Combat the Airline Fee Increase With Credit Cards That Get You Free Checked Bags

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

INSIDER SECRET: If you carry a credit card that offers free checked bags, you could easily save several hundred dollars on a roundtrip flight.

Have you noticed the meteoric rise of airline fees? Select seats are becoming more expensive, changes and cancellations are pricier, and some airlines will tack on fees if you bring anything more than an antibacterial towelette.

Baggage fees are the most common fee to increase among airlines at the moment. Fortunately, there are steps you can take to negate these extra charges. And they’re as easy as opening a credit card. I’ll show you the best credit cards to combat the airline fee increase.

Best Credit Cards to Avoid Baggage Fees

- Best Credit Card for Free American Airlines Bags: Citi® / AAdvantage® Platinum Select® World Elite Mastercard®

- Best Credit Card for Free United Airlines Bags: United℠ Explorer Card

- Best Credit Card for Free Delta Bags: Gold Delta SkyMiles® Credit Card from American Express

- Best Credit Card for Free JetBlue Bags: Barclaycard JetBlue Plus Card

- Best Credit Card for Free Alaska Airlines Bags: Alaska Airlines Visa Signature® credit card

- Best Credit Card for Free Hawaiian Airlines Bags: Barclaycard Hawaiian Airlines Credit Card

- Best Credit Card for Free Bags With Other Airlines: The Platinum Card® from American Express

Information for the Barclaycard JetBlue Plus Card, United Club Card has been collected independently by Million Mile Secrets and has not been reviewed by the card issuer.

Beat the Airline Fee Increase With These Cards

Through all the disappointing bag fee decisions airlines are making, there’s still a ray of sunshine from Southwest. As others jack up prices, Southwest stays firm to its policy of 2 free checked bags per passenger. No credit card needed!

This is one of the reasons Million Mile Secrets loves Southwest. Most of us choose to fly Southwest if we can help it. For everyone else, you need a checked bag game plan, or you could find yourself with a sizable balance on your credit card, even if you used your miles & points know-how to book free flights!

This is especially true for large families that travel together. Opening one of the cards below could literally save you hundreds on a single trip!

Here are our top recommendations:

Best Credit Cards for Free American Airlines Bags

Apply Here: Citi® / AAdvantage® Platinum Select® World Elite Mastercard®

Read our review of the Citi AAdvantage Platinum Select

Apply Here: CitiBusiness® / AAdvantage® Platinum Select® World Mastercard®

Read our review of the CitiBusiness AAdvantage

What’s the Benefit and Who Gets It? With the small business version, the primary cardholder and up to 4 companions on the same reservation will receive 1 free checked bag on domestic itineraries (partner airlines don’t qualify for this perk).

You’ll normally pay $30 one-way for a checked bag with American Airlines (or $60 roundtrip). So if you and a travel buddy make ONE roundtrip flight each year, you’ve more than made up for the card’s $99 annual fee.

Note: This benefit does NOT apply to overweight or oversized bags. So if you’re taking a gun safe or a Macy’s Thanksgiving Day Parade balloon, this perk is no good to you.

Other Compelling Benefits: If the checked bag fees aren’t enough to convince you to keep the card, consider this pro tip: This card lets you book American Airlines’ Basic Economy fares with very little consequence.

Basic Economy is the absolute cheapest fare American Airlines sells. But it’s tangled in fees and restrictions. For example, you can’t choose your seat and you board the plane dead last.

Having one of these American Airlines cards gives you preferred boarding and a free checked bag for EVERY domestic American Airlines flight. So you can save $20 here and $30 there with Basic Economy without being relegated to the humiliation that comes with it.

The CitiBusiness AAdvantage Platinum Select comes with 70,000 American Airlines miles after you make $4,000 in purchases in first four months from account opening.

Both cards have $99 annual fees, waived the first 12 months.

The information for the Citi AAdvantage Platinum and CitiBusiness AAdvantage Platinum card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

That’s a lot of American Airlines miles! You could fly roundtrip to Europe for 60,000 miles. Or one-way in lie-flat Business Class! That ticket could cost thousands of dollars otherwise.

Best Credit Card for Free United Airlines Bags

Apply Here: United Explorer Card

Read our our review of the Chase United Explorer

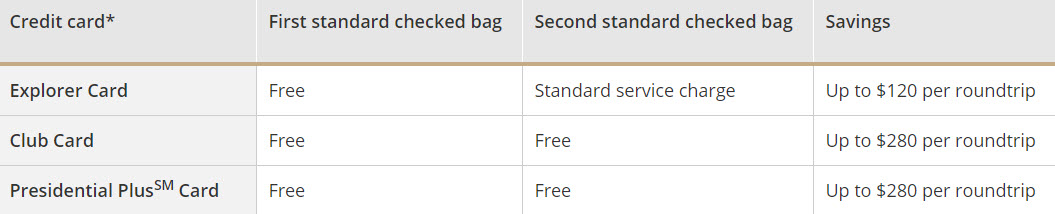

What’s the Benefit and Who Gets It? With the United Explorer Card, the primary cardholder and 1 companion will receive their first checked bag free. And with the United Club Card, you’ll get the first and second bag free.

United Airlines is upping its checked bag fees:

- $30 for your first checked bag (previously $25)

- $40 for your second checked bag (previously $35)

The credit card landing pages indicate that they will cover up to the cost of the old prices. But a look at the United Airlines website shows that you’ll be covered for the new prices.

A hugely important note for both of these cards is that you have to pay for your airfare (or the taxes & fees for an award flight) with your card to get the free checked bag. Just having the card is NOT enough.

PLEASE Tell Me This Card Saves Me From Basic Economy Like the American Airlines Card Does: Heck yes it does! United Airlines Basic Economy is just as irritating as American Airlines. But having one of these cards will give you priority boarding and a free carry-on bag no matter what. So you can save a few bucks booking Basic Economy fares without much fallout.

Other Compelling Benefits: These cards have a list of valuable perks, but my favorite about the United Explorer Card is that it gives you access to more available award seats when you’re booking a flight with miles. So if someone without the card logs into the United Airlines site, they might not see any available seats like you do!

The United Club Card comes with a membership to United Club airport lounges, with free snacks, alcohol, and lots more!

Welcome Offers: The United Explorer Card comes with a limited time bonus of up to 65,000 bonus miles; 40,000 miles after you spend $2,000 in purchases in the first three months. Plus, an additional 25,000 bonus miles after you spend $10,000 total on purchases in the first six months your account is open.

The United Club Card comes with 50,000 United Airlines miles after you spend $3,000 on purchases in the first 3 months.

United Airlines miles can take you just about anywhere. For example, you can book a roundtrip coach flight to Peru for 40,000 United Airlines miles. Or a roundtrip coach flight to the Caribbean for 35,000 miles!

The United Explorer Card comes with a $95 annual fee, waived the first year. And the United Club Card comes with a $450 annual fee, NOT waived the first year.

Best Credit Cards for Free Delta Bags

Apply Here: Gold Delta SkyMiles® Credit Card from American Express

Apply Here: Gold Delta SkyMiles® Business Credit Card from American Express

Apply Here: Platinum Delta SkyMiles® Business Credit Card from American Express

What’s the Benefit and Who Gets It? Delta is generous with their free checked bag waivers if you have an Amex Delta card. The primary cardholder and up to 8 passengers on the same reservation will have their first checked bag waived. Delta checked bag fees are $25 one-way. That means you could potentially save $450 on a single roundtrip flight with your unsettlingly large family. 😉

One note, Delta says:

The first checked bag fee waiver will only be applied on flight segments which originate on a Delta or Delta Connection® carrier when you check-in with Delta for both a Delta marketed and Delta operated flight.

I’ve successfully had my checked bag fee waived on itineraries booked through another airline. For example, I booked an award flight with Korean Air, and flew Delta from Cincinnati to San Francisco. Even though I didn’t book through Delta, I gave my frequent flyer number to the Delta agent once at the airport, and she waived my bag fee.

Dope. Same Deal for Basic Economy, as Well? That’s right. Delta doesn’t take away your carry-on bag for booking Basic Economy, but they DO have you board dead last. Holding an Amex Delta card will give you priority boarding.

Other Compelling Benefits: Both Amex Delta Platinum personal and small business cards come with an annual companion certificate that allows you add a second passenger to your domestic roundtrip flight reservation (within the contiguous 48 US states) by only paying the taxes and fees for that passenger. That’s incredible!

Welcome Offers:

- Gold Delta SkyMiles® Credit Card from American Express – 30,000 Delta miles after spending $1,000 on purchases in the first three months of account opening and receive $50 in statement credits for Delta purchases made directly with Delta within the same time frame.

- Platinum Delta SkyMiles® Credit Card from American Express – 35,000 bonus miles and 5,000 Medallion® Qualification Miles (MQMs) after you spend $1,000 on purchases within the first 3 months. Plus, earn a $100 statement for Delta purchases made directly with Delta in the same time frame.

- Platinum Delta SkyMiles® Business Credit Card from American Express – 35,000 bonus miles and 5,000 Medallion® Qualification Miles (MQMs) after you spend $1,000 on purchases within the first 3 months. Plus, earn a $100 statement for Delta purchases made directly with Delta in the same time frame.

- Gold Delta SkyMiles® Business Credit Card from American Express – 30,000 Delta miles after spending $1,000 on purchases in the first three months of account opening and receive $50 in statement credits for Delta purchases made directly with Delta within the same time frame.

Delta miles are worth 1 cent each when you redeem them through Pay With Miles, which is only available to Delta cardholders. But you’ll typically get much better value by redeeming for award flights instead.

The Amex Delta Gold cards come with a $95 annual fee, waived the first year. And Amex Delta Platinum Business card comes with a $195 annual fee, NOT waived the first year.

Note: If you’ve received a welcome bonus on a particular Delta card in the past, you’re not eligible to earn it again on the same card. But because each of these 4 cards are considered different products, you’re eligible for the welcome bonus on the Gold if you’ve already earned the bonus on the Platinum, and vice versa. The same is true for business and personal versions of the same card.

Best Credit Card for Free JetBlue Bags

Our Review: Avoid JetBlue Baggage Fees

What’s the Benefit and Who Gets It? The JetBlue Plus Card comes with a free first checked bag for the primary cardholder and up to 3 companions on the same reservation. Similar to the United Airlines credit cards, you have to use your JetBlue Plus Card to purchase the tickets, or the taxes & fees of your award flight.

JetBlue has increased all kinds of fees, including their checked bags. You’ll now pay $30 for your first checked bag instead of $25. So this card will save you at least $60 per roundtrip when you check a bag.

Nice. What Else Ya Got? You’ll earn 5,000 bonus JetBlue points every anniversary year. Plus an annual $100 statement credit after you purchase a JetBlue Vacations Package of $100 or more.

Welcome Offer: You’ll earn 40,000 bonus JetBlue points after spending $1,000 on purchases in the first 90 days of account opening and paying the $99 annual fee.

Because JetBlue cards are worth ~1.4 cents each, you can get ~$560 in JetBlue flights from this bonus. And JetBlue awards are tied directly to the cash price of the ticket. So when they have a sale, the award price drops, too.

JetBlue flies to lots of fun destinations around the US and Caribbean. So you’ll get good use from these points.

This card comes with a $99 annual fee, NOT waived the first year.

Best Credit Card for Alaska Airlines Bags

Apply Here: Alaska Airlines Visa Signature® credit card

Apply Here: Alaska Airlines Visa® Business credit card

What’s the Benefit and Who Gets It? With both the Alaska Airlines personal and small business credit cards, the primary cardholder and up to 6 other travelers on the same reservation will receive their first checked bag free. Alaska Airlines charges $25 per bag, so you’ll save at least $50 for a roundtrip flight when you check a bag.

Give Me One More Reason to Apply. Each year you hold onto the card, you’ll get a companion certificate that allows you to bring along a travel buddy for as little as from $121 ($99 fare, plus taxes and fees, usually ~$22)

Welcome Offers: With the Alaska Airlines personal card and small business you’ll earn 40,000 Alaska Airlines miles, plus a Companion Fare from $121 ($99 fare, plus taxes and fees from $22) after spending $2,000 in purchases within the first 90 days of opening your account (not available if you’ve had the card before).

Best Credit Card for Hawaiian Airlines Bags

What’s the Benefit and Who Gets It? The Barclaycard Hawaiian Airlines Card comes with 1 free checked bag for the primary cardholder only. And you must use your card to purchase your tickets or the taxes & fees of your award flight.

Hawaiian Airlines charges $25 for your first checked bag to the mainland US. So you’ll save $50 for a roundtrip.

Snooze. Other Benefits? You’ll receive a one-time 50% off companion discount for roundtrip coach travel between Hawaii and the mainland US on Hawaiian Airlines. You’ll also get an annual companion discount of $100 off coach roundtrip coach fares between the mainland US and Hawaii after each account anniversary.

Welcome Offer: You’ll earn 60,000 bonus Hawaiian Airlines miles after spending $2,000 on purchases in the first 90 days of account opening. That’s more than enough for a roundtrip coach flight to Hawaii!

Best Credit Cards for Free Bags on Other Airlines

Apply Here: The Platinum Card From American Express

Read our review of the American Express Platinum

Apply Here: The Business Platinum Card From American Express

Read our American Express Business Platinum Review

There are other non-airline travel cards that offer statement credits for airline incidental purchases.

There are plenty of American Express cards that cover fees like this:

- The Platinum Card From American Express ($200 airline fee credit per calendar year, but you must choose your qualifying airline)

- The Business Platinum Card From American Express ($200 airline fee credit per calendar year, but you must choose your qualifying airline)

Just remember, you’ll only be reimbursed if you pay the bag fee separately. Because paid airfare does NOT qualify for the credit.

You can also use cards like the U.S. Bank Altitude™ Reserve Visa Infinite® Card, which comes with $325 in annual statement credits for eligible travel purchases like checked baggage fees. And the Chase Sapphire Reserve comes with an annual travel credit reimbursing you for the first $300 you spend on travel per year. Including checked bag fees!

Even the Hilton Honors American Express Aspire Card comes with an annual $250 airline incidental fee credit, which covers checked bags.

The information for the Hilton Aspire card has been collected independently by Million Mile Secrets. The card details on this page have not been reviewed or provided by the card issuer.

Bottom Line

The best credit cards for free checked bags are:

- Citi® / AAdvantage® Platinum Select® World Elite Mastercard®: Best Credit Card for Free American Airlines Bags

- United℠ Explorer Card: Best Credit Card for Free United Airlines Bags

- Gold Delta SkyMiles® Credit Card from American Express: Best Credit Card for Free Delta Bags:

- Barclaycard JetBlue Plus Card: Best Credit Card for Free JetBlue Bags

- Alaska Airlines Visa Signature® credit card: Best Credit Card for Free Alaska Airlines Bags

- Barclaycard Hawaiian Airlines Credit Card: Best Credit Card for Free Hawaiian Airlines Bags

- The Platinum Card® from American Express: Best Credit Card for Free Bags With Other Airlines

Don’t forget travel cards that are NOT an airline card, like the Amex Platinum or the US Bank Altitude Reserve. These cards come with statement credits which include airline incidental fees like bag fees.

Let me know your favorite card for offsetting the airline fee increase!

For rates and fees of the Gold Delta SkyMiles Card, please click here.

For rates and fees of the Gold Delta Business SkyMiles Card, please click here.

For rates and fees of the Platinum Delta Business SkyMiles Card, please click here.

For rates and fees of the Hilton Aspire Card, please click here.

For rates and fees of the Amex Platinum card, click here.

For rates and fees of the Amex Business Platinum card, click here.

For the latest money-saving tips and tricks, please subscribe to the Million Mile Secrets daily email newsletter.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!