| For more credit card news, deals and analysis sign-up for our newsletter here. |

Chase United Explorer review: Earn 60,000 bonus miles and a stack of benefits

Signing up for credit cards through partner links earns us a commission. Terms apply to the offers listed on this page. Here’s our full advertising policy: How we make money.

Update: One or more card offers in this post are no longer available. Check our Hot Deals for the latest offers.

The United℠ Explorer Card currently has an intro bonus offer of 60,000 miles after meeting minimum spending requirements. That’s more than enough for a round-trip coach award flight within the U.S. and to the Caribbean, Mexico, or South America. It’s worth quite a lot, — and that’s not even accounting for the card’s valuable ongoing perks.

Apply for the Chase United Explorer card here.

But, now that United Airlines has eliminated its award chart it’s a bit more difficult to know the exact value of your United miles. Still, there are plenty of great ways to redeem United miles and this is a great airline credit card if you want to earn United miles. So let’s take an in-depth look at the card with our Chase United Explorer Card review.

Chase United Explorer review

Current bonus

When you open the Chase United Explorer card, you earn 60,000 bonus miles after you spend $3,000 on purchases in the first three months your account is open.

Benefits & perks

The Chase United Explorer card is packed with benefits. You’ll get the most out of it if you like to fly United Airlines. With the card, you’ll earn:

- 2 United Airlines miles per dollar you spend on purchases from United Airlines

- 2 United Airlines miles per dollar spent at restaurants and hotels when you book directly

- 1 United Airlines mile per dollar you spend on everything else

A free checked bag for you and a companion

When you use your Chase United Explorer card to purchase a ticket (or pay the taxes and fees on your award ticket) and add your loyalty program number, you’ll get one free checked bag for yourself and a companion traveling with you. You’ll only get a free checked bag on flights operated by United Airlines and United Express, not partner flights.

Considering United Airlines has raised the fee to $30 for your first checked bag, this perk alone can save you and a companion $120 per round-trip flight. If you use this perk just one time a year, it easily covers the annual fee after the first year when it’s waived anyway. If you check bags often on United Airlines, having this card is a no-brainer.

Two United Club passes per cardmember year

Each year when you renew your Chase United Explorer card, you’ll get two United Club Lounge one-time passes. One-day passes are usually $59 each, so if you use both passes, you can easily cover the card’s annual fee once again.

Lounges are a great place to unwind, grab a snack and a drink and use free Wi-Fi. Some locations even have a shower that can come in handy during a long trip. Keep in mind that you’ll need to be traveling United Airlines or one of its partners to access United Clubs.

Priority boarding

You can board after first class and just before general boarding when you have the Chase United Explorer Card. Get in line and stow your bags before everyone else does.

Save 25% inflight

When you use your Chase United Explorer to pay for inflight food, drinks or Wi-Fi, you’ll get 25% credited back to your account. That doesn’t justify a $12 sandwich, but it eases the sting a little. Cheers, and yes, I’ll have another.

Global Entry or TSA PreCheck credit

With the Chase United Explorer card, you’ll get a credit of up to $100 every four years for Global Entry or TSA PreCheck, which allow you speed through airport security. I recommend Global Entry, which helps you clear customs faster when you return from overseas, because it includes TSA PreCheck perks. Enrolling in these programs will save you a boatload of time both before and after your flight.

Primary rental car insurance

You’ll get primary rental car insurance for most rentals under 31 days when you charge the entire amount of the rental to your Chase United Explorer card. This insurance kicks in before you have to file a claim with your personal insurance company.

Purchase protection

New purchases made to your card are covered for 120 days against damage or theft, up to $10,000 per claim and $50,000 per year.

Extended warranty

Manufacturer’s warranties get an additional year added, on eligible warranties of three years or less.

Trip cancellation and interruption insurance

This insurance reimburses you or your immediate family members up to $1,500 if something extreme prevents you from taking a trip (like sudden sickness or a tropical storm), and up to a maximum of $6,000 per trip.

Trip delay insurance

When your travel is delayed 12+ hours or requires an overnight stay, you and your family are covered for unreimbursed expenses, like meals and lodging, up to $500 per ticket.

Lost luggage reimbursement

If you or an immediate family member check or carry on luggage that’s then lost or damaged, you’re covered up to $3,000 per passenger.

Baggage delay insurance

If your bags don’t arrive when you do, this insurance kicks in after six hours. You can get reimbursed up to $100 a day for three days for things like toiletries, a change of clothes and other essentials until your bags arrive.

Get 25% more miles through MileagePlus X app

The MileagePlus X app lets you buy gift cards to dozens of retailers and earn United Airlines miles in the process. If you haven’t downloaded it, definitely take a look.

And folks with the Chase United Explorer card get 25% more miles instantly added to their account. Even better, you don’t have to use the card to pay for gift cards within the app — simply having it is enough to trigger the bonus.

No foreign transaction fee

This card has no foreign transaction fees, so it’s a good option for making purchases overseas.

How to redeem United miles

United Airlines miles can be powerful tools for discounted travel, you should never have a problem receiving a value of at least 1.3 cents per mile. If you know what you’re doing, you could even get a value many times higher.

As an example, you can book a round-trip flight to Peru for 40,000 United Airlines miles. This card’s bonus is enough to get you that trip to Machu Picchu you’ve been wanting to make. A flight from Cincinnati to Lima regularly costs $900+ round-trip, so this bonus could easily be worth $900 or 2.225 cents per United mile.

United Airlines makes it easy to book award flights directly on their website. However, United has announced huge changes to its award program. They’ve eliminated the award chart. But for now, United isn’t changing the prices of its partner awards and United Airlines is part of the Star Alliance, which includes partners like Air Canada and Lufthansa. You can use your miles to travel on United Airlines or any of their 20+ partners.

United Airlines never adds fuel surcharges to award flights like other mileage programs. These junk fees can easily cost hundreds of dollars, so using United Airlines miles can lead to huge cash savings, depending on where you want to visit and which airline you want to fly.

With the current award chart, you can use United Airlines miles for trips with partners like a round-trip coach award flight within the U.S. or Canada (not including Alaska) for 25,000 United Airlines miles, a one-way coach award flight to Hawaii for 22,500 United Airlines miles or a one-way coach award flight to Argentina, Bolivia, Brazil, Chile, Paraguay or Uruguay, for 30,000 United Airlines miles.

And if you want to be fancy, you can redeem United miles for trips in the carrier’s highly-rated Polaris business class product.

Dynamic pricing had changed prices for United operated flights. But it has led to even lower prices on some dates, so it could sometimes work out in your favor.

Is the annual fee worth it?

There’s a $95 annual fee with this card but it’s waived the first year. And if you fly United Airlines a lot it can be worth it to pay the fee in future years. I’ve had this card for a few years and always get a big return – and it’s not like I’m flying every other weekend. You can easily cover the annual fee with free checked bags and the two United Club airport lounge passes. And remember, the annual fee is waived the first year, so you can always see how you like it for ~11 months with nothing to lose.

Plus, the 60,000 mile bonus can provide a whole lot of value, so you’ll definitely be coming out ahead in the first few years of having the card. This is a Chase credit card, so it’s affected by Chase’s 5/24 rule, wherein Chase will not approve you for most of their cards if you’ve opened five or more cards from any bank (not counting certain business credit cards) in the past 24 months.

Who is the Chase United Explorer for?

If you fly United Airlines, either with paid tickets or award seats, the Chase United Explorer Card can save you money and time when you travel — even if you don’t fly often. On top of this card’s welcome bonus, you also get perks when you fly United, like free checked bags, access to more award seats and two passes to United lounges each cardmember year.

Insider secrets

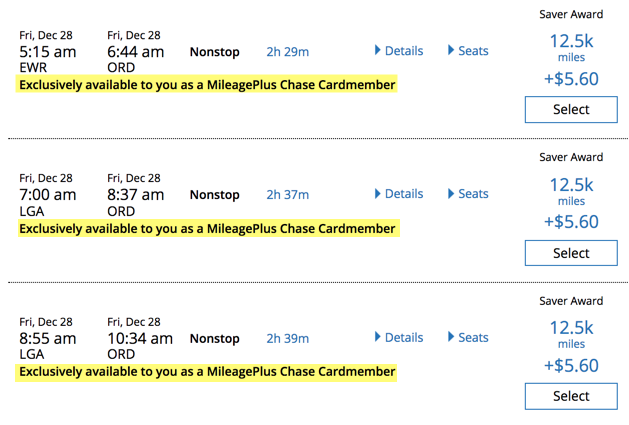

United Airlines offers you more award seats when you have one of their credit cards — including the Chase United Explorer. This perk is valuable because with more seats available, you can make a better connection, secure a better arrival time to your destination and see awards that aren’t available on other days.

Even better, it’s shareable, meaning you can book these awards for other people.

Credit cards similar to the Chase United Explorer

If you like to fly United Airlines you are spoiled with credit card choices. United Airlines is a Chase Ultimate Rewards points transfer partner, so cards like the Chase Sapphire Preferred® Card, Chase Sapphire Reserve® and Ink Business Preferred Credit Card all earn points that can be converted into United Airlines miles. They also have a better earning rate than United Airlines cards.

For example, I earn three Chase Ultimate Rewards points with my Chase Sapphire Reserve® for all my dining and travel purchases. The travel category includes any airline and I can book my hotel through a third party and still earn bonus points.

But for casual flyers looking to save on checked bags and get perks for flying, the Chase United Explorer card should be enough. It’s done me well for a few years and I plan to keep it long term. Many award travelers carry both a United co-brand and Chase Sapphire Preferred card.

Bottom line

The Chase United Explorer card comes with a bonus of up to a 60,000 United Airlines miles once you complete the minimum spending requirements. There are many ways to use United Airlines miles but keep in mind, United has eliminated its award chart. But the prices for partner awards aren’t changing… for now.

The Chase United Explorer has money-saving perks like free checked bags, 25% off snacks and Wi-Fi in flight and two lounge passes every cardmember year. You can save time with Global Entry (there’s a $100 credit for your application every four years) and priority boarding so you can stow your carry-on faster. Plus, you’ll find more award seats.

It doesn’t have the best category bonuses but folks who fly United Airlines can do well with this card. I’ve gotten a great return on the $95 annual fee, which is waived the first year.

Apply here for the Chase United Explorer.

Editorial Note: We're the Million Mile Secrets team. And we're proud of our content, opinions and analysis, and of our reader's comments. These haven’t been reviewed, approved or endorsed by any of the airlines, hotels, or credit card issuers which we often write about. And that’s just how we like it! :)

Join the Discussion!