Planning a Trip to Hawaii on a Budget: With Miles and Points Your Vacation Can Be Truly Free!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

INSIDER SECRET: A lot goes into vacation planning – it’s not just airfare and hotel. Having other travel or cash back cards is an easy way to cover all the extras, leaving you with a final price tag of $0, no matter where you go!

Planning a trip to Hawaii on a budget with miles and points is a terrific way to wipe out a big chunk of your vacation expenses. I’m doing this soon with my family on a trip to Maui, by booking 5 nights at the Grand Wailea with Hilton Honors points for free and redeeming Citi ThankYou points for 5 round-trip flights to Hawaii on United Airlines.

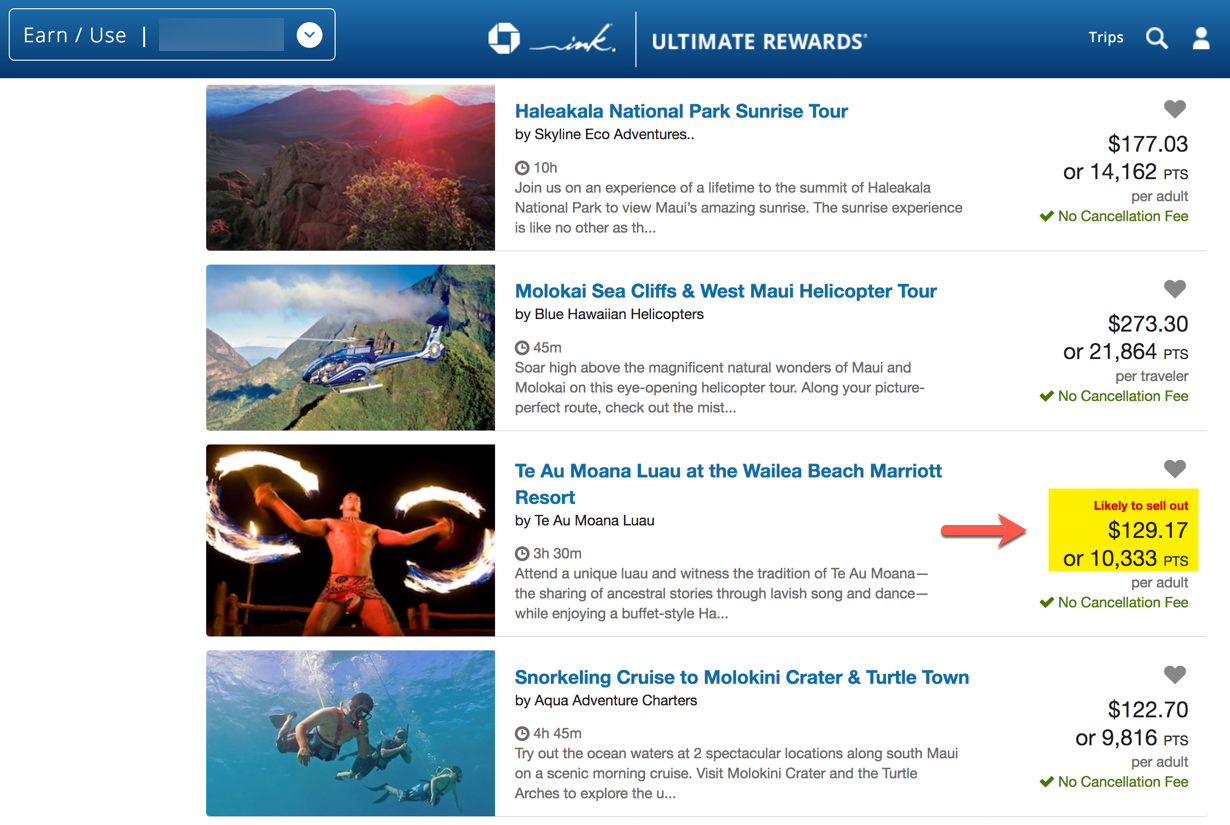

Those redemptions are already worth about $6,300, but there are still other costs you can’t avoid — on any trip. You still have to eat and get around once you’re at your destination, and there are additional expenses to consider, like tours, activities, and souvenirs. My eyes nearly popped out of my head when I saw the price of a luau I wanted to book in Hawaii!

Fortunately, there are ways to reduce or eliminate these costs entirely with the best travel credit cards and cashback credit cards. I’ll show you how.

Hawaii Trip Planning on a Budget – How to Erase Incidental Expenses With Miles, Points, and Cash Back

While it’s relatively easy to redeem miles and points from the best travel credit cards for airfare and hotels, we all know those aren’t the only expenses you’ll have to worry about on a trip. And costs like this can sure add up, including:

- Ground transportation (rental car, gas, taxi, Uber, Lyft, public transportation)

- Meals, snacks, and drinks

- Organized tours and activities

- Entertainment like tourist attractions, museums, theme parks, and concert tickets

- Shopping and souvenirs

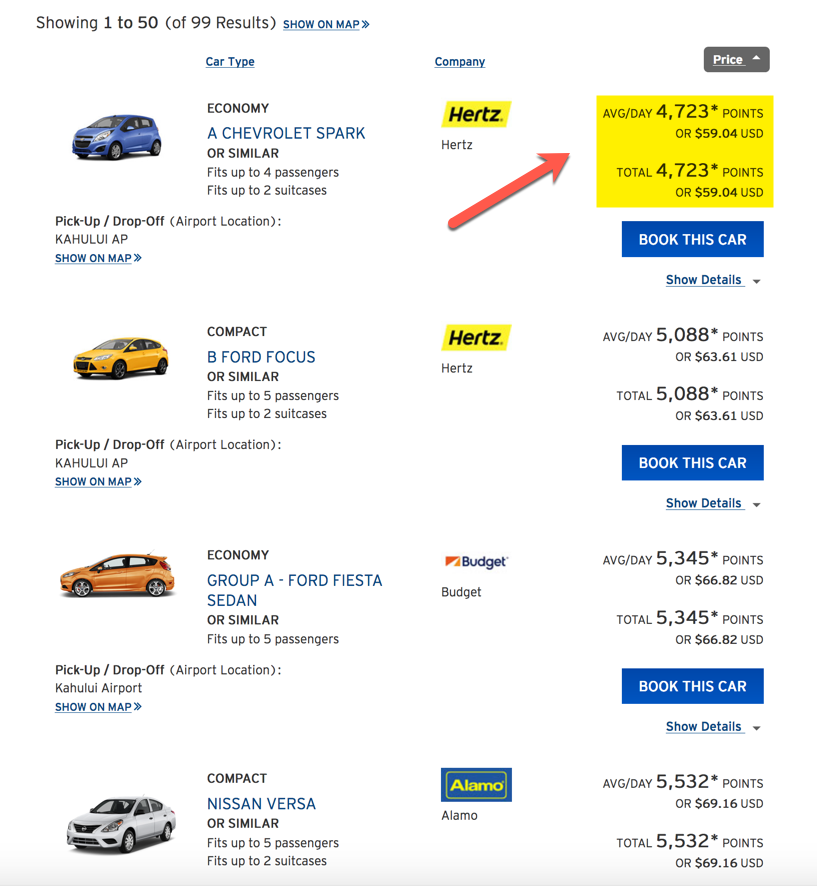

I’m adding these up for our trip to Hawaii and it sure isn’t cheap. A rental car alone is going to run at least $600, and I’ll have to add food and activities to the budget.

Fortunately, there are still ways to erase similar expenses on any trip using flexible bank points and cashback credit cards. Here’s how to do it.

Use Flexible Bank Points to Pay for Rental Cars, Activities, and More

One of the great things about flexible points is how much choice you have in using them. With certain programs, you can transfer points to airline and hotel partners, use them towards paid travel at a fixed rate per point, or redeem them for cash back.

Bank portals like the Chase travel portal and Citi ThankYou portal let you redeem your points for airfare, hotels, rental cars, activities, and cruises. Depending on the card you have and what you’re booking, you could get an even better value per point. For example, these Chase Ultimate Rewards cards offer an increased redemption rate when you book travel through the portal:

- Chase Sapphire Reserve – 1.5 cents per point

- Chase Sapphire Preferred Card – 1.25 cents per point

- Ink Business Preferred Credit Card – 1.25 cents per point

Bank portals like these function similarly to any other third-party site like Orbitz or Expedia, except you can redeem points (or a combination of points and cash) for your booking.

I’ve got the Citi Premier℠ Card and used Citi ThankYou points through the portal to book 5 round-trip flights to Hawaii when there were no award seats available for my family. I could also use Citi ThankYou points to book a rental car at a rate of 1.25 cents per point (which also applies to airfare, hotels, and cruises; activities are at 1 cent per point).

Before you book a car or activity with points through a bank portal, shop around to see if you can get a better deal. While sometimes (especially in the case of rental cars) you can find better deals through the bank portal than booking directly through the merchant site, that’s not always the case.

Pay for Travel Directly and Erase the Charge With Miles

If you don’t want to fuss with a travel portal and would rather make your bookings directly, having miles from cards like the Capital One Venture Rewards Credit Card and Barclaycard Arrival Plus® World Elite Mastercard® can come in handy for purchases that code as travel, like rental cars, Uber, or Airbnb.

When you pay for travel with either of these cards, you can “erase” the purchase with miles within a certain timeframe of the transaction.

The travel categories with these cards are quite broad, and include things like:

- Airlines, hotels, rail lines, car rental agencies, limousine services, bus lines, cruise lines, taxi cabs, travel agents, and timeshares (in the case of the Capital One Venture Rewards Credit Card)

- Airlines, hotels, motels, timeshares, campgrounds, car rental agencies, cruise lines, purchase and travel agencies, discount travel sites, trains, buses, taxis, limousines, ferries, and the account annual fee as defined by the merchant category code (in the case of the Barclaycard Arrival Plus® World Elite Mastercard®) — note that you can only redeem miles for travel purchases of $100+ with this card

Read our post about the best way to use Capital One miles and Barclaycard Arrival Plus review for more details.

Use Cash Back to Offset Other Expenses

What’s great about cash back credit cards is you can redeem your rewards for anything — not just travel. Using cash back credit cards for travel expenses you can’t offset with miles and points can make your vacation truly free.

You can put the cash back you earn towards purchases like:

- Groceries and dining out

- Gas

- Equipment rental (snorkel and SCUBA gear, bikes, paddleboards, etc)

- Shopping and souvenirs

- Tickets to museums, state parks, or shows

- Incidentals like toiletries and medications

I’m considering applying for the Capital One Savor Cash Rewards Credit Card before our Hawaii trip. It comes with a $300 cash bonus after spending $3,000 on purchases in the first 3 months of opening your account, which will help offset the cost of meals in Maui. It’s perfect for travel, too, because it earns unlimited 4% cash back on dining and entertainment, and we’ll spend a chunk of change in those categories on the trip. Check out our Capital One Savor card review to find out more. The information for the Capital One Savor Cash Rewards card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

Credit Card Travel Statement Credits for Easy Redemption

This is a no-brainer way to offset travel expenses when you have certain cards. A handful of cards offer an annual travel statement credit that will kick in any time you make a travel purchase, up to a maximum amount. For example:

- Chase Sapphire Reserve – Up to $300 annual credit every cardmember anniversary for travel purchases such as airfare, hotels, Uber, Airbnb, etc

- Citi Prestige Card – Up to $250 annual credit that renews after the close of your December billing statement for travel purchases

- U.S. Bank Altitude™ Reserve Visa Infinite® Card – Up to $325 in annual credit each cardmember year for eligible travel purchases

I’m definitely applying for the Chase Sapphire Reserve before our trip. It’ll knock out $300 in travel expenses and also comes with primary rental car insurance, which will save us money.

Bottom Line

Getting flights and hotels using miles and points from the best travel credit cards is only part of the equation if you’re looking to book a truly free vacation. My family is using these strategies to stick to a budget on our upcoming vacation to Hawaii:

- Using flexible bank points like Chase Ultimate Rewards and Citi ThankYou to pay for rental cars, activities, and more

- Paying for travel directly and erasing the charge with miles from cards like the Capital One Venture and Barclaycard Arrival Plus

- Using cash back credit cards like the Capital One Savor to offset other expenses

- Taking advantage of easy credit card travel statement credits from cards like the Chase Sapphire Reserve for miscellaneous travel expenses

For more reading on traveling for cheap (or free!), check out these posts:

- All the ways to book award flights to Hawaii with flexible points

- Find out all about hotel award booking tricks

- Insider tips to save money on hotels

- Are travel credit cards worth it?

While you’re here, please subscribe to the Million Mile Secrets daily email newsletter for more tips, tricks, and insights into traveling for free.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!