Our guide to applying for an Amex small business card

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Don’t be intimidated by the idea of applying for a small-business American Express card. It’s not as scary as you might imagine. Conquer your fear and a whole new world of miles and points will open up to you.

You might worry that applying for a business credit card is difficult, but being approved for an Amex small-business card is relatively easy. You don’t need to be a multimillion dollar company to be approved. Something you already do – like freelancing, tutoring or driving for Uber – may qualify you for a small-business card.

The application is straightforward, here’s an update on what you need to know.

Why consider small-business cards?

Here’s the million-dollar secret about opening small-business cards: Most do not appear on your personal credit report. This means that opening an Amex small-business card won’t hurt your chances of being approved for Chase credit cards later on. If you’ve opened five or more credit cards from any bank in the past 24 months (excluding most small-business cards), Chase won’t approve you for some of their best cards.

Business credit cards are an easy way to get extra miles and points if you’re self-employed or simply have a side hustle. Lots of folks may qualify for small-business cards without realizing it. For example, if you’re a freelance writer, a tutor or a seller on eBay or Etsy, you could be eligible for a small business card.

Business credit cards do not come with all the consumer protections of a personal rewards credit card. For example, banks can raise the annual percentage rate (APR) on your small-business card without warning (which they can’t do with a personal travel credit card). Understand the card benefits so you use the best credit card for your purchases.

Keep in mind, that the Amex welcome offer rules restrict you from earning a welcome offer on the same card more than once. So if you’ve had a card before, you can’t earn the welcome offer when you open the card again. Before filling out the application, make sure you apply for the card with the highest offer. Amex occasionally targets customers for bigger welcome offers that aren’t publicly available.

How to fill out an American Express business-card application

The American Express small-business card applications are similar to the personal credit card applications, but they have an additional page of required information. Fortunately, all Amex small-business card applications are nearly identical.

Here’s what they look like.

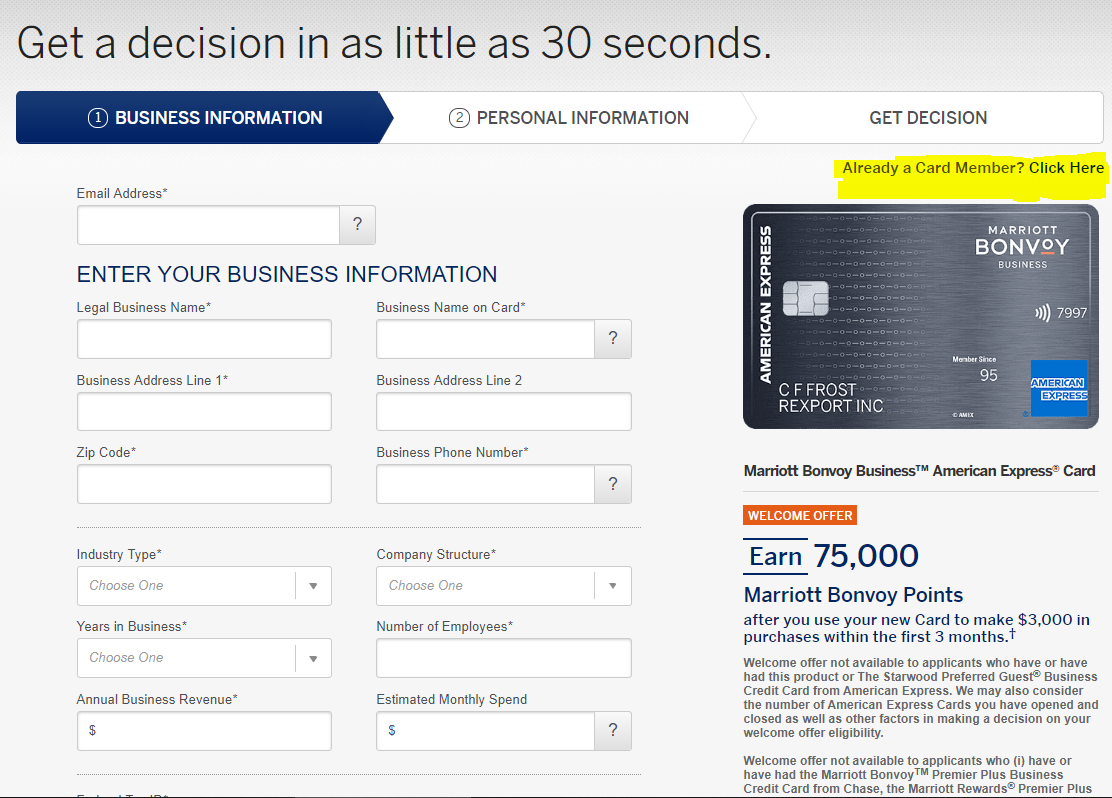

Shortcut for American Express customers

If you are an existing American Express customer, you can click the “Already a Card Member?” button. Then, fill out your user ID and password to have the application automatically enter your existing personal information.

Enter your business information

Here’s how to fill out the form for a business with a sole proprietor:

Legal business name: If you’re a sole proprietor, you can enter your full name as your legal business name.

Business name on card: This is the name of your business that you want printed on the credit card. This can also be your name.

Business address: This is your home address if you run the business from your home.

Industry type: The genre of work you perform.

Company structure: Sole proprietor (if the business is run by one person).

Years in business: This doesn’t mean the amount of time you’ve been making a profit. For example, if you have been thinking of selling homemade cookies for the last 18 months and have been buying ingredients to test different recipes, you can enter “1-2 years.”

Annual business revenue: Enter the total amount you receive annually for selling your products. If you haven’t yet earned anything, don’t fib. Entering $0 is perfectly acceptable.

Estimated monthly spending: Let Amex know how much money you think you’ll put on your card each month to keep your business running.

Number of employees: You have at least “1 employee” (yourself) if you are a sole proprietor.

Federal Tax ID: If you’re a sole proprietor, enter your Social Security number (SSN). The format of the text box in the application is for 9 digits, but in the format of 12-3456789. Your Social Security number is also nine digits, but is formatted as 123-45-6789. As a sole proprietor, your nine-digit Social Security number is your nine-digit Federal Tax ID.

It is very important to fill out all information in credit card applications truthfully. It’s much better to say that you have no annual income than to enter a fictitious amount. In the past, MMS team members have entered revenue of less than $100 and were still approved for a small-business card.

Enter your personal information

Input everything you’d need to enter on a personal credit card application. Again, if you’re already an Amex customer, you can skip this step by signing into your Amex account.

Verify and submit your application

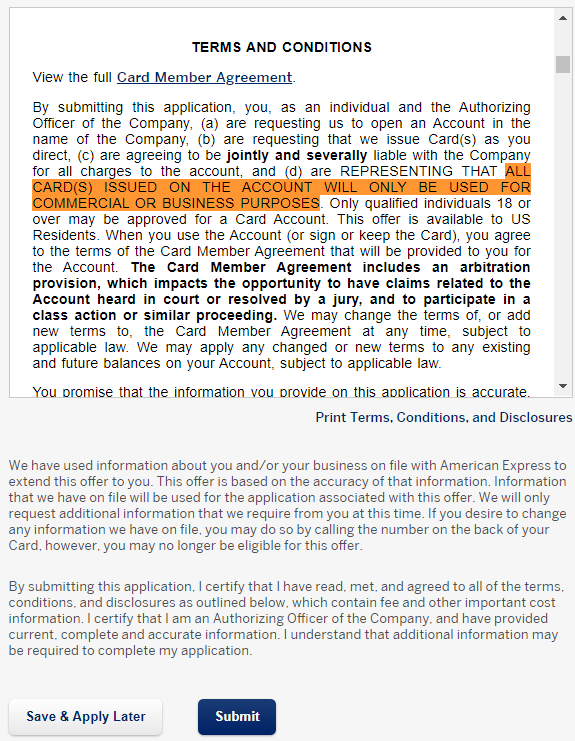

Click the “Verify Application” box to agree to the terms and conditions.

Part of the terms read:

” … ALL CARD(S) ISSUED ON THE ACCOUNT WILL ONLY BE USED FOR COMMERCIAL OR BUSINESS PURPOSES …”

Getting a small-business card is a terrific way to keep your personal and small-business expenses separate. That said, I know people who’ve occasionally used a personal card for business expenses or vice versa. Just know that American Express would like you to use the small-business card only for business expenses. Then, click “Submit Application.”

Wait for approval

If you’re not automatically approved for the card, I recommend you do not call the reconsideration line, but instead wait until you get a message from Amex telling you their decision (or you see the result through your online application status). This will give you two shots at being approved.

If the Amex computers don’t end up approving you, there’s still hope. You can call the reconsideration line and provide more information about your small business. Sometimes, clarifying your situation with a representative can help get you approved.

When you call the reconsideration department, try to get a sense of whether the Amex representative is willing to help you early in the call. If the representative is unwilling to help or appears to be a stickler, politely hang up and call back later.

Top American Express business cards

There are lots of great Amex small-business credit cards to choose from:

- The Business Platinum Card® from American Express – Earn 120,000 Membership Rewards® points after you spend $15,000 on eligible purchases with your Card within the first 3 months of Card Membership. Terms apply.

- The Hilton Honors American Express Business Card – Earn 130,000 Hilton Honors bonus points after you spend $3,000 in purchases on the card in the first three months of card membership. Plus, you can earn up to $130 in statement credits on eligible purchases made on the card at any of the Hilton family hotels in the first 12 months of Membership. Offer expires 7/6/2022.

- Delta SkyMiles® Platinum Business American Express Card -Earn 100,000 bonus miles after you spend $4,000 in purchases on your new card in your first three months of card membership.

Bottom line

Small-business cards are a great way to earn extra miles and points, especially when you’re trying to stay below the Chase “5/24 rule.” That’s because most small-business cards don’t appear on your personal credit report.

You also don’t need an established business to get approved for a small-business card. Many people have small businesses without knowing it. If you have a side gig, like selling items on Etsy, coaching a football team or performing handyman duties for money, you could qualify for a small-business card.

| For more travel and credit card news, deals and analysis sign up for our newsletter here. |

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!