American Express Business Gold Card Approval Tips

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

INSIDER SECRET: The American Express® Business Gold Card is not specifically designed for foodies, but it’s one of the best dining cards you can have because of its generous restaurant spending bonus.

If you like to earn lucrative welcome bonuses to save money on travel, applying for Amex small business cards can be a great way to boost your rewards balances or receive significant savings on your everyday purchases. With the American Express® Business Gold Card, you’ll earn 70,000 Membership Rewards® points after you spend $10,000 on eligible purchases with the Business Gold Card within the first 3 months of Card Membership.

Here are 5 tips for getting approved for the Amex Business Gold Card, as well as a few reasons why this card could make sense for you!

Increase Your Amex Business Gold Card Approval Odds

If you’re considering applying for the Amex Business Gold Card, the good news is that Amex small business cards are relatively easy to get.

1. Determine Your Eligibility

You’ll likely qualify for an Amex small business card as long as you’re operating a for-profit business (even if you have very low income).

But don’t forget, Amex only allows folks to earn a welcome bonus once per card per lifetime.

Here’s more about how to qualify for a small business credit card (and why you should get one!). And several quick business ideas to earn more miles & points.

2. Know Your Credit Score

I was instantly approved for the card a couple years ago, with a credit score that hovers around 800.

That said, no matter how great your credit score is, American Express always has the final say. They look at many factors, and can decline you for any reason, including:

- Credit limit across accounts

- Credit utilization

- Too many recent credit card applications

- Too many Amex cards

3. Fill Out the Application Correctly

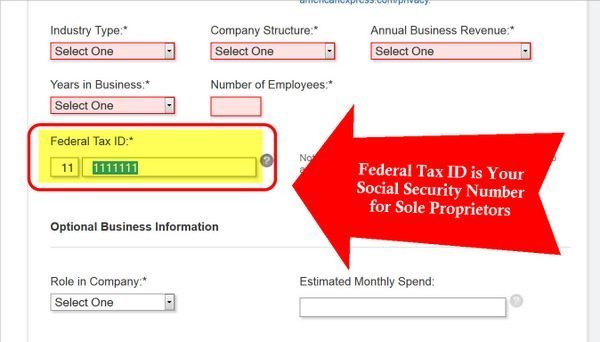

You’ll need to answer more questions on the Amex Business Gold Card application than you would on a personal card application. But if you’re an existing American Express customer, you can log into your account to have the application automatically enter your existing personal information.

You can apply using just your social security number if you don’t have an EIN (Employer Identification Number). Plus, Amex does NOT have strict income requirements for small business cards.

I’ve always used my social security number to apply as a sole proprietor for small business cards. And if you’re applying as a sole proprietor (meaning you’re not in any type of partnership), you can use your name as the legal business name.

Here’s a complete guide to filling out an Amex business card application.

4. Include ALL Income You Earn

Along with your credit score, the total income you report on your credit card application can be an important factor in receiving approval.

Most banks allow you to include income beyond traditional salaries and wages. You can include things like:

- Investment income from stocks and rental properties

- Social security

- Retirement benefits

- Military allowances

- Shared income from a partner

Just be sure to tell the truth in your application. If you’re including income from non-traditional sources, be prepared to explain it to the bank!

5. If Necessary, Call the Reconsideration Line

When you apply for a credit card, you’ll see one of the following results:

- approved

- declined

- pending application

If you’re not instantly approved for the Amex Business Gold Card, you might consider waiting to call the reconsideration line. Instead, wait until you get a message from Amex telling you their final decision (or you see the result through your online application status).

That said, if you’re declined in the end, it’s worth a call to the bank’s reconsideration line. You can speak to a credit representative to find out what’s going on.

A few tips to remember when calling the reconsideration line:

- Be friendly. Customer service representatives will appreciate kindness because they put up with a lot

- Know key features of the card that you’ll use. Don’t say you just want the welcome bonus

- Be prepared to provide documentation regarding your business, such as a copy of a business card, proof of mailing address, invoices, etc.

Here are a few ways to ensure your credit card reconsideration is a success!

The American Express Business Gold Card

Apply Here: American Express Business Gold Card

Read our review of the American Express Business Gold

When you apply for the Amex Business Gold Card, you’ll earn 70,000 Membership Rewards® points after you spend $10,000 on eligible purchases with the Business Gold Card within the first 3 months of Card Membership.

Just note that this card bonus is usually Amex Membership Rewards points instead of a statement credit, which can often be worth significantly more than cash. And some folks tell me they’ve received targeted mailers with larger bonus offers. So keep an eye out to see if you can get a better deal.

Remember, with Amex, you can only earn the welcome bonus on a card ONCE per person, per lifetime on ALL their cards. So it’s best to apply when you can take advantage of a larger than normal bonus.

You’ll earn four Amex Membership Rewards points per dollar on two categories where you spend the most each month (capped at the first $150,000 in combined purchases each calendar year, then 1 point per dollar):

- Airfare purchased directly from airlines

- US purchases for advertising in select media (online, TV, radio)

- US purchases made directly from select technology providers of computer hardware, software and cloud solutions

- US purchases at gas stations

- US purchases at restaurants

- US purchases for shipping

Amex Business Cards Do NOT Foil Your Future Chase Card Applications

Because Amex business cards will not show up on your personal credit report, getting the Amex Business Gold Card will NOT count toward Chase’s 5/24 rule.

So getting this card won’t hurt your chances of being approved for Chase cards in the future!

Bottom Line

With the Amex Business Gold Card, you’ll earn 70,000 Membership Rewards® points after you spend $10,000 on eligible purchases with the Business Gold Card within the first 3 months of Card Membership.

Before you apply, make sure you meet these requirements:

- Have a good/excellent credit score

- Operate a for-profit venture

- You may not have previously received the welcome bonus from the Amex Business Gold

Keep in mind, American Express still has the final say in whether you’ll be approved. If your application isn’t immediately approved, you should wait for the automated system to make a decision. But if you’re declined, you should call Amex to request reconsideration.

Have any approval tips of your own? Share them in the comments to help your fellow readers! And subscribe to our newsletter for more credit card approval tips.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!