How I Stacked Amex Offers and the Hilton Aspire Resort Credit to Effortlessly Save $550 on a Hawaii Vacation

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

INSIDER SECRET: If you make the most of the benefits and perks of the Hilton Honors Aspire Card from American Express, you can come out way ahead of the $450 annual fee (see rates and fees).

The Hilton Honors Aspire Card from American Express is turning out to be the most profitable card in my wallet. It doesn’t get enough attention — maybe because the high Hilton Aspire annual fee at first glance seems prohibitive — but if you stay at Hilton hotels with any frequency you should consider the card. The information for the Hilton Aspire card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

A while back I shared how my family would be getting a $4,200 luxury stay for free in Hawaii with Hilton Honors points at the Waldorf Astoria Grand Wailea. I’d also added two separate Amex Offers to my Hilton Aspire card, both of which could save us big bucks on other costs for the stay, but was unsure if they would stack.

I’m happy to report that both offers kicked in. Between those deals and the $250 per year Hilton resort credit that comes with the Hilton Aspire card, we saved $550 after spending just over $1,000 at the resort – a discount of nearly 55%.

Two Amex Offers Plus the Hilton Aspire Meant a $550 Discount on Our Hawaii Vacation

Apply Here: Hilton Honors Aspire Card from American Express

Read our review of the Hilton Aspire

The Hilton Honors Aspire Card from American Express comes with the biggest bonus of all the Amex Hilton cards. You’ll earn 150,000 Hilton Honors points after spending $4,000 on purchases in the first three months of account opening, plus many other benefits and perks that make the card well worth the $450 annual fee. (See rates and fees)

Conveniently, while planning our Hawaii trip using Hilton Honors points, two Amex Offers appeared in my account that could apply to our Grand Wailea stay.

Amex Offers are targeted statement credits or bonus points you can earn when you enroll your card and spend a certain amount at qualifying merchants, including hotels, airlines and shopping.

Most Amex cards are eligible, and offers change frequently. Over the years I’ve saved $1,000 or more with Amex Offers on different cards, including the Hilton Aspire, Marriott Bonvoy Business™ American Express® Card, and The Blue Business®️ Plus Credit Card from American Express.

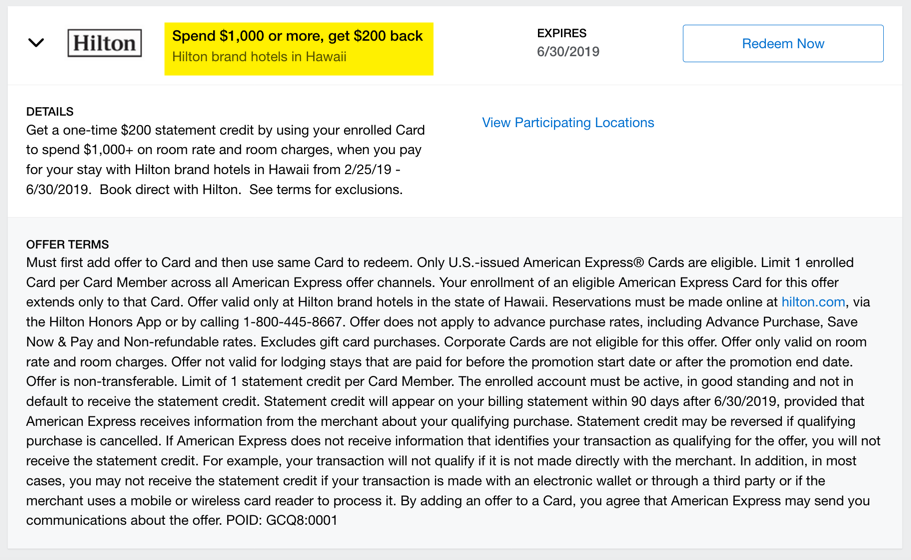

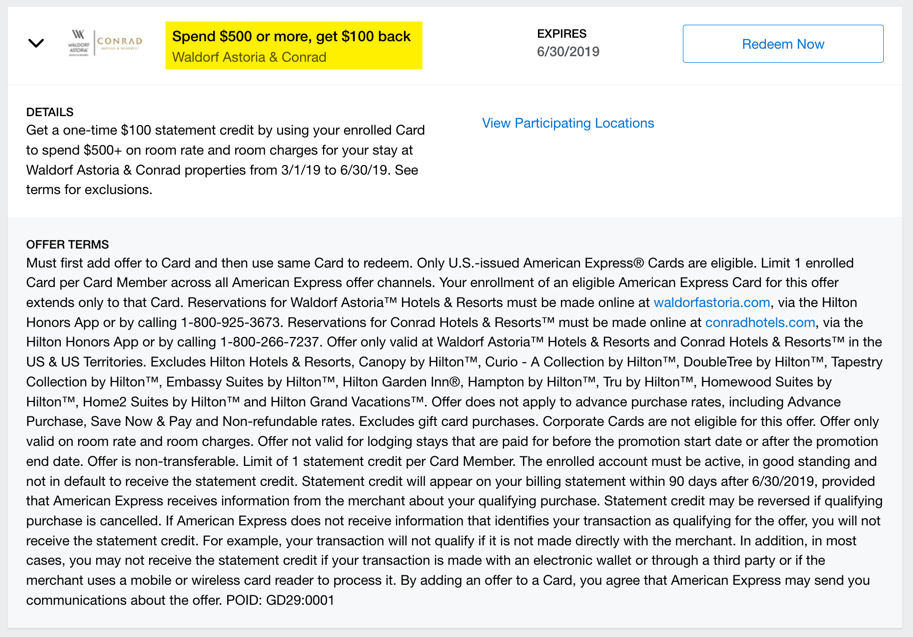

Here were the two offers on my Hilton Aspire that I added to my card:

- Spend $1,000 or more, get $200 back at Hilton hotels in Hawaii

- Spend $500 or more, get $100 back at Waldorf Astoria and Conrad hotels

The big question was, if I spent $1,000 on the card on incidentals at the Waldorf Astoria Grand Wailea, would it trigger both statement credits? Among the Million Mile Secrets team the general consensus was yes, the offers would stack, but I was still a little unsure.

I ended up spending a little over $1,000 at the Grand Wailea on incidentals like:

- Grand Luau at Honua’ula for the five of us (pricey, but totally worth it — the food was top-notch and the performances were incredible)

- Poolside lunch at the Volcano Bar and Grill

- Snacks and drinks at Bistro Molokini

- Shave ice for the kids at the snack stand by the activity pool

- Five days of valet parking at $40 per day

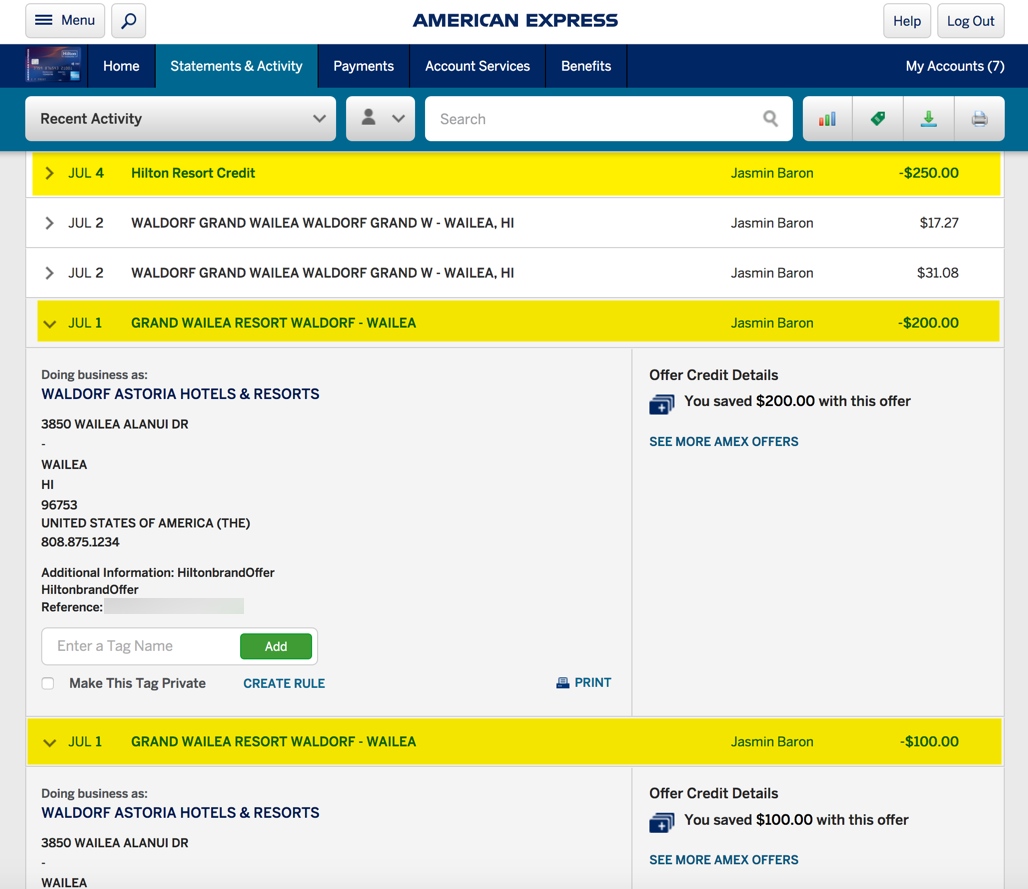

In my experience, it usually takes several days for Amex Offers statement credits to appear in your Amex account (and Amex says it can take up to 90 days), and this case was no different. I was thrilled when I saw that our stay triggered both offers (and the yearly $250 Hilton resort credit that comes with the Aspire) just a couple of days after checkout.

Essentially, my out-of-pocket cost for about $1,000 in spending at the resort was just $450 ($1,000 in spending – $550 in credits). That’s a heck of a deal for what we got — the luau tickets alone cost more than that.

We Saved Even More With Hilton Diamond Elite Status From the Hilton Aspire

On top of the statement credits, because of the Diamond Hilton status that comes with the Amex Hilton Aspire card, we were upgraded to an ocean view room (the standard award room is a terrace view) which would have cost over $1,100 per night. Plus we got our fifth award night free (any level of elite status qualifies you for this perk).

We also received free continental breakfast for two people every morning at the Grand Dining Room (my boyfriend and I rotated with each of the kids) for having Diamond status (Gold elites get this too).

Had we paid for it, it would have cost $19 per person plus tax, so we received at least $40 in value each day. While not as fancy or heavy as the Grand Wailea full breakfast buffet ($45 per person, Hilton Gold and Diamond elites could upgrade their breakfast for $27), it suited us just fine with fresh tropical fruit, a yogurt and granola parfait and house-made pastries and muffins.

If you’re not looking to pay a hefty annual fee but like the idea of complimentary breakfast, consider the Hilton Honors American Express Surpass® Card. It comes with Hilton Gold status, which is a step below Diamond but still comes with free breakfast at all Hilton hotels. The information for the Hilton Surpass card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

It’s also got a limited-time offer through August 28, 2019 of 130,000 Hilton points and a weekend night certificate after you spend $4,000 on purchases within the first four months of account opening (this used to be called the Hilton Honors American Express Ascend Card). There’s a $95 annual fee (see rates and fees).

Here’s why Hilton Gold status is the most valuable mid-tier hotel elite status (and it’s so easy to earn too).

Bottom Line

My family saved $550 after spending $1,000 at the Waldorf Astoria Grand Wailea in Maui by stacking two Amex Offers and the yearly $250 Hilton resort statement credit from the Amex Hilton Aspire card. With these deals, we saved big on activities and incidentals like luau tickets, valet parking and lunch, snacks and drinks by the pool.

Additionally, because the Hilton Aspire card comes with complimentary Diamond Hilton status, we were upgraded to a much nicer (and more expensive) room with an ocean view. And each morning, we received free continental breakfast for two (worth $40 per day) for additional savings.

Our hotel room was free because I used Hilton Honors points to book it (and got the fifth night free for having elite status). You can read more about my Hawaii trip-planning process with Hilton points here.

The Amex Hilton Aspire should be in your wallet if you like Hilton hotels and can use the perks and elite status. Mine’s been very profitable and I haven’t even had it a year yet, so I intend to keep it for the long term, even with the $450 annual fee.

To learn more about Hilton points, check out our guides:

- Hilton Honors Review

- Hilton Points Value

- Hilton Status

- Best Use of Hilton Points

- How to Earn Hilton Honors Points

- How to Setup a Hilton Account

- How to Use Hilton Honors Points

- Hilton Award Chart

- Do Hilton Points Expire?

- Current Hilton Promotions

For the latest tips and tricks on traveling big without spending a fortune, please subscribe to the Million Mile Secrets daily email newsletter.

For rates and fees of the Hilton Surpass Card, please click here.

For rates and fees of the Hilton Honors Aspire Card from American Express, click here.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!