Apply Before 2018 to Get 2X the Yearly Bonus With These Cards

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.Besides lucrative welcome bonuses, certain rewards credit cards come with amazing ongoing perks, like an annual credit for certain travel purchases. It depends on the card, but the credit could cover airfare, baggage fees, or even airline gift cards.

Having a card with annual travel credits can help offset card annual fees AND get you Big Travel with Small Money at the same time!

If you’re savvy, it’s possible to apply for a card now to get the credit in 2017 and again in early 2018. So you can receive the travel credit twice by paying just 1 annual fee. But this only works with select cards!

Take Advantage of Calendar Year Travel Credits Twice With Just 1 Annual Fee!

Many premium credit cards come with annual travel credits. But not all offer the credit based on a calendar year.

For example, new Chase Sapphire Reserve cardholders get $300 annual travel credit after each cardmember anniversary. This means you can NOT get the credit 2 times without paying 2 annual fees.

But here are 5 top cards that come with credits for eligible travel purchases per calendar year. So if you apply soon, you could earn the travel credits 2 times in the first 12 months you have the card.

1. AMEX Platinum

Link: The Business Platinum® Card from American Express

Link: My Review of the AMEX Business Platinum Card

Link: The Platinum Card® from American Express

Link: My Review of the AMEX Platinum (Personal)

AMEX Platinum (personal, Mercedes-Benz, and small business) cardholders can receive up to $200 in statement credits per calendar year for airline incidentals with their selected airline. You can choose from:

- Alaska Airlines

- American Airlines

- Delta

- Frontier Airlines

- Hawaiian Airlines

- JetBlue

- Southwest

- Spirit

- United Airlines

And you can use the credit for:

- Checked baggage

- In-flight food or beverages

- Lounge day passes

- Change or cancellation fees

- Seat assignments

In my experience, certain airline gift card purchases also get reimbursed. Then, you can use the gift cards for flights later on!

And American Express considers the day the qualifying charge was made, NOT the billing statement the charge appears on. So you could make eligible travel purchases up until December 31, 2017, and they should still count toward this year’s credit.

Then, the clock resets on January 1, 2018. So you could earn a total of $400 in credits in just a couple of months, which nearly offset the annual fee expense.

Plus, consider other valuable money-saving card perks like a statement credit for Global Entry or TSA PreCheck and airport lounge access!

2. AMEX Premier Rewards Gold

Link: Premier Rewards Gold Card from American Express

Link: My Review of the AMEX Premier Rewards Gold Card

The AMEX Premier Rewards Gold card comes with a $100 annual airline fee credit.

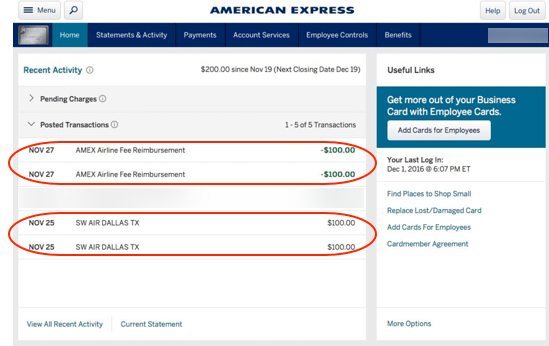

It works just like the AMEX Platinum credit. Just select an airline and make eligible travel purchases and you’ll receive a statement credit.

Apply now to use the $100 credit by the end of 2017 and earn another $100 in 2018!

Like the AMEX Platinum, you can select your airline once you get the card. But choose wisely because you can’t change it until the following January!

3. Bank of America Premium Rewards Card

Link: Bank of America® Premium Rewards® credit card

Link: My Review of the Bank of America Premium Rewards card

The Bank of America Premium Rewards card is the only card with an airline incidental credit that completely offsets the card’s annual fee.

With this card, you get up to a $100 airline incidental credit for things like checked baggage fees, in-flight entertainment, and in-flight meals and drinks.

The card’s annual fee is $95 (NOT waived the first year). So not taking into account other card perks, the airline incidental credit alone is worth the annual fee expense!

But if you’re new to miles & points, this isn’t the first card I’d recommend. Instead, consider Chase cards, which have very valuable sign-up bonuses and are harder to get if you apply for cards with other banks first.

4. Chase Ritz-Carlton

Link: Ritz-Carlton Rewards® Credit Card

With the Chase Ritz-Carlton card, you can earn a $300 annual travel credit each calendar year for qualifying airline purchases, which includes:

- Airline lounge passes

- Baggage fees

- In-flight entertainment & Wi-Fi

- In-flight meals

- Seat upgrades

Unlike other credit cards, the travel credit on the Chase Ritz-Carlton is NOT applied automatically. But the nice part is you’re not restricted to using the credit with just one airline.

To get the credit, you’ll have to call Chase directly to request the credit for your qualifying airline purchases. And the Chase representative might ask for details of your purchase to confirm it’s eligible.

To qualify for the credit, you must contact Chase within 4 billing cycles of the charge appearing on your statement.

Note: Charges can sometimes take a few days to actually post (pending charges don’t count). So don’t wait until December 31, 2017, to make a qualifying purchase!Remember, even if you’re not eligible for other Chase cards because you’ve opened 5+ new cards in the past 24 months, you’re still eligible for the Ritz-Carlton card.

5. Citi Prestige

Link: Citi Prestige

Citi will reimburse you up to $250 each year for airline purchases. This includes airfare, baggage fees, and lounge access.

I like how you can just pay for airfare with the card and get a credit (up to $250) for the purchase. Earlier this year, team member Keith paid for a Southwest flight with the Citi Prestige to get the $250 credit. And because has the Southwest Companion Pass, he added his wife for just the cost of taxes & fees!

That said, if you want to earn the $250 travel credit for 2017, the qualifying purchases MUST post on your December statement or it will count towards next year’s travel credit.

And keep in mind, the Citi Prestige does NOT currently come with a sign-up bonus.

Note: It takes 1 to 2 billing cycles to get the statement credit.Bottom Line

You might want to act quickly if you’re considering applying for these travel rewards credit cards:

- AMEX Platinum (personal, Mercedes-Benz, or small business)

- Bank of America® Premium Rewards® Credit Card

- Premier Rewards Gold Card from American Express

- Chase Ritz-Carlton

- Citi Prestige

Because these cards offer credits for certain travel purchases each calendar year. So it’s possible to earn the credit by the end of 2017 and again in early 2018. This means you’ll only pay 1 annual fee, but get the travel credit 2 times!

Keep in mind, certain airline gift card purchases get reimbursed with cards like the AMEX Platinum. This is outstanding because you can hang onto the gift cards until you’re ready to book a flight!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!