Ruined: A Once-in-a-Lifetime Family Trip to Europe (and Plans to Fix It)

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

A friend of mine and her family have been planning a bucket-list trip to Europe this summer for nearly 2 years. They’ve never traveled overseas before, so there was much excitement in anticipation of all the amazing new things they’d see and do.

With the help of a travel agent, she came up with an incredible itinerary, including stops in London, Paris, and Rome. And last Christmas morning, she shared a Facebook video – she and her husband had kept it all secret, and surprised their teenage children with the trip by having them unwrap travel-themed items, guidebooks, and personalized t-shirts. The kids were positively ecstatic!

But recently, just before the departure date, their dream vacation was shockingly pulled out from under them. There were NO flights, hotels, or tour reservations made. The travel agent had stolen their money and not booked the trip.

They were devastated. Imagine the heartbreak, outrage, anger … it’s unfathomable that someone could do this to them.

It’s unlikely they’ll ever see their hard-earned money again (thousands and thousands of dollars). The kids are so disappointed. And my mind has been racing trying to figure out ways to help them.

How to Re-Create a Trip for 4 to Europe

My friend and I have been talking. She’s not a miles and points person, but I’ve offered to help try to re-create a similar vacation for them by figuring out the best travel cards she and her hubby could apply for to earn enough rewards to make up this trip in the future.

It’s too late for this summer. And between bank rules and minimum spending requirements, they’ll have to space out their card applications over months anyway. Especially because they’ll need enough miles and points for 4 people.

But it’s certainly not impossible. Once the dust settles, she and I are gonna get together and talk strategy. Here’s what I’ve come up with for her so far (but this is certainly not the only method, and please comment if you come up with better angles for them!).

If you’re thinking of a family trip to Europe (and it doesn’t have to be the same cities), maybe this could help you, too!

1. Flights From the US to Europe

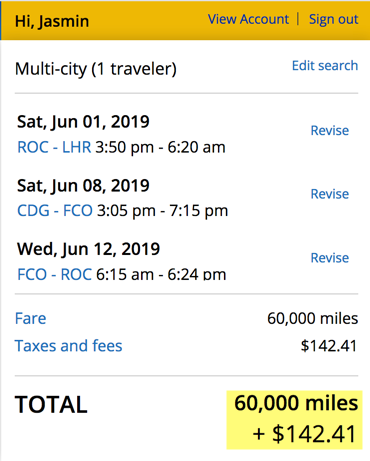

Because their trip involves 3 cities in Europe, redeeming United Airlines miles for round-trip flights makes the most sense. That way, they’ll be able to take advantage of a free one-way flight within Europe using the United Airlines Excursionist Perk.

Round-trip coach flights between the US and Europe cost 60,000 United Airlines miles per person. So they’ll need a total of 240,000 United Airlines miles for their flights (plus taxes and fees, but United Airlines doesn’t add fuel surcharges, which helps a ton!).

Here’s an example of how they could use the Excursionist Perk to snag a free one-way flight between Paris and Rome on an itinerary from the US to London, then Rome to the US. Keep in mind, you can redeem United Airlines miles on Star Alliance partners like Air Canada, Lufthansa, and SWISS along with United Airlines.

They’d have to make their own way between London and Paris, but that’s easily done via train or a cheap flight on a European budget airline.

Now, 240,000 United Airlines miles is a pretty substantial amount. But because United Airlines is a Chase Ultimate Rewards transfer partner, I think their best bet is to each apply for 2 Chase Ultimate Rewards points earning cards with big sign-up bonuses:

Chase Sapphire Preferred Card – Earn 50,000 Chase Ultimate Rewards points after spending $4,000 on purchases in the first 3 months of opening your account (here’s why I always recommend this card to friends and family when they’re first starting out with miles and points).

Also great for beginners – the $95 annual fee is waived the first year.

Chase Ink Business Preferred – Earn 80,000 Chase Ultimate Rewards points after spending $5,000 on purchases in the first 3 months of opening your account. This is the highest sign-up bonus of any Chase Ultimate Rewards card.

There’s a $95 annual fee.

After accounting for minimum spending, they’d earn a total of at least 170,000 Chase Ultimate Rewards points (80,000 point sign-up bonus + at least 5,000 points from minimum spending, X 2).

Grand Total: 288,000 Chase Ultimate Rewards points

So they could transfer 240,000 Chase Ultimate Rewards points to United Airlines for their flights, and still, have 48,000 points left over for other uses on their trip (more on that in a bit!).

2. Hotels Within Europe

This is where it gets a little trickier because can be difficult (but not impossible) to find a standard room in Europe that will accommodate 4 people, especially using points. So they might have to spring for 2 rooms in some locations.

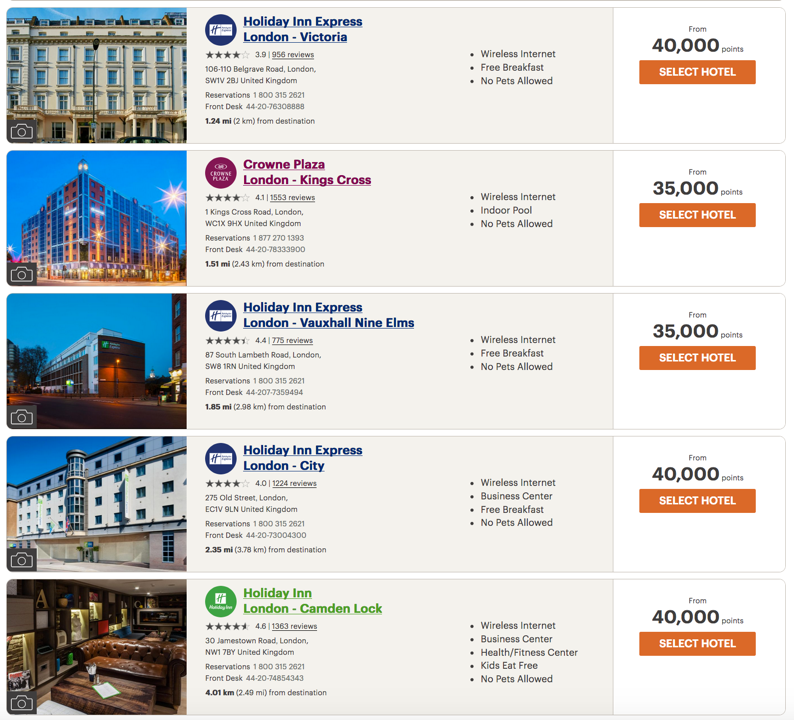

3 Free Nights in London

London is actually a perfect spot to redeem IHG points, because there are several centrally-located hotels that will accommodate 4 adults in a standard room:

If my friend or her hubby were to pick up one IHG® Rewards Club Premier Credit Card, they’d earn 80,000 IHG points after spending just $2,000 on purchases in the first 3 months of opening the account. There’s an $89 annual fee.

And after a year, they’d earn an anniversary night certificate good at any IHG hotel that costs 40,000 IHG points or less. That covers any of these hotels in London, so with one sign-up bonus (105,000 IHG points total) and the anniversary free night after a year, they’d have more than enough for 3 free nights in London.

4 or More Free Nights in Paris

Speaking from personal experience, Paris is a bear when it comes to finding award rooms that fit more than 2 people. So my friend would likely have to book 2 rooms to fit her family.

Last fall, my mom, daughter, and I stayed at the recently-renovated Hyatt Regency Paris Etoile. Compared to other Hyatt hotels in Paris (ahem … Park Hyatt Paris-Vendome), it’s very reasonably priced at 15,000 Hyatt points per night. So for 30,000 Hyatt points per night, my friend’s family could book 2 rooms.

If both parents signed-up for The World Of Hyatt Credit Card, they’d each earn up to 60,000 Hyatt points after meeting tiered minimum spending requirements.

They’d each earn:

- 40,000 bonus Hyatt points after spending $3,000 on purchases in the first 3 months of opening the account

- Another 20,000 bonus Hyatt points after spending an additional $3,000 on purchases within the first 6 months of opening the account

There’s a $95 annual fee on this card.

In total, they’d earn at least 132,000 Hyatt points (60,000 points sign-up bonus + at least 6,000 points from minimum spending, X 2).

And after a year, they’d each get an anniversary night certificate good at any Hyatt category 1 to 4 hotel, including the Hyatt Regency Paris Etoile.

Between the 2 of them, with these cards, they’d have enough Hyatt points for 4 nights (2 rooms) at the Hyatt Regency Paris Etoile (15,000 points per night X 2 rooms X 4 nights). Or 6 nights if they include the anniversary night certificates they’d each after a year.

4 Nights in Rome

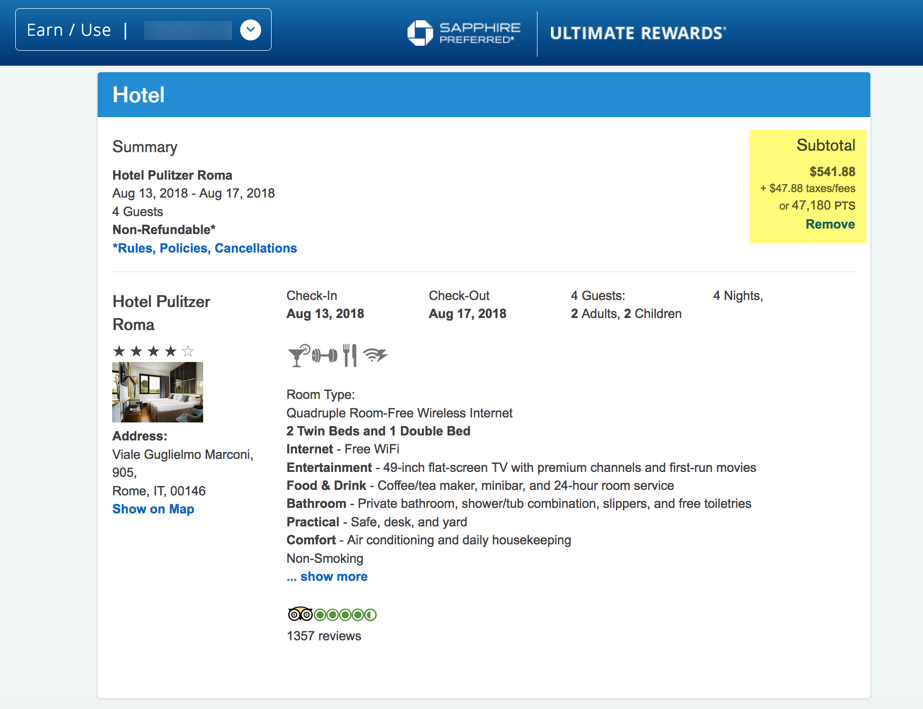

Remember the leftover 48,000 Chase Ultimate Rewards points from booking flights by transferring points from the Chase Sapphire Preferred and Chase Ink Business Preferred to United Airlines? Here’s where they can use them!

The great thing about Chase Ultimate Rewards points is that they’re super flexible. So you can transfer them to travel partners like United Airlines to book award flights, or you can redeem them for paid travel through the Chase Ultimate Rewards Travel Portal.

Chase Ultimate Rewards points linked to the Chase Sapphire Preferred or Chase Ink Business Preferred are worth 1.25 cents each towards flights, hotels, rental cars, or activities booked through the Chase Ultimate Rewards Travel Portal. So 48,000 Chase Ultimate Rewards points are worth $600 in travel (48,000 points X 1.25 cents per point).

I did a quick search in Rome for hotels in peak season (August) through the Chase portal, and found the Hotel Pulitzer Roma, which is highly rated on TripAdvisor. The total cost for 4 nights in a quadruple room is just shy of 48,000 Chase Ultimate Rewards points.

This is where Chase Ultimate Rewards points really shine. In a spot like Rome where chain hotels (especially those with 4 beds) are pricey and harder to come by, it’s often cheaper and easier to check the portal for a non-chain hotel that fits your budget.

3. What About Other Expenses?

So that covers the framework of the trip – flights and hotels. But what about the other stuff? Train tickets, subway rides, buses, and taxis will all add up.

After all of this is sorted (and assuming my friend isn’t tired of the credit card scene yet), I’d recommend one parent (the one who didn’t get the Chase IHG Premier card) apply for the Capital One® Venture® Rewards Credit Card. It’s got a 50,000 Venture mile welcome bonus after spending $3,000 on purchases in the first 3 months of account opening. The bonus is worth $500 in travel.

With $500 worth of miles to redeem towards things like flights or the Eurostar train between London and Paris, taking public transportation, or hopping in a taxi, this card will put a dent in those miscellaneous expenses. Here’s a post about all the ways you can redeem Capital One Venture miles.

This is the card I’d recommend they apply for last. Because Capital One pulls from all 3 credit bureaus, a card application has a bigger (short-term) effect on your credit score. And if you’re new to miles and points, it’s always better to apply for the Chase cards you want first because of their “5/24 rule.”

Bottom Line

My friend and her family were devastated when, after trusting a travel agent with helping them plan a once-in-a-lifetime trip to Europe, the agent scammed them and stole their money. So we’re working on a strategy to re-create their trip with miles and points, and hopefully get them to Europe in the future. Perhaps this strategy will help you, too.

The idea is that my friend and her hubby will each have to apply for 4 cards:

- Parent 1 – Chase Sapphire Preferred, Chase Ink Business Preferred, The World of Hyatt Card, Chase IHG Premier

- Parent 2 – Chase Sapphire Preferred, Chase Ink Business Preferred, The World of Hyatt Card, Capital One Venture

That may seem like a LOT to someone who’s not in our hobby. So I’ll assure her that this doesn’t have to be done all at once. And nor should it, because there are things like minimum spending requirements (here are easy ways to meet them) and annual fees to spread out.

A trip like this for a family of 4 is a long game when you’re collecting miles and points, but it’s very doable. I’d love to see them find a way to overcome the despicable act of their travel agent and still get to see Europe while their kids are young.

So, this is where I ask for your help, Million Mile Secret Agents. I’ve shared my ideas, and now I’d love to hear yours. Can you think of other angles or a better path my pals could take? There are many ways to skin this cat, and I know some of you have done this before.

And if you’ve been taken advantage of by a travel agent and have some advice for a friend, please share too.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!