Hilton Business credit card review: 125,000 Hilton points, airport lounge visits and elite status

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

If you’re a Hilton Honors fan with a small business, the Hilton Honors American Express Business Card can turn your company expenses into free award nights and earn you a whopping 125,000 bonus Hilton points after spending $3,000 on purchases in the first three months of account opening.

This is a terrific welcome bonus and the card comes with lots of other perks. In this Hilton business credit card review, I’ll share ideas on how to qualify and ways to use the Hilton business card’s bonus.

Who is the Hilton Business card for?

If you qualify for a small business card and are looking for an excellent way to earn a stash of Hilton points, you shouldn’t overlook the Hilton Business card. Plus, Amex business cards won’t appear on your personal credit report, so they won’t count toward your Chase 5/24 limit).

Qualifying for a small-business credit card isn’t as complicated as you might think. You don’t need to be a huge corporation to open a small-business card. You can often use your own name as the legal business name and your Social Security number as your business tax ID.

If you think you’ll qualify for the card and you’re ready to apply, check out our step-by-step guide on how to complete an Amex business card application. Keep in mind, you can only earn the welcome bonus on an Amex card once per lifetime.

Hilton business credit card bonus

When you open the Amex Hilton Business Card, you’ll earn 125,000 Hilton points after spending $3,000 on purchases in the first three months of card membership. You can learn more about how to meet the credit card minimum spend here.

The $95 annual fee is not waived for the first year (see rates & fees), but with the big welcome offer and Gold Hilton elite status, it’s easily worth it.

For example, you’ll get free breakfast at Hilton hotels because of the Gold elite status that comes with this card. For longer stays, you’ll always get the fifth night free on award stays. I found rooms at the Hilton Vienna Danube Waterfront for 29,000 Hilton points per night. Four nights would cost 116,000 Hilton points, but you could get the fifth night for no added points and free breakfast each morning of your stay.

If you paid cash for this same stay it would set you back $650+ and that’s not including the free breakfast.

Benefits and perks of the Hilton business credit card

The Amex Hilton business card comes with perks you won’t find on other cards.

Free weekend nights

If you’re a big spender, this card is worth keeping long term. You’ll earn free weekend nights (to use on Friday, Saturday, or Sunday) — one after spending $15,000 and a second with an additional $45,000 ($60,000 in total) in purchases in a calendar year.

You can use these weekend nights at almost any Hilton hotel, including the Conrad Bora Bora Nui, which can easily cost $1,500+ per night.

Spend your way to elite status

You’ll earn Diamond Hilton status, the highest elite status, after spending $40,000 on purchases in a calendar year. That comes with benefits like a 100% bonus on base points, room upgrades, and guaranteed access to hotel lounges. So by spending $60,000 on the card, you’ll earn two weekend nights and Hilton Diamond elite status.

Ten Priority Pass lounge visits

Folks who don’t have lounge access with another card will appreciate the 10 Priority Pass lounge visits per year. Considering day passes can be ~$50 if the lounge even sells them, this perk alone can cover the annual fee if you can use it.

Free ShopRunner membership

You’ll get a free ShopRunner membership with the card, which gets you free 2-day shipping at 100+ stores.

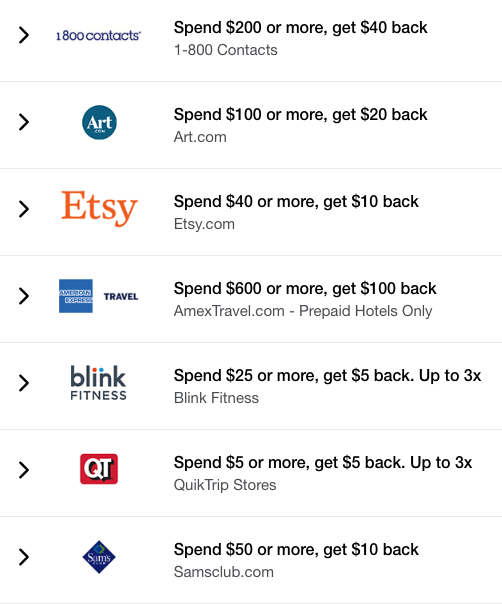

Access to Amex Offers

Amex Offers are an easy way to save on purchases you might make anyway.

I’m always adding and redeeming these offers for bonus points, promotion codes, and statement credits. All you have to do is add them to your card and spend like normal.

Rental car insurance

You can get primary rental car insurance with the card when you enroll in the American Express Premium Car Rental Protection program for up to 42 days. You must decline the rental agency’s collision insurance and charge the entire rental to your Amex Hilton small business card to use the benefit. Keep in mind, you will pay for the premium car rental insurance.

If you rent vehicles for business often, this can be a tremendous money-saver and give you peace of mind. But you must opt in to get coverage. If you don’t, coverage is secondary and covers up to a maximum of $50,000 per rental agreement. The secondary coverage is complimentary.

Extended warranty

When you purchase an item with your card, Amex will extend the original manufacturer’s warranty up to an additional year, on U.S. warranties of five years or less.

Purchase protection

Your purchases are protected from accidental damage or theft for up to 90 days, up to $1,000 per occurrence and $50,000 per calendar year and the coverage is secondary.

Complimentary employee cards

You can add employee cards to your Amex Hilton small-business account for free (see rates & fees). You’ll be able to set individual employee spending limits, plus you’ll earn rewards from their purchases.

How to earn points with the Hilton business credit card

With this card, you’ll earn Hilton points as follows:

- 12x Hilton points at Hilton hotels and resorts

- 6x Hilton points on select business and travel purchases (including wireless phone services from U.S. providers, U.S. restaurants, U.S. gas stations, car rentals, and more)

- 3x Hilton points everywhere else

- Complimentary Hilton Gold status (late checkout, free breakfast at Hilton hotels, complimentary upgrades, 80% bonus on all the Hilton base points you earn)

- Hilton Diamond status after you spend $40,000 on eligible purchases on your card in a calendar year (you can earn an upgrade to Hilton Honors Diamond status through the end of the next calendar year)

- A free weekend night after spending $15,000 on your card in a calendar year

- A second free weekend night after spending an additional $45,000 ($60,000 total) on your card in the same calendar year

- Priority Pass™ Select membership with 10 free visits each year (enrollment required). Each guest you bring costs an additional free visit

- Terms & limitations apply

How to redeem Hilton Honors points earned with the Hilton business credit card

All of the Hilton brands are tailored to different kinds of travelers. Hilton is one of the biggest hotel chains, so there’s likely a Hilton hotel that can meet your needs, no matter where you’re traveling.

Hilton hotels include:

- Conrad

- Canopy

- Curio

- DoubleTree

- Embassy Suites

- Hampton Inn

- Hilton

- Hilton Garden Inn

- Hilton Grand Vacations

- Home2 Suites

- Homewood Suites

- LXR

- Tapestry Collection

- Tru

- Waldorf Astoria

You can earn Hilton Honors points faster than many other hotel chains and it’s free to pool your Hilton points with up to 10 friends and family each year. So booking expensive awards should be easier.

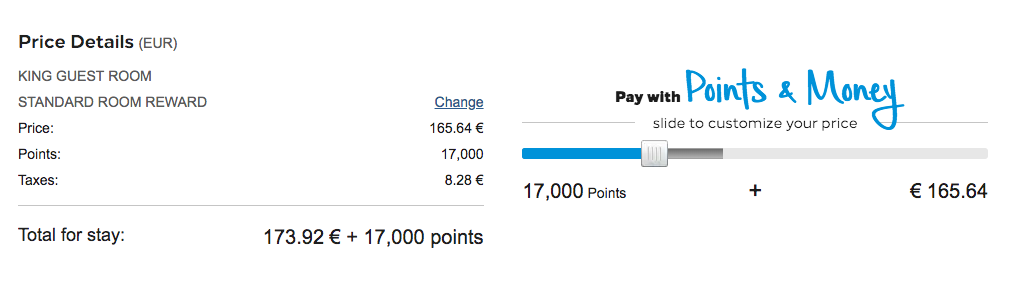

Hilton also gives you the option to pay for part of your award stay with points using the Points & Money feature. This is a great way to stretch your points even further.

Top-tier Hilton hotels can cost 95,000 Hilton points per night. So after you meet the Amex Hilton small-business card’s spending requirements, you could use your 125,000 points to book a night at the best Hilton locations, like the Conrad Maldives, which can cost $1,400+ per night.

Or use the points to book a cheaper hotel, like the Hilton Garden Inn Kuala Lumpur Jalan Tuanku Abdul Rahman North, for more than two weeks. It can cost 10,000 Hilton points per night or less. Because you’ll get automatic Gold status when you have the Amex Hilton small-business card and therefore the fifth night free, you can stay 15 nights with 120,000 Hilton points (10,000 points per night X 15 nights = 150,000 points – 30,000 points for the 5th, 10th, and 15th night free).

Is the Hilton Business credit card worth it?

If you make the most of just one of the perks, like free breakfast with Gold elite status, or use a few of the Priority Pass lounge passes, it’s easy to get more value from the benefits than the cost of the annual fee.

Plus, all the other benefits, including Amex Offers, a free ShopRunner membership, and free weekend nights for big spending, only add to the value.

Some aren’t as meaningful if you get the same perks with other American Express cards you might already have. But if you spend a lot in the bonus categories, it might be worth it to earn extra Hilton points for award stays throughout the year.

Credit cards similar to the Hilton business credit card

There are four Amex Hilton credit cards. They all earn Hilton points, but they’re all different as far as annual fees, benefits and which categories earn bonus Hilton points.

The Amex Hilton small-business card is the only card aimed at small businesses, but if you’re looking to have access to even more lucrative perks you should consider the The Hilton Honors American Express Aspire Card. It not only has the largest intro offer of any of the Hilton cards (150,000 points after spending $4,000 in the first three months of account opening) it also comes with automatic Hilton Diamond status, up to $250 in airline-fee credits and up to $250 in Hilton credits. All of those benefits make it well worth paying the card’s $450 annual fee (see rates and fees). To learn more about the card, read our full Hilton Aspire card review. The information for the Hilton Aspire card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

Bottom line

The Hilton Honors American Express Business Card has a great welcome bonus and terrific perks like free Gold elite status and 10 Priority Pass airport lounge visits every year.

You can earn 125,000 Hilton points after spending $3,000 in purchases on your card in the first three months of card membership. With this bonus, you could book a long vacation at one of Hilton’s more inexpensive hotels or you could stay a night at a top-tier hotel, like the Conrad Koh Samui.

Qualifying for a small-business credit card is easier than you might think. You can apply as a sole proprietor, and use your own name and Social Security number on your Amex business-card application. And lots of activities, like selling on eBay, renting your room on Airbnb, and driving with Uber or Lyft could make you eligible for a small-business card.

You can apply for the Hilton Honors American Express Business Card here.

For the latest tips and tricks on traveling big without spending a fortune, please subscribe to the Million Mile Secrets email newsletter.

For rates and fees of the Hilton Honors Card, please click here.

For rates and fees of the Hilton Business Card, please click here.

For rates and fees of the Hilton Aspire Card, please click here.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!