Quick Links for Checking Your Credit Card Application Status Online!

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

Very little in life is more thrilling than watching the animated loading wheel as you await the bank’s verdict on your credit card application. We all hope for an instant approval. But that’s not always the result!

Your application might not be instantly approved for various reasons. It doesn’t necessarily mean you’ll be denied the card! But did you know it’s easy to check the status of your application while you’re impatiently waiting?

I’ll show you how to check your application status online with the major banks!

Easily Check Your Credit Card Application Status Online

Link: Card Application Pending? Don’t Worry, Follow These Steps

When you apply for a credit card, you’ll see 1 of the following results: Approved, declined, or pending application.

Your application might not be instantly approved for several reasons. For example:

- You may not get an instant approval if you already have lots of credit with a single bank (you may be at or near the maximum amount of credit they’re willing to extend you)

- If you’re applying for a small business card, the bank may want more information about your business before approving you

- If you apply for credit cards regularly (like most of us in this hobby!), the bank may just want to confirm that the application isn’t fraudulent

If your application is shown as “pending“, it may be best NOT to call the bank reconsideration line, and instead wait for your application to process automatically. Full disclosure, I’m pretty impatient, and usually call the reconsideration line immediately. But by waiting, it’s like getting 2 shots at an approval.

If you wait, the automated system may approve you. If not, you can call reconsideration for another chance.

If your credit card application is pending, here’s how to check your application status online with the most popular banks!

1. Barclays

Link: Check Barclays Application Status

To check your Barclays credit card application status, just follow this link and enter a few bits of personal information.

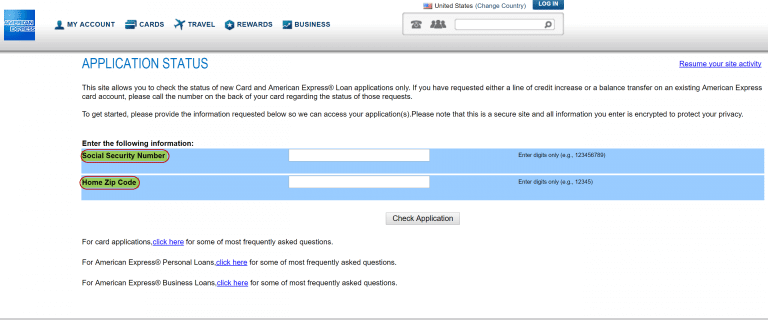

2. American Express

Link: Check American Express Application Status

American Express is probably the easiest bank to check your online application. They require just 2 pieces of information: Your social security number, and your zip code. Click this link to check your status.

See Related: Best American Express credit card

3. Chase

Unlike most other banks, you can NOT check your application status for Chase credit cards online. You’ll have to call the reconsideration line to find out.

Again, my advice is to wait for the automated system to give you an answer. Do NOT call Chase right away. That way you have more chances of being approved!

Chase’s automated system may still approve you. If it doesn’t, call Chase and speak to a representative to plead your case.

If you already have other Chase cards, you can usually tell if your application has been approved, because the new card will appear in your online account alongside your other cards.

4. Capital One

Similar to Chase, you can NOT check your Capital One application online. But you can do it over the phone. Check the status of your application any time by calling 800–903–9177.

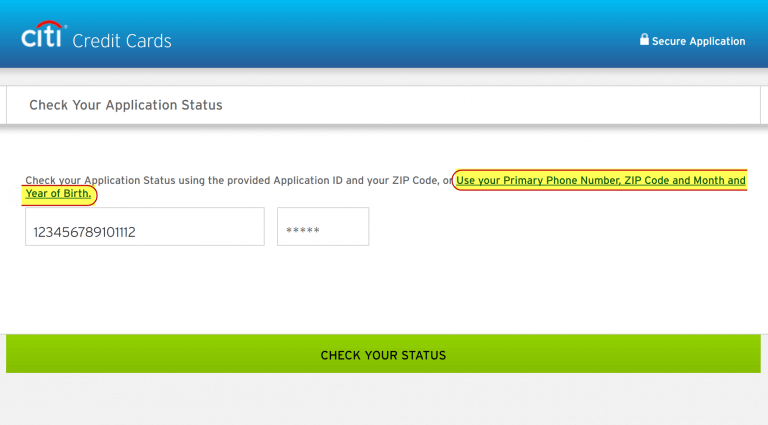

5. Citi

Link: Check Citi Application Status Online

Citi gives you a couple of options for checking your application online.

When you apply for a Citi credit card, you should get an Application ID. You can enter this number along with your zip code to check your application status through this link.

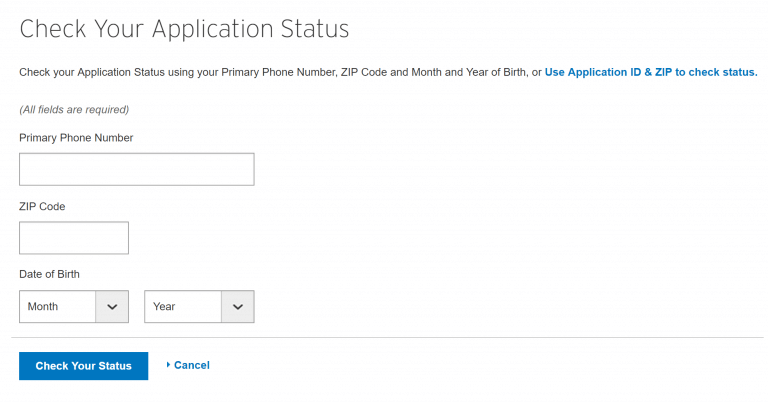

If you don’t have your Application ID handy, you can click the link that says “Use your Primary Phone Number, ZIP Code and Month and Year of Birth“.

You’ll be taken to a page with required information that should NOT take any digging for you to find the answer. 😉

Don’t fret if your application status doesn’t change right away. It can take days (and occasionally even weeks!) for banks to make a decision.

Remember, if the automated system declines your application, you should always call reconsideration! Team member Joseph said that he called Citi to inquire about his declined Citi ThankYou Premier application, and the agent literally said “Hmm, let me take a look at that… Okay now you’re approved.”

Talking on the phone isn’t the most popular option for lots of folks, but it’s worth it!

Check Chase Credit Card Application Status

- You can NOT check your Chase application status online

- You’ll have to call the automated application status line to check

- I recommend waiting for the automated system to give you an answer. This way you have more chances of being approved!

- If you’re not automatically approved, call Chase and speak to a representative to ask them to reconsider your application

Bottom Line

If you’re a miles & points enthusiast, chances are you’ll get a pending credit card application at some point!

Banks make checking your application status really easy. Most let you do this online, though some issuers, like Capital One and Chase, do not.

Checking your application online is handy, because it usually takes 7 to 10 days for a bank to contact you with an answer via mail.

Other Popular Million Mile Secrets Articles to Read

- Spice up your next trip with the AMEX FHR perk!

- Big Travel with Small Money is within reach when you get the right credit card for travel

- Your next adventure is waiting with the Southwest Companion Pass

- Collecting Marriott points is easy with the bonus from this Chase Marriott credit card

- Heavy Duty! Take a look at these metal credit cards

- Free snacks, drinks, and Wi-Fi! Try these credit cards with lounge access!

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!