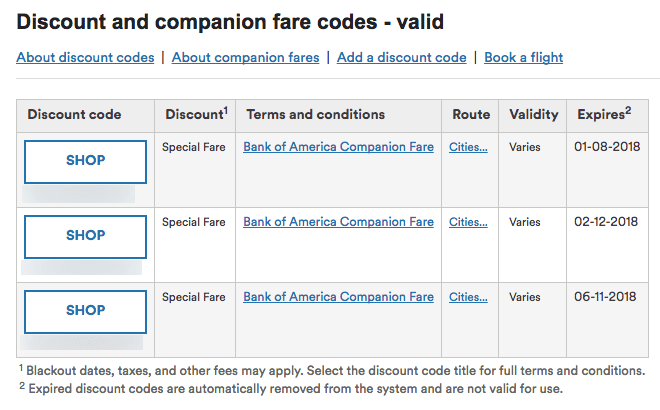

2, 3. Bank of America Alaska Airlines Card

Link: Bank of America Alaska Airlines Visa Signature® Cards

I have 2 of these cards, because Bank of America allows you to have more than one of the same card open at a time. But I haven’t been able to use the companion fares that come with the card, so it’s not worth keeping them and paying 2 annual fees.

4. Bank of America Alaska Airlines Business Card

Link: Bank of America Alaska Airlines Visa Business Card®

This one is the same as above. But applying for this small business card doesn’t impact your chances of getting Chase cards in the future. Because the account does NOT appear on your personal credit report! So it could be a nice way to earn miles toward a dream trip without harming your 5/24 status.

5. Citi American Airlines Platinum Select MasterCard

Link: Citi® / AAdvantage® Platinum Select® World Elite™ Mastercard®

Citi tightened the rules so you can’t receive a sign-up bonus if you’ve opened or closed a card under the same family of cards within 24 months. So I’ll cancel this card to reset the clock and avoid paying 2 annual fees on similar Citi cards. The information for the Citi AAdvantage Platinum Select card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

6. Discover It

Link: Discover it® Cash Back

I’ll cancel one of my Discover it Cash Back cards and keep the other to maintain access to the 5X rotating quarterly categories.

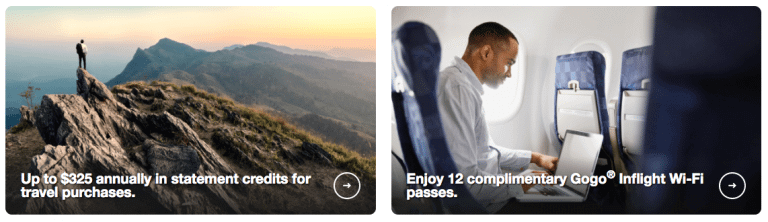

7. US Bank Altitude Reserve

Link: U.S. Bank Altitude Reserve Visa Infinite® Card

I had high hopes for this card. And I’m still a bit on the fence about it. I thought I’d use the 3X mobile payments category a lot more. I added the card to Apple Pay. But have only used it once or twice. And I don’t want to go too far out of my way or change my normal habits just to use this card.

The $325 annual travel credit and 12 in-flight Gogo passes per year easily cover the $400 annual fee. After the $325 credit, each Gogo pass only costs ~$6 ($75 / 12), which is a great deal! I need to see if I’ll actually get use from this card. I might end up keeping it. But at this point, I’m leaning toward canceling it when the annual fee is due again.

How I Keep Track of My Cards

Link: Evernote

When I tell people I have 30 credit cards, they think I’m crazy. And maybe I am. But the right kind of crazy, right? 😉

Evernote has been absolutely indispensable for keeping track of them all. Each time I get a new card, I scan the card into Evernote.

To each note, I add:

- Card number

- Expiration

- Date I opened the card

- How long I have to meet the minimum spending and the amount to spend

- What the bonus is

- Any screenshots of the deal I applied for

- Anything else useful in keeping track, or a note to myself to review the card with an added reminder

Bottom Line

I have 30 credit cards right now – and plan to keep the lion’s share of them.While my annual fee expense on the cards I’m keeping is ~$2,400 (really ~$1,300 after statement credits), I get amazing perks like free hotel nights and annual travel credits with several cards. For example, in 2016, I saved well over $3,000 using the 4th night free perk with my Citi Prestige.

Having so many cards hasn’t hurt my credit score. In fact, it’s nearly 800! And I highly recommend Evernote to keep track of everything digitally – especially anything to do with travel, points, or credit cards!

What do you think of my credit card strategy? Are there any others I should pick up? 😉

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!