Elite Status, Fancy Lounge Access, Free Hotel Nights, and More: We Rank the Best Credit Card Perks

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Have you ever rushed to your gate after being delayed at airport security, and meanwhile watched happy, relaxed people stroll out of the airport lounge to enjoy priority boarding? Or maybe you’ve been paying the bill for your hotel breakfast and wondered how the family next to you got it for free?

They’re not all elite travelers or wealthy people flying First Class. In many cases, the only difference between you and them is they’re enjoying the best credit card perks. And average folks like us can get the same credit card benefits by keeping the right cards in our wallets!

Applying for credit cards isn’t just about unlocking big welcome bonuses that will get you Big Travel with Small Money. Every card also has its unique set of perks that give you a reason to keep and use the card long term. These perks can include airport lounge access, shorter security and customs lines, automatic travel or purchase protection and insurance, or complimentary hotel elite status (upgrades, breakfast) and free stays!

Looking for the Best Credit Card Perks?

We’ve done the research and picked the very best credit card perks that can save you money and make your travel experiences more comfortable. And some of these benefits offer extra protection or insurance for when things go wrong.

As fun as it is to utilize these perks, we recommend you pay off your cards in full and on time each month. Otherwise, interest charges can negate any benefits you receive!

We also recommend keeping an eye on your credit score, using tools like MyBankrate to check it for free. Banks have the final say in approving you for a card, and a specific credit score does not guarantee approval, because banks consider many other factors beyond credit score. But it does give you an idea of how likely you are to get approved.

Here Are the Best Credit Card Perks:

- Best Credit Card for Cell Phone Protection: Chase Ink Business Preferred Credit Card

- Best Credit Card for Free Hotel Nights with Points: Chase Sapphire Reserve

- Best Credit Card for Complimentary Hotel Night on Your Card Anniversary: The World of Hyatt Credit Card

- Best Credit Card for Free 4th Night at Hotels: Citi Prestige® Card

- Best Credit Card for Hotel Room Upgrades: The Platinum Card® from American Express

- Best Credit Card for Rental Car Status: The Business Platinum® Card from American Express

- Best Credit Card for Rental Car Insurance: Chase Sapphire Preferred Card

- Best Credit Card for Airport Lounge Access: The Business Platinum® Card from American Express

- Best Credit Card for Delayed or Lost Baggage Coverage: Chase Sapphire Preferred

- Best Credit Card for Trip Delay Protection: Chase Sapphire Reserve

- Best Credit Card for In-Flight Wi-Fi: US Bank Flexperks® Travel Rewards Visa Signature®

- Best Credit Card for TSA PreCheck / Global Entry: United℠ Explorer Card

How We Chose the Best Credit Card Perks

Unlike many of the other reviews we do, here we’ll highlight cards for one specific perk they have. So when deciding which card wins out over other cards, we focused strictly on the perk in question to see which card gives you the most bang for your buck, while ignoring most other factors of the card.

In the case of a tie, we looked at:

- Other benefits the card provides (the big picture, if you will)

- Which card is more accessible (usually with a lower annual fee)

While it’s fun to declare one card the winner in each category, don’t forget that many other cards are often very close in benefits. You’ll see the runners up at the end of each section.

Best Credit Card for Cell Phone Protection

Apply Here: Chase Ink Business Preferred

Link: Our Review of Chase Ink Business Preferred

Link: How Chase Ink Business Preferred Cell Phone Insurance Works

We all love our cell phones, and it’s important to protect our investment. Luckily, some cards offer protection against damaged or stolen phones.

The Chase Ink Business Preferred card is the best credit card for cell phone protection, because when you pay your cell phone bill with this card, you’ll get automatic cell phone insurance. This coverage will reimburse you up to $600 per claim towards the replacement or repair of your phone. You can file up to 3 claims per 12-month period, and there is a $100 deductible per claim.

Plus, you’ll earn 3x Chase Ultimate Rewards points for cell phone bill payments!

Million Mile Secrets team member Keith filed a claim to repair his damaged iPhone 7+ after he dropped it on the sidewalk. The repair amount after paying the deductible nearly covered his $95 annual fee for the Chase Ink Business Preferred for the year!

Runner Up: Wells Fargo also offers a cell phone protection perk with many of their credit cards, including the Wells Fargo Cash Wise Visa® card. They also have a lower deductible of only $25 with the same $600 maximum reimbursement as the Ink Business Preferred. But you’re limited to fewer total claims (only 2 per 12 month period), and the coverage is limited to personal and family plans only (no business plans or employee phones are covered).

The information for the Wells Fargo Cash Wise has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

Best Credit Card for Free Hotel Nights with Points

Apply Here: Chase Sapphire Reserve

Link: Our Review of Chase Sapphire Reserve

Many cards offer travel rewards points you can redeem for free hotel nights. But for most, the best credit card for free hotel nights with points is the Chase Sapphire Reserve.

The Chase Sapphire Reserve card wins this category because of 4 things:

- Earn 3X Chase Ultimate Rewards points per $1 spent on travel (excluding $300 travel credit) & dining worldwide

- You can redeem Chase Ultimate Rewards points for 1.5 cents each through the Chase Ultimate Rewards travel portal (for free rooms at nearly any hotel)

- You can transfer Chase Ultimate Rewards points 1:1 to hotels like Hyatt, Marriott, IHG, and Ritz-Carlton for even more redemption value

- $300 annual credit each cardmember anniversary for travel purchases including hotels

So the Chase Sapphire Reserve can get you free stays at nearly any hotel. Folks also earn 3X points in travel & dining categories, and your points are worth more than even other Chase cards (1.5 cents each in the travel portal). Plus, you earn a $300 annual credit each cardholder anniversary which you can use towards hotel stays as well.

The Sapphire Reserve is a premium travel card and has a $450 annual fee. But the $300 annual travel credit alone reduces your out-of-pocket cost to $150 per year. This makes it effectively cost only $55 more per year than other travel cards like Chase Sapphire Preferred or Capital One Venture Rewards Credit Card

Runner Up: Many other cards are close competitors in this category. The Capital One Venture card is arguably the most flexible card because you can use Venture miles to erase nearly ANY hotel purchase, without worrying about award charts or travel portals. Each Venture mile is worth 1 cent and you’ll earn 2X Venture miles per $1 spent on all purchases. But for bonus category spending, extra perks like lounge access, and the ability to transfer points to airline and hotel partners for exceptional value, the Chase Sapphire Reserve still wins.

Best Credit Card for Complimentary Hotel Night on Your Card Anniversary

Apply Here: The World of Hyatt Credit Card

Many of us keep hotel cards with a free anniversary night year after year because the value of the night more than offsets the card’s annual fee.

Our favorite card for complimentary hotel night on your card anniversary is The World of Hyatt Credit Card. You’ll earn a free night at a Hyatt Category 1 to 4 hotel each cardmember anniversary. It’s well worth keeping and paying the $95 annual fee, because it’s easy to get much more value than that for your free night!

Plus, you’ll get an additional free night at a category 1 to 4 Hyatt hotel or resort after spending $15,000 in an anniversary year. Depending on where you stay, you’ll could get HUNDREDS of dollars in value from each night! For example, the Hyatt at Olive 8 costs $280 per night! So by using 2 free nights here, you’d save $560!

Overall, this card’s annual fee of $95 and the potentially high value of the hotel stay (usually ~$250+ for Category 4 hotels) are what pushed this card above others.

Runner Up: Most of the branded hotel credit cards offer similar benefits, so it really depends on which hotel chain you use the most, as they might have a card which is comparable. For example:

- Marriott Rewards® Premier Plus Credit Card offers a complimentary night (up to 35,000 point value) each cardholder anniversary with an annual fee of $95. But depending on where you stay, it might be tricky to find a hotel at this rate, like in New York City or San Francisco

- Hilton Honors Ascend Card from American Express is another excellent option. You’ll earn a weekend night after spending $15,000 on purchases each calendar year. The annual fee on this card is $95 (

Best Credit Card for Free 4th Night at Hotels

Apply Here: Citi Prestige® Card

Link: This Citi Prestige Perk Might Be the Most Lucrative Benefit of ANY Credit Card!

If you frequently have longer (4+ night) paid hotel stays, the Citi Prestige can save you a TON of cash.

With the Citi Prestige, you’ll get the 4th night of your hotel stay for free on stays of 4+ consecutive nights when you pay with your card and book through one of these methods:

- Log-in and book through the Citi ThankYou® Travel Center

- Call Citi Concierge at 561-922-0158

- Email your reservation request to [email protected]

Your rebate will be equal to the average daily rate of the stay, NOT including taxes. Million Mile Secrets Team Members Keith and Jasmin have saved hundreds of dollars – much more than the $450 annual fee – by making the most of this perk.

The Citi Prestige also offers a $250 air travel credit each year, Priority Pass lounge access, and a Global Entry or TSA PreCheck application credit every 5 years, making this card an even better deal.

Runner Up: This is a relatively unique perk, so there isn’t as much competition in this category. However, there are a few hotel branded cards that earn you a similar perk where you can get a night free with longer reward redemption stays, including:

- Hilton Honors Ascend Card from American Express and The Hilton Honors American Express Business Card both come with complimentary Hilton Honors Gold elite status which offers your 5th night free with each hotel stay booked with points

- Hilton Honors Aspire Card from American Express earns complimentary Hilton Honors Diamond status which has the same 5th night free perk when you book 5 or more nights with points

- Hilton Honors Card from American Express gets you Hilton Honors Silver status which also has the same 5th night free benefit mentioned above

- The IHG Rewards Club Premier Credit Card offers the 4th night free on award stays of 4+ nights

Best Credit Card for Hotel Room Upgrades

Apply Here: The Platinum Card® from American Express

Link: Our Review of The Platinum Card® From American Express

If you’re hoping for an upgrade to a nicer hotel room, having the right credit card might make all the difference. Several branded hotel credit cards offer elite status which may get you room upgrades at check-in for that hotel brand. But what if you stay at several different hotel chains?

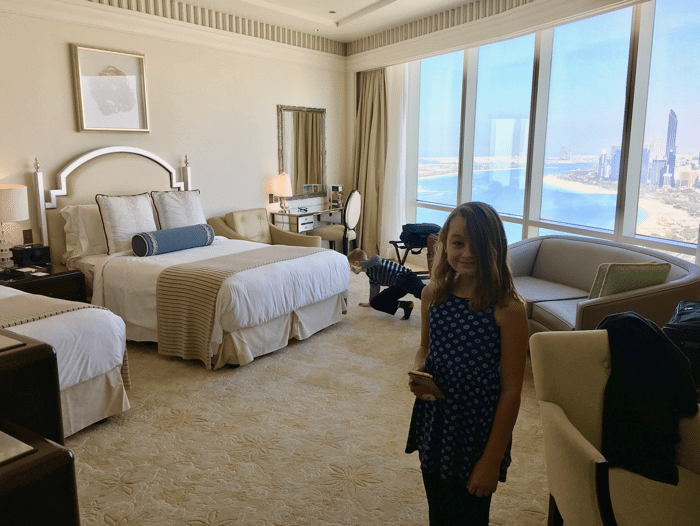

The AMEX Platinum Card will actually earn you complimentary elite status to Hilton, Marriott, and Starwood hotels. And with elite status, you’ll get better hotel perks, which could include room upgrades! Each hotel brand handles these differently, and they are not guaranteed, but unless the hotel is completely booked during the nights you are staying there, you’ll usually have a decent chance of getting a nicer room.

Here’s what you could get with the elite statuses that come with the AMEX Platinum card:

- Hilton: Space-available upgrade to a preferred room at most brands, including Waldorf-Astoria, Conrad, Curio, Hilton and Doubletree

- Marriott: Complimentary room upgrade at check-in based on availability, up to (and including) suites

- Starwood: Upgrade to an enhanced room at check-in, such as a higher-floor room, or a room with more space or views like a corner room

Runner Up: The Business Platinum® Card from American Express offers the same elite statuses, making it a great option for business owners looking for hotel room upgrades. Many hotel branded cards fit here as well, because they often elite status that can get you upgraded, except only for the one hotel brand they represent.

Best Credit Card for Rental Car Status

Apply Here: The Business Platinum® Card from American Express

Link: Our Review of the AMEX Business Platinum

Having car rental company elite status can get you serious (and slick!) benefits, like upgrades to sports cars or SUVs, even if you paid for a compact car. Other perks can include dedicated lines for elite members and lower rental rates when you redeem points.

The Business Platinum® Card from American Express comes with Preferred status with Avis, Executive status with National Car Rental, and Gold Plus Rewards with Hertz.

You’ll get the following perks:

- Avis Preferred Status

- A free weekend rental certificate when you rent twice within 6 months

- Skip the lines and paperwork and go straight to your car (at 1,400+ participating locations)

- Access to the newest cars in the fleet in the most convenient available parking spots

- Complimentary shuttle ride to your car

- National Emerald Club Executive Status

- Access to the Executive Selection where you can choose your favorite car of fullsize or higher class cars for the midsize rate

- Guaranteed upgrades where you’ll always pay one car class less when you reserve a fullsize through luxury car

- Accelerated points earning schedule – with size rental credits you get one free rental day

- Access to an exclusive reservation line for Executive members only

- Hertz Gold Plus

- No stopping at the counters at over 40 of the world’s largest airports

- Up to 20% off best contract rate at participating Hertz locations worldwide

- Up to 25% off best contract rate on Hertz Prestige Collection weekend rentals

- 4-hour no-charge grace period when returning a car before an extra day charge is applied

- 10% bonus on Hertz Gold Plus Rewards

- A one-car-class upgrade on all rentals

Runner Up: The Citi Prestige card comes in as a close second place behind the AMEX Business Platinum because it also offers you elite status at 3 different car rental companies: Avis, National, and Sixt. But Sixt isn’t as commonly found throughout the US and around the world.

Best Credit Card for Rental Car Insurance

Apply Here: Chase Sapphire Preferred

Link: Our Review of Chase Sapphire Preferred

The Chase Sapphire Preferred offers excellent travel protections, including primary car rental insurance, which covers damage due to theft or collision to your rental car, when you pay for the rental with your card.

Secondary insurance requires you to contact your normal car insurance provider (if you have one) to cover the accident and will only cover anything that your primary insurance provider is unable to cover. This is why it’s better to use a card with primary car rental insurance when you rent a car.

The Chase Sapphire Preferred is great for personal trips, because many cards restrict the primary insurance to business trips. You also earn 2X Chase Ultimate Rewards points on travel and dining and no foreign transaction fees!

In fact, the Chase Sapphire Preferred is the #1 card we recommend for beginners in the miles & points hobby. And it’s our top pick to use for car rentals if you aren’t interested in a premium card like the Chase Sapphire Reserve.

With Chase Sapphire Preferred primary car insurance, you’ll decline the rental agency’s collision damage waiver (CDW) and be covered with the card your primary provider when you pay with the card (without the need to rely on your normal car insurance provider or pay their deductible). The $95 annual fee (waived the first year) makes this card a terrific deal as the best credit card for rental car insurance.

Runner Up: There are other cards that provide primary insurance, many of which are business cards, which is why we love the Chase Sapphire Preferred for personal use. The Chase Sapphire Reserve also covers personal rentals if you are looking for a great card with other premium travel benefits like lounge access. For business rentals, the Chase Ink Business Preferred has you covered as well.

Best Credit Card for Airport Lounge Access

Apply Here: The Business Platinum® Card from American Express

Link: Our Review of The Business Platinum® Card from AMEX

When it comes to airline travel, nothing beats a luxurious airport lounge. Not only does it allow you plenty of options to charge your stuff and get Wi-Fi access, but it’s also quiet and far more comfortable than waiting at the gate. My favorite reason of all to seek out an airport lounge is the free food and drink.

The American Express Business Platinum card offers you the largest selection of airport lounges for a single card. With this card, you’ll get access to lounges from Delta (when you’re flying Delta the same day), Priority Pass, Airspace, and American Express Centurion lounges. This includes more than 1,000 airport lounges across 120 countries.

Runner Up: The Platinum Card® from American Express will also get you into all the same lounges as this card, but with a higher annual fee of $550 (See Rates & Fees). American Express cards really are unmatched when it comes to the extent of airport lounges you have access to. However, several other cards do offer Priority Pass Select memberships which give you access to a large number of airport lounges as well. The Chase Sapphire Reserve and Citi Prestige both offer this.

Best Credit Card for Delayed or Lost Baggage Coverage

Apply Here: Chase Sapphire Preferred

Link: Our Review of Chase Sapphire Preferred

If you travel long enough, inevitably your bags will get lost or delayed. If you book the flight with the right credit card, many will cover the loss of baggage and personal items if you purchase the entire flight with that card.

Delayed baggage protection is somewhat less common. This means that you can be reimbursed for essential items like toiletries, clothes, or a cell phone charger that might be delayed by the airline (assuming they find it a few days later).

The Chase Sapphire Preferred is our pick for the best credit card for delayed or lost baggage coverage. This is because this coverage (specifically the delay protection) is generally only offered by premium credit cards with $450+ annual fees. However, the Chase Sapphire Preferred manages to impress us with equal level of protection for only a $95 annual fee (waived the first year).

If your bags are delayed 6+ hours, you will be covered for up to $100 per day (up to 5 days) while the airline recovers your bags. If the bag is deemed lost, then the card protects you with up to $3,000 per insured person per trip (limitations apply) towards replacement of what was lost.

Runner Up: Other cards to consider with this protection are the Chase Sapphire Reserve and the Citi Prestige. Both of these cards match the $3,000 coverage per lost bag and $500 maximum for delayed baggage. But these cards come with a $450 annual fee.

Best Credit Card for Trip Delay Protection

Apply Here: Chase Sapphire Reserve

Link: Our Review of Chase Sapphire Reserve

Sometimes flights get delayed, causing you to need to get a hotel or food before you can continue your journey. This is the exact scenario that trip delay protection is designed to cover.

The best credit card for trip delay protection is the Chase Sapphire Reserve. This was a close comparison because coverage was almost identical to most other cards.

While most cards offer $500 in reimbursements per ticket for a delay of 12 hours or more, the Chase Sapphire Reserve is better only requires a delay of only 6 hours to qualify for trip delay protection. The coverage amount of $500 is the same, however.

Runner Up: The Citi Prestige card would have been our top pick because in the past they’ve offered similar delay protection after only a 3 hour delay. But that’s changing to 6 hours as of July 29, 2018.

Best Credit Card for In-Flight Wi-Fi

Apply here: US Bank Flexperks® Travel Rewards Visa Signature®

For those of you that just need to get some work done (or check your Facebook) in the air, you might be looking for a card that gives you free in-flight Wi-Fi.

Purchasing an all-day internet pass through GoGo Inflight directly (before your flight) will cost you $19 per day. This is often cheaper than buying it directly on the plane, and it allows you to save across multiple flight segments within a 24 hour period. Airlines will often charge about double these prices if you wait to purchase a pass while mid-flight.

The U.S. Bank Flexperks Travel Rewards card is a lesser known card, but maintains its title of the best credit card for in-flight Wi-Fi. With the U.S. Bank Flexperks Travel rewards car you will get a total of 12 complimentary Gogo® inflight Wi-Fi passes. These passes are good for 1 flight segment each in the US and Canada on a GoGo enabled flight.

Runner Up: The AMEX Business Platinum is very close, offering a total of 10 free Gogo in-flight Wi-Fi passes each calendar year.

Best Credit Card for TSA PreCheck / Global Entry

Apply Here: United Explorer Card

Global Entry and TSA PreCheck are lifesavers for folks who travel even just a few times a year. Speeding through customs and security makes the airport process far less painful. These programs normally carry application fees of up to $100 for Global Entry (which includes TSA PreCheck also) and last for 5 years.

Many premium travel cards will reimburse this application fee for you once every 4 or 5 years to maintain your status in these programs. Because all these benefits are mostly equal (they cover the same amount), the tie-breaker is going to come down to the card with the lowest annual fee.

Thanks to our readers for helping us reevaluate which card is best for this fantastic perk! After taking another look, the United Explorer Card is the real winner. Chase recently added a few new benefits to the card, including up to a $100 Global Entry or TSA PreCheck fee credit every 4 years.

The United Explorer Card has a $95 annual fee, waived the first year. So you can get $100 in value from a card that has a $0 annual fee the first year! That’s a pretty great deal. And that’s before factoring in all the other excellent benefits of this card, like access to an increased number of award seats, and 2 United Airlines lounge passes each year you have the card.

Runner Up: The Bank of America Premium Rewards credit card has an annual fee of $95, NOT waived the first year. That’s still way lower than most other premium travel cards with this benefit. The Platinum Card from American Express is one of the few cards that is different with this perk. While the $100 application fee waiver is the same, and the 4-year limit is the same, the AMEX Platinum will let you add up to 3 additional users to your account for a flat $175 annual fee (See Rates & Fees) (on top of the $550 annual fee for the primary cardholder). Each of these authorized users will also be able to earn the Global Entry statement credit (in addition to their own lounge access pass, hotel elite statuses, and more).

Bottom Line

Getting and keeping these cards (and paying the annual fee) is worth it beyond the sign-up bonus because of the valuable perks you get, like travel protections, anniversary hotel nights, elite status, lounge access, Wi-Fi, and more.

These Are the Best Credit Card Perks:

- Best Credit Card for Cell Phone Protection: Chase Ink Business Preferred

- Best Credit Card for Free Hotel Nights with Points: Chase Sapphire Reserve

- Best Credit Card for Complimentary Hotel Night on Your Card Anniversary: The World of Hyatt Credit Card

- Best Credit Card for Free 4th Night at Hotels: Citi Prestige® Card

- Best Credit Card for Hotel Room Upgrades: The Platinum Card® from American Express

- Best Credit Card for Rental Car Status: The Business Platinum® Card from American Express

- Best Credit Card for Rental Car Insurance: Chase Sapphire Preferred

- Best Credit Card for Airport Lounge Access: The Business Platinum® Card from American Express

- Best Credit Card for Delayed or Lost Baggage Coverage: Chase Sapphire Preferred

- Best Credit Card for Trip Delay Protection: Chase Sapphire Reserve

- Best Credit Card for In-Flight Wi-Fi: US Bank Flexperks® Travel Rewards Visa Signature®

- Best Credit Card for TSA PreCheck / Global Entry: United Explorer Card

This list was fun to put together, but don’t forget that just because a card is the best for a specific perk category, doesn’t mean it is the only card that offers that benefit. Many of these categories had very close competitors between cards.

Take a look at which cards offer the benefits that you are looking for and if it is worth the annual fee. Considering the value of the perk, the annual fee for the card, and any other benefits or statement credits that you will use will help you decide if a card is right for you.

Do you agree with our rankings or did we miss your favorite card? Please let us know in the comments!

For rates and fees of the Amex Platinum card, please click here.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!