5 Reasons Folks Would Rather Pay a $450 Annual Fee (Instead of $95)

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Keith: The Ink Business Preferred Credit Card is one of the top credit card offers because of its lucrative sign-up bonus.

But The Business Platinum® Card from American Express has some terrific ongoing perks, which can make it a better card over the long term.

At first glance, you might be skeptical about getting a card with a $450 annual fee. But savvy folks can make use of ongoing perks with the AMEX Business Platinum to more than offset the annual fee expense!

You must have a small business to qualify for these 2 cards. But remember there are lots of side activities that can make you eligible! For example, I qualify by selling items on eBay for a profit. Plus, you can apply using just your social security number!

Superior Perks of the AMEX Business Platinum!

The best small business card for your personal situation depends on your travel preferences and goals. But here are 5 reasons the AMEX Business Platinum can be the best fit!

1. Annual $200 Airline Incidental Fee Credit

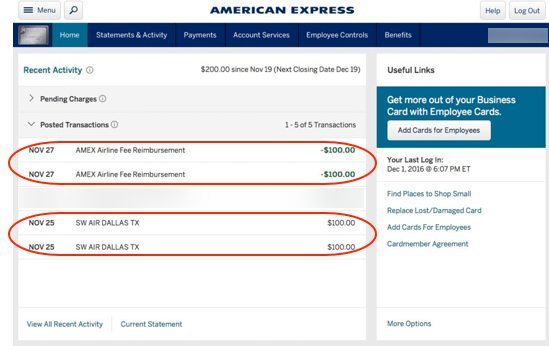

An excellent perk for AMEX Business Platinum cardholders is the up to $200 in statement credits per calendar year for airline incidentals.

With this credit, you can pay for baggage fees, seat upgrades, lounge day passes, and get a statement credit a few days after making your purchase. I even got the full $200 credit by purchasing Southwest gift cards!

You must select one of these airlines in order to take advantage of the credit:

- Alaska Airlines

- American Airlines

- Delta

- Frontier Airlines

- Hawaiian Airlines

- JetBlue

- Southwest

- Spirit

- United Airlines

This benefit effectively reduces the AMEX Business Platinum annual fee to $250 ($450 annual fee – $200 credit).

2. Lounge Access

Link: How to Find AMEX Platinum Airport Lounges

With an AMEX Business Platinum card, you’ll get access to a variety of airport lounges, including:

- Over 1,200 Priority Pass lounges

- AMEX Centurion Lounges in 8 US Cities and Hong Kong

- AirSpace Lounges

- Delta Sky Club lounges when you have a same day flight with Delta

Spending time in airport lounges (especially Centurion Lounges) is a terrific way to save money on overpriced airport food and drinks.

It’s hard to quantify the savings because it depends on your travel habits. But personally, I’ve gotten hundreds of dollars worth of value thanks to the complimentary beer and wine offered in the lounges. 🙂

You don’t get lounge access as an Ink Business Preferred cardholder. So having the AMEX Business Platinum is better if you make the most of this perk!

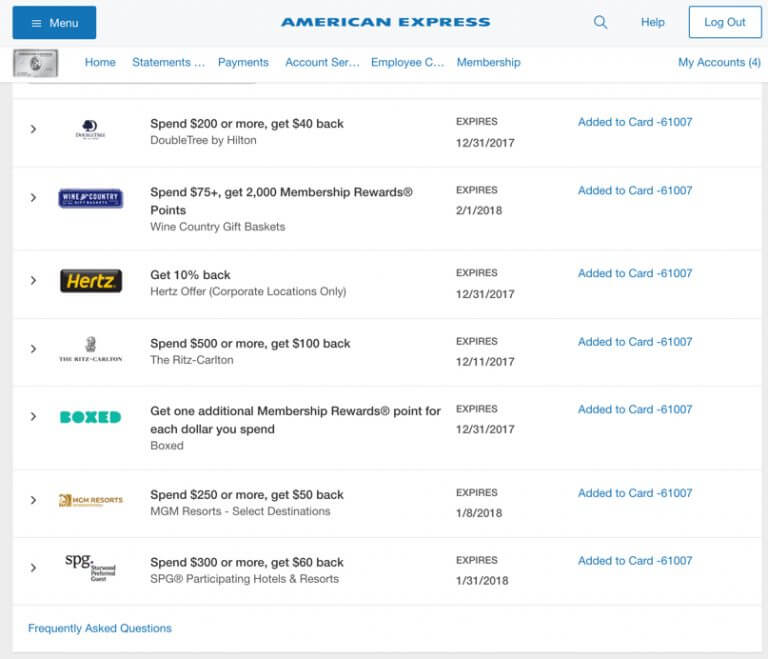

3. Save Money on Purchases You’re Already Planning With AMEX Offers

AMEX Business Platinum cardholders get easy money saving or bonus point earning opportunities thanks to AMEX Offers.

For example, you can get a statement credit just by using your card to pay for hotel stays or while shopping online at popular retailers. These are targeted deals that are constantly changing. When you see one you like, you just have to add it to your card.

You can read how team member Meghan profited nearly $1,000 thanks to an AMEX Offer!

4. Earn Bonus Points for Large Purchases

I know business owners are constantly investing to grow or market their companies. This means you might have to make large purchases for new equipment or other expenses.

With the AMEX Business Platinum card, you earn 1.5X AMEX Membership Rewards Points for single purchases of $5,000+. These are valuable points you can transfer to 19 airline or hotel partners, like Hilton or Singapore Airlines!

Unfortunately, the AMEX Business Platinum does NOT have as many bonus spending categories as the Ink Business Preferred.

For example, with the Ink Business Preferred, you’ll earn 3X Chase Ultimate Rewards points for every $1 you spend on travel, shipping purchases, internet, cable and phone services, advertising purchases made with social media sites, and search engines (up to a maximum of $150,000 in combined purchases per account anniversary year).

So if you frequently make purchases in the above bonus categories, the Ink Business Preferred could be a better pick.

5. Get More Value for Points Through the AMEX Travel Portal

With the AMEX Business Platinum, you can use Pay With Points to book airfare through the AMEX travel portal with no blackout dates. When you book this way, you’ll get:

- 35% of your points back for ALL First Class or Business Class flights

- 35% of your points back for coach tickets booked with your selected airline

Taking advantage of this booking option effectively makes your AMEX Membership Rewards points worth ~1.5 cents each.

$100 worth of airfare would require 10,000 AMEX Membership Rewards points. But you’ll get 3,500 points back (35% X 10,000 points). So in the end you’re using 6,500 points for $100 worth of airfare ($100 airfare / 6,500 points = ~1.5 cents per point)

The Ink Business Preferred also has an option for using points to book airfare through the Chase travel portal. But you’ll only get 1.25 cents per point worth of value. The advantage of using Chase Ultimate Rewards points through the portal is you can also book hotels and rental cars, not just airfare.

AMEX Business Platinum 75,000-Point Offer

Link: The Business Platinum® Card from American Express

Link: Our Review of the American Express Business Platinum Card

When you apply for the AMEX Business Platinum card you’ll earn:

- 50,000 AMEX Membership Rewards points after you spend $10,000 on purchases in the first 3 months of account opening.

- 25,000 AMEX Membership Rewards points after you spend an additional $10,000 on qualifying purchases within the same timeframe

So between the intro bonus and points you earn from minimum spending, you’ll have at least 95,000 AMEX Membership Rewards points (75,000 point total intro bonus + at least 20,000 minimum spending points).

Bottom Line

Right now, you can earn lucrative bonuses with the AMEX Business Platinum and Ink Business Preferred cards. The Ink Business Preferred is our favorite card offer because you earn extremely valuable Chase Ultimate Rewards points.

But the AMEX Business Platinum card comes with amazing ongoing perks that could make it a better card to keep in the long term.

This includes benefits like:

- $200 in statement credits for airline incidental purchases

- Access to Priority Pass lounges, AMEX Centurion Lounges, AirSpace Lounges, and Delta Sky Club

- AMEX Offers, which can save you money on purchases you’re already planning

- Bonus points for large purchases ($5,000+)

- 35% points rebate when using Pay With Points to book select flights through the AMEX travel portal

These perks can more than offset the $450 annual fee on the AMEX Business Platinum. And they’re why folks like me don’t mind paying for a premium card!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!