Will opening credit cards hurt your credit score? Here’s what you need to know

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

By far the number one question I get from people who are interested in learning how to travel cheaply thanks to travel credit cards is: “Doesn’t that hurt your credit score?”

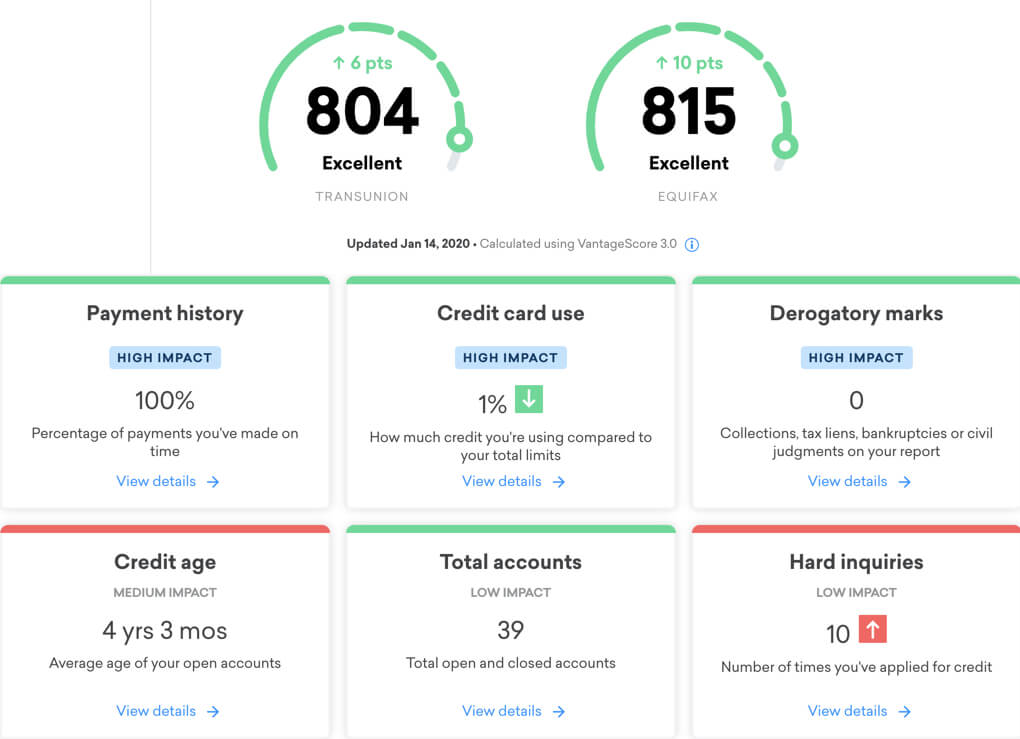

I’ve opened dozens of credit cards over the years and my credit score currently is sitting above 800. So racking up miles and points with rewards credit cards doesn’t have to tank your credit score. Here’s what you need to know and credit cards and how they impact your credit score.

Credit cards and credit score

Your credit score is comprised of the following factors:

- 35% payment history

- 30% amounts owed/credit utilization

- 15% length of credit history/average age of accounts

- 10% new credit

- 10% types of credit

How credit cards impact your credit score?

When you open a new credit card you will see a temporary dip in your credit score (usually 3-7 points) when the hard inquiry shows up on your report. Opening a new account also will decrease the age of your accounts. But those factors carry less weight and when you open a new account you’ll have access to more credit, which should improve your credit utilization ratio. The key is to be sure to pay off your balance in full each month.

Take this example, if you have $5,000 in credit and put $1,000 in spending on your card every month you are using 20% of your available credit. If you opened a second card with a $5,000 credit limit your monthly credit utilization would drop to 10% because you just doubled the amount of credit you have access to. Another tactic you could use is to pay off your card before the statement closes so that a balance of zero will appear on your credit report.

Also, I hold quite a few credit cards with no annual fee, that way I can keep those accounts open long-term (without paying fees) to help increase the age of my accounts.

What credit score do I need to get a credit card?

To have the best chance of being approved for the best travel cards you’ll want a credit score of at least 700. Below are the general classifications each score falls into and a good card option for each one:

- Very good to excellent: 740+, you could apply for a card with top-tier benefits like the Chase Sapphire Reserve® or The Platinum Card® from American Express.

- Good: 670-739, consider the Chase Sapphire Preferred® Card is our #1 card for beginners.

Having a high credit score is important, but a credit score of 780 or 820 won’t necessarily improve your chances of getting that next card compared to a score of 750. Also, you can have a pristine credit score and still get denied for a card because your credit score isn’t the only thing a bank considers when you apply. Many banks of specific application rules and there are even sometimes applications restrictions attached to a specific card. For example, you aren’t eligible for the intro offer on an American Express card if you’ve ever had that card before (or you currently have it). And you won’t be approved for any Chase credit card if you’ve opened five or more cards from any bank (not counting most business credit cards) in the past 24 months. Chase also limits you to having only one personal Southwest credit card at a time.

How does your credit score affect your credit card application?

Your credit score is a big factor in whether or not you’ll get approved for that shiny new card. So having a higher score is always a good idea, but it won’t only improve your chances of being approved it can also save you money down the line. Having a healthy credit score makes you eligible for the best interest rates on credit cards and loans.

So it really can pay off to work toward building and maintaining a score above 740. It’s also a bit of a catch-22 because paying off your credit card debt is a good way to increase your score, but if you don’t carry a balance on your card it won’t matter what the interest rate is because you won’t be paying interest.

Bottom line

Credit card rewards are a great way to put a huge dent in your vacation expenses and you don’t have to sink your credit score to make it happen. As long as you start slowly and pay off all your bills in full and on time you’re good to go. My wife and I have both opened dozens of credit cards in the past few years and we both have credit scores of 800+.

| For more travel and credit card news, deals and analysis sign-up for our newsletter here. |

Featured photo by garagestock/Shutterstock.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!