You Can Easily Replicate My Strategy to Save on Destination Bachelor Party Travel Expenses

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Keith: I have the honor of being a groomsman in my good friend’s wedding this summer. Before the wedding, we’re heading to Nashville for his bachelor party.

From experience, I know destination bachelor parties can be expensive. Between flights, hotels, and eating out for a long weekend, it’s not hard to spend $1,000 or more. If you’re thrifty like me, it can be painful for your wallet to spend that much money for just one weekend.

There are a few excellent rewards credit cards that can help you significantly reduce your out-of-pocket travel expenses to popular bachelor party destinations, including Nashville!

I’ll share how I used points to save more than $450 on a round-trip flight to the bachelor party in Nashville. And let you know which cards can help you follow the same strategy!

Earn Flexible Miles or Points You Can Use to Save on a Destination Bachelor Party!

Link: Beginner’s Guide to Miles & Points

To avoid frustration in the miles & points hobby, I always recommend friends and family get started by earning flexible credit card rewards, which are easy to redeem.

For example, I transferred flexible Chase Ultimate Rewards points to my Southwest account to book a round-trip award flight to Nashville for the upcoming bachelor party I’m attending. Redeeming points for my flight saved me more than $450!

Southwest has no blackout dates. As long as a seat is available for sale, you can book using points. This means you don’t have to study complicated award charts or waste time searching for available award seats!

Even if you’re not flying Southwest, you can follow the same strategy with a different Chase airline transfer partner. Or quickly redeem points for airfare through the Chase travel portal.

You might also consider other straightforward credit card rewards, which you can redeem after you pay for travel with your credit card. I know some folks prefer this because you don’t have to change your booking habits and can still save money on travel!

Here are 3 cards I’d recommend if you’re looking for an easy way to save on travel expenses (especially airfare) to a destination bachelor party.

1. Chase Sapphire Preferred

Link: Chase Sapphire Preferred Card

Link: Review of the Chase Sapphire Preferred

The Chase Sapphire Preferred is an excellent card to consider if you’re a beginner in the miles & points hobby. My 22-year-old sister-in-law just got this card and is excited to use the rewards she earns to start planning vacations!

When you sign-up for the card, you’ll earn 50,000 Chase Ultimate Rewards points after spending $4,000 on purchases in the first 3 months of opening your account.

You can use the sign-up bonus points to get $625 worth of airfare by booking through Chase’s travel portal. When you book this way, there are no blackout dates and you can find flights on just about any airline. I’ve found prices on the portal are the same as booking directly or through an online travel agency.

With the Sapphire Preferred, you’ll also get:

- 2X points on travel and dining

- Ability to transfer points directly to Chase’s travel partners like Hyatt and Southwest (neither of which have blackout dates for award bookings!)

- Primary car rental insurance – Covers damage from collision or theft to your rental car, when you pay for the rental with your card

- Trip delay reimbursement – Get up to $500 back per ticket when your trip is delayed more than 12 hours

- NO foreign transaction fees, great for international destination weddings!

And the $95 annual fee is waived the first year. So you can test the card out for nearly a year without paying anything. Then, decide if you like the benefits enough to pay the annual fee.

Keep in mind, Chase has strict application rules, which can make it difficult to get their cards if you apply for lots of cards with other banks first. But if you’re new to miles & points, you don’t have to worry about these rules!

2. Chase Sapphire Reserve

Link: Chase Sapphire Reserve

Link: Review of the Chase Sapphire Reserve

The Chase Sapphire Reserve is a very popular premium travel rewards credit card.

When you sign-up, you’ll earn 50,000 Chase Ultimate Rewards points after you spend $4,000 on purchases in the first 3 months from account opening.

Points linked to the Chase Sapphire Reserve are worth 1.5 cents each on travel booked through Chase! This means the sign-up bonus can get you $750 worth of travel when you redeem points for flights, hotels, car rentals, and more through the Chase travel portal.

With the Sapphire Reserve card, you’ll also get:

- 3X Chase Ultimate Rewards points per $1 on travel and dining

- $300 statement credit for travel purchases (like airfare, Airbnb, hotels, car rental, Uber, etc.) each account anniversary year

- Priority Pass Select for access to airport lounges

- $100 statement credit for Global Entry

- No foreign transaction fees

The card comes with a $450 annual fee, that’s NOT waived the first year. But you can offset this fee with perks like the $300 travel statement credit and airport lounge access.

This is the #1 card I use because earning 3X points on travel and dining purchases can really add up!

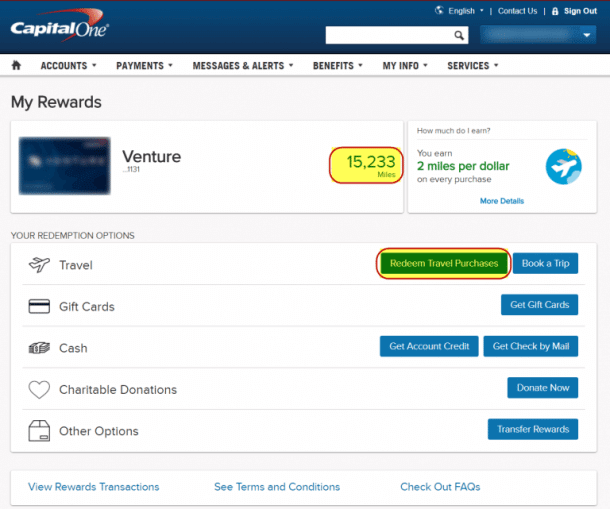

3. Capital One Venture

Link: Capital One® Venture® Rewards Credit Card

Link: Review of the Capital One Venture Card

The miles you earn with the Capital One Venture card are extremely easy to redeem. You just pay for travel expenses (like airfare or hotel stays) with your credit card. Then, you can “erase” the charge by redeeming your Venture miles.

When you sign-up for the card, you’ll earn 50,000 Venture miles (worth $500 in travel) after spending $3,000 on purchases within the first 3 months.

In addition to the card’s valuable sign-up bonus, you’ll get:

- 2 Venture miles per $1 you spend on all purchases

- No foreign transaction fees

The card also comes with Visa Signature Benefits, which include:

- Rental car insurance – Secondary protection against collision or theft

- Travel accident insurance – Up to $250,000 insurance for accidental loss of life, limb, sight, speech, or hearing

- Lost luggage insurance – Up to $3,000 per trip, provided the luggage was lost from theft or misdirection by the airline, cruise, etc.

- The card has a $95 annual fee

Bottom Line

Attending a destination bachelor party can result unexpected and expensive out-of-pocket travel expenses.

But planning ahead and earning credit card rewards can really help you save money! For example, having a stash of Chase Ultimate Rewards points saved me $450+ on airfare to my friend’s upcoming bachelor party in Nashville.

The best strategy for saving on unplanned travel expenses is to collect flexible credit card rewards, which are easy to redeem. You can do that with cards like the Chase Sapphire Preferred, Chase Sapphire Reserve, and Capital One Venture.

If you have any other tips or secrets for saving on a bachelor party getaway, I’d love to hear in the comments!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!