Chase Sapphire Preferred vs Chase Sapphire Reserve

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

When it comes to your Chase credit card strategy there are a few rules you need to keep in mind. The first is the Chase 5/24 rule, which restricts you from getting a new Chase card if you’ve opened five or more cards from any bank in the past 24 months. There are also other rules that apply to specific cards. For example, you can only have one personal Southwest credit card at a time and you can only have one version of a Sapphire card.

With the recent increase in the Chase Sapphire Reserve® card’s annual fee (to $550) there are a lot of people wondering whether to keep that card or to downgrade to the Chase Sapphire Preferred® Card. Since you can only have one card or the other, let’s compare the Chase Sapphire Reserve and Chase Sapphire Preferred cards.

| Chase Sapphire Preferred Card | Chase Sapphire Reserve | |

|---|---|---|

| Sign-up bonus | Earn 60,000 Chase Ultimate Rewards points after you spend $4,000 on purchases in the first 3 months from account opening | Earn 50,000 Chase Ultimate Rewards points after you spend $4,000 on purchases in the first 3 months from account opening |

| Rewards earning rate | Earns 2X points on travel & dining Earns 1 point per $1 everywhere else | Earns 3X points on travel (excluding $300 travel credit) & dining Earns 1 point per $1 everywhere else |

| Transferring Chase Ultimate Rewards points to travel partners | Yes, points transfer at 1:1 | Yes, points transfer at 1:1 |

| Booking travel through Chase Travel Portal | Points are worth 1.25 cents each | Points are worth 1.5 cents each |

| Travel details | Primary rental car insurance $10,000 in trip cancellation / interruption per covered trip $500 in trip delay reimbursement NO foreign transaction fees | Primary rental car insurance $10,000 in trip cancellation / interruption per person per covered trip (up to $20,000) $500 in trip delay reimbursement $300 annual credit for travel purchases such as airfare and hotels $100 statement credit for Global Entry Priority Pass Select for access to airport lounges NO foreign transaction fees |

| Annual fee | $95 | $550 |

| Notes | This is our all-around favorite credit card for Big Travel with Small Money! It’s also the top card we recommend if you’re new to miles & points. | This is a fantastic premium travel credit card with top-quality travel perks. It is also a Visa Infinite credit card |

| Full review | Read our review of the Chase Sapphire Preferred | Read our review of the Chase Sapphire Reserve |

Chase Sapphire Reserve versus Chase Sapphire Preferred

The Chase Sapphire Preferred and Chase Sapphire Reserve are both top travel credit cards that earn Chase Ultimate Rewards points and enable transfers to Chase’s travel partners. So comparing the cards is fairly straight forward.

With the Chase Sapphire Reserve, you get all of the same benefits as the Chase Sapphire Preferred, plus a bunch of extra or enhanced perks. The main benefit of the Sapphire Preferred is that is has a much smaller annual fee of only $95. Meanwhile, the Chase Sapphire Reserve has the tall task of justifying it’s $550 annual fee.

So the question you need to answer for yourself is: “Is the Chase Sapphire Reserve worth paying an extra $455 a year?” Let’s take a look at the benefits you get for the additional expense.

Travel credit

The Chase Sapphire Reserve’s $300 in annual travel credits is one of the best rewards credit card perks out there. It’s super easy to use because you’ll automatically be reimbursed for the first $300 in eligible travel purchases you make each year. That effectively reduces the cost of your annual fee down to $250, which really levels the playing field with the Sapphire Preferred.

Rewards earning rate

The Sapphire Preferred earns 2 Chase Ultimate Rewards points per dollar on travel and dining purchases and one point on all other purchases. The Reserve earns 3x Chase points on the same travel (except for the purchases reimbursed by the $300 travel credit) and dining purchases and one point everywhere else.

So you’ll be earning 33% more points for travel and dining with the Reserve. Let’s say you only spend $5,000 eating out and on eligible travel expenses, like hotels, airfare, rental cars, timeshares, cruise lines, campground, parking, tolls, trains, buses, ferries, travel agencies, discount travel sites and taxis (including Uber). We value Chase points at two cents each, so that’s an extra $100 a year in travel for the Reserve over the Preferred. If you spend heavily in these bonus categories just the bonus points could make the Chase Sapphire Reserve worth it.

Both cards also earn bonus points on Lyft rides (through Mar. 31, 2022), 5x points for the Preferred and 10x points for the Reserve. The Reserve also comes with a free year of Lyft Pink, which gets you 15% off Lyft rides and other perks. You just need to activate the Membership by March 31, 2022. Lyft Pink normally costs $19.99/month, so that’s a huge savings if you already pay for it or if you can regularly take advantage of the 15% off.

Chase travel portal points value

You can use Chase points to pay for travel booked through the Chase travel portal. But the value you get for your points will depend on which card you have.

With the Sapphire Preferred each point is worth 1.25 cents and with the Chase Sapphire Reserve your points are 1.5 cents a piece. The best part about this is that you can pool the points you earn from other Chase cards, like the Chase Freedom® and Chase Freedom Unlimited® onto your Reserve or Preferred card to make your points more valuable.

The information for the Chase Freedom card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

So if you’ve been amassing Chase points with other cards, having the Chase Sapphire Reserve can instantly make those points more valuable for booking through the Ultimate Rewards travel portal.

Airport lounges

The Reserve is one of the best cards for airport lounge access. With it, you’ll get a Priority Pass Select membership, which gets you and up to two guests unlimited access to 1,200+ airport lounges around the world. This also includes food and beverage credits at Priority Pass partner restaurants, which is something you don’t get with American Express cards that come with a Priority Pass membership.

TSA PreCheck/Global Entry credit

When you pay for your TSA PreCheck or Global Entry application with your Chase Sapphire Reserve card you’ll be reimbursed for the fee (up to $100). You can earn this credit once every four years.

Food delivery benefits

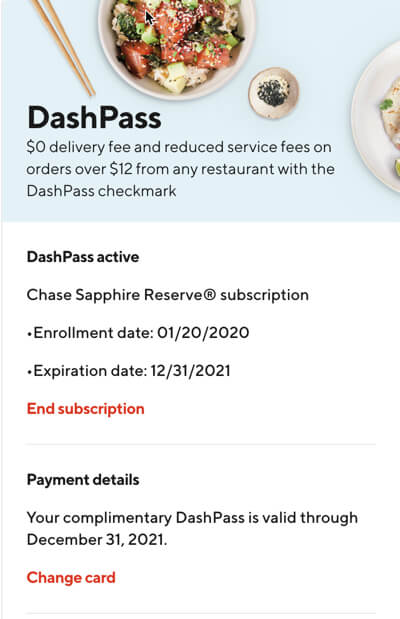

Both cards are eligible for a complimentary membership of DoorDash’s DashPass, which normally costs $9.99 a month. This membership gets you free delivery on orders of $12 or more at restaurants that participate in DashPass.

You’ll get at least a year of free DashPass as long as you activate the membership by Dec. 31, 2021. Reserve cardholders can also earn up to $120 DoorDash credits, they’ll earn $60 in credit in 2020 and another $60 in credit in 2021.

Coverages and protections

Both cards have rock-solid built-in travel protections, like primary rental car insurance. But the Chase Sapphire Reserve’s travel insurance is a bit more robust.

For example, with the Sapphire Preferred the trip delay reimbursement will cover you (when you pay for the travel with your card or Chase points) when your travel is delayed 12+ hours or requires an overnight stay. With the Reserve the trip delay reimbursement kicks in for delays of 6+ hours or when it requires an overnight stay. This might not be something most people will use very often, but you only need to take advantage of it once for it to be worthwhile.

Bottom line

The Chase Sapphire Preferred and Chase Sapphire Reserve are similar cards with vastly different annual fees. The Preferred only costs $95 a year to keep, while the Reserve has an annual fee of $550. But the Reserve’s easy to use travel credit effectively reduces the out-of-pocket cost for most people to $250, so is the Reserve worth paying at extra $155 a year to have?

For most people it’s not hard to justify the extra cost. The Reserve earns more points for travel, dining and on Lyft rides and it makes all your Chase points worth more when you use them to book through the Chase travel portal. It also comes with a Global Entry/TSA PreCheck fee credit worth up to $100 (every four years) and a Priority Pass Select airport lounge membership. Add to that the DoorDash credits ($60 in 2020 and $60 in 2021) and the beefed up travel protections and you don’t need to be a full-time road warrior for the card to make sense.

But if you only travel 1-2 times a year the Sapphire Preferred gets you everything you need at a fraction of the cost, that’s why it’s been our #1 credit card for beginners for years.

| For more travel and credit card news, deals and analysis sign-up for our newsletter here. |

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!