Do Capital One miles expire? The policy is straightforward

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Losing your hard-earned credit card rewards due to account inactivity or closure is a mistake people make all too often, even experienced miles and points enthusiasts.

We like Capital One miles because they’re straightforward to earn with the best Capital One credit cards. And they’re just as simple to redeem. Capital One’s expiration policy is as easy as it gets, too.

Do Capital One miles expire? Nope, as long as your account is open your miles will not expire. But what if you want to close your account?

Do Capital One miles expire?

Capital One’s rewards expiration rules can’t be any easier. They say:

There’s no limit to the amount of rewards you can earn and they never expire, but you will lose them if you ever close your account.

So keep your account open and in good standing, and you’ll be in good shape. The Capital One cards that earn miles are:

- Capital One Venture Rewards Credit Card

- Capital One VentureOne Rewards Credit Card

- Capital One Spark Miles for Business

- Capital One Spark Miles Select for Business

The information for all of the Capital One Spark Miles and Spark Miles Select listed has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

But what if you need to close your account? Don’t do it until you’ve done one of these things to save your miles.

Transfer your miles to another Capital One account

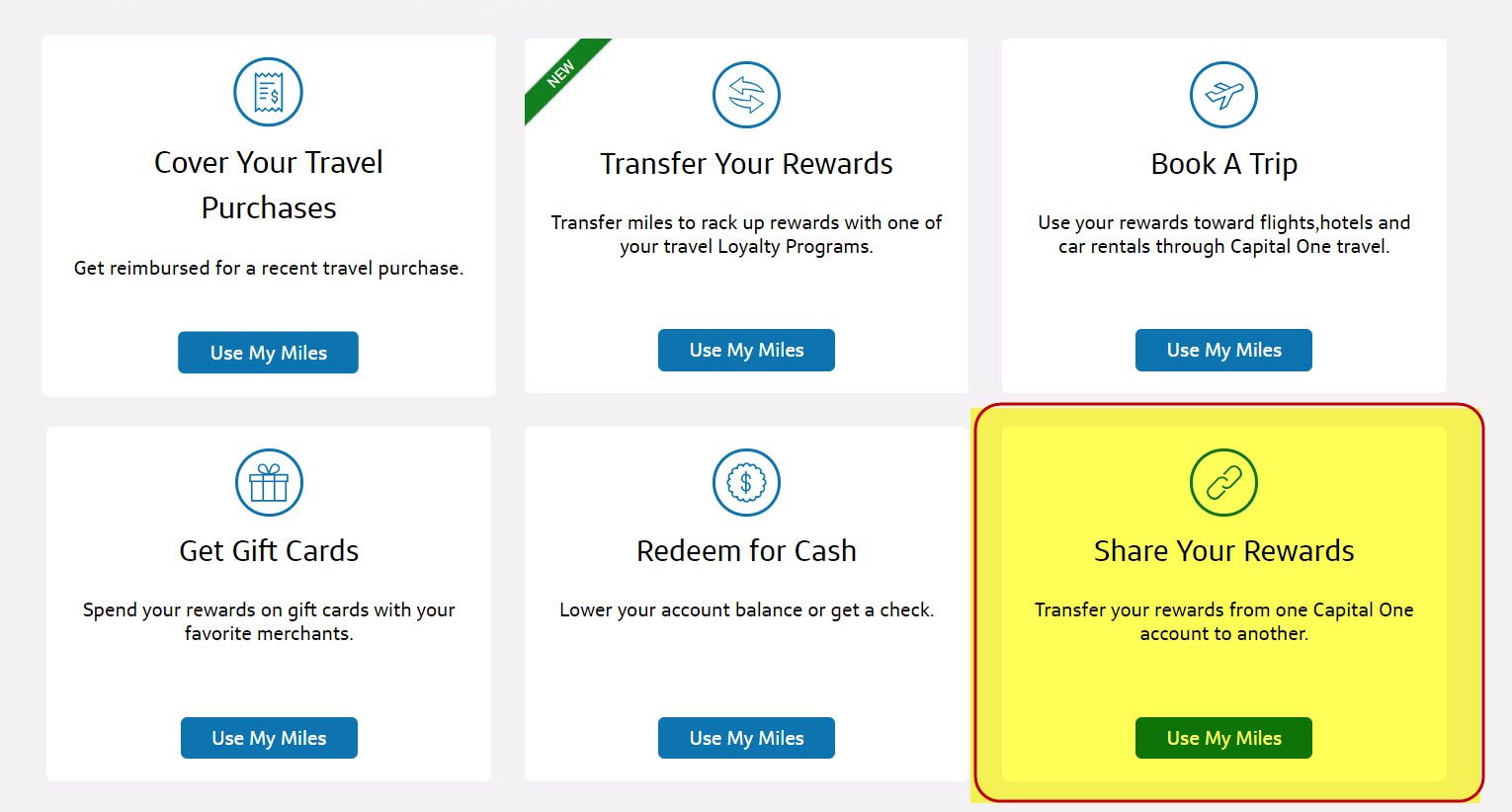

You can now transfer your Capital One miles to another Capital One miles-earning account (either your own or someone else’s). This is probably the easiest way to prevent your Capital One miles from expiring if you need to close a card.

Joseph wrote an excellent guide to combining your Capital One miles that’ll take you through the process step by step.

Transfer Capital One miles to an airline partner

Capital One miles transfer partners include these airlines:

- Aeromexico

- Air Canada (Aeroplan)

- Air France & KLM (Flying Blue)

- Alitalia

- Avianca

- Cathay Pacific

- Emirates

- Etihad

- EVA Air

- Finnair

- Hainan Airlines

- JetBlue

- Qantas

- Qatar Airways

- Singapore Airlines

The transfer ratio is 2:1.5 for most partners, so you’ll get 1.5 airline miles for every two miles you transfer. The exceptions are Emirates, JetBlue and Singapore Airlines, which have a 2:1 transfer ratio.

Of course, you should pick a transfer partner where you’ll actually be able to use the miles. For help, check our post on the best and worst Capital One airline transfer partners to see what’s best for you.

Redeem your Capital One miles for travel, gift cards, or cash back

If you’ve recently booked travel or have plans coming up, you can use Capital One miles to “erase” your travel purchase at a rate of one cent per mile. You can either use your Capital One Venture or Spark card to make a travel purchase, then log into your account to use your miles to offset the charge within 90 days.

There are a couple of other ways to redeem Capital One miles, but they’re not all as attractive. You can cash out your miles for gift cards at a rate of one cent per mile (same as travel). Worst case, you can redeem them for cash back, but you’ll only get half the value – 0.5 cents per mile.

Redeem your miles for eligible restaurant delivery, takeout and streaming service purchases (limited-time)

In response to the coronavirus pandemic, Capital One has added a new way to redeem your Venture miles.

Through April 2021, you can redeem your miles for eligible restaurant delivery, takeout and streaming service purchases. Since we’re all spending more time at home these days, this is a nice option to have. Just note, food subscription boxes, premade meal kits and grocery delivery aren’t eligible. But restaurant delivery services like DoorDash and Uber Eats are. You can redeem your miles in the same way you would for travel purchases — just log into your account and “erase” the charge within 90 days.

Any of these options is a better deal than letting your miles go altogether if you close your Capital One account.

Bottom line

Capital One rewards will not expire as long as your account stays open and is in good standing. But if you need to close your account, make sure to do something with your miles first so you don’t lose them! Your options are:

- Move your miles to another Capital One account (your own or someone else’s)

- Transfer Capital One miles to an airline partner

- Redeem your Capital One miles for travel, gift cards, or cash back

- Redeem your Capital One miles for eligible restaurant delivery, takeout and streaming service purchases

| For more travel and credit card news, deals and analysis sign-up for our newsletter here. |

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!