10 Easiest Awards to Book in 2018 to Save Money on Travel

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

You don’t have to be a miles & points expert to book some of the best deals in award travel. Even “miles newbies” can take advantage of easy awards to save money on flights, hotel stays, and more!

It can be as simple as making a travel purchase with a certain rewards credit card to trigger an automatic reimbursement. Or quickly redeeming your miles and points to book airfare or hotels without having to worry about blackout dates.

I know some folks shy away from this hobby because it can seem overwhelming at first with so many different award programs and credit card options. But it’s surprising how many straightforward deals are available to help you achieve your travel goals!

Book Easy Award Travel

Link: Beginner’s Guide to Miles & Points

Link: Hot Deals

Here are the 10 easiest award travel and miles & points deals you can take advantage of in 2018!

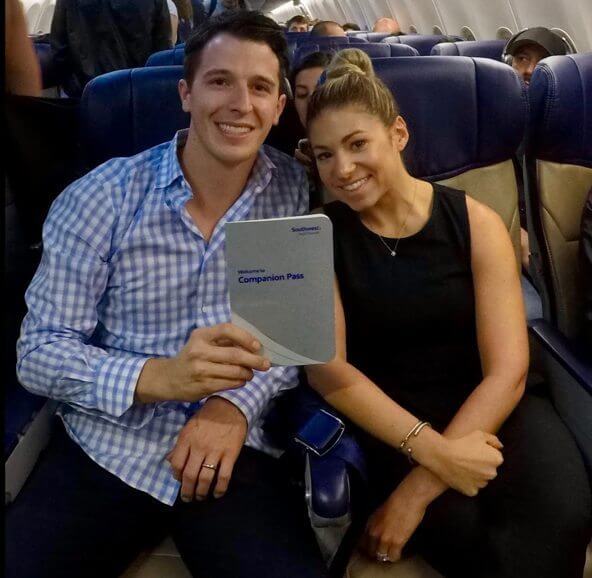

1. Get 2-for-1 Flights With the Southwest Companion Pass

Link: Southwest Rapid Rewards® Plus Credit Card

Link: Southwest Rapid Rewards® Premier Credit Card

Link: Southwest Rapid Rewards® Premier Business Credit Card

Link: How to Fly (Almost) Free For Two Years on Southwest!

Southwest award tickets are easy to book. There are no blackout dates! As long as there’s a seat available for sale, you can book an award ticket.

Plus, award flight prices are based on the cash price of their tickets. So you don’t have to spend time reviewing a complicated award chart.

Folks who fly Southwest can also take advantage of my favorite deal in travel, the Southwest Companion Pass. Team member Keith recently shared how having the Companion Pass got him 11 vacations and $2,750 worth of airfare savings in 2017.

With the Companion Pass, a friend or family member flies with you for nearly free on both paid and award tickets! You just have to pay taxes & fees for your companion’s award ticket, which is typically just ~$11 for a round-trip flight within the US.

The best part is you never have to step foot on a Southwest flight to earn the Companion Pass. You can get it by earning credit card sign-up bonuses. And it’s a great time to consider doing so because of the increased offers on the 3 Chase Southwest credit cards.

2. Chase Sapphire Reserve $300 Annual Travel Credit

Link: Chase Sapphire Reserve

Link: My Review of the Chase Sapphire Reserve Card

Link: Chase Sapphire Reserve $300 Travel Credit, Everything to Know

Chase Sapphire Reserve cardholders get a $300 annual travel credit. Simply make a travel purchase with the card and you’ll see a statement credit automatically (up to $300 every cardmember year).

You do NOT have to spend $300 in one transaction to use the entire travel credit. Instead, you will be reimbursed for all travel purchases until you’ve reached the $300 limit. I like that there are lots of purchases that code as travel, including:

- Airlines (even for airfare and incidentals like change fees or checked bags)

- Hotels & motels (including Airbnb)

- Timeshares

- Campgrounds

- Car rental agencies

- Cruise lines

- Travel agencies

- Discount travel sites

- Passenger trains

- Buses

- Taxis (including Uber and Lyft)

- Limousines

- Ferries

- Toll bridges & highways

- Parking lots & garages

Check out my full review of the Sapphire Reserve to see why I think this top premium card pays for itself!

3 & 4. Citi Prestige $250 Annual Airline Fee Credit and 4th Night Free Hotel Perk

Link: Citi Prestige Card

Folks with the Citi Prestige card can take advantage of 2 easy deals.

Cardholders get a $250 annual statement credit for airline fees such as airfare and baggage fees. It’s as simple as booking an airline ticket and paying with the card. If you book a cheap fare, the statement credit could substantially reduce your out-of-pocket airfare expense!

With the Citi Prestige, you can also take advantage of the 4th night free perk for paid hotel stays, which is one of the most valuable perks on any rewards credit card. And it’s easy to use.

There are 3 ways to book eligible 4th night free reservations:

- Log-in and book through the Citi ThankYou® Travel Center

- Call Citi Concierge at 561-922-0158

- Email your reservation request to [email protected]

Several Million Mile Secrets team members use the 4th night benefit for their paid hotel stays. Team member Jasmin has saved $730 with this perk. And team members Keith and Harlan have each received more than $2,800 in statement credits during the time they’ve had the Citi Prestige!

Just be sure to check out this post explaining why you might NOT want to book 4th night free reservations online.

5. Redeem Chase Ultimate Rewards Points for Travel and Avoid Blackout Dates

Link: Save Points (and Money) Using the Chase Ultimate Rewards Travel Portal

Link: Not All Chase Ultimate Rewards Points Are Equal!

One reason Chase Ultimate Rewards points are my favorite type of flexible rewards is you have the ability to book airfare, hotel stays, or car rentals thorough the Chase travel portal. This can be a huge time-saver as you’ll avoid blackout dates, which are a common frustration when you’re booking certain type of awards.

And depending on the airfare price or hotel cost, you’ll sometimes pay fewer points through the Chase travel portal than if you book as an award. And prices are usually the same as what you’ll find on Expedia, Travelocity, or through other online travel agencies.

You can watch this short video guide to learn how to book travel through the Chase portal.

| Chase Ultimate Rewards Card | How Much Are Points Worth Toward Travel? |

|---|---|

| Chase Freedom | 1 cent |

| Chase Freedom Unlimited | 1 cent |

| Chase Sapphire (no longer available) | 1 cent |

| Chase Sapphire Preferred Card | 1.25 cents |

| Chase Sapphire Reserve | 1.5 cents |

| Chase Ink Business Cash Credit Card | 1 cent |

| Chase Ink Bold (no longer available) | 1.25 cents |

| Chase Ink Plus (no longer available) | 1.25 cents |

| Chase Ink Business Preferred Credit Card | 1.25 cents |

So if you have more than one of these cards, your points will be worth more when you move them to the card account with the highest redemption rate to book your travel!

6. Book Airfare, Cruises, Hotels, and More Through the Citi ThankYou Travel Portal

Folks with the Citi ThankYou® Premier Card can redeem Citi ThankYou points for 1.25 cents each toward airfare, cruises, hotels and car rentals when you book through the Citi travel portal. Just like the Chase example above, this is a straightforward way to use your points to save money on travel and avoid blackout dates.

And if you have the Citi Prestige you can get the same rate of 1.25 cents per point when you book paid airfare through the portal.

7. JetBlue Award Flights

Link: 10 Secrets to Better JetBlue Travel

Link: The JetBlue Plus Card

Link: The JetBlue Card

Link: JetBlue Business Card from Barclaycard

JetBlue award flights are similar to Southwest in that the number of points you’ll pay is tied to the cash price of the ticket. So there’s NO complicated award chart! And there are no blackout dates!

JetBlue points are worth ~1.4 cents each. So 10,000 JetBlue points can get you ~$140 worth of flights (10,000 points x 1.4 cents). Team member Keith used JetBlue points for flights to New York City over the holidays when it’s typically harder to use other type of airline miles.

You can earn JetBlue points directly with Barclaycard cards like The JetBlue Plus Card.

Million Mile Secrets team member Scott loves flying JetBlue because of the extra legroom and free live TV for sports and news.

8. Capital One Miles

Link: Capital One® Venture® Rewards Credit Card

Link: Capital One® Spark® Miles for Business

Link: Smart Ways to Use Capital One Venture or Spark Miles for Big Travel

Capital One has a very straightforward rewards program. It’s easy to earn AND redeem if you have cards like the Capital One Venture Rewards Credit Card or Capital One Spark Miles for Business.

Spark and Venture miles are worth 1 cent each. You can use your miles as a credit towards nearly any travel purchase you make on your card, such as airfare, Airbnb, seat upgrades, and much more!

To redeem your miles, just make a travel purchase like you normally would and pay with your Capital One card. Then, you have 90 days to sign-in to your online account, find the travel purchase, and “erase” it with your miles!

These cards have NO minimum redemption increment when you use miles to completely offset a travel purchase. But if you’re using miles to partially pay for a travel purchase the minimum redemption is 2,500 miles ($25).

9. Hyatt Award Nights (No Blackout Date Policy!)

Link: The Hyatt Credit Card

It’s easy to get Big Travel with Small Money at Hyatt hotels! The hotel chain has a no “blackout date” policy. As long as a standard room is available for sale, you can book it using points! That’s one reason the chain is my favorite Chase Ultimate Rewards hotel transfer partner!

It’s simple to book free nights at low-level Hyatt hotels or luxurious hotels, like the Park Hyatt New York. Team member Jasmin stayed at this hotel and had a fantastic experience.

Chase Hyatt cardholders also get a free night at a Hyatt Category 1 to 4 hotel each cardmember anniversary, which is an easy award to book.

Remember, the Chase Hyatt is NOT affected by the 5/24 rule. So even if you’ve opened 5 or more cards in the past 24 months, it’s still possible to be approved for the card.

10. AMEX Pay With Points to Save on Airfare and Avoid Blackout Dates

Link: How to Use AMEX Pay With Points

To get the most value for your AMEX Membership Rewards points, I typically recommend transferring them directly to airline partners. But then you have to deal with award charts and blackout dates.

Instead, you can redeem points for airfare using Pay With Points through the AMEX travel portal.

When you use your AMEX Membership Rewards points towards air travel, you’ll get 1 cent per point toward your ticket. And folks with The Business Platinum® Card from American Express can get a better deal by taking advantage of the 35% points rebate for coach flights on your selected airline or ANY Business Class or First Class flight.

Bottom Line

Taking advantage of easy award travel deals or credit card perks is a terrific way to get started miles & points hobby! Even if you’re an expert in our hobby, booking simple deals makes it easy to avoid the headaches of dealing with complicated award programs.

For example, it’s easy to redeem JetBlue or Southwest points for award flights because the airlines have no blackout dates. As a long as a seat is available for sale, you can book it using points!

Or you can easily save money on travel by using a credit card that offers annual statement credits. With the Chase Sapphire Reserve, you get a $300 annual travel credit. Just make a travel purchase with the card and you’ll see a statement credit automatically (up to $300 every cardmember year).

What award travel deal do you think is the easiest to book? Let me know in the comments below!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!