How to combine Capital One miles with anyone

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Capital One miles are already the easiest miles to use for free travel. Just swipe your card for a travel purchase like you normally would, and you have 90 days to log into your account and “erase” that purchase from existence with your miles.

In addition, you can transfer your Capital One miles too several airline partners. Plus, you can combine Capital One miles between cards or anyone else with a Capital One miles account.

This applies to folks who have any of the following cards:

- Capital One Venture Rewards Credit Card

- Capital One VentureOne Rewards Credit Card

- Capital One Spark Miles for Business

- Capital One Spark Miles Select for Business

The information for the Capital One Spark Miles and Capital One Spark Miles Select has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

The process to combine miles is really simple. I’ll walk you through how to combine Capital One miles.

Why combine Capital One miles?

Combining your points across multiple accounts is a fantastic benefit for any travel program. It gives you the ability to achieve your travel dreams much faster!

Often those of us with multiple credit cards will find ourselves with “orphan” points after a big redemption — AKA, not enough points to redeem for anything.

How to combine Capital One miles

Combining Capital One miles is (literally) as easy as 1-2-3.

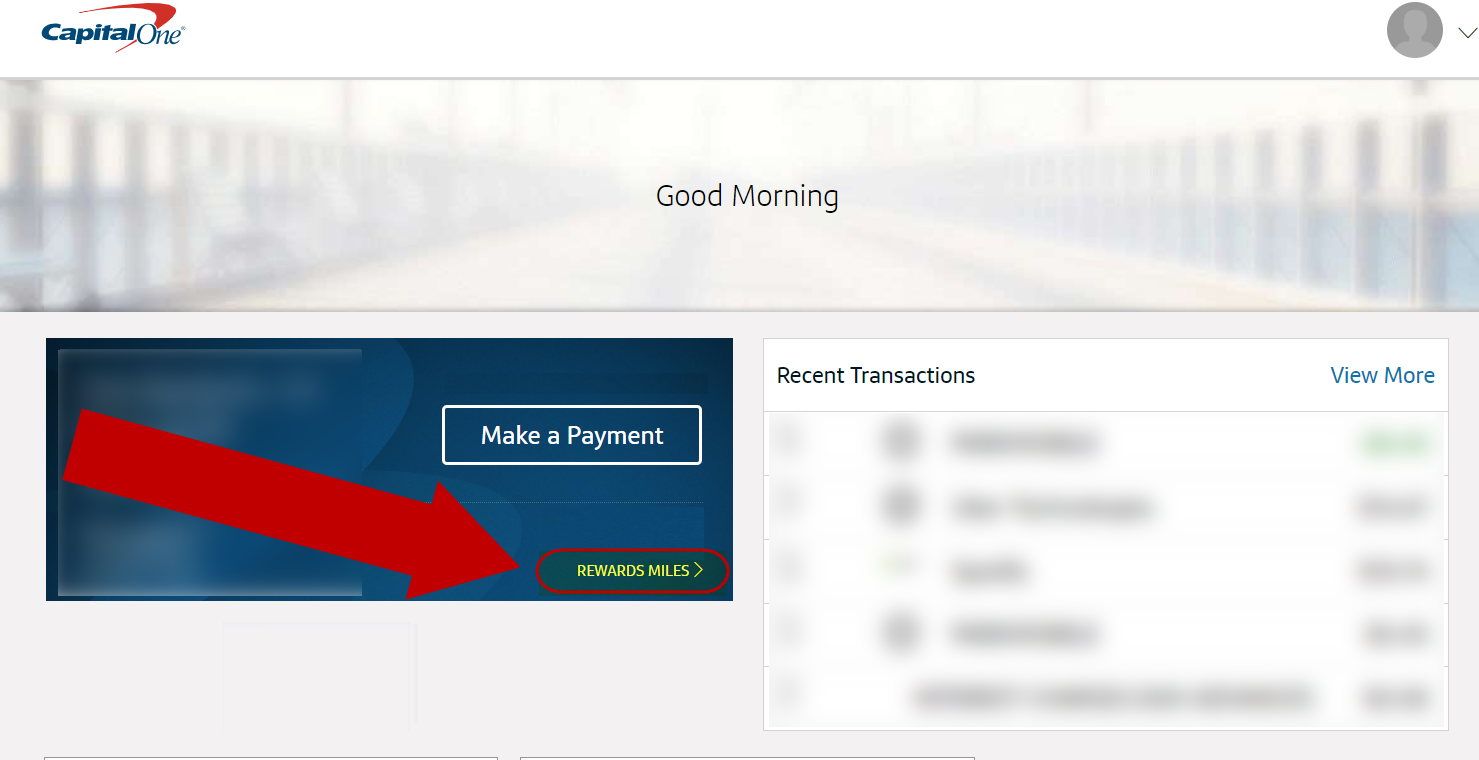

Step 1. Click “Rewards Miles” on your account homepage

Log into your Capital One online account and click the “Rewards Miles” link under the “Make a Payment” button.

Step 2. Click the “Share Your Rewards” box

Scroll down the page until you see the “Share Your Rewards” section. Click “Use My Miles”.

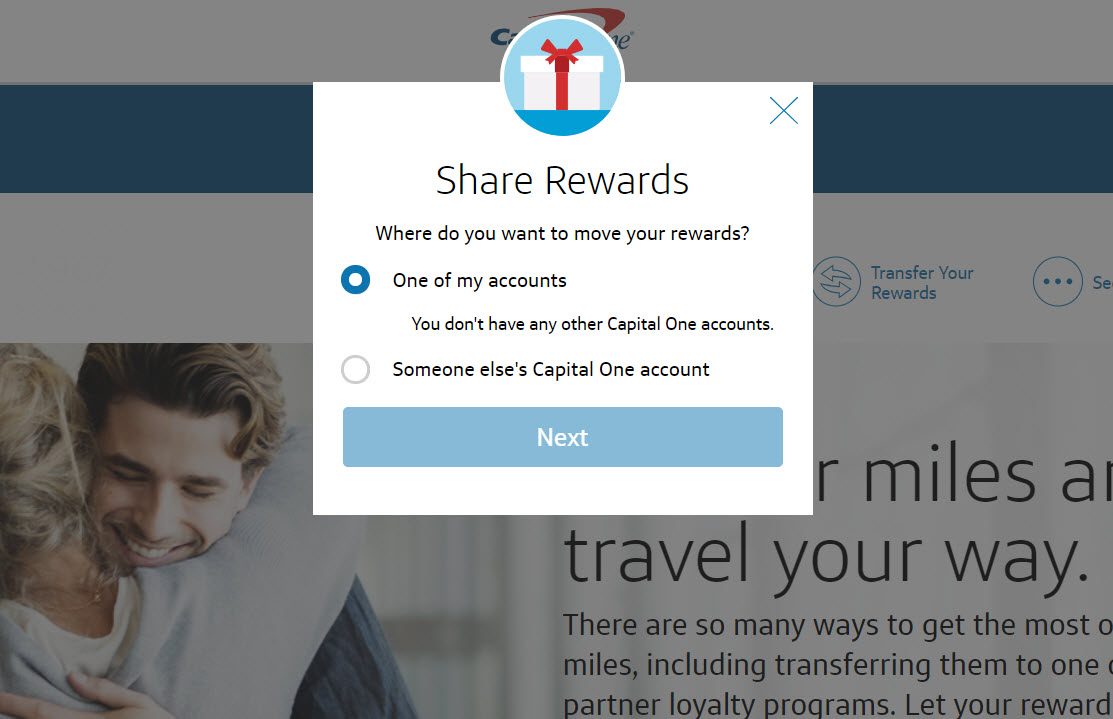

Step 3. Choose the account you want to share your miles with

You will now have the option to transfer your Capital One miles to the account of your choice. Like… anybody, as long as they have a Capital One miles account. You can even combine Venture miles with Spark miles.

The first option lets you combine points with yourself. In other words, if you have a Capital One Venture card and you want to combine those points with your Capital One Spark Miles card, you can.

I have just one Capital One card, the Capital One Venture, so this option doesn’t serve me at the moment.

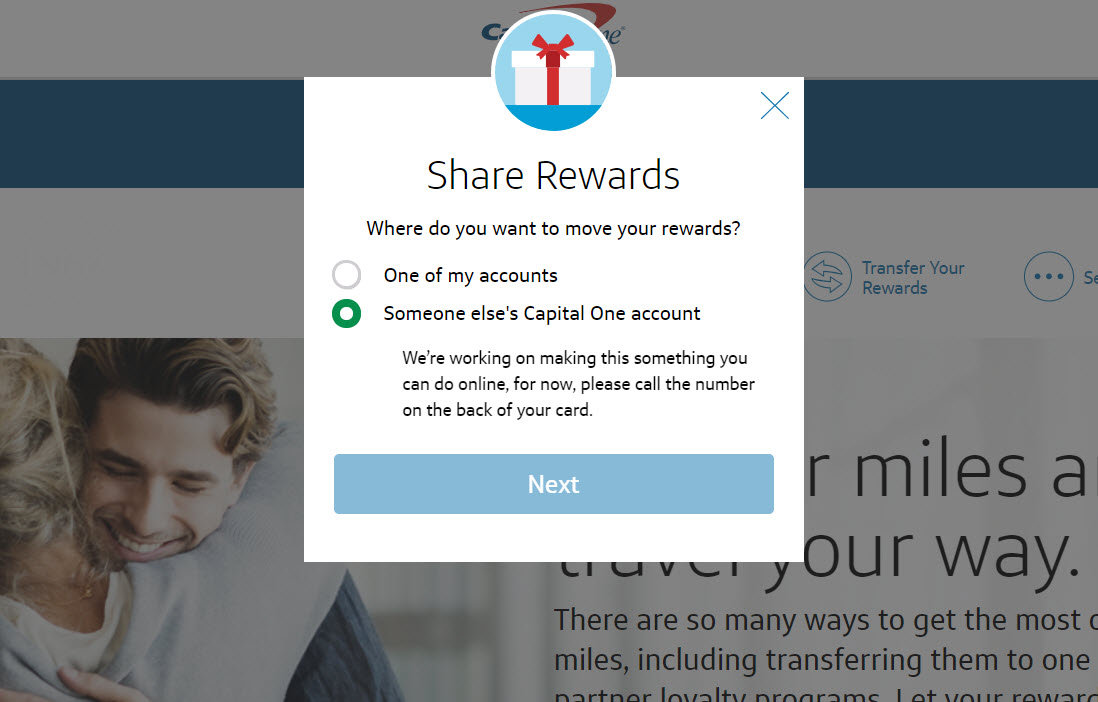

The second option allows you to combine your points with another person’s Capital One miles account. Currently you can not do this online. Selecting the option brings up a message telling you to call the number on the back of your card for this service.

How does this compare with the transfer policies of other flexible points programs?

With all three top flexible points programs, you can consolidate the points you earn to one card. But they have other quirks you should know about concerning transferring points to others:

- Chase Ultimate Rewards points – You can transfer points from personal cards to the account of one person in your household. If you have a small business card, you also have the option to transfer points to a co-owner of your business.

- AMEX Membership Rewards points – You can not transfer points to another AMEX account. But you can transfer your AMEX Membership Rewards points into a loyalty account of an authorized user on your card.

- Citi ThankYou points – You can share points with anyone who has a Citi ThankYou points account. You can both send and receive up to 100,000 points per calendar year. Points expire 90 days after they are transferred.

As you can see, the Capital One rules look to be the most flexible. You can share them with anyone, any time, as often as you like, with no cap. If other banks adopted this policy, free travel would be much easier.

This is also a great way to preserve your Capital One miles if you’re considering canceling your card. If you cancel your Capital One Venture with a points balance, you’ll lose it all. But if you transfer the points to a travel buddy, they won’t go to waste. Plus, Capital One miles never expire.

Note: If you’re thinking about canceling a Capital One card with an annual fee, consider downgrading to a no-annual-fee card instead. You’ll keep your miles, and your account will stay open which will improve your credit history.

Bottom line

The simplest miles & points currency to earn is also one of the easiest to use. You can open multiple Capital One miles-earning cards, earn the bonus, and then combine them for one heck of a miles balance.

You can combine the miles you earn from the following cards:

- Capital One Venture Rewards Credit Card

- Capital One VentureOne Rewards Credit Card

- Capital One Spark Miles for Business

- Capital One Spark Miles Select for Business

Even better, you can combine your miles with anyone else who also has one of these cards. That means you and a travel companion can work together to build a points balance by earning bonuses and throwing them in the same pot.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!