Barclaycard Arrival Plus Review: A Hefty Sign-Up Bonus Worth $700 in Travel With No Blackout Dates (Expires June 7, 2019)

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers. Note: This offer expires, today, June 7, 2019.The Barclaycard Arrival Plus® World Elite Mastercard® is a top-class credit card that earns 2X Arrival miles on every purchase. And it comes with a welcome bonus of 70,000 Arrival miles (worth $700 in travel statement credits) after spending $5,000 on purchases in the first 90 days of opening your account.

Most travelers can get tremendous value from this welcome bonus. Those who’ll enjoy this card best are folks who dislike the hassle of finding available award seats or hotel nights, and prefer booking paid travel directly with no blackout dates.

You can apply for the Barclaycard Arrival Plus here.

Here’s our full review of the Barclaycard Arrival Plus to help you decide if it’s the right card for your wallet!

The Barclaycard Arrival Plus Card Sign-Up Bonus Is Worth $700

Apply Here: Barclaycard Arrival Plus® World Elite Mastercard®

With the Barclaycard Arrival Plus, you’ll earn a welcome bonus of 70,000 Arrival miles (worth $700 in travel statement credits) after spending $5,000 on purchases in the first 90 days of opening your account.

Meeting the spending requirement of $5,000 will earn you an additional 10,000 Arrival miles (2 Arrival miles per $1). So you’d earn a grand total of 80,000 Arrival miles. That’s worth $800 in travel!

You’ll earn 2X Arrival miles on ALL purchases and can redeem Arrival miles for eligible travel purchases of $100+ made in the past 120 days.

According to Barclays, eligible travel purchases include:

Airlines, hotels, motels, timeshares, campgrounds, car rental agencies, cruise lines, purchase and travel agencies, discount travel sites, trains, buses, taxis, limousines, ferries, and the account annual fee as defined by the merchant category code.

How to Earn Miles With the Barclaycard Arrival Plus Card

Earning miles with the Barclaycard Arrival Plus couldn’t be any easier. You’ll earn 2X Arrival miles per $1 on every purchase, no matter what! When you redeem for travel, that’s like getting 2% back.

So there’s no keeping track of bonus categories or caps, which is perfect for folks who prefer simplicity.

How to Use Your Barclaycard Arrival Miles

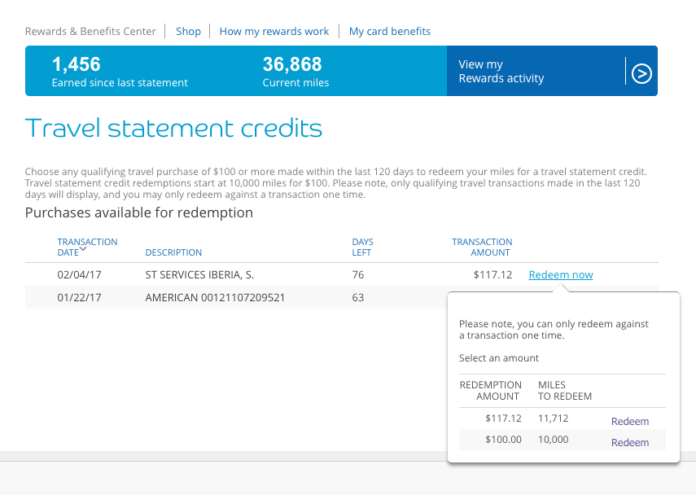

Using your miles is just as easy as earning them. You can redeem Arrival miles for eligible travel purchases of $100 or more made with your Barclaycard Arrival Plus card in the past 120 days.

Every time you redeem miles for travel, you’ll get a 5% rebate. This effectively increases that 2% return to a 2.1% return on all your purchases when you redeem for travel.

You can redeem miles through your Barclaycard online account starting at 10,000 Arrival miles ($100) or more. But after that, you don’t have to redeem in $100 increments. So if you book a $117 flight, you can redeem 11,700 Arrival miles toward the expense.

Benefits of the Barclaycard Arrival Plus Card

Your Barclaycard Arrival Plus includes World Elite MasterCard benefits. We’ll highlight some of the top perks, but feel free to check out the full suite of benefits here. 🙂

Chip-and-PIN Security

Chip-and-PIN security comes standard on the Barclaycard Arrival Plus. When traveling abroad, chip-and-PIN cards are expected even though most US-based cards don’t offer this. So it’s an excellent perk that can bring peace of mind to international travelers.

Free Shipping With ShopRunner

So long as you have your card, you’ll also get ShopRunner membership. ShopRunner is like Amazon Prime but for over 100 retail stores! You get free 2-day shipping and free returns with your online orders through participating retailers. An annual membership for ShopRunner normally costs $79.

Home Sharing With Onefinestay

Want access to 10,000+ high-end rentals in cities worldwide including New York, Los Angeles, Boston, and San Francisco? You got it!

Amenities include local guest services available 24/7, high-quality toiletries, free Wi-Fi, and a complimentary iPhone to use during your stay.

Barclaycard Arrival Plus cardholders receive a 10% discount on all bookings.24/7 Concierge and MasterCard Airport Concierge

Because the Barclaycard Arrival Plus is a World Elite MasterCard, you’ll get complimentary 24/7 concierge service that acts like a personal assistant. If you need to locate a gift or reserve a table for your anniversary, give the concierge a call!

You can also arrange for a personal and dedicated agent to escort you through the airport for any flight (additional charges apply). They operate 24/7/365 at over 700 locations worldwide.

To contact the concierge, call the number on the back of your card.

Trip Cancellation Insurance

We love to see these types of benefits, especially because we encourage our readers to travel!

Trip cancellation insurance protects the Barclaycard Arrival Plus credit cardholders against forfeited, non-refundable, unused payments and deposits if a trip is cancelled for covered reasons. Coverage is available up to $5,000 per trip and up to $10,000 per 12-month period.

MasterCard Luxury Hotel & Resorts PortfolioEnjoy complimentary room upgrades, early check-in, and late check-out upon availability, daily breakfast for 2, and preferred amenities at more than 2,000 properties around the globe when booking a stay with a Mastercard Luxury Hotel & Resort.

And if you find the same exact prepaid hotel stay for less, MasterCard will refund the difference. The caveat here, is that you have to submit your claim at least 72 hours before your reservation starts.

Some places, like The Langham Sydney, offer $100 hotel credit when you book using through MasterCard’s portal. Remember, you can redeem your Arrival miles for these types of purchases.

Is the Barclaycard Arrival Plus Card Worth the Annual Fee?

The annual fee is $89 and is waived for the first year.

After you meet the minimum spending requirement of $5,000 on purchases in the first 90 days, you’ll have at least $800 worth of Arrival Plus miles to redeem.

Beyond the first year and welcome bonus, the annual fee is only worth it if you’re able to make the most of the World Elite MasterCard perks that come with the card. Because you can get a similar rate of return on spending with other cards that have no annual fee.

Does the Barclaycard Arrival Plus Card Have a Foreign Transaction Fee?

No.

Who Is Eligible for the Barclaycard Arrival Plus Card?

Before you apply for the Barclaycard Arrival Plus, remember that Barclays is one of the tougher banks when it comes to credit card approvals. You’ll typically only be approved for 1 or 2 Barclays credit cards a year. And if they see a lot of recently opened cards, or if you haven’t been using the Barclays cards you already have, you’re likely to be denied.

In the past, team member Jason had Barclays applications denied for not spending much on his current Barclays card. And data points show that you aren’t eligible for the bonus if you already hold either the Barclaycard Arrival Plus or the no-annual-fee Barclays Arrival.

Also, from the Barclaycard Arrival Plus card’s terms & conditions:

From time to time, we may offer bonuses of miles or other incentives to new Barclaycard Arrival Plus Mastercard cardmembers in connection with an application for a new account.These bonuses and/or incentives are intended for persons who are not and have not previously been Barclaycard Arrival Plus Mastercard cardmembers. You understand and agree that you may no longer be eligible for any bonuses and/or incentives in connection with a new Barclaycard Arrival Plus Mastercard account after this Account is opened.

If you receive a bonus or incentive for which you are not eligible due to your status as a current or former Barclaycard Arrival Plus Mastercard cardmember, we may revoke the bonus or incentive, or reduce your miles by the amount of the bonus or incentive, or charge your Account for the fair value of the bonus or incentive, in our sole discretion.

I haven’t heard of anyone applying for the card and being denied the bonus because of this rule, so I don’t know how strictly it is enforced. But before you apply, know that if you’ve had the card in the past, you may not be able to get the bonus again.

Customer Support for the Barclaycard Arrival Plus Card

With the Barclaycard Arrival Plus, you get 2 dedicated teams to help you if you ever need it: Barclays’ customer support and the MasterCard Concierge!

Barclays’ customer support team will help you with bank related questions, and MasterCard Concierge can help you with any travel related inquiries.

Know that Barclays offers $0 fraud liability protection meaning you are not responsible for unauthorized charges you report to Barclays.

Bottom Line

The Barclaycard Arrival Plus is a good card for folks who want a hefty sign-up bonus and simple way to earn and redeem miles. With 2X Arrival miles per $1 on every purchase, there’s no need to worry if you’re spending in the “right category.”

You’ll earn a welcome bonus of 70,000 Arrival miles (worth $700 in travel statement credits) after spending $5,000 on purchases in the first 90 days of opening your account. And you can redeem your miles for eligible travel purchases of $100+ (within 120 days of purchase).

Redeeming Arrival miles means that you don’t need to deal with blackout dates or finding available award seats or nights. When you find a great deal on travel, purchase with your card and then redeem your miles to credit your account!

But as a long-term card, keep in mind there are no-annual-fee cards which offer a similar rate of return on spending. Keeping the card after the first year is worth it if you’ll make good use of its perks.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!