What to Do if You’re Not Eligible for the Chase Sapphire Reserve Bonus!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.Are you disappointed in not getting approved for the Chase Sapphire Reserve because you’ve opened ~5+ credit cards in the last 24 months?

Or maybe you’re uncertain if Chase will approve you and aren’t sure what to do?

The good news is, there are still ways to earn Big Travel with Small Money with Chase and other bank cards.

I’ll share strategies to help you decide what to do.

Can’t Get Chase Sapphire Reserve?

Link: My Review of the Chase Sapphire Reserve

Folks who’ve been at this hobby for a while often apply for lots of credit cards (including me!). That’s because earning miles and points from big sign-up bonuses and credit card spending is the fastest way to get Big Travel with Small Money.

So many of us don’t qualify for cards like the Chase Sapphire Reserve because of Chase’s stricter application rules. That means if you’ve opened ~5+ cards from any bank (except certain business cards) in the past 24 months, it’s unlikely you’ll be approved for most Chase cards.

That said, there are Chase cards that are exceptions to the rule. And if you’ve lost track of how many cards you’ve opened, see my post on how to easily find your Chase 5/24 status.

But if you have your heart set on the Chase Sapphire Reserve, consider these options!

1. Wait It Out

If you haven’t opened many cards recently, but still fall under the Chase “5/24” rule, it may be worth holding off on card applications until your credit report shows fewer than 5 cards opened in the past 24 months.

But folks who’ve recently opened a lot of cards might have to wait a year or more. So there’s an opportunity cost, because you’ll potentially miss out on other lucrative credit card sign-up bonuses in the meantime.

And keep in mind, the 100,000 Chase Ultimate Rewards point sign-up bonus on the Chase Sapphire Reserve may not last forever. So there’s a risk the sign-up bonus could be reduced while you’re waiting.

A Possible Workaround

Should you choose to stop applying for new cards for the time being, it’s still possible to earn sign-up bonuses for Big Travel. If you have a small business, remember most big banks do NOT report small business cards to your personal credit report as long as you pay on time.

So you could shift your focus to opening small business cards only until your personal credit report shows fewer than 5 cards opened in the past 24 months.

It’s up to you to decide if the Chase Sapphire Reserve is so compelling that you’re willing to forego other personal cards in the meantime.

2. Take a Chance, but Have a “Plan B”

Folks who aren’t sure if they’re impacted by the “5/24” rule, perhaps because they’re authorized users on other accounts or opened small business cards from smaller banks, could still take a chance on applying for the Chase Sapphire Reserve.

But have another Chase card NOT impacted by the tighter rules in mind should you get denied.

For example, the Chase Ritz-Carlton has a terrific sign-up bonus of 3 complimentary nights at tier 1 to 4 Ritz-Carlton hotels after meeting minimum spending. And it has many similar benefits to the Chase Sapphire Reserve, like a $300 annual travel credit and travel insurance.

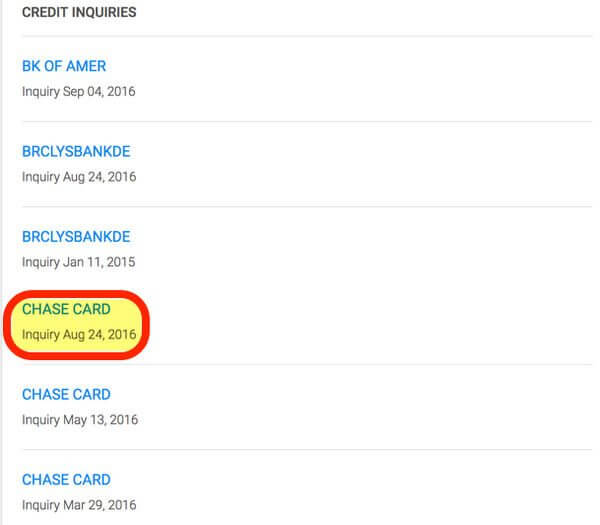

So, if you’re denied for the Chase Sapphire Reserve, you can apply for your second choice card on the same day. This way, you won’t waste a credit inquiry, because Chase will likely combine the credit pulls. This lessens the impact on your credit score.

Remember, even though certain Chase cards aren’t impacted by the tighter application rules, there’s no guarantee you’ll be approved. It depends on your credit score, the amount of credit Chase has already extended you, and other factors.

3. Product Change

Perhaps you’re most interested in the ongoing benefits of the Chase Sapphire Reserve, like earning 3X points on travel and dining, Priority Pass lounge access, 1.5 cents per point when you book paid travel on the Chase Travel Portal, travel accident insurance, emergency medical and dental coverage, and medical evacuation insurance.

You could consider a product change from one of your existing Chase Ultimate Rewards point-earning cards, like the Chase Sapphire Preferred, Chase Freedom, or Chase Freedom Unlimited.

You will NOT earn the Chase Sapphire Reserve 100,000 point sign-up bonus. But you’ll get all the other benefits of the card. And it won’t disqualify you from earning the bonus in the future if you meet the right conditions. Note: I spoke to a Chase representative who said it’s not guaranteed they’ll allow you to upgrade the card. It depends on your personal banking profile with Chase.4. Sign-Up for Other Premium Cards

There are cards from other banks that offer good sign-up bonuses and similar perks, like travel credits and lounge access. If that’s what you’re after, consider cards like:

- The Business Platinum® Card from American Express OPEN – Earn up to AMEX 100,000 Membership Rewards points after meeting tiered minimum spending requirements, 1.5X AMEX Membership Rewards points on single purchases of $5,000+, 50% of your points back for ALL First Class or Business Class flights booked through the AMEX travel portal using Pay With Points, $200 annual travel credit. Here’s my review of this offer, which ends on January 25, 2017.

- The Platinum Card® from American Express Exclusively for Mercedes-Benz – 50,000 AMEX Membership Rewards points after meeting minimum spending, 5X points on airfare, Priority Pass Select, Airspace, Centurion, and Delta lounge access, $200 annual travel credit. Here’s my review of the American Express Mercedes-Benz Platinum.

- The Platinum Card® from American Express – 40,000 AMEX Membership Rewards points after meeting minimum spending, 5X points on airfare, Priority Pass Select, Airspace, Centurion, and Delta lounge access, $200 annual travel credit. Here’s my review of the American Express Platinum.

- Citi® / AAdvantage® Executive World Elite™ Mastercard® – 50,000 American Airlines miles after meeting minimum spending, Admirals Club membership, authorized user Admirals Club access. Here’s my review of the Citi AAdvantage Executive.

- Citi Prestige® Card – 40,000 Citi ThankYou points after meeting minimum spending, bonus points on travel, dining, and entertainment, Priority Pass Select lounge access, $250 annual airfare credit, 4th night free on paid hotel stays. Here’s my review of the Citi Prestige.

Bottom Line

If you’re not eligible for the Chase Sapphire Reserve because of Chase’s tighter application rules, there are ways to get cards with similar perks!

Consider:

- Holding off on applying for cards until your credit report shows fewer than 5 new cards in the past 24 months (and remember most small business cards won’t show up on your credit report!). Here’s how to check!

- If you’re not sure whether you’ll be approved, try applying. But have a second Chase card (not affected by the 5/24 rule) in mind (like the Ritz-Carlton card) should you be denied, and apply for it the same day so you’ll only get one credit pull.

- Upgrade one of your other Chase Ultimate Rewards points-earning cards to the Chase Sapphire Reserve, but remember you won’t earn this sign-up bonus

- Apply for cards with similar perks, like lounge access, from other banks

Let me know if you have other ideas, and please share your experiences applying for the Chase Sapphire Reserve!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!