Ways to use the Ink Business Preferred 100,000 point sign-up bonus

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

The Ink Business Preferred® Credit Card currently has the highest sign-up bonus of any Chase Ultimate Rewards card. You can earn 100,000 Chase Ultimate Rewards points after meeting minimum spending requirements.

Without a doubt, one of the best credit card sign-up bonuses at the moment comes with the Ink Business Preferred. You can use it for at least $1,250 in travel through the Chase Ultimate Rewards Travel Portal, and potentially much more when you transfer Chase points to valuable airline and hotel partners!

Best ways to use the Ink Business Preferred 100,000 point bonus

Stay at the Hyatt Zilara Cancun

The all-inclusive Hyatt Zilara Cancun costs 25,000 Hyatt points per night for double occupancy. Top-shelf drinks, unlimited meals and snacks, and lots of activities are included in the room rate. Considering rooms here can cost $700+, you could easily save nearly $3,000 by using the Chase Ink Business Preferred’s 100,000 point bonus for four free nights.

Many of us on the team have been to the Hyatt Zilara. We love the beautiful rooms, pristine beaches and attentive staff here. Most of us would return in a heartbeat — if there weren’t so many other amazing things to see on Earth!

Last-minute flights

In the past, we’ve received lots of value from Chase points by using them for otherwise expensive fares. I used miles to book expensive flights for an emergency visit to California when my gramma was sick. Airlines love to gouge travelers with higher prices close to your departure date — they know last-minute travelers are willing to pay more.

Meghan recently transferred Chase points to United Airlines for a last-minute family trip at a time when tickets were selling for $700+ each. She was able to use 35,000 United Airlines miles per ticket, and saved thousands of dollars!

With miles & points, it’s easier to plan (and afford!) a getaway when the travel bug bites.

A visit to Hawaii

Hyatt is one of our favorite hotel chain. They’re an excellent hotel for both value and comfort. I’ve never stayed at a Hyatt hotel and thought it was dirty or neglected.

With the 100,000 point bonus from the Chase Ink Business Preferred, you could easily cover the cost of a trip to Oahu, Maui, Kauai or Kona. Everyone on the team has been to Hawaii at least once, and here are a couple ways you could save on your own trip.

Jasmin attended a wedding in Kauai a couple of years ago and spent an incredible night at the Grand Hyatt Kauai, which is a Category 6 hotel on the Hyatt award chart, meaning you’ll spend 25,000 Hyatt points per night. It possesses a vast and gorgeous property, multiple pools, lazy river and waterslide had me wishing the kids were there, too.

This hotel can cost $700+ per night. By transferring 100,000 Chase points to Hyatt, you could stay here for four nights and potentially save $2,800+.

You can book round-trip coach flights from the East Coast to Hawaii on United Airlines by transferring 35,000 Chase points to Singapore Airlines (Singapore Airlines is a partner of United Airlines). You and a friend could fly to Hawaii for 70,000 Singapore Airlines miles round-trip.

Or, if you live on the West Coast, you can fly to Hawaii for as little as 12,000 miles round-trip in coach, but you’ll be flying on Singapore’s partner Alaska Airlines. That means you and a friend could fly to Hawaii and back for a total of 48,000 miles. You’d still have 52,000 Chase points left from the Chase Ink Preferred bonus — enough for two nights at the Grand Hyatt Kauai!

A trip to Walt Disney World

MMS readers are obsessed with Disney World. This is a driving factor as to why many collect Chase Ultimate Rewards points.

They often get there by using points to fly Southwest because they’re kid-friendly, everyone gets two free checked bags, and there are no blackout dates. Southwest doesn’t have an award chart. Instead, Southwest points are worth ~1.5 cents each towards award flights. That means when Southwest has a fare sale (which they often do), award ticket prices go down, too. Chase points can take you far with Southwest.

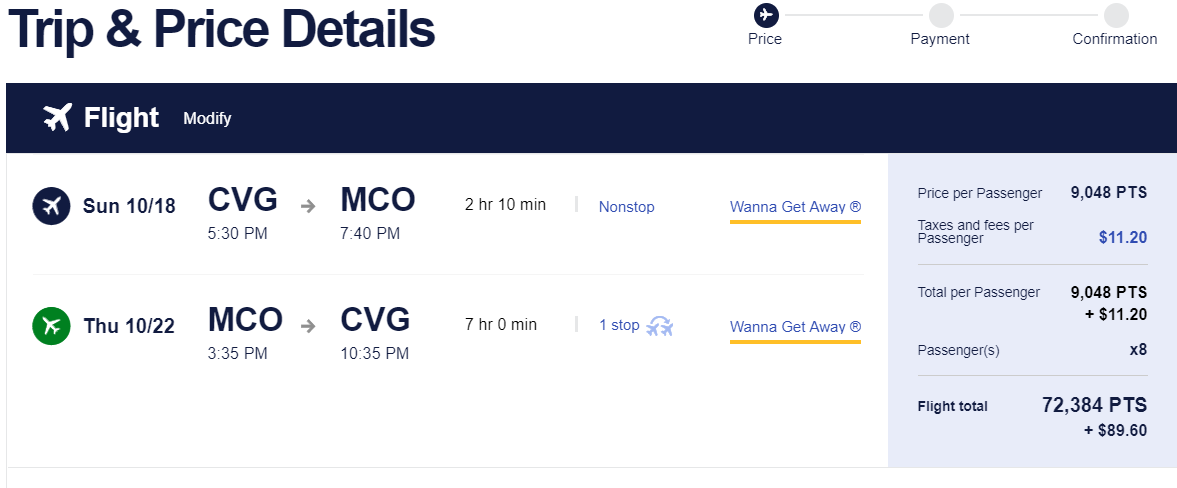

For example, if I wanted to take friends and family to Disney, I could book eight round-trip flights between my home airport of Cincinnati and Orlando for as little as ~73,000 points total. That means I’d have 27,000 points left from the Chase Ink Business Preferred 100,000 point sign-up bonus.

Plus, if the fare drops after I book, I can always cancel and get our Southwest points back — then re-book at the lower rate!

Chase low fares with $1,250 in free travel

When you redeem your points through the Chase Ultimate Rewards Travel Portal, they’re worth a flat 1.25 cents each (unless you also have the Chase Sapphire Reserve, which increases your Chase points value to 1.5 cents each through the online travel portal). This means the 100,000 point Ink Business Preferred sign-up bonus is worth $1,250 when you use your points through the Chase Ultimate Rewards Travel Portal (100,000 points x 1.25 cents each).

I find that I can often buy fares so cheaply that it doesn’t even make sense to redeem points for an award flight. And there have been lots of cheap fares to Europe, the Asia and Australia of late.

For example, I found a super cheap fare to India recently. For more than a decade I’ve wanted to visit India, after a friend from Mumbai coerced me into watching a Bollywood movie. I’d love to visit myself, just to watch random pedestrians participate in complicated and unrehearsed dance choreography in the middle of the street.

When you buy airfare through the Chase portal, you will also earn miles for your flight. So if I find a really long flight for cheap, I’ll buy the ticket through the Chase Ultimate Rewards Travel Portal, and credit the miles I fly to a useful airline. Booking super cheap flights to exciting places through the Chase Ultimate Rewards Travel Portal is a great way to stretch points, and earn more at the same time.

I’d get a lot of exciting travel from the Chase Ink Business Preferred sign-up bonus because I’m willing to let the airfare deals guide my travels. That may not be a strategy that many folks would follow, understandably.

Bringing loved ones together

One of the best parts of this hobby is being able to bring our friends and family together. And because Chase Ultimate Rewards points are so flexible, it’s easier to use them to help plan trips for others. We use our rewards this way quite often. For example, I’ve used miles to fly three of my friends to Barbados for an extended weekend. I’ve used them to visit my friends on the West Coast for Thanksgiving. I’ve used them to help my mom attend her family reunion.

Jasmin used miles to fly her daughters unaccompanied on Air Canada from Toronto to Victoria a couple years ago. Their grandpa lives 3,000 miles away, so they don’t get to see him often. Air Canada isn’t a Chase transfer partner, but United Airlines is — and it’s a partner of Air Canada, so by extension, you can use United Airlines miles to book Air Canada award flights. By transferring the Chase Ink Business Preferred sign-up bonus to United Airlines, you’d have enough for four round-trip, non-stop coach award tickets on United Airlines or Air Canada (four tickets x 25,000 United Airlines miles).

Last year, Meghan was able to get her whole family, including her sister who lives in California, free tickets to Panama by transferring Chase points to United Airlines.

Reserve points for unexpected travel

While the primary goal for our Chase points is to book cheap airfare and hotels, all of us agree that it’s good to have a small reservoir of points for unexpected events. So in the weeks and months we’re waiting for a fun, cheap trip to manifest, we can have peace of mind in knowing that if we want to go somewhere, we can.

One of my favorite examples is from a few years ago. I decided to book travel to South Carolina for an ideal view of the solar eclipse. The Hyatt House Charleston / Historic District was selling rooms for an outrageous +$500 per night (because of the solar eclipse), but I was able to book the room for just 12,000 Hyatt points per night. I would not have been able to afford this if I didn’t have Chase Ultimate Rewards points sitting in my account, waiting for a spur of the moment trip.

Note: We often repeat that it’s a bad idea to hoard points, letting them collect dust in your account. It’s generally not a good idea to collect points unless you have a certain redemption in mind, because any of Chase’s transfer partners could devalue their loyalty programs overnight. However, if you use your points often, there’s no harm in keeping a few around for an emergency wanderlust trip. And Chase Ultimate Rewards points don’t expire so long as you have a Chase Ultimate Rewards earning credit card.

Do what makes YOU happy

It can be difficult to pry yourself away from trying to find the best monetary value per point instead of using your points for what will make you the happiest. I’m less inclined to spend lots of points for luxury travel, though it’s definitely a nice treat once in a while. I prefer to use my miles & points to get the most travel, not the most glam. But for those who have no problem keeping the miles and points flowing in, luxury travel is likely a preferable option.

Chase Ink Business Preferred offer

When you open the Chase Ink Business Preferred card, you’ll earn 100,000 Chase Ultimate Rewards points after you spend $15,000 on purchases in the first three months from account opening. You’ll also get:

- 3 Chase Ultimate Rewards points per dollar you spend on travel, shipping purchases, internet, cable and phone services, advertising purchases made with social media sites, and search engines (up to a maximum of $150,000 in combined purchases per account anniversary year)

- 1 Chase Ultimate Rewards point per dollar on all other purchases

- Up to $1,000 in cell phone insurance when you pay your cell phone bill with the card

- 25% bonus when you redeem points through the Chase Ultimate Rewards travel portal

- Primary auto rental insurance (CDW) when renting for business purposes, plus purchase and extended warranty protection

The card has a $95 annual fee, not waived the first year.

The Chase Ink Business Preferred is impacted by Chase application rules, namely the “5/24 rule”. If you’ve opened five or more cards from any bank (not counting Chase business cards and certain other business cards) in the past 24 months, it’s unlikely you’ll be approved for this card.

Remember, the Chase Ink Business Preferred is a small business card. To qualify, you must have a for-profit venture, even if it’s just a side-gig like Airbnb, Rover or freelance writing. It’s actually much easier than you probably think to qualify for a small business credit card. In fact, you can simply use your own name and Social Security Number as your business name and EIN.

Read our post on how to complete a Chase business card application here. We’ve even outlined some solid Chase Ink Business Preferred approval tips.

Bottom line

With the Chase Ink Business Preferred, you can earn 100,000 Chase Ultimate Rewards points after you spend $15,000 on purchases in the first three months after opening your account. That’s an incredible sign-up bonus, and the highest of all Chase Ultimate Rewards points earning credit cards.

There are an infinite amount of ways to use this bonus other than that listed in this post — but perhaps your creative juices will begin flowing if you hear how we’ve used Chase points in the past! Your travel goals might be completely different, after all. But Chase Ultimate Rewards points are flexible, so whether you’d like to book one memorable business class flight or visit multiple destinations in coach, do whatever makes you the happiest!

Let us know how you’d spend the 100,000 point Ink Business Preferred sign-up bonus. And subscribe to our newsletter for more posts like this in the future.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!