Review: Capital One Venture Card Vs. Capital One VentureOne

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Y’all know how much I love getting Big Travel with Small Money by collecting airline miles and hotel points. But sometimes there are blackout dates around my travel times. Or there aren’t available award seats or nights on the dates I want.

If you prefer the flexibility of booking flights, rooms, and other travel whenever you want, the Capital One® Venture® Rewards Credit Card and Capital One® VentureOne® Rewards Credit Card are better options than credit cards like the Chase United MileagePlus Explorer Card or Hilton Honors Ascend Card from American Express, which earn miles & points that you can only use if there are available award seats or nights.

The Capital One VentureOne comes with 20,000 Venture miles (worth $200 in travel) after spending $1,000 on purchases within the first 3 months. And the Capital One Venture card offers 50,000 Venture miles (worth $500 in travel) after spending $3,000 on purchases within the first 3 months.

I’ll show you what I like about the Capital One Venture cards. But why folks new to miles & points might do better with different cards.

Capital One Venture Card Review

Capital One Venture miles are flexible points that you can use for nearly any travel purchase, like taxi rides, hotels, room service, and free flights. And you won’t have to worry about searching for available award seats or hotel nights!

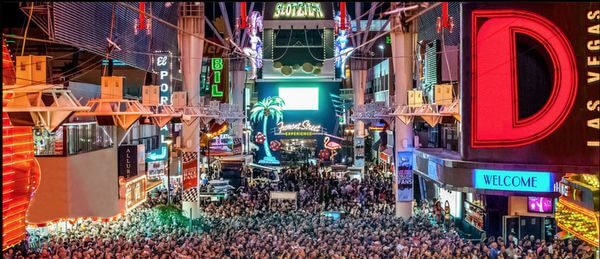

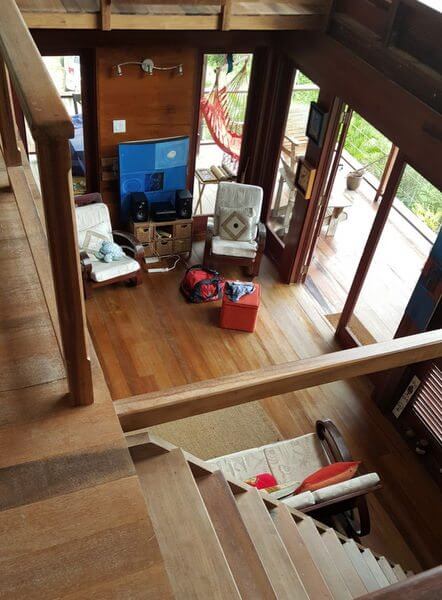

Team member Joseph has the Capital One Venture, and has used it for free room service in Dubai, as well as a free Airbnb stay in Barbados. He says it’s extremely easy to redeem the miles, and he’s reimbursed for his travel purchases within a day or two!

Joseph also thinks it’s cool that the metal card is noticeably heavier than other metal cards like the Chase Sapphire Preferred Card.

To be approved for either of these cards, Capital One suggests you only apply if you have “excellent credit.” Capital One describes excellent credit to be anyone who has:

- Never declared bankruptcy or defaulted on a loan

- Has not been more than 60 days late on a loan in the past year

- Has had a loan or credit card for 3+ years with a credit limit of $5,000+

So if this describes you, you have a good chance at being approved for these cards! Here’s what you can expect:

1. Capital One VentureOne

Link: Capital One® VentureOne®

The Capital One VentureOne comes with 20,000 Venture miles (worth $200 in travel) after spending $1,000 on purchases within the first 3 months.

You’ll also get:

- 1.25 Venture miles per $1 you spend on all purchases

- 10 Venture miles per $1 you spend on hotel stays booked and paid through this Hotels.com link (through January 31, 2020)

- NO foreign transaction fees

- NO annual fee

Everyone should have a no annual fee card. It helps increase the average age of your credit accounts. This is especially important if you apply for & cancel cards frequently.

2. Capital One Venture

Link: Capital One® Venture® Card

The Capital One Venture card offers 50,000 Venture miles (worth $500 in travel) after spending $3,000 on purchases within the first 3 months.

You’ll also get:

- 2 Venture miles per $1 you spend on all purchases

- 10 Venture miles per $1 you spend on hotel stays booked and paid through this Hotels.com link (through January 31, 2020)

- Statement credit for Global Entry or TSA PreCheck

- NO foreign transaction fees

- $95 annual fee, waived the first year

If you don’t already have Global Entry or TSA PreCheck, you don’t know what you’re missing! You’ll save hours at the airport, not to mention a lot of hassle. For example, with TSA PreCheck, you won’t have to take off your shoes or remove your laptop from your bag at domestic security checkpoints.

And because of the Capital One Venture’s $95 annual fee, you’ll have to spend at least $12,667 each year for the card to be more profitable than the no annual fee Capital One VentureOne ($95 annual fee / 0.75 cents difference in rewards earnings) if you decide to keep it for more than a year.

Note: Multiple data points show that the Capital One Venture can NOT be downgraded to a no annual fee card. But a few lucky folks have had success. So it’s worth a try if you’re thinking about canceling your card because of the annual fee.

If you are able to downgrade your card, just remember to use it once every ~6 months! Or Capital One might close your card.

Both cards have Visa Signature Benefits, which include:

- Rental car insurance – Secondary protection against collision or theft

- Travel accident insurance – Up to $250,000 insurance for accidental loss of life, limb, sight, speech or hearing

- Lost luggage insurance – Up to $3,000 per trip, provided the luggage was lost from theft or misdirection by the airline, cruise, etc.

How to Redeem Venture Miles

Venture miles are worth 1 cent each. You can use your miles as a credit towards most travel purchases you make on your card, such as airfare, hotels, Uber, and more!

To redeem your miles for travel, just buy travel like you normally would with your card. Then, you have 90 days to sign-in to your online account, find the travel purchase, and “erase” it with your miles!

I like that these cards have NO minimum redemption increment when redeeming miles, unless you’re using miles to partially pay for a travel purchase. In that case, the minimum is 2,500 miles ($25).

Note: Capital One also has a site similar to the Chase Ultimate Rewards Travel Portal called No Hassle Rewards portal. Through this site, you can book travel with your miles instead of purchasing your travel and erasing it later. If you use the portal, there is no minimum miles requirement to book.

Whether you choose to redeem your points through the No Hassle Rewards portal or by erasing your purchase later, you’ll still get a value of 1 cent per point.

Are These Cards Right for You?

If you’re just starting out in miles & points, and plan to apply for lots of cards later, these are NOT good cards for you. There are other credit cards with much higher sign-up bonuses that earn more valuable points and have better travel benefits.

Opening these cards could decrease your chances of being approved for great Chase cards later on. That’s because if you’ve opened 5+ cards in the past 24 months (with the exception of certain small business cards), Chase will NOT approve you for many of their cards (though there are some exceptions).

However, if you already have all the Chase cards you want, and you’re looking for other cards to get Big Travel with Small Money, these are definitely worth a peek!

The best thing about these cards is the sign-up bonuses. You’ll get either $200 or $500 in free travel, depending on which card you apply for, after you’re approved and meet minimum spending requirements.

But the rewards are less useful than any cash back cards. I’ll explain!

Other Credit Card Options

Link: Citi® Double Cash Card

Link: Chase Freedom

There are other credit cards with equal or greater rewards earning rates, like the the no annual fee Citi Double Cash or Chase Freedom.

For example, the Capital One Venture earns an effective 2 miles per $1 spent. But the Citi Double Cash earns 1% cash back on purchases, and 1% cash back when you pay your bill.

That might sound like the same earning rate, but earning cash back is better, because you can spend cash on anything.

That said, there are some positives that these other cash back cards don’t offer:

- No annual fee cash back cards do NOT usually come with a sign-up bonus

- You’ll earn a flat amount of points per $1 (2 points with the Capital One Venture, 1.25 points with the Capital One VentureOne), so you don’t have to worry about category bonuses.

- Data points show the rewards deposit almost immediately after your purchases post to your account. So you can start redeeming again in just a day or two!

Note: Capital One pulls your credit score from all 3 main credit bureaus, giving you 3 hard inquiries on your report! This isn’t ideal, because hard inquiries cause your credit score to temporarily dip.

The information for the Capital One Venture, Capital One VentureOne, Chase Freedom has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

Bottom Line

The Capital One VentureOne and Capital One Venture cards are great for folks who can’t rely on available award flights and hotels. If you’re someone who does NOT have the luxury of flexible travel dates and times, these cards might be right for you!

The Capital One VentureOne comes with 20,000 Venture miles (worth $200 in travel) after spending $1,000 on purchases within the first 3 months. And the Capital One Venture card offers 50,000 Venture miles (worth $500 in travel) after spending $3,000 on purchases within the first 3 months.

Both cards have NO foreign transaction fees, so they’re good cards to use internationally.

Remember, these are NOT good cards to apply for if you’re just beginning your miles & points career. Because there are other better travel rewards cards you consider first.

What are your thoughts on these offers from Capital One?

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!