Hilton Aspire review: Vastly improved $250 resort credit, annual weekend night and more

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

The Hilton Honors Aspire Card from American Express is one of the best travel cards on the market.

It comes with a welcome offer of 150,000 Hilton points after you make $4,000 in purchases in the first three months of account opening. It’s quite easy to receive a value of ~0.5 cents per Hilton point, so you should have no problem achieving at least $750 in hotel stays from that bonus.

The card also comes with hundreds of dollars in hotel and airline credits, an impossibly valuable annual weekend night and much more.

The information for the Hilton Aspire card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

Amex Hilton Aspire review

Current bonus

The Hilton Honors Aspire Card from American Express comes with 150,000 Hilton points after you spend $4,000 on purchases in your first three months from account opening. You can learn more about how to meet the credit card’s minimum spend here.

We generally consider the median value of a Hilton point to be 0.5 cents. So a 150,000-point bonus should net you at least $750 in Hilton hotel stays. However, you can receive a lot more value if you know where to use them.

For example, 150,000 Hilton points is more than enough for two nights at a fancy hotel like the Rome Cavalieri, A Waldorf Astoria Resort, which consistently sells rooms for ~$440 per night. Or stay closer to home at a gorgeous property like The Reach Key West, A Waldorf Astoria Resort.

You can get more for your points by staying at less fancy hotels. This is the way I prefer to use my points. I find that I save way more by using my points for average hotels. Then I can spend the money I’ve saved on a five-star hotel during my vacation. And Hilton has lots of cheap hotels all around the world.

For example, you can reserve a free night at the Hilton Garden Inn Vienna South in Austria for 10,000 Hilton points. Rooms sell for ~$110 per night. So with 150,000 points, you could receive $1,650 in free nights at this hotel.

benefits and perks

Now, let’s dig into those sweet Amex Hilton Aspire ongoing benefits and perks.

Earning rates

With the Amex Hilton Aspire, you’ll earn (terms apply):

- 14 Hilton points per dollar spent at participating Hilton hotels

- 7 Hilton points per dollar on flights booked directly with airlines or Amex Travel, on car rentals booked directly from select car rental companies and at U.S. restaurants

- 3 Hilton points per dollar spent on all other purchases

COVID-19 benefit enhancement: From May to July 2020, you’ll now earn 12 Hilton points per dollar at U.S. supermarkets. Plus, any bonus points you earn through eligible purchases that post between May 1 and December 31, 2020, will be considered “base points,” and will count towards elite tier qualification and Lifetime Diamond Status.

Annual weekend night awards

When you open the Amex Hilton Aspire, you’ll get an award of a free annual weekend night, valid at nearly every Hilton hotel in the world (excluding these listed here). You’ll get another weekend night every year after you renew your card.

Plus, you’ll earn a second free-weekend-night award at participating Hilton hotels each calendar year in which you spend $60,000+ in eligible purchases on your card. This can more than make up for the $450 annual fee. This is a good card to keep year after year if you can make the most of the free weekend nights.

COVID-19 benefit enhancement: A weekend night can normally only be redeemed for a free night on Friday, Saturday or Sunday. However, Hilton is relaxing this policy due to restricted travel from the coronavirus. Weekend night certificates issued on or before December 31, 2020, can now be used for any night, not just weekend nights. That makes this perk far more useful.

Hilton Diamond elite status

The automatic Diamond elite status (Hilton’s top status tier) is pretty great too, as it includes perks such as:

- 100% bonus points on paid stays

- Upgrades to a suite when available (that can be worth a lot of money)

- Executive hotel lounge access (usually has lots of free food and drinks)

- 48-hour room guarantee

- Complimentary breakfast at all Hilton hotels

- 5th award night free when you book with points

Priority Pass Select membership

With a Priority Pass Select membership, you can access 1,300+ airport lounges worldwide. The Amex Hilton Aspire allows you to bring two guests with you for free. That’s actually better than any lounge membership you can buy, FYI. The most expensive Priority Pass plan costs $429 per year, and still charges $32 per guest.

Travel statement credits

The Amex Hilton Aspire provides a couple high-dollar statement credits each year (read our post on the Hilton Aspire benefits for all the details). My favorite is the Hilton resort credit of up to $250. You’ll receive it when you open your card and each year you renew. If you stay at any of Hilton’s participating resorts, you can use this resort credit toward eligible purchases, including room rate, resort restaurants, spas, etc.

COVID-19 benefit enhancement: Between June and August 2020, you can now redeem this statement credit toward eligible purchases at U.S. restaurants, including takeout and delivery. This means you don’t have to travel to get good use from this perk.

How to redeem points

There are currently 14 Hilton hotel brands (with a couple more coming soon):

- Conrad

- Canopy

- Curio

- DoubleTree

- Embassy Suites

- Hampton Inn

- Hilton

- Hilton Garden Inn

- Hilton Grand Vacations

- Home2 Suites

- Homewood Suites

- Tapestry Collection

- Tru

- Waldorf Astoria

You can cash in your Hilton points for free nights at any of these hotels. Team member Darren is using his Hilton points for free nights at the stunning Conrad Maldives later this year.

Check out this post for a full guide about these different Hilton brands.

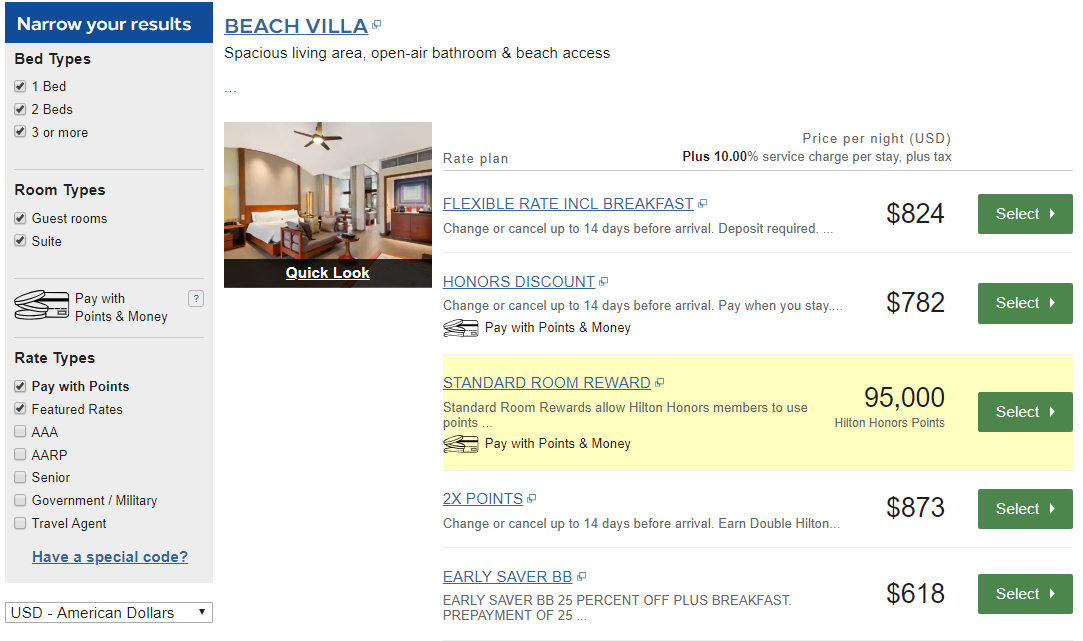

Searching for Hilton hotel nights is easy. Just navigate to the Hilton website and type in your destination. When you’ve found your desired hotel, click “Pay with Points” to see available award nights and points rates for your stay.

You can even choose to split your payment between cash and points. Hilton will offer you a slide bar so you can choose the percentage of money you want to use.

Hilton doesn’t have a proper award chart, so you’ll have to check your specific hotel and date(s) to see how many points you’ll need to pay.

You can also redeem your Hilton points for flights, experiences and other things (though this is generally not a good deal). Check out this post for a full guide on how to use Hilton Honors points.

Is the annual fee worth it?

Few cards are more obviously worth the annual fee than the Amex Hilton Aspire. If you can use even a fraction of its benefits (which we’ll closely examine in a minute), it is unquestionably worth than its $450 annual fee (see rates and fees).

Yes, you’ll receive free upgrades to suites, free breakfast and hundreds of dollars in resort credits each year. But you’ll also get unlimited access to 1,200+ fancy airport lounges worldwide and various kinds of travel insurance.

Who is this card for?

If you find Hilton resorts fit your travels (and there are hundreds of them), the Amex Hilton Aspire is for you. Even if you’re not a loyal Hilton customer, this card can single-handedly revolutionize your travel — even outside the hotel.

Just note that Amex only allows you to receive each of their cards’ welcome bonuses once per lifetime. If you’ve opened the Amex Hilton Aspire in the past, you won’t be eligible for its bonus again.

Also, this is considered a premium travel card. You’ll need a credit score over 700 if you plan to apply.

Insider tip

The Amex Hilton Aspire proudly touts a reusable property credit worth $100 per eligible 2+ night stay with Conrad or Waldorf Astoria. You’ll get a hotel credit equal to $1 for each dollar of qualifying charges made at the hotel, up to $100. The property credit is applied as a hotel credit on your bill at checkout.

However, some readers have noticed that the rates associated with the promo code are nowhere near the lowest when compared to other rates, like the Hilton member rate and AAA rate. If you’re not careful, you may end up paying more than this $100 credit is worth.

Credit cards similar to the Hilton Aspire

If you’re freaking out at the prospect of a $450 annual fee, there are other Hilton cards that can serve you.

The Hilton Honors American Express Surpass® Card comes with 130,000 Hilton Honors bonus points plus a free night reward after you spend $2,000 in purchases on the card in the first three months of card membership. It also comes with complimentary Gold elite status. You can earn Diamond elite status after you spend $40,000 on eligible purchases with your card in a calendar year (valid through the end of the next calendar year after it’s earned).

The card also gives you 10 complimentary Priority Pass airport lounge visits each year, but each guest counts as one of your visits. You can even earn one free weekend night after you spend $15,000 on purchases in a calendar year.

This card has a $95 annual fee (see rates and fees), but you can achieve many of the same benefits as the Amex Hilton Aspire if you’re a big spender.

The information for the Hilton Surpass has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

Bottom line

With the Amex Hilton Aspire, you’ll earn 150,000 Hilton points after spending $4,000 on purchases in the first three months from account opening. There’s a $450 annual fee, which is not waived for the first year.

You could effortlessly receive $750+ in free travel at terrific hotels — even pricey resorts — with that bonus. Or stretch your points for more nights at less fancy hotels (which is my favorite way to use hotel points).

The Amex Hilton Aspire has a load of ongoing benefits that can save you a ton (terms apply):

- Annual weekend-night award (at participating Hilton hotels)

- Automatic Diamond elite status (100% bonus points on paid stays, upgrades to a suite when available, executive hotel lounge access, etc.)

- Priority Pass Select airport lounge access (bring two guests for free)

- Up to $250 annual airline-fee credit

- Up to $250 annual Hilton resort credit

- Up to $100 property credit at Conrad and Waldorf Astoria hotels per stay of 2+ nights

- Terms Apply

Between these benefits and the welcome bonus, you could easily receive $2,500 in travel from this card the first year, and $1,000+ every following year.

For rates and fees of the Hilton Surpass Card, please click here.

For rates and fees of the Hilton Aspire Card, please click here.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!