Helping My General Contractor Plan a Credit Card Strategy for His Small Business

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Welcome to the next installment of the Monday small business series!

Here’s team member Meghan to share why anyone with a small business or side hustle should never forget to ask a simple question to be sure you’re making the most of your business expenses.

Meghan: In last week’s small business series post, I mentioned I was in the middle of a house flipping project. I have a general contractor overseeing much of it, who has heard me rave about miles & points for a while now. So I was excited when he asked me to help him develop a plan to earn more miles & points for his own business expenses!

He explained that most months, he charges thousands of dollars to his Business Gold Rewards Card from American Express OPEN. But knew there were other ways for him to earn even more travel rewards.

So we sat down to strategize!

Finding the Right Cards for Your Businesses

Link: Top Small Business Credit Cards

Link: How to Qualify for a Small Business Credit Card (And Why You Should Get One!)

My general contractor (let’s just call him Bob), regularly charges thousands of dollars to his AMEX Business Gold Rewards card each month. Mostly from having to pay for project materials. It’s the only credit card he has!

When he first asked me to help him figure out a credit card strategy, he mentioned he’d always used the AMEX Membership Rewards points he’d earn for gift cards…hence why I’m keeping his identity a secret. That’s just heresy! 😉

So I started by explaining all of the other (better!) ways he could be using his AMEX Membership Rewards points. For example, by using them for free flights within the US and to Europe, for free hotel stays, and more.

Then we got down to the business of planning which other credit cards he should consider, and why.

He expressed his concerns about getting into the miles & points hobby, many of which were the same common misconceptions lots of folks have. Like keeping a good credit score, the difficulty of managing multiple cards (tracking sign-up bonuses, annual fee dates, etc.), and being able to easily track business expenses.

But I’m pretty sure I convinced him that getting at least 1 more card would be a great idea, because he could use the travel rewards or cash back to take his girlfriend on nearly free trip to Hawaii. 😉

The Cards I Recommended And Why

I recommended Bob get the following cards:

1. Chase Ink Business Preferred

Link: Chase Ink Business Preferred Credit Card

Getting the Ink Business Preferred is a no-brainer for Bob.

It comes with an 80,000 Chase Ultimate Rewards points sign-up bonus after meeting minimum spending requirements. It’s the biggest sign-up bonus of any Chase Ultimate Rewards earning card at the moment!

He loved learning about the flexibility of Chase Ultimate Rewards, and how many options he’d have to transfer the points he earns to valuable travel partners. And, of course, how he could plan that trip to Hawaii using his points!

Plus, I explained how the sign-up bonus alone is worth at least $800. So even if he never decided to travel, he could get cash back.

You can read our full review of the Chase Ink Business Preferred card here.

Note: If you’ve opened 5+ cards from any bank (NOT counting Chase business cards and these other business cards) in the past 24 months, it’s unlikely you’ll be approved for most Chase cards.

2. SimplyCash® Plus Business Credit Card from American Express

Link: SimplyCash® Plus Business Credit Card from American Express

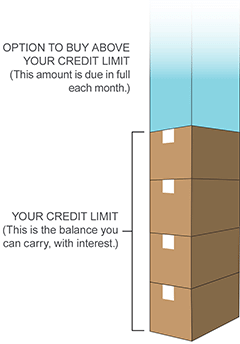

I also recommended the AMEX Simply Cash Plus small business card, because Bob mentioned he needed a large credit limit and the ability to pay big bills (like $10,000+). And it offers to ability to “buy above your credit limit.” Meaning he’d be able to spend above his credit limit without any over-the-limit fees. Which could be helpful for growing his business!

Plus, AMEX small business cards to NOT count against Chase’s 5/24 rule. So Bob will have a better chance of getting other great Chase travel rewards cards in the future.

Check out our review of the AMEX Simply Cash Plus card here.

3. AMEX Business Platinum

Link: The Business Platinum® Card from American Express

Lastly, I mentioned the AMEX Business Platinum card, because you can earn:

- 50,000 AMEX Membership Rewards points after you spend $10,000 on purchases in the first 3 months of account opening.

- 25,000 AMEX Membership Rewards points after you spend an additional $10,000 on qualifying purchases within the same time frame

That’s a total of up to 75,000 AMEX Membership Rewards points! And the card includes lots of valuable perks, like lounge access, an annual airline incidental fee credit, and more!

Here’s our full review of the card. And tips for using AMEX Membership Rewards points for flights to Hawaii.

He still isn’t sure the high annual fee ($450; See Rates & Fees) on the AMEX Business Platinum card would be worth it for his particular situation. But he plans to regularly update his credit card strategy to make sure the cards he’s using still make sense. And might consider it when he’s more comfortable managing multiple cards!

Bottom Line

The general contractor I’m currently working with asked me for advice on which cards he should get for his own small business. Because he wants to get more involved in the miles & points hobby, and take his girlfriend to Hawaii!

After considering his concerns and personal travel goals, I recommended the Chase Ink Business Preferred, the AMEX Simply Cash Plus Business card, and the AMEX Business Platinum card to my general contractor. Because with these 3 cards, he’ll be able to make the most of his business expenses by earning points, miles, and cash back.

For rates and fees of the Amex Business Platinum card, click here.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!