$2,300+ Worth of Airfare With 1 Sign-Up Bonus!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.I was excited to be approved for the limited-time AMEX Platinum Business Card offer.

Between the 100,000 point welcome bonus and points from the minimum spending requirement, I earned more than 115,000 AMEX Membership Rewards points. That’s almost triple the amount you’d normally earn with The Business Platinum® Card from American Express OPEN!

These points are worth at least $2,300 in paid airfare because of the card’s Pay With Points perk. So it’s a fantastic card for folks looking to get Big Travel!And this is an AMEX small business card. So it does NOT count toward card limits for new Chase applications!

Activating the AMEX Business Platinum was a breeze! I’ll show you how to do it!

American Express Business Platinum Activation

Link: The Business Platinum® Card from American Express OPEN

Link: My Review of the American Express Business Platinum Card

It’s always fun to activate a new card and begin working toward earning the sign-up bonus. Plus, with the AMEX policy, I know I’ll only get the Business Platinum sign-up bonus ONCE in my lifetime. So I’ll enjoy be sure to enjoy this bonus!

My AMEX Business Platinum card came 2 days after I was approved.

Here’s how to activate the card once it arrives.

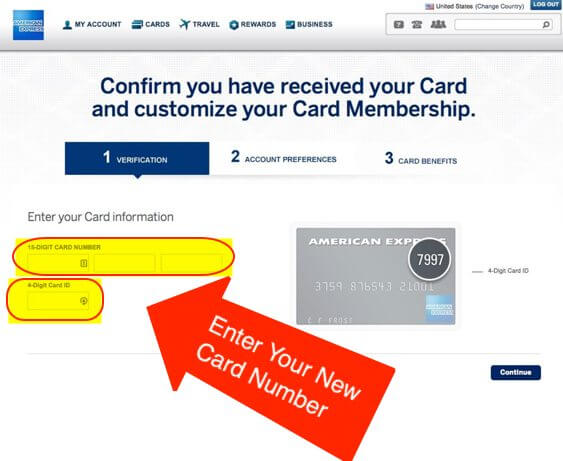

Step 1. Enter Your Card Number

You can visit the dedicated AMEX website for activating new cards. Then, enter your new card number.

Step 2. Set Paperless Billing Settings

Next, you’ll have the option to enroll in paperless billing. This is a personal choice, but I prefer less paper. And it’s better for the environment!

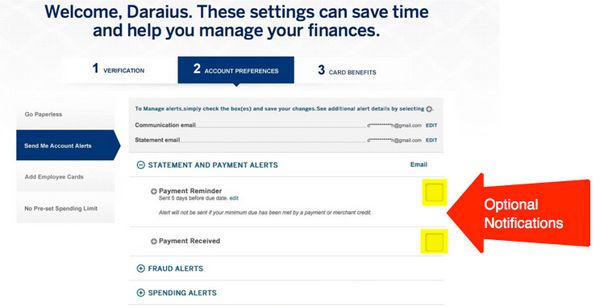

Step 3. Set-Up Account Alerts

During the activation process, you can also establish account alerts for things like payment reminders, fraud notices, and spending alerts.

You’ll have the option to change your account settings afterward. But it’s a good to set-up at activation, so it’s one less thing to worry about in the future.

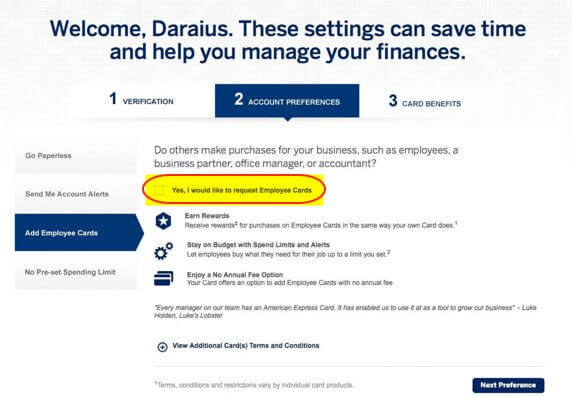

Step 4. Add Employee Cards

You can choose to add employee cards. Remember, you’ll earn points from purchases made by employees linked to your account.

But consider any fees you’ll have to pay. To add employees with Business Platinum cards, you’ll have to pay a $300 annual fee.

But you’ll also have a free option to add American Express Green Corporate cards.

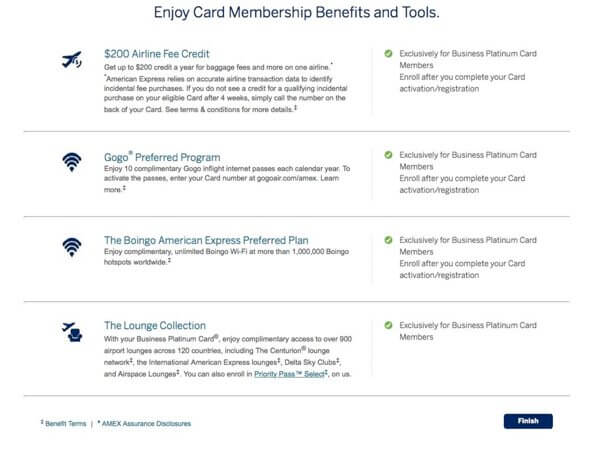

Step 5. Review Your Benefits and Begin Using the Card

You’re all set!

Before using your card, you can review the benefits of your card, like earning 1.5X AMEX Membership Rewards points on large purchases of $5,000+.

Plus, the card has other terrific perks like a $200 airline fee credit and gets you access to airport lounges!

Why I Got the Business Platinum Card

Link: If You Don’t Know This AMEX Secret, You’re Missing Out!

Link: Now Get 50% of Your Points Back With AMEX Business Platinum

I took advantage of the Business Platinum offer because it’s the highest public welcome bonus I’ve seen for the card.

In addition, the card comes with perks like:

- 1.5X AMEX Membership Rewards points on single purchases of $5,000+

- 50% of your points back for ALL First Class or Business Class flights booked through the AMEX travel portal using Pay With Points

- 50% of your points back for all flights, including coach tickets, booked with your selected airline through the AMEX travel portal using Pay With Points

- $200 in statement credits per calendar year for airline incidentals with your selected airline (luggage fees, in-flight food & drink, etc.)

- Access to airport lounges (Delta, Priority Pass, Airspace, and American Express Centurion Lounges)

- Statement credit for Global Entry or TSA PreCheck

- Free Hilton HHonors Gold elite status (free breakfast and upgrades when available)

This card does have a significant minimum spending requirement to earn the 100,000 points. You’ll have to spend a total of $15,000 on the card within the first 3 months to get the full bonus.

But with an upcoming blog redesign, I was able to put a large dent in the spending requirement. Other small business owners might have large purchases to make at the end of this year or early next year that can help hit the minimum spending.

The AMEX Business Platinum has a $450 annual fee that’s NOT waived. But using the Pay With Points perk to book paid airfare through the AMEX travel portal, I’ll get at least $2,300+ worth of paid airfare using points earned from the welcome bonus and minimum spending requirement.

If you’re considering this card, keep in mind American Express small business cards are often relatively easy to get.

Bottom Line

I applied for the The Business Platinum® Card from American Express OPEN because of the increased 100,000 AMEX Membership Rewards point sign-up bonus and Pay With Points perk, which will save me lots of money on airfare.

The points earned from the welcome bonus and $15,000 minimum spending requirement are worth at least $2,300. That’s amazing for just 1 card bonus!

That’s why I was excited to activate the card when it arrived!

Do you plan on taking advantage of the limited-time AMEX Business Platinum card offer?

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!