5 Best Small Business Credit Cards for Airbnb Hosts in 2018

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Many of our team members manage vacation rentals on the side to earn extra cash. Harlan and Keith use Airbnb to advertise their listings, while Meghan prefers VRBO. More income is a good thing! And I asked Harlan to share how he earns hundreds of thousands of miles & points each year with his Airbnb business!

Harlan: I currently have 4 Airbnb listings. One of them is a spare room in my home that covers over half my monthly mortgage!

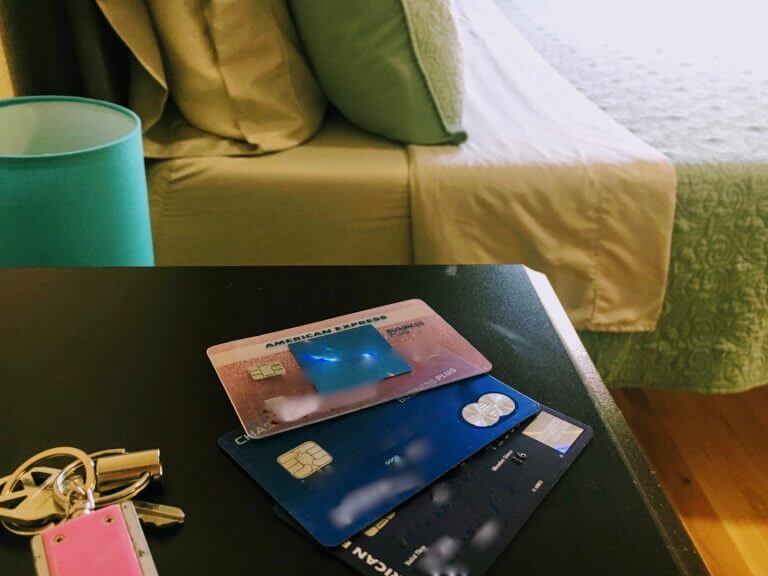

Having a profitable Airbnb side hustle qualifies me for small business credit cards, which I use for all my Airbnb expenses. I earn triple-digit thousands of miles & points every year with a combination of welcome offers, bonus categories, limited-time promotions, and everyday spending – a real Million Mile Secret!

I’ll share my top 5 credit card picks for Airbnb hosts so you can earn extra miles & points for Big Travel with Small Money, too!

5 Best Cards for Airbnb Hosting Expenses 2018

Link: Small Business Credit Cards

Link: Earn Big Miles & Points With These 7 Quick Small Business Ideas

Small business credit cards are an easy way to rack up more miles & points on spending you already have for your business. If you aim to make a profit, you could qualify for small business cards!

When you have an Airbnb, common costs include:

- Bedding and linens

- Towels

- Maid service

- Cleaning products

- Coffee, tea, and snacks for guests

- Internet and cable subscriptions

- Electricity service

- Furniture

I also use credit cards to make rent or mortgage payments via Plastiq. This is my biggest expense. So I love getting tons of points for it!

Keep in mind, Plastiq charges a 2.5% fee. But it could be worth paying to meet minimum spending requirements on a new card. If you pay a lot in rent, you can earn a big sign-up bonus with just a couple of payments.

Here are 5 cards to consider for your Airbnb business. Keep in mind, the best rewards to earn will depend on your travel goals!

1. Chase Ink Cash

Link: Ink Business Cash℠ Credit Card

Link: My Review of the Chase Ink Cash

When you open the Chase Ink Business Cash card, you’ll earn 30,000 Chase Ultimate Rewards points (worth $300) after you spend $3,000 on purchases in the first 3 months from account opening. This card is ideal for Airbnb hosts because you’ll earn:

- 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on cellular phone, landline, internet, and cable TV services each account anniversary year

- 2% back back on the first $25,000 spent in combined purchases at gas stations and restaurants each account anniversary year

- 1% cash back on all other purchases

There’s NO annual fee on this card. And you’ll earn 5 Chase Ultimate Rewards points per $1 spent on internet and cable bills. Plus, you can purchase cleaning supplies, snacks, and a new desk at an office supply store to earn more rewards.

The points you earn with this card can be more valuable if you also have the Chase Sapphire Preferred Card, Chase Sapphire Reserve, Ink Business Preferred, Chase Ink Plus (no longer available), or Chase Ink Bold (no longer available).

Because you can combine flexible Chase Ultimate Rewards points between card accounts and transfer them to travel partners like Hyatt or Southwest. Or you can keep the card on its own and redeem the points you earn for cash back!

Keep in mind, this card is impacted by Chase’s tougher application rules. If you’ve opened ~5+ credit cards (from ANY bank) in the past 24 months, (excluding Chase business cards and certain other business cards) it’s unlikely you’ll be approved.

Here’s how to complete a Chase business card application!

2. Chase Ink Business Preferred

Link: Ink Business Preferred℠ Credit Card

Link: My Review of the Chase Ink Business Preferred

This card is another good choice for Airbnb hosts because it earns:

- 3 Chase Ultimate Rewards points for every $1 you spend on travel, shipping purchases, internet, cable and phone services, advertising purchases made with social media sites, and search engines (up to a maximum of $150,000 in combined purchases per account anniversary year)

- 1X Chase Ultimate Rewards points on all other purchases

When you open the Chase Ink Business Preferred card, you’ll earn 80,000 Chase Ultimate Rewards points (worth $800) after you spend $5,000 on purchases in the first 3 months from account opening. If you spend a lot on internet and TV subscriptions, this card is worth considering because it earns 3 Chase Ultimate Rewards points per $1 spent.

You’ll earn the same rate for travel and shipping purchases (in case your guest leaves something behind), too! Keep in mind the 3X rate is for a combined maximum of $150,000 spent per account anniversary year across all the bonus categories.

Plus, you’ll get $600 in cell phone insurance when you pay your cell phone bill with the card. So you’ll never have to be without your phone for interacting with guests!

The card has a $95 annual fee, which is NOT waived the first year. But it could be worth it to earn the sign-up bonus and use the 3X bonus categories. Plus, you can transfer the points you earn directly to Chase’s travel partners. Team member Jasmin can’t wait to get this card for these very reasons!

Remember, this card is also impacted by Chase’s application rules.

3. AMEX Blue Business Plus

Link: The Blue Business®️ Plus Credit Card from American Express

Link: My Review of the AMEX Blue Business Plus

I love this card because it earns 2X AMEX Membership Rewards points on your first $50,000 in purchases each year, with NO bonus categories to think about (then 1X on the rest)! It doesn’t get easier than that. Plus, there’s NO annual fee on this card (See Rates & Fees).

When I make a purchase not included as a bonus category on another card, I use the AMEX Blue Business Plus card. Little things like key copies, and recurring expenses like cleaning services, go on this card to score easy double rewards points. The value lies in the simplicity. And the rewards add up quick!

And because it’s free to keep, there’s no reason to ever cancel it. This card is always in my wallet.

Here’s how to fill out an AMEX business card application.

4. AMEX Starwood Small Business Card

Link: Starwood Preferred Guest® Business Credit Card from American Express

Link: How to Use Starwood Points

Starwood points are difficult to earn, but extremely valuable. If you have a lot of business expenses, the AMEX Starwood Small Business card is an easy way to earn more!

When you transfer 20,000 Starwood points to an airline partner with a 1:1 transfer ratio, you’ll get 5,000 bonus miles. That means you’ll earn 1.25 airline miles per $1 spent on this card (25,000 airline miles / 20,000 Starwood points). And that’s a better earning rate than most airline cards, which is great if you want to redeem miles for award flights!

Starwood points are versatile. And you could always use them for a stay at a luxurious Starwood hotel, in case an Airbnb isn’t nearby. 😉

5. AMEX SimplyCash Plus

Link: SimplyCash® Plus Business Credit Card from American Express

Link: My Review of the SimplyCash® Plus Business Credit Card from American Express

If you like earning cash back instead of miles & points, consider the AMEX SimplyCash Plus card. You’ll earn a $250 statement credit after spending $5,000 in qualifying purchases on your card within the first 6 months of card membership. And another $250 statement credit after spending an additional $10,000 or more in qualifying purchases on your card within the first year of card membership.

You’ll also get:

- 5% cash back at US office supply stores & on wireless telephone service purchased directly from US service providers on purchases up to $50,000 per calendar year (1% after that)

- 3% cash back in the category of your choice (from a list of 8) on purchases up to $50,000 per calendar year (1% after that)

- 1% cash back on all other purchases.

- No annual fee

- Terms and limitations apply

You can purchase your supplies from office supply stores, and charge your cell phone bill, to make the most of the 5% cash back categories on this card. Then, decide which 3% cash back category you prefer. It can be 1 of the following:

- Airfare purchased directly from airlines

- Hotel rooms purchased directly from hotels (excluding timeshares, banquets, and events)

- Car rentals purchased from select car rental companies

- US gas stations

- US restaurants

- US purchases for advertising on select media

- US purchases for shipping

- US computer hardware, software, and cloud computing purchases made directly from select providers

Depending on what you need for your business, the 3% bonus category could earn you a lot of money!

And if you have $10,000 in spending for your business over the next year (just ~$833 a month!), you stand to put $500 back in your pocket with the current welcome offer. That’s a great deal for a card with NO annual fee!

Bottom Line

As an Airbnb host, you qualify for a small business card if you aim to earn a profit, which is a great way to track your expenses. But it can also help you earn miles, points, or cash back.

The top 5 cards I recommend for Airbnb hosts are:

- Chase Ink Cash

- Ink Business Preferred℠ Credit Card

- The Blue Business®️ Plus Credit Card from American Express

- Starwood Preferred Guest® Business Credit Card from American Express

- SimplyCash® Plus Business Credit Card from American Express

The best card for you depends on your travel goals. And here’s how to apply for a small business card with Chase or AMEX.

If you’re an Airbnb, VRBO, or other vacation rental host, there’s no reason not to earn rewards on your expenses!

For rates and fees of the Blue Business Plus Card, please click here.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!