Hidden gem: Earn 2x points on up to $50,000 per year and pay no annual fee with the Amex Blue Business Plus

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

INSIDER SECRET: You can keep this no-annual-fee small business card (See Rates & Fees) open year after year. That will preserve Amex Membership Rewards points you earn — even rewards from other cards that earned Membership Rewards points if you decide to cancel them.

The Blue Business® Plus Credit Card from American Express is one of my favorite no-annual-fee cards for small businesses (See Rates & Fees). I carry it in my wallet because using it is an easy way to earn bonus Amex Membership Rewards points, which you can transfer to airline and hotel partners like Delta, Hilton, JetBlue, Singapore Airlines and many others.

Amex Blue Business Plus review

The Amex Blue Business Plus Card comes with:

- Welcome offer of 15,000 bonus points after spending $3,000 in eligible purchases within the first three months of card membership

- 2 Amex Membership Rewards points per $1 on the first $50,000 in purchases per calendar year (then 1x Membership Rewards point per $1 on all purchases)

- No annual fee (See Rates & Fees)

- Terms Apply

Having a no-annual-fee Amex card that earns 2x points per $1 on $50,000 in purchases per year is an excellent deal. Similar no-annual-fee small-business cards have a lower earning rate.

Plus, Amex small business-cards don’t appear on your personal credit report, so opening a new Amex business account won’t hurt your chances of being approved for Chase cards because of the Chase 5/24 rule.

How can you redeem points earned with the Amex Blue Business Plus?

Amex Membership Rewards points are valuable when you transfer them directly to any of the Amex transfer partners to book award travel. Airline alliances and partnerships make it easier to find award flights to your destination. For example, you can transfer Membership Rewards points to Air Canada to book an award flight on United Airlines, a Star Alliance partner.

If you have multiple cards that earn Membership Rewards points, the points will accumulate in one account automatically. This makes it easy to manage and redeem your points. Keeping the Amex Blue Business Plus Card active will preserve the points you earned on other cards if you decide to cancel them.

Transferring points to airline or hotel partners can get you significant value. For example, team member Meghan often transfers Membership Rewards points to British Airways for short-haul flights on partner airlines within the U.S. Tickets between her hometown of Missoula, Montana, and Seattle regularly cost $350+ but are only 15,000 Avios points round-trip. That’s a value of ~2.3 cents per point.

You can also book travel through Amex at a rate of 1 cent per point, but this is usually not the best way to use your points.

Perks of the American Express Blue Business Plus Card

Spend above your credit limit

Although the Amex Blue Business Plus Card is a credit card with a set credit limit, Amex offers the ability to spend above your limit. This is helpful for small-business owners with a large upcoming purchase.

For example, team member Meghan used this feature in the past to pay large bills as part of her home-building business.

I have an $18,000 credit limit with this card, but as a test, I checked online if a $50,000 purchase would go through and Amex said it would be approved.

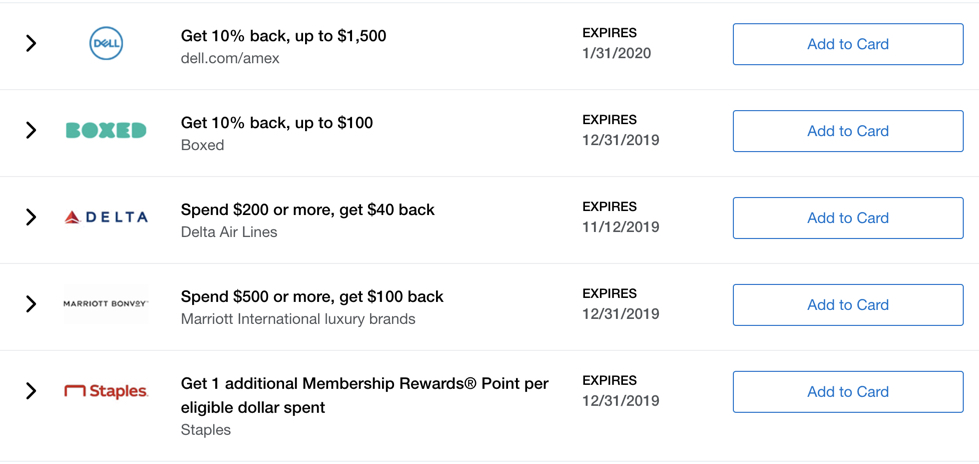

Access to Amex Offers

Amex Offers can save you lots of money on purchases you might make anyway. I recently showed a friend how to add an offer to his card and it saved him $10 off lunch.

We’ve seen recent deals for Marriott hotels, Amazon, and many others. The deals are always updating.

Team member Jasmin stocks up on household products, kids’ snacks for school, etc. whenever the Boxed.com Amex offer pops up. If you know what you’re doing, you can even turn these discounts into a profit. Team member Meghan made ~$1,000 by taking advantage of an Amex offer reselling products for miles and points.

Plus, the bonus points or statement credits you receive from Amex Offers are applied after your purchase. So you can take advantage of any other money-saving tactics without worrying that they won’t combine with Amex Offers. You can use shopping portals, promotional codes, coupons and more. Be sure you meet your offer’s minimum spending requirement. Eligibility for Amex Offers is limited. Enrollment is required in the Amex Offers section of your account before redeeming.

Note: Both statement credits and bonus Amex Membership Rewards points will post within 90 days after you redeem your Amex Offer. In my experience, it usually posts within a few days.

Free employee cards

Tracking expenses and bookkeeping can take up a lot of time for a small-business owner. Amex makes it easy to track spending by giving you the ability to add employee cards to your account at no cost (See Rates & Fees). Plus, you have the ability to set spending limits on employee cards.

Extended warranty

This perk extends the length of the original manufacturer’s warranty for eligible items purchased with your card. Original warranties of less than two years will be matched (i.e. doubled). If the original warranty is between two and five years, it will be extended an additional two years. If the original warranty is longer than five years, it is not eligible for this benefit.

Car rental loss and damage insurance

When you pay entirely for an eligible rental car with your card, you’re covered for theft or damage to the rental vehicle. This coverage is secondary.

Baggage insurance

When you pay your entire travel fare with the Blue Business Plus card (or Amex Membership Rewards points), you’ll be covered for lost, stolen, or damaged baggage. Your spouse, domestic partner or dependent children under age 23 are also covered.

Purchase protection

This benefit covers the cost to repair, replace, or reimburse you for eligible items for 120 days (90 days for New York residents) for up to $1,000 per item and $50,000 per account per calendar year. This coverage is secondary.

Travel accident insurance

You can be covered up to $100,000 for an eligible incident. To qualify for this coverage you must pay your entire fare with your eligible card or a combination of your card and Membership Rewards points.

Free Shoprunner membership

You’ll get a complimentary ShopRunner Membership (worth $79), which entitles you to free two-day shipping at hundreds of online retailers. Enrollment required for select benefits.

Does the Amex Blue Business Plus have a foreign transaction fee?

Yes. (See Rates & Fees)

Tips to qualify for an Amex small-business card

Applying for an Amex small business card is not as intimidating as you might imagine. You can apply using your Social Security number and Amex doesn’t have strict income requirements for small-business cards.

You can check out our step-by-step guide to completing an Amex business-card application.

We have lots of posts on the blog with side hustles that can help you qualify for a small business credit card. You don’t need to have a huge corporation with lots of employees to open a business credit card account. As long as you’re trying to make a profit with a side activity, you should be eligible for a business credit card.

Examples include selling items on eBay, tutoring, freelancing and consulting. I do a few things on the side that produce 1099 tax income forms. This is the income I report to banks when applying for small-business cards.

Customer support for the Amex Blue Business Plus Card

Taking care of issues with Amex cards is easy because they have a helpful chat function to send the bank a secure message. So you can log into your account, instead of waiting for hours on the phone.

Credit cards similar to the Amex Blue Business Plus Card

If the Amex Blue Business Plus Card isn’t the right card for your business, you might consider one of these other no-annual-fee business cards:

- Ink Business Cash Credit Card

- Ink Business Unlimited Credit Card

Both of the cards earn cash-back rewards in the form of Chase Ultimate Rewards points.

The Chase Ink Business Cash card has several lucrative bonus categories. You can earn 5x Chase Ultimate Rewards points (5% cash back) for the first $25,000 spent on combined purchases at office supply stores and on cellular phone, landline, internet, and cable TV services each account anniversary year. You’ll earn 2x Chase Ultimate Rewards points (2% cash back) on the first $25,000 spent on combined purchases at gas stations and restaurants each account anniversary year.

You can apply for the Chase Ink Business Cash card here.

The Chase Ink Business Unlimited card doesn’t have any spending bonus categories. Instead, it earns 1.5x Chase Ultimate Rewards points (1.5% cash back) on every purchase. So it’s great if your business doesn’t have a lot of expenses that fall into specific bonus categories.

You can apply for the Chase Ink Business Unlimited card here.

Bottom Line

With the no-annual-fee Amex Blue Business Plus Card you’ll earn 2 Amex Membership Rewards points per $1 on the first $50,000 in purchases per year (1x Membership Rewards point per $1 on all purchases after that).

If you spend the maximum, you could earn 100,000 Amex Membership Rewards points per year. That’s a great deal for a card with no annual fee.

Membership Rewards points can help you save big on travel. You can move them directly to Amex transfer partners to book award travel. This includes Delta, Etihad, JetBlue, Singapore Airlines, and many others.

Amex doesn’t have a minimum business income requirement to be approved for their small-business cards. And Amex small-business cards do not appear on your personal credit report. So opening a new Amex business account won’t hurt your chances of being approved for Chase cards because of the Chase 5/24 rule.

Check out these post for more about earning and using Amex Membership Rewards points:

- Our American Express points review

- The best way to use Amex points

- Your full guide on how to use American Express points

- What can you expect for Amex points value?

- Find out about all the airline and hotel Amex transfer partners

- How to earn Amex points

- How to set up an American Express Membership Rewards account

- The best way to use Amex points

- Do American Express points expire?

For the latest tips and tricks on traveling big without spending a fortune, please subscribe to the Million Mile Secrets daily email newsletter.

For rates and fees of the Blue Business Plus Card, please click here.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!