Which Credit Card Earns the Most Points for Hilton Stays?

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.Million Mile Secrets reader Christopher comments:

I was looking at the Virgin Atlantic terms and conditions and it looks like they now transfer miles to Hilton points at a rate of 2 Virgin Atlantic miles to 3 Hilton Honors points.Also, please double check my math, but the highest earning Hilton point credit card would actually be the Bank of America Virgin Atlantic MasterCard? You get 13 Honors points per $1 (after you convert the 2 Flying Club miles to 3 Hilton points).

Christopher wants to know if the Bank of America Virgin Atlantic MasterCard, which earns 1.5 miles per $1 you spend on regular purchases (including hotels) is the best card for earning points on Hilton hotel stays.

Virgin Atlantic miles transfer to Hilton at a 2:3 ratio. But depending on how you set-up your Hilton account, you could “double-dip” and earn both Virgin Atlantic miles and Hilton points on hotel stays.

Then transfer the Virgin Atlantic miles earned from double-dipping and from using the credit card to Hilton points.

Bank of America Virgin Atlantic Card

Link: Bank of America Virgin Atlantic MasterCard

The Bank of America Virgin Atlantic MasterCard has had better sign-up bonuses in the past. Currently, with this card, you’ll get:- 20,000 miles after your 1st purchase

- 25,000 miles if you spend at least $12,000 in qualifying purchases in the 1st 6 months

- Up to 15,000 miles on your card anniversary

- Up to 5,000 miles when you add authorized users to your card

- 3 miles per $1 you spend on Virgin Atlantic

- 1.5 miles per $1 you spend on everything else

- Annual fee of $90, NOT waived for the 1st year

There’s no bonus for purchases other than Virgin Atlantic with this card, so you’ll earn 1.5 miles per $1 you spend at hotels. But you can transfer the miles you earn to Hilton at a 2:3 ratio.

Note: You can only transfer Virgin Atlantic miles to Hilton points in 10,000 mile increments.Earning Points at Hilton Hotels

Link: Hilton Hotels

Link: Hilton Honors Earning Preferences (Log-In Required)

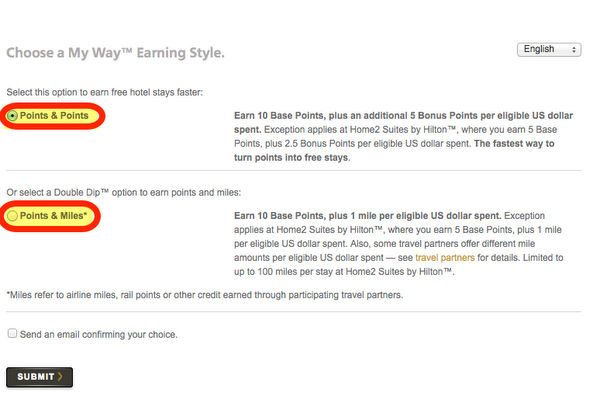

Hilton Honors lets members decide how they earn points on Hilton stays. You can “Double Dip” to earn a combination of points and airline miles, or choose to earn just Hilton points. Log into your Hilton account and go to “Preferences“ to change your earning style.

If you pick “Points & Miles” as your earning style, you’ll earn 10 Hilton points per $1 you spend at Hilton hotels (except Home2 Suites), plus 1 or more airline mile per $1 you spend.

If you choose Virgin Atlantic as your preferred travel partner, you’ll earn 2 Virgin Atlantic miles per $1 you spend at Hilton (in addition to 10 Hilton points per $1).

Folks who choose “Points & Points” earn 15 Hilton points per $1 they spend at Hilton hotels (except Home2 Suites).

Let’s Do the Math

Points & Miles

Using Christopher’s strategy, suppose you chose “Points & Miles” as your Hilton earning style, and used the Bank of America Virgin Atlantic MasterCard for your stay.

For each $1 you spend, you’d earn:

- 10 Hilton points from Hilton hotels (through the Points & Miles option)

- 2 Virgin Atlantic miles from Hilton hotels (through the Points & Miles option)

- 1.5 Virgin Atlantic miles from using the Virgin Atlantic card

You’d earn a total of 10 Hilton points and 3.5 Virgin Atlantic miles per $1 you spend. The 3.5 Virgin Atlantic miles transfer to Hilton points at a 2:3 ratio, so they’d become 5.25 Hilton points (3.5 x 1.5).

So after transferring Virgin Atlantic miles to Hilton, you’d earn a grand total of 15.25 Hilton points per $1 you spend (10 points directly from Hilton + 5.25 points from transferring Virgin Atlantic miles).

Points & Points

What if you pick “Points & Points” as your earning style, and use the Bank of America Virgin Atlantic MasterCard for your stay?

For each $1 you spend, you’d earn:

- 15 Hilton points from Hilton hotels (through the Points & Points option)

- 1.5 Virgin Atlantic miles from using the Virgin Atlantic card

At a 2:3 ratio, you could transfer 1.5 Virgin Atlantic miles to Hilton and get 2.25 Hilton points (1.5 x 1.5).

So you’d earn a grand total of 17.25 Hilton points per $1 you spend (15 points directly from Hilton + 2.25 points from transferring Virgin Atlantic miles).

So you should choose “Points & Points” as your earning style to earn the most Hilton points.

What About Hilton Cards?

Can you do better using a Hilton credit card for your stays instead? Let’s look at what these cards earn at Hilton hotels using the “Points & Points” earning style.

Hilton Honors Card from American Express

Link: Hilton Honors Card from American Express

The Hilton Honors Card from American Express earns 7 Hilton points per $1 you spend at Hilton hotels. It has no annual fee and has a sign-up bonus of 50,000 points after spending $750 in the 1st 3 months.

For each $1 you spend, you’d earn:

- 15 Hilton points directly from Hilton

- 7 Hilton points from using the American Express Hilton Honors card

That’s a grand total of 22 Hilton points per $1 you spend.

Hilton Honors Surpass Card from American Express

Link: Hilton Honors Surpass Card from American Express

You’ll earn 12 Hilton points per $1 you spend at Hilton hotels with the American Express Hilton Honors Surpass card.

Until February 28, 2015, the sign-up bonus is 80,000 points after you spend $3,000 in the 1st 3 months. But there’s a $75 annual fee which is not waived.

For each $1 you spend, you’d earn:

- 15 Hilton points directly from Hilton

- 12 Hilton points from using the American Express Hilton Honors Surpass card

In total, you’d earn 27 Hilton points per $1 you spend.

Citi Hilton HHonors Reserve

Link: Citi Hilton HHonors Reserve Card

The sign-up bonus on the Citi Hilton HHonors Reserve card is 2 free weekend nights at any Hilton hotel (with a few exceptions) after you spend $2,500 in the 1st 4 months.

The annual fee of $95 is not waived. This card earns 10 Hilton points per $1 you spend at Hilton hotels.

For each $1 you spend, you’d earn:

- 15 Hilton points directly from Hilton

- 10 Hilton points from using the Citi Hilton HHonors Reserve card

So you’d earn a total of 25 Hilton points per $1 you spend.

Citi Hilton HHonors Visa Signature

Link: Citi Hilton HHonors Visa Signature Card

The Citi Hilton HHonors Visa Signature card has a sign-up bonus of 50,000 points after you spend $1,000 in the 1st 4 months.

There’s no annual fee, and you’ll earn 6 Hilton points per $1 you spend at Hilton hotels.

For each $1 you spend, you’d earn:

- 15 Hilton points directly from Hilton

- 6 Hilton points from using the Citi Hilton HHonors Visa Signature card

In this case, you’d earn a total of 21 Hilton points per $1 you spend.

So What’s the Verdict?

Here’s a summary of what each of these cards earns when used at Hilton hotels, along with their sign-up bonus and annual fee (if any).

| Credit Card | Points per $1 Spent at Hilton Hotels | Sign-Up Bonus | Annual Fee |

|---|---|---|---|

| Bank of America Virgin Atlantic MasterCard | 17.25 | Up to 65,000 miles | $90 |

| American Express Hilton HHonors | 22 | 50,000 points | None |

| American Express Hilton HHonors Surpass | 27 | 80,000 points | $75 |

| Citi Hilton HHonors Reserve | 25 | 2 free weekend nights at (almost) any Hilton + $100 statement credit for Hilton stay | $95 |

| Citi Hilton HHonors Visa Signature | 21 | 40,000 points + $50 statement credit for Hilton stay | None |

So the American Express Hilton Honors Surpass card earns the highest number of points (27) per $1 you spend at Hilton hotels. That’s much better than the 17.25 points you’d earn using the Bank of America Virgin Atlantic MasterCard.

That said, my favorite card is still the Citi Hilton HHonors Reserve card, because the sign-up bonus of 2 free weekend nights at almost any Hilton is the most valuable. And it earns 25 points per $1 you spend at Hilton hotels (only 2 fewer points than the Hilton HHonors Surpass card).

Bottom Line

You can earn a lot of points on Hilton stays by using the right credit card.

Some, like the Bank of America Virgin Atlantic MasterCard, let you double-dip by earning miles that can later be transferred to Hilton points. With that card, you could earn as many as 17.25 Hilton points per $1 you spend.

But the cards that earn the most points are Hilton credit cards, like the American Express Hilton Honors, American Express Hilton Honors Surpass, Citi Hilton HHonors Reserve, or Citi Hilton HHonors Visa Signature. Depending on the card, you could 21 to 27 points per $1 you spend at Hilton hotels!

Thanks for the comment, Christopher!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!